- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 15-05-2018.

| index | closing price | change items | % change |

| Nikkei | -47.84 | 22818.02 | -0.21% |

| TOPIX | -0.77 | 1805.15 | -0.04% |

| Hang Seng | -389.05 | 31152.03 | -1.23% |

| CSI 300 | +14.81 | 3924.10 | +0.38% |

| Euro Stoxx 50 | -1.45 | 3564.29 | -0.04 |

| FTSE 100 | +12.00 | 7722.98 | +0.16% |

| DAX | -7.67 | 12970.04 | -0.06% |

| CAC 40 | +12.48 | 5553.16 | +0.23% |

| DJIA | -193.00 | 24706.41 | -0.78% |

| S&P 500 | -18.68 | 2711.45 | -0.68% |

| NASDAQ | -59.69 | 7351.63 | -0.81% |

| S&P/TSX | +12.20 | 16097.81 | +0.08% |

Major US stock indexes finished trading in the red after the latest data on retail sales showed an increase in inflation and pushed the yield of treasury bonds, while trade problems in the negotiations between the US and China remained without signs of progress.

As the report of the Ministry of Trade showed, retail sales in the US only slightly increased in April. According to the report, retail sales increased seasonally by 0.3% m / m last month, as economists had forecast. The increase in spending last month was mostly widespread: food and beverage stores, as well as clothing and accessories retailers, experienced the largest increase in sales since last year. On the contrary, weak spending was observed in restaurants and bars, which declined by 0.3% since March. Sales at gas stations in April rose by 0.8% compared to the previous month, which was due to the recent increase in fuel prices. With the exception of gasoline and cars, costs rose 0.3% since March. With the exception of cars and auto parts, sales also rose by 0.3%. Economists had expected growth of 0.5% of retail sales excluding cars.

In addition, the index of the state of the housing market from the NAHB grew in May. The confidence of builders in the market of newly built houses for a single family rose by 2 points to 70 in May after the April reading of the NAHB / Wells Fargo housing market index (HMI). This is the fourth time that the HMI has reached 70 or higher this year.

Almost the majority of S & P sectors recorded a decline. The greatest decrease was shown by the sector of conglomerates (-1.5%). The commodities sector grew most (+ 0.9%).

Almost all components of DOW finished trading in the red (28 of 30). Outsider were shares of Caterpillar Inc. (CAT, -1.93%). Leader of the growth were shares of NIKE, Inc. (NKE, + 0.83%).

All S & P sectors recorded a decline. The largest drop was shown by the healthcare sector (-1.3%).

At closing:

Dow 24,706.34 -193.07 -0.78%

S&P 500 2,711.45 -18.68 -0.68%

Nasdaq 100 7,351.63 -59.69 -0.81%

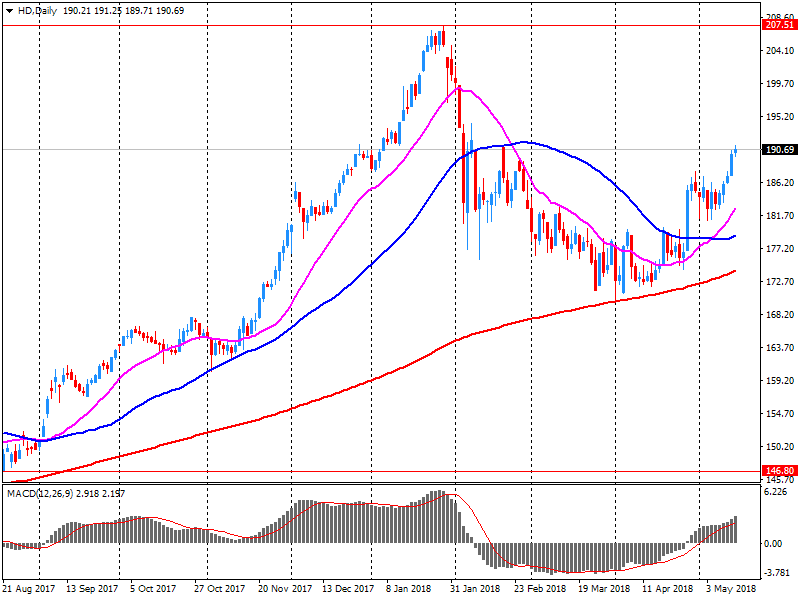

U.S. stock-index futures fell on Tuesday as investors digested April retail sales and Q1 financials of Home Depot (HD), while awaiting news about the second round of trade talks between the U.S. and China.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,818.02 | -47.84 | -0.21% |

| Hang Seng | 31,152.03 | -389.05 | -1.23% |

| Shanghai | 3,192.58 | +18.55 | +0.58% |

| S&P/ASX | 6,097.80 | -37.50 | -0.61% |

| FTSE | 7,744.95 | +33.97 | +0.44% |

| CAC | 5,559.71 | +19.03 | +0.34% |

| DAX | 12,988.72 | +11.01 | +0.08% |

| Crude | $71.65 | | +0.97% |

| Gold | $1,301.40 | | -1.27% |

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 54.93 | -0.09(-0.16%) | 3460 |

| Amazon.com Inc., NASDAQ | AMZN | 1,593.00 | -8.54(-0.53%) | 19558 |

| Apple Inc. | AAPL | 187.15 | -1.00(-0.53%) | 145898 |

| AT&T Inc | T | 32.21 | 0.02(0.06%) | 15423 |

| Barrick Gold Corporation, NYSE | ABX | 13.33 | -0.15(-1.11%) | 11305 |

| Boeing Co | BA | 343.08 | -1.51(-0.44%) | 5151 |

| Caterpillar Inc | CAT | 154.5 | -0.78(-0.50%) | 1811 |

| Chevron Corp | CVX | 130.55 | 0.16(0.12%) | 5868 |

| Cisco Systems Inc | CSCO | 45.55 | -0.15(-0.33%) | 12640 |

| Citigroup Inc., NYSE | C | 72.47 | -0.15(-0.21%) | 6620 |

| Exxon Mobil Corp | XOM | 82.06 | 0.23(0.28%) | 9989 |

| Facebook, Inc. | FB | 185.32 | -1.32(-0.71%) | 255578 |

| Ford Motor Co. | F | 11.1 | -0.08(-0.72%) | 62537 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.08 | -0.12(-0.74%) | 3570 |

| General Electric Co | GE | 14.73 | 0.02(0.14%) | 63341 |

| General Motors Company, NYSE | GM | 36.53 | -0.10(-0.27%) | 3515 |

| Goldman Sachs | GS | 243.5 | -0.41(-0.17%) | 1906 |

| Google Inc. | GOOG | 1,093.50 | -6.70(-0.61%) | 3075 |

| Home Depot Inc | HD | 185.6 | -5.48(-2.87%) | 249090 |

| Intel Corp | INTC | 54.6 | -0.30(-0.55%) | 10027 |

| International Business Machines Co... | IBM | 144.18 | -0.12(-0.08%) | 653 |

| JPMorgan Chase and Co | JPM | 113.63 | -0.27(-0.24%) | 6897 |

| McDonald's Corp | MCD | 164.64 | -0.08(-0.05%) | 732 |

| Merck & Co Inc | MRK | 59.31 | -0.37(-0.62%) | 291 |

| Microsoft Corp | MSFT | 97.5 | -0.53(-0.54%) | 12023 |

| Nike | NKE | 68.83 | -0.01(-0.01%) | 332 |

| Pfizer Inc | PFE | 35.69 | -0.17(-0.47%) | 5609 |

| Procter & Gamble Co | PG | 73.2 | -0.08(-0.11%) | 3127 |

| Starbucks Corporation, NASDAQ | SBUX | 57 | -0.13(-0.23%) | 1095 |

| Tesla Motors, Inc., NASDAQ | TSLA | 284.7 | -7.27(-2.49%) | 221469 |

| The Coca-Cola Co | KO | 41.98 | -0.06(-0.14%) | 3522 |

| Twitter, Inc., NYSE | TWTR | 33.25 | -0.14(-0.42%) | 47270 |

| UnitedHealth Group Inc | UNH | 242 | -0.90(-0.37%) | 400 |

| Verizon Communications Inc | VZ | 48.48 | -0.01(-0.02%) | 5767 |

| Visa | V | 130.56 | -0.65(-0.50%) | 1089 |

| Wal-Mart Stores Inc | WMT | 84.35 | -0.04(-0.05%) | 24504 |

| Walt Disney Co | DIS | 102.43 | -0.01(-0.01%) | 1851 |

| Yandex N.V., NASDAQ | YNDX | 35 | 0.14(0.40%) | 1405 |

Tesla (TSLA) target lowered to $291 from $376 at Morgan Stanley

Ford Motor (F) downgraded to Neutral from Overweight at Piper Jaffray

Home Depot (HD) reported Q1 FY 2018 earnings of $2.08 per share (versus $1.67 in Q1 FY 2017), beating analysts' consensus estimate of $2.05.

The company's quarterly revenues amounted to $24.947 bln (+4.4% y/y), generally in-line with analysts' consensus estimate of $25.172 bln.

The company reaffirmed guidance for FY 2018, projecting EPS of $9.31 (versus analysts' consensus estimate of $9.43) on revenues of $107.50 bln (versus analysts' consensus estimate of $107.73 bln).

HD fell to $185.50 (-2.92%) in pre-market trading.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.