- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 14-12-2017.

(index / closing price / change items /% change)

Nikkei -63.62 22694.45 -0.28%

TOPIX -2.70 1808.14 -0.15%

Hang Seng -55.72 29166.38 -0.19%

CSI 300 -23.94 4026.15 -0.59%

Euro Stoxx 50 -25.53 3556.22 -0.71%

FTSE 100 -48.39 7448.12 -0.65%

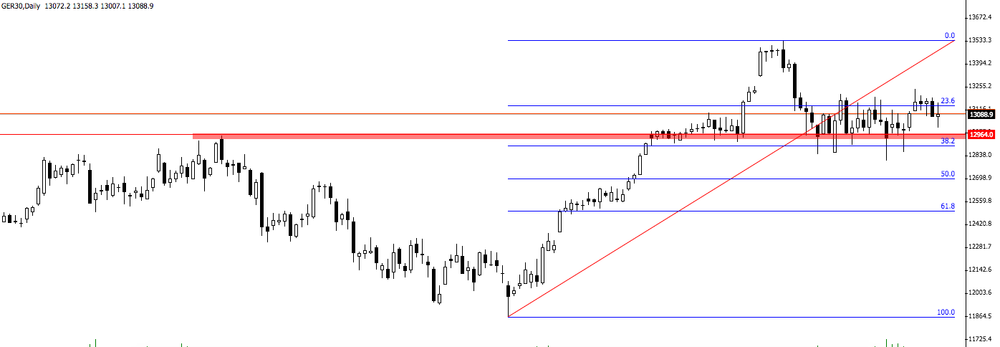

DAX -57.56 13068.08 -0.44%

CAC 40 -42.31 5357.14 -0.78%

DJIA -76.77 24508.66 -0.31%

S&P 500 -10.84 2652.01 -0.41%

NASDAQ -19.27 6856.53 -0.28%

S&P/TSX -120.13 16016.46 -0.74%

The main US stock indexes have moderately decreased, having receded from record marks. Market dynamics continued to be affected by the Fed's optimistic view of the economy and news that changes in the Republican tax code will be put to the final vote in Congress before the end of the year.

In addition, as it became known, the initial applications for unemployment benefits in the US for the week to December 9 fell by 11,000 to 225,000. This is only slightly higher than the post-recession low. Economists predicted that the figure would be 239,000.

Meanwhile, the US Department of Commerce reported that retail sales for November, adjusted for seasonal fluctuations and holidays and trading days, but not price changes, amounted to $ 492.7 billion, which is 0.8% more than in October, and 5.5% higher than November 2016. Total sales for the period from September 2017 to November 2017 increased by 5.2% compared to the same period in 2016. The change from September to October was revised from 0.2% to 0.5%.

A separate report from the Ministry of Trade indicated that the volume of commercial inventories in the US declined in October on the back of strong sales growth, which indicates that investment in inventories is likely to make a major contribution to economic growth in the fourth quarter. Commodity inventories declined 0.1% in October after they did not change in September. The last change coincided with the forecasts. Retail stocks, except for cars that go into the calculation of GDP, increased by 0.4%. In September, they decreased by 0.1%.

Most components of the DOW index recorded a decline (22 out of 30). Outsider were shares of Caterpillar Inc. (CAT, -1.39%). The leader of growth was the shares of The Walt Disney Company (DIS, + 2.99%).

All sectors of the S & P index finished trading in the red. The health sector showed the greatest decline (-0.9%).

At closing:

DJIA -0.31% 24.510.11 -75.32

Nasdaq -0.28% 6,856.53 -19.27

S & P -0.40% 2,652.14 -10.71

U.S. stock-index futures were flat on Thursday as investors focused on a $52.4 billion stock deal between Walt Disney (DIS) and 21st Century Fox (FOX) and gains in shares of big banks.

Global Stocks:

Nikkei 22,694.45 -63.62 -0.28%

Hang Seng 29,166.38 -55.72 -0.19%

Shanghai 3,293.58 -9.46 -0.29%

S&P/ASX 6,011.30 -10.50 -0.17%

FTSE 7,484.30 -12.21 -0.16%

CAC 5,388.46 -10.99 -0.20%

DAX 13,043.94 -81.70 -0.62%

Crude $56.26 (-0.60%)

Gold $1,253.50 (+0.65%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 42.04 | 0.18(0.43%) | 402 |

| ALTRIA GROUP INC. | MO | 72.49 | 0.17(0.24%) | 530 |

| Amazon.com Inc., NASDAQ | AMZN | 1,164.00 | -0.13(-0.01%) | 10851 |

| Apple Inc. | AAPL | 172.46 | 0.19(0.11%) | 31043 |

| AT&T Inc | T | 37.9 | -0.14(-0.37%) | 9245 |

| Boeing Co | BA | 292.4 | 0.56(0.19%) | 8915 |

| Caterpillar Inc | CAT | 149 | 0.43(0.29%) | 3424 |

| Chevron Corp | CVX | 119.98 | 0.05(0.04%) | 143 |

| Cisco Systems Inc | CSCO | 38.25 | 0.10(0.26%) | 10010 |

| Citigroup Inc., NYSE | C | 75.33 | 0.19(0.25%) | 9505 |

| Exxon Mobil Corp | XOM | 82.99 | -0.13(-0.16%) | 1986 |

| Facebook, Inc. | FB | 178.4 | 0.10(0.06%) | 35714 |

| Ford Motor Co. | F | 12.71 | 0.08(0.63%) | 1697 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.28 | -0.04(-0.25%) | 12690 |

| General Electric Co | GE | 17.82 | 0.06(0.34%) | 43669 |

| Goldman Sachs | GS | 256.5 | 0.94(0.37%) | 816 |

| Hewlett-Packard Co. | HPQ | 20.6 | -0.25(-1.20%) | 2118 |

| Home Depot Inc | HD | 183.41 | 0.38(0.21%) | 193 |

| Intel Corp | INTC | 43.57 | 0.23(0.53%) | 1495 |

| International Business Machines Co... | IBM | 154.5 | 0.59(0.38%) | 908 |

| JPMorgan Chase and Co | JPM | 105.9 | 0.39(0.37%) | 16573 |

| McDonald's Corp | MCD | 173.75 | 0.20(0.12%) | 989 |

| Merck & Co Inc | MRK | 56.61 | 0.18(0.32%) | 4203 |

| Microsoft Corp | MSFT | 85.54 | 0.19(0.22%) | 9376 |

| Nike | NKE | 64.46 | 0.16(0.25%) | 32741 |

| Pfizer Inc | PFE | 36.67 | 0.03(0.08%) | 3887 |

| Starbucks Corporation, NASDAQ | SBUX | 59.44 | -0.05(-0.08%) | 1452 |

| Tesla Motors, Inc., NASDAQ | TSLA | 340.55 | 1.52(0.45%) | 20602 |

| The Coca-Cola Co | KO | 46.05 | 0.15(0.33%) | 2098 |

| Twitter, Inc., NYSE | TWTR | 21.83 | 0.17(0.78%) | 30671 |

| United Technologies Corp | UTX | 124.47 | 0.17(0.14%) | 100 |

| Verizon Communications Inc | VZ | 52.64 | -0.25(-0.47%) | 3387 |

| Visa | V | 113.6 | 0.29(0.26%) | 646 |

| Wal-Mart Stores Inc | WMT | 98 | 0.24(0.25%) | 3013 |

| Walt Disney Co | DIS | 106.4 | -1.21(-1.12%) | 757115 |

| Yandex N.V., NASDAQ | YNDX | 33.08 | 0.36(1.10%) | 3705 |

Procter & Gamble (PG) initiated with Buy at Deutsche Bank

McDonald's (MCD) target raised to $185 from $175 at Piper Jaffray

NIKE (NKE) target raised to $76 from $61 at Deutsche Bank

Honeywell (HON) target raised to $180 from $162 at Jefferies

Honeywell (HON) target lowered to $169 at Stifel

European stocks pulled back from a five-week high Wednesday, with investors bracing for an expected hike in borrowing costs by the Federal Reserve, while retail shares were showing strength. Italian stocks fared the worst in the region as the country begins to gear up for a national election next year.

U.S. stocks mostly rose on Wednesday, with the Dow ending at a record for a fourth straight session after the Federal Reserve raised interest rates, as had been widely expected. While the day's gains were broad, a sharp decline in financial shares limited the broader market's advance and pushed the S&P 500 into slightly negative territory in the final minutes of trading.

Asian stocks edged higher on Thursday after the Federal Reserve delivered a much-anticipated interest rate hike but flagged caution about inflation, tempering expectations for future tightening, which weighed on the dollar and Treasury yields. China's central bank also raised rates, though marginally.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.