- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 21-06-2017.

(index / closing price / change items /% change)

Nikkei -91.62 20138.79 -0.45%

TOPIX -5.69 1611.56 -0.35%

Hang Seng -148.46 25694.58 -0.57%

CSI 300 +41.47 3587.96 +1.17%

Euro Stoxx 50 -6.31 3554.35 -0.18%

FTSE 100 -24.92 7447.79 -0.33%

DAX -40.53 12774.26 -0.32%

CAC 40 -19.39 5274.26 -0.37%

DJIA -57.11 21410.03 -0.27%

S&P 500 -1.42 2435.61 -0.06%

NASDAQ +45.92 6233.95 +0.74%

S&P/TSX -1.07 15148.53 -0.01%

Major US stock indices showed mixed dynamics on Wednesday, as the growth of shares in the health sector was countered by the fall in quotations of the main materials sector.

In addition, as it became known, in May, home sales in the secondary market in the US unexpectedly rose to the third highest monthly level in a decade, and the chronic shortage of stocks pushed the median price of housing to a record level. The National Association of Realtors said that home sales in the secondary market grew by 1.1% to 5.62 million units, taking into account seasonal fluctuations last month. Economists predicted that sales would fall to 5.55 million.

Oil prices fell by more than 2%, the reason for which were the continuing concerns about the oversaturation of the market. Since the beginning of this year, oil futures have lost about 20% of their value, which is the worst result for the first six months of the year since 1997. Compliance with the agreement between OPEC and other producers to reduce production by 1.8 million barrels per day reached the highest level in May since the signing of this pact, namely 106%. This means that they cut production more than necessary. Compliance with the agreement by OPEC members was 108%, and among non-OPEC countries, it was 100%. Nevertheless, the global reserves of crude oil and petroleum products remain significantly higher than their long-term average values.

Most components of the DOW index recorded a decline (18 out of 30). Most fell shares of Caterpillar Inc. (CAT, -3.46%). Leader of the growth were shares of NIKE, Inc. (NKE, + 1.80%).

Most sectors of the S & P index showed a decline. Most of all fell the sector of basic materials (-1.1%). The leader of growth was the healthcare sector (+ 1.3%).

At closing:

DJIA -0.24% 21.415.23 -51.91

Nasdaq + 0.74% 6.233.95 +45.92

S & P -0.06% 2.435.66 -1.37

U.S. stock-index futures were flat as investors decided to take a breath after the market was on a roller coaster ride earlier this week.

Stocks:

Nikkei 20,138.79 -91.62 -0.45%

Hang Seng 25,694.58 -148.46 -0.57%

Shanghai 3,156.38 +16.36 +0.52%

S&P/ASX 5,665.72 -91.53 -1.59%

FTSE 7,436.36 -36.35 -0.49%

CAC 5,263.50 -30.15 -0.57%

DAX 12,770.38 -44.41 -0.35%

Crude $43.72 (+0.48%)

Gold $1,244.70 (+0.10%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 77.3 | -0.03(-0.04%) | 5035 |

| Amazon.com Inc., NASDAQ | AMZN | 996.04 | 3.45(0.35%) | 18108 |

| American Express Co | AXP | 82.7 | 0.19(0.23%) | 675 |

| Apple Inc. | AAPL | 145.38 | 0.37(0.26%) | 57936 |

| AT&T Inc | T | 38.9 | 0.24(0.62%) | 759 |

| Barrick Gold Corporation, NYSE | ABX | 15.65 | 0.07(0.45%) | 36168 |

| Boeing Co | BA | 198.6 | 0.27(0.14%) | 800 |

| Caterpillar Inc | CAT | 106.8 | -0.24(-0.22%) | 6485 |

| Chevron Corp | CVX | 105.9 | -0.58(-0.54%) | 18543 |

| Cisco Systems Inc | CSCO | 31.86 | 0.01(0.03%) | 3557 |

| Citigroup Inc., NYSE | C | 64.03 | 0.12(0.19%) | 11432 |

| Facebook, Inc. | FB | 152.37 | 0.12(0.08%) | 14494 |

| FedEx Corporation, NYSE | FDX | 206.55 | -2.40(-1.15%) | 71457 |

| Ford Motor Co. | F | 11.17 | 0.05(0.45%) | 16734 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.38 | 0.14(1.25%) | 31306 |

| General Electric Co | GE | 28.15 | 0.02(0.07%) | 4965 |

| Goldman Sachs | GS | 224.7 | -0.40(-0.18%) | 2663 |

| Intel Corp | INTC | 34.35 | -0.51(-1.46%) | 536031 |

| JPMorgan Chase and Co | JPM | 87.56 | 0.04(0.05%) | 2939 |

| McDonald's Corp | MCD | 154.5 | 0.43(0.28%) | 1005 |

| Microsoft Corp | MSFT | 70.1 | 0.19(0.27%) | 8469 |

| Nike | NKE | 52.14 | 0.58(1.12%) | 56348 |

| Procter & Gamble Co | PG | 89.5 | -0.13(-0.15%) | 7736 |

| Tesla Motors, Inc., NASDAQ | TSLA | 374.5 | 2.26(0.61%) | 51053 |

| Twitter, Inc., NYSE | TWTR | 16.93 | 0.02(0.12%) | 25284 |

| Verizon Communications Inc | VZ | 45.99 | 0.05(0.11%) | 560 |

| Visa | V | 94.74 | 0.36(0.38%) | 1357 |

| Walt Disney Co | DIS | 104 | 0.06(0.06%) | 2227 |

| Yandex N.V., NASDAQ | YNDX | 26.31 | 0.06(0.23%) | 4100 |

General Motors (GM) initiated with a Neutral at Guggenheim

Ford Motor Co. (F) initiated with a Neutral at Guggenheim

Intel (INTC) downgraded to Neutral from Buy at BofA/Merrill

Chevron (CVX) downgraded to Neutral from Outperform at Macquarie

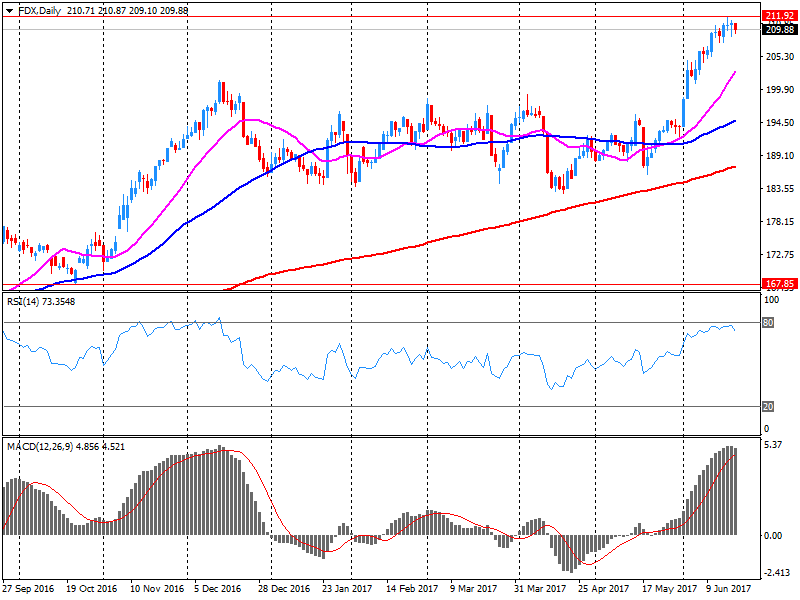

FedEx (FDX) reported Q4 FY 2017 earnings of $4.25 per share (versus $3.30 in Q4 FY 2016), beating analysts' consensus estimate of $3.88.

The company's quarterly revenues amounted to $15.700 bln (+21% y/y), generally in line with analysts' consensus estimate of $15.560 bln.

The company also issued in-line guidance for FY 2018, projecting EPS of $13.20-14.00 versus analysts' consensus estimate of $13.58. Its CapEx is expected to amount to $5.9 bln in FY 2018, in line with analysts' expectations.

FDX fell to $208.30 (-0.31%) in pre-market trading.

European stocks ended lower Tuesday, reversing gains as oil prices sank toward bear-market territory, taking energy-related shares with them. The Stoxx Europe 600 Oil and Gas Index SXEP, -2.18% was shoved 2.2% lower, losing the most since November as West Texas Intermediate oil futures CLN7, -1.95% and Brent crude futures LCOQ7, -0.17% swung lower by about 3%.

U.S. stocks finished lower Tuesday as investors dumped energy shares after crude-oil prices sank into bear-market territory. The S&P 500 SPX, -0.67% dropped 16.43 points, or 0.7%, to close at 2,437.03, with nine of the 11 main sectors trading lower. The energy sector was down 1.3%, topping the losers.

Stocks were lower across the Asia-Pacific region early Wednesday, as global price declines for oil hurt energy companies, though mainland markets were resilient after MSCI Inc. said it would include Chinese stocks in its emerging-markets index. Oil prices returned to bear-market territory overnight and the U.S. benchmark has fallen 20% from its last high point, with cuts by the Organization of the Petroleum Exporting Countries offset by increasing production elsewhere.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.