- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 12-01-2018.

The main US stock indexes have moderately grown, having updated the record highs. The catalyst for this was the strong quarterly results of JPMorgan and reliable data on retail sales and consumer prices.

The Commerce Ministry said retail sales increased by 0.4% in seasonally adjusted terms in December compared with November. Economists had expected an increase of 0.4%. Retail sales increased by 0.9% in November, and sales growth in October was also revised upward. Sales in the fourth quarter as a whole increased by 5.5% compared to the same period a year earlier. With the exception of cars, often unstable, sales increased by 0.4%; economists were expecting a 0.3% increase. With the exception of cars and gasoline, sales rose 0.4% in December.

A separate report from the Ministry of Labor showed that the consumer price index increased by 0.1% in December, compared to the previous month. This increase was less than the expectations of economists (+ 0.2%). In December, except for the volatile categories of food and energy, prices rose 0.3%, which is the biggest increase in so-called base prices since January 2017. Economists had expected base prices to grow more modestly, by 0.2% compared to November.

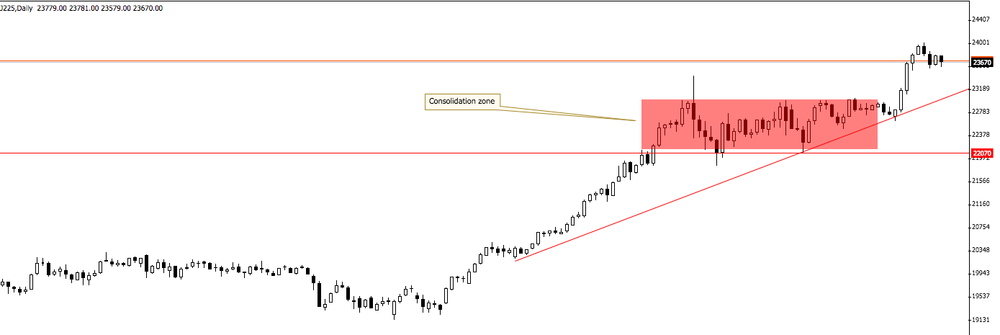

Most components of the DOW index finished trading in positive territory (24 out of 30). The leader of growth was the shares of The Boeing Company (BA, + 2.49%). Outsider were shares of General Electric Company (GE, -1.55%).

Most sectors of S & P showed an increase. The services sector grew most (+ 0.9%). The utilities sector showed the greatest decrease (-0.5%).

At closing:

Dow + 0.80% 25.778.80 +204.07

Nasdaq + 0.59% 7,254.01 +42.23

S & P + 0.59% 2.783.83 +16.27

U.S. stock-index futures were mixed on Friday, as investors digested fourth-quarter earnings from financial heavyweights JPMorgan Chase (JPM) and Wells Fargo (WFC), while Facebook (FB) saw selling pressure amid concerns that recent updates to its news feed will cause users to spend less time on the site.

Global Stocks:

Nikkei 23,653.82 -56.61 -0.24%

Hang Seng 31,412.54 +292.15 +0.94%

Shanghai 3,429.32 +3.97 +0.12%

S&P/ASX 6,070.10 +2.50 +0.04%

FTSE 7,773.23 +10.29 +0.13%

CAC 5,503.06 +14.51 +0.26%

DAX 13,185.87 -17.03 -0.13%

Crude $63.26 (-0.85%)

Gold $1,326.90 (+0.33%)

(company / ticker / price / change ($/%) / volume)

| AA | ALCOA INC. | 57.35 | 0.44(0.77%) | 5101 |

| AAPL | Apple Inc. | 175.83 | 0.55(0.31%) | 250101 |

| ABX | Barrick Gold Corporation, NYSE | 14.77 | 0.12(0.82%) | 33825 |

| AIG | AMERICAN INTERNATIONAL GROUP | 61 | -0.15(-0.25%) | 1000 |

| AMZN | Amazon.com Inc., NASDAQ | 1,275.00 | -1.68(-0.13%) | 92223 |

| AXP | American Express Co | 100.23 | -0.50(-0.50%) | 4050 |

| BA | Boeing Co | 329.75 | 1.63(0.50%) | 38824 |

| C | Citigroup Inc., NYSE | 75.45 | -0.11(-0.15%) | 52248 |

| CAT | Caterpillar Inc | 170.02 | 0.82(0.48%) | 18620 |

| CSCO | Cisco Systems Inc | 40.13 | 0.03(0.07%) | 16989 |

| CVX | Chevron Corp | 132.48 | -0.09(-0.07%) | 6043 |

| DE | Deere & Company, NYSE | 168.34 | 0.88(0.53%) | 2316 |

| DIS | Walt Disney Co | 111.3 | 0.31(0.28%) | 2748 |

| F | Ford Motor Co. | 13.06 | -0.10(-0.76%) | 53602 |

| FB | Facebook, Inc. | 178.8 | -8.97(-4.78%) | 3789493 |

| FCX | Freeport-McMoRan Copper & Gold Inc., NYSE | 19.82 | -0.06(-0.30%) | 16604 |

| FDX | FedEx Corporation, NYSE | 272.28 | 1.09(0.40%) | 649 |

| GE | General Electric Co | 19.12 | 0.10(0.53%) | 528093 |

| GM | General Motors Company, NYSE | 44.3 | 0.11(0.25%) | 19240 |

| GOOG | Google Inc. | 1,105.00 | -0.52(-0.05%) | 20731 |

| GS | Goldman Sachs | 254.14 | -0.99(-0.39%) | 49381 |

| HD | Home Depot Inc | 194.8 | 0.12(0.06%) | 3881 |

| HPQ | Hewlett-Packard Co. | 22.35 | -0.06(-0.27%) | 424 |

| IBM | International Business Machines Co... | 165.05 | 0.85(0.52%) | 8458 |

| INTC | Intel Corp | 43.5 | 0.09(0.21%) | 57501 |

| JNJ | Johnson & Johnson | 145.2 | 0.41(0.28%) | 1959 |

| JPM | JPMorgan Chase and Co | 111.45 | 0.61(0.55%) | 466402 |

| KO | The Coca-Cola Co | 46.21 | 0.17(0.37%) | 19802 |

| MCD | McDonald's Corp | 173.82 | 0.43(0.25%) | 2009 |

| MMM | 3M Co | 243 | 0.69(0.28%) | 874 |

| MO | ALTRIA GROUP INC. | 70.21 | -0.08(-0.11%) | 1533 |

| MRK | Merck & Co Inc | 57.81 | 0.21(0.36%) | 4107 |

| MSFT | Microsoft Corp | 88.38 | 0.30(0.34%) | 63722 |

| NKE | Nike | 64.4 | 0.11(0.17%) | 834 |

| PFE | Pfizer Inc | 36.66 | 0.10(0.27%) | 6938 |

| PG | Procter & Gamble Co | 90.28 | 0.13(0.14%) | 12790 |

| SBUX | Starbucks Corporation, NASDAQ | 60.11 | 0.11(0.18%) | 9866 |

| TRV | Travelers Companies Inc | 132.82 | 0.48(0.36%) | 2036 |

| TSLA | Tesla Motors, Inc., NASDAQ | 339 | 1.05(0.31%) | 15827 |

| TWTR | Twitter, Inc., NYSE | 24.99 | 0.64(2.63%) | 639831 |

| UNH | UnitedHealth Group Inc | 226.43 | 1.04(0.46%) | 924 |

| UTX | United Technologies Corp | 135.93 | 0.94(0.70%) | 2190 |

| V | Visa | 120.07 | 0.23(0.19%) | 6811 |

| VZ | Verizon Communications Inc | 52.16 | 0.05(0.10%) | 5053 |

| WMT | Wal-Mart Stores Inc | 100 | -0.02(-0.02%) | 3692 |

| XOM | Exxon Mobil Corp | 86.94 | 0.01(0.01%) | 3784 |

Apple (AAPL) target raised to $204 from $193 at Maxim Group

Twitter (TWTR) target raised to $30 from $25 at BTIG Research

Visa (V) target raised to $136 from $124 at Citigroup

Alphabet (GOOG) target raised to $1300 from $1150 at Piper Jaffray

Johnson & Johnson (JNJ) target raised to $160 from $155 at Wells Fargo

Microsoft (MSFT) target raised to $100 from $90 at Wells Fargo

Amazon (AMZN) target raised to $1400 from $1270 at SunTrust

Caterpillar (CAT) target raised to $189 from $158 at BofA/Merrill Boeing (BA) target raised to $375 from $310 at Credit Suisse UnitedHealth (UNH) target raised to $255 from $235 at Evercore ISI Home Depot (HD) target raised to $227 from $200 at Deutsche Bank

American Express (AXP) downgraded to Neutral from Overweight at JP Morgan

Coca-Cola (KO) upgraded to Outperform from In-line at Evercore ISI

Wells Fargo (WFC) reported Q4 FY 2017 earnings of $1.16 per share (versus $0.96 in Q4 FY 2016), beating analysts' consensus estimate of $1.03.

The company's quarterly revenues amounted to $22.050 bln (+2.2% y/y), missing analysts' consensus estimate of $22.638 bln.

WFC fell to $62.24 (-1.22%) in pre-market trading.

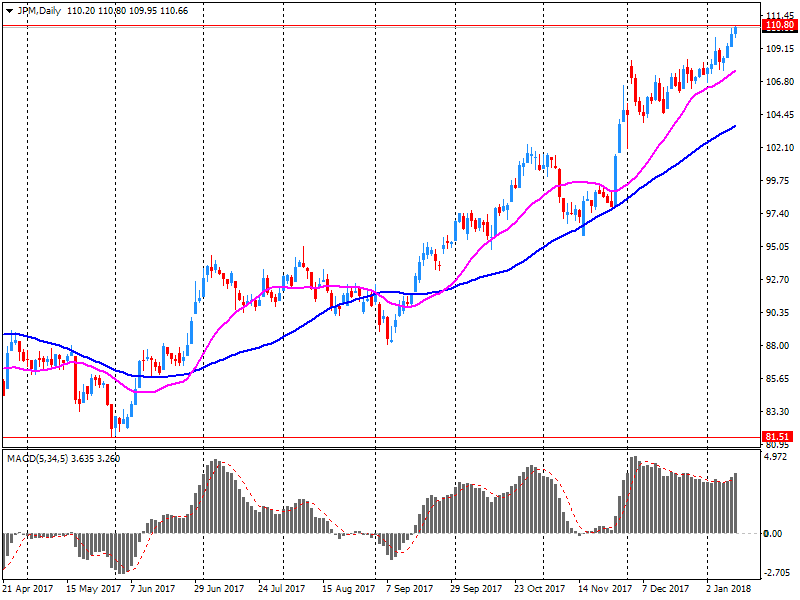

JPMorgan Chase (JPM) reported Q4 FY 2017 earnings of $1.76 per share (versus $1.71 in Q4 FY 2016), beating analysts' consensus estimate of $1.69.

The company's quarterly revenues amounted to $24.153 bln (+3.3% y/y), missing analysts' consensus estimate of $24.873 bln.

JPM fell to $110.36 (-0.43%) in pre-market trading.

European stocks finished at their lowest in a week Thursday, as investors considered a signal from the European Central Bank that it's positioning for a more hawkish view on monetary policy. Retailers, meanwhile, struggled after the release of disappointing financial updates from the sector that included the key Christmas shopping period.

U.S. stock benchmarks resumed their climb to close at records on Thursday, a day after the S&P 500 and Nasdaq suffered the first down day of the year on anxieties about appetite for Treasurys from the world's second-largest economy, China.

Asian stocks resumed their ascent on Friday, supported by US earnings optimism and a rise in oil prices while the euro edged higher as the European Central Bank signalled an end to its massive stimulus.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.