- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 18-08-2017.

The major stock indexes of the United States completed trading with a decrease. Some influence on the market was provided by news reports on the Axios news website that Senior Advisor of the White House Steve Bannon could soon be dismissed. Soon, the NY Times, citing sources in the administration, said that Trump had decided to fire Stephen C. Bannon, as the senior presidential adviser.

In addition, according to preliminary research results submitted by Thomson-Reuters and the Michigan Institute, the mood sensor among American consumers grew in August stronger than expected. The consumer sentiment index rose to 97.6 compared with the final reading for July at 93.4. According to estimates, the index was to grow to 94 points.

However, the representative of the Federal Reserve Kaplan said that GDP growth in 2017 will be slightly above 2%. "The US consumer sector supports the economy." The US households have the opportunity to spend money, "Kaplan said, adding that for labor force growth it is necessary to increase labor resources

Most components of the DOW index recorded a decline (20 out of 30). Outsider were the shares of NIKE, Inc. (NKE, -4.52%). Caterpillar Inc. was the growth leader. (CAT, + 0.72%).

The sectors of the S & P index showed mixed dynamics. The utilities sector grew most (+ 0.7%). The largest decline was demonstrated by the sector of conglomerates (-0.7%).

At closing:

Dow -0.35% 21.674.51 -76.22

Nasdaq -0.09% 6.216.53 -5.38

S & P -0.18% 2.425.55 -4.46

U.S. stock-index futures rose slightly on Friday, a day after the equity market demonstrated a significant drop amid concerns over President Donald Trump's ability to legislate his pro-growth agenda.

Global Stocks:

Nikkei 19,470.41 -232.22 -1.18%

Hang Seng 27,047.57 -296.65 -1.08%

Shanghai 3,269.24 +0.8117 +0.02%

S&P/ASX 5,747.11 -32.10 -0.56%

FTSE 7,321.29 -66.58 -0.90%

CAC 5,097.53 -49.32 -0.96%

DAX 12,164.76 -38.70 -0.32%

Crude $47.29 (+0.42%)

Gold $1,301.50 (+0.70%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 64.4 | 0.10(0.16%) | 215 |

| Amazon.com Inc., NASDAQ | AMZN | 964 | 3.43(0.36%) | 15323 |

| American Express Co | AXP | 85.62 | -0.47(-0.55%) | 100 |

| AMERICAN INTERNATIONAL GROUP | AIG | 61.4 | -0.27(-0.44%) | 237 |

| Apple Inc. | AAPL | 158.7 | 0.84(0.53%) | 137244 |

| AT&T Inc | T | 37.68 | 0.08(0.21%) | 8922 |

| Barrick Gold Corporation, NYSE | ABX | 17.04 | 0.19(1.13%) | 32780 |

| Boeing Co | BA | 235.91 | 0.32(0.14%) | 731 |

| Caterpillar Inc | CAT | 112.68 | -0.46(-0.41%) | 2669 |

| Cisco Systems Inc | CSCO | 31.08 | 0.04(0.13%) | 1368 |

| Citigroup Inc., NYSE | C | 66.61 | 0.01(0.02%) | 2010 |

| Deere & Company, NYSE | DE | 115.75 | -8.23(-6.64%) | 278878 |

| Exxon Mobil Corp | XOM | 76.41 | 0.15(0.20%) | 2994 |

| Facebook, Inc. | FB | 167.7 | 0.79(0.47%) | 83989 |

| Ford Motor Co. | F | 10.67 | 0.03(0.28%) | 11283 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.19 | -0.01(-0.07%) | 3948 |

| General Electric Co | GE | 24.69 | -0.06(-0.24%) | 22624 |

| General Motors Company, NYSE | GM | 35.1 | 0.10(0.29%) | 1301 |

| Goldman Sachs | GS | 222 | 0.58(0.26%) | 2060 |

| Google Inc. | GOOG | 914 | 3.02(0.33%) | 2678 |

| Hewlett-Packard Co. | HPQ | 18.52 | -0.12(-0.64%) | 1804 |

| Home Depot Inc | HD | 150 | 0.33(0.22%) | 1213 |

| Intel Corp | INTC | 35.3 | 0.13(0.37%) | 7667 |

| International Business Machines Co... | IBM | 140.6 | -0.10(-0.07%) | 732 |

| JPMorgan Chase and Co | JPM | 90.85 | 0.20(0.22%) | 4653 |

| McDonald's Corp | MCD | 158.5 | 0.61(0.39%) | 1912 |

| Microsoft Corp | MSFT | 72.66 | 0.26(0.36%) | 4253 |

| Nike | NKE | 55.14 | -2.32(-4.04%) | 183115 |

| Starbucks Corporation, NASDAQ | SBUX | 53 | -0.04(-0.08%) | 1867 |

| Tesla Motors, Inc., NASDAQ | TSLA | 354 | 2.08(0.59%) | 34154 |

| The Coca-Cola Co | KO | 45.95 | 0.09(0.20%) | 918 |

| Twitter, Inc., NYSE | TWTR | 15.94 | 0.07(0.44%) | 49963 |

| United Technologies Corp | UTX | 116 | -0.10(-0.09%) | 315 |

| Verizon Communications Inc | VZ | 48 | 0.11(0.23%) | 1517 |

| Visa | V | 102.01 | -0.15(-0.15%) | 541 |

| Wal-Mart Stores Inc | WMT | 79.88 | 0.18(0.23%) | 6122 |

| Walt Disney Co | DIS | 101.07 | -0.31(-0.31%) | 417 |

Wal-Mart (WMT) target raised to $77 from $76 at RBC Capital Mkts

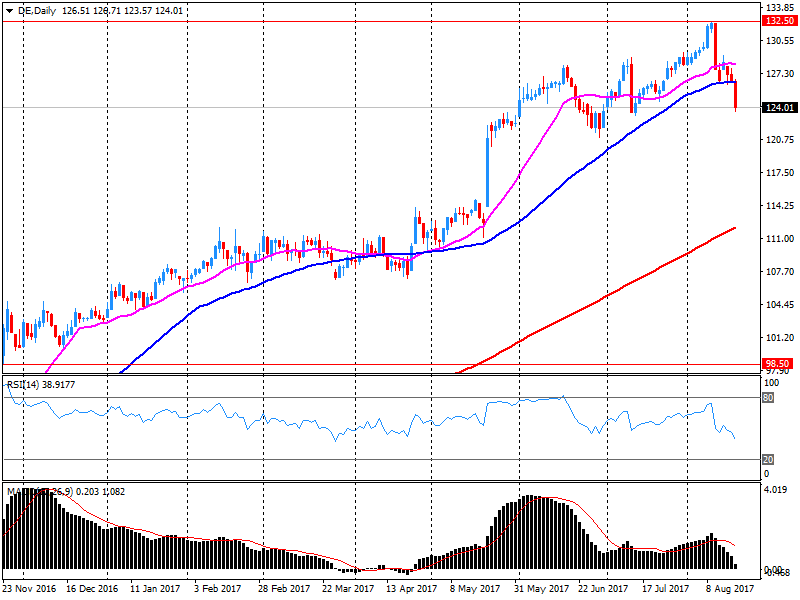

Deere (DE) reported Q3 FY 2017 earnings of $1.97 per share (versus $1.55 in Q3 FY 2016), beating analysts' consensus estimate of $1.95.

The company's quarterly revenues amounted to $6.833 bln (+16.6% y/y), missing analysts' consensus estimate of $6.919 bln.

DE fell to $118.00 (-4.82%) in pre-market trading.

Equity markets across the Asia-Pacific region were down Friday with Japan's Nikkei hitting a three-month low, weighed by overnight weakness on Wall Street following days of solid gains. Concerns about a terrorist attack in Barcelona, Spain, that left at least 13 people dead, as well as political uncertainties in the U.S. and simmering geopolitical tensions spurred investors to pull their money from riskier assets.

European stocks broke a three-day winning run Thursday, with bank shares dragged down by doubts about another U.S. interest rate hike in 2017, while the euro came under further pressure following minutes from the European Central Bank's meeting last month.

The Dow Jones Industrial Average on Thursday closed with its first drop of at least 1%, snapping a streak that had run for more than 60 sessions. The Dow DJIA, -1.24% finished 274 points, or 1.2%, lower at 21,750, as the broader stock market faced its biggest selloff since last week's North Korea-fueled jitters.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.