- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 09-05-2018.

| index | closing price | change items | % change |

| Nikkei | -99.81 | 22408.88 | -0.44% |

| TOPIX | -6.91 | 1772.91 | -0.39% |

| Hang Seng | +133.33 | 30536.14 | +0.44% |

| CSI 300 | -7.06 | 3871.62 | -0.18% |

| Euro Stoxx 50 | +11.86 | 3569.74 | +0.33% |

| FTSE 100 | +96.77 | 7662.52 | +1.28% |

| DAX | +30.85 | 12943.06 | +0.24% |

| CAC 40 | +12.70 | 5534.63 | +0.23% |

| DJIA | +182.33 | 24542.54 | +0.75% |

| S&P 500 | +25.87 | 2697.79 | +0.97% |

| NASDAQ | +73.00 | 7339.91 | +1.00% |

| S&P/TSX | +68.10 | 15910.81 | +0.43% |

Major US stock indices rose on Wednesday amid rising oil prices after Donald Trump pulled the United States out of a nuclear deal with Iran.

In addition, as it became known, wholesale stocks in the US increased less than originally expected in March, amid a decline in car stocks and a number of other goods. The Ministry of Commerce said on Wednesday that wholesale stocks rose 0.3% instead of 0.5%, which it reported last month. Stocks of wholesalers in February rose by 0.9%. The component of wholesale stocks, which goes into the calculation of gross domestic product - wholesale stocks, excluding auto, - increased by 0.4% in March.

At the same time, producer prices in the US increased slightly last month, becoming a possible sign that inflationary pressures remain relatively modest in the economy. The producer price index, a measure of the prices charged by companies for their goods and services, increased seasonally by 0.1% in April compared with the previous month, the Ministry of Labor said on Wednesday. Economists forecast an increase of 0.2%. Since last year, producer prices have increased by 2.6% last month, which is the smallest annual increase since December.

Oil prices rose by almost 3%, reaching 3.5-year highs, after US President Trump refused a nuclear deal with Iran and announced the imposition of economic sanctions against a member of OPEC at "the highest level"

Most DOW components are in the black (22 out of 30). The leader of growth was the shares of DowDuPont Inc. (DWDP, + 2.82%). Outsider were shares Walmart Inc. (WMT, -3.14%).

Almost all sectors of S & P completed the auction in positive territory. The commodities sector grew most (+ 2.2%). The decrease was shown only by the utilities sector (-0.5%).

At closing:

Index

Dow 24,542.54 +182.33 +0.75%

S&P 500 2,697.79 +25.87 +0.97%

Nasdaq 100 7,339.90 +73.00 +1.00%

U.S. stock-index futures rose on Wednesday, as energy stocks surged on oil rally, triggered by the U.S. president Donald Trump's decision to pull his country out of the Iran nuclear deal, and reimpose sanctions against Tehran.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,408.88 | -99.81 | -0.44% |

| Hang Seng | 30,536.14 | +133.33 | +0.44% |

| Shanghai | 3,158.81 | -2.68 | -0.08% |

| S&P/ASX | 6,108.00 | +16.10 | +0.26% |

| FTSE | 7,602.77 | +37.02 | +0.49% |

| CAC | 5,517.48 | -4.45 | -0.08% |

| DAX | 12,906.53 | -5.68 | -0.04% |

| Crude | $70.74 | | +2.43% |

| Gold | $1,313.20 | | -0.04% |

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 1,603.79 | 11.40(0.72%) | 49061 |

| Google Inc. | GOOG | 1,057.50 | 3.59(0.34%) | 2295 |

| 3M Co | MMM | 202.9 | 1.16(0.58%) | 522 |

| Apple Inc. | AAPL | 186.62 | 0.57(0.31%) | 130807 |

| AT&T Inc | T | 31.75 | 0.05(0.16%) | 45308 |

| Barrick Gold Corporation, NYSE | ABX | 13.25 | -0.03(-0.23%) | 27880 |

| Boeing Co | BA | 340.3 | 1.93(0.57%) | 18703 |

| Caterpillar Inc | CAT | 150.85 | 0.92(0.61%) | 7132 |

| Chevron Corp | CVX | 128 | 1.43(1.13%) | 8902 |

| Cisco Systems Inc | CSCO | 45.89 | 0.18(0.39%) | 13996 |

| Citigroup Inc., NYSE | C | 71.26 | 0.26(0.37%) | 11097 |

| Deere & Company, NYSE | DE | 143 | 0.93(0.65%) | 1400 |

| Exxon Mobil Corp | XOM | 78.95 | 0.86(1.10%) | 23602 |

| Facebook, Inc. | FB | 179.35 | 0.43(0.24%) | 68317 |

| Ford Motor Co. | F | 11.23 | -0.04(-0.35%) | 122354 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.38 | 0.08(0.52%) | 13500 |

| General Electric Co | GE | 14.4 | 0.13(0.91%) | 120128 |

| General Motors Company, NYSE | GM | 36.49 | 0.16(0.44%) | 1095 |

| Goldman Sachs | GS | 238.92 | 1.92(0.81%) | 27913 |

| Hewlett-Packard Co. | HPQ | 21.92 | -0.04(-0.18%) | 1872 |

| Home Depot Inc | HD | 185.6 | 0.56(0.30%) | 1641 |

| HONEYWELL INTERNATIONAL INC. | HON | 144.6 | 0.37(0.26%) | 400 |

| Intel Corp | INTC | 53.79 | 0.16(0.30%) | 16078 |

| International Business Machines Co... | IBM | 142.18 | 0.75(0.53%) | 4943 |

| Johnson & Johnson | JNJ | 123 | 0.39(0.32%) | 1806 |

| JPMorgan Chase and Co | JPM | 111.5 | 0.51(0.46%) | 10044 |

| McDonald's Corp | MCD | 165.58 | 0.81(0.49%) | 1824 |

| Microsoft Corp | MSFT | 96.1 | 0.29(0.30%) | 85420 |

| Nike | NKE | 68.54 | 0.08(0.12%) | 822 |

| Pfizer Inc | PFE | 35.2 | 0.22(0.63%) | 1341 |

| Procter & Gamble Co | PG | 71.74 | 0.30(0.42%) | 7026 |

| Starbucks Corporation, NASDAQ | SBUX | 57.58 | 0.21(0.37%) | 16198 |

| Tesla Motors, Inc., NASDAQ | TSLA | 303 | 1.03(0.34%) | 31193 |

| The Coca-Cola Co | KO | 41.93 | 0.12(0.29%) | 5180 |

| Twitter, Inc., NYSE | TWTR | 31.98 | 0.13(0.41%) | 59313 |

| United Technologies Corp | UTX | 122.5 | 0.71(0.58%) | 1572 |

| UnitedHealth Group Inc | UNH | 233 | 0.97(0.42%) | 489 |

| Verizon Communications Inc | VZ | 47.22 | 0.20(0.43%) | 8632 |

| Visa | V | 130.2 | 0.30(0.23%) | 7613 |

| Wal-Mart Stores Inc | WMT | 81.72 | -4.02(-4.69%) | 1611291 |

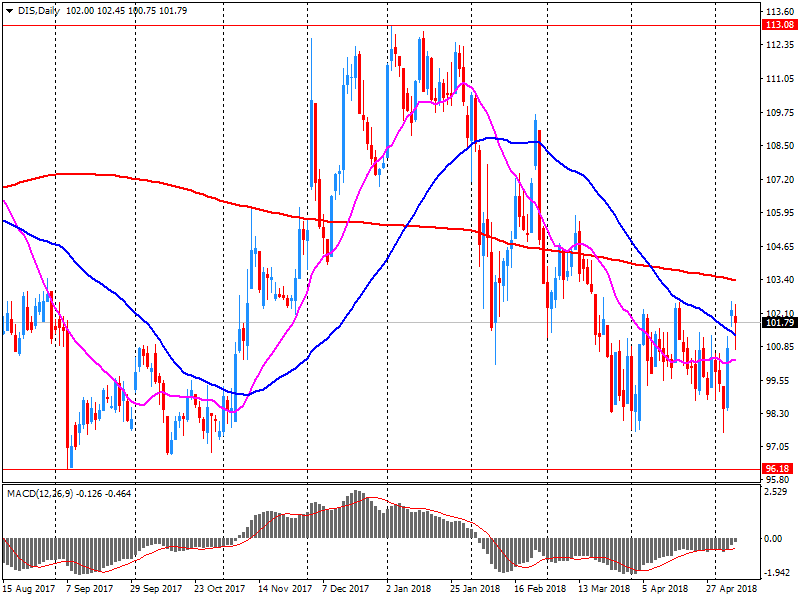

| Walt Disney Co | DIS | 101.1 | -0.69(-0.68%) | 94685 |

Walt Disney (DIS) target lowered to $123 from $125 at B. Riley FBR

Walt Disney (DIS) reported Q2 FY 2018 earnings of $1.84 per share (versus $1.50 in Q2 FY 2017), beating analysts' consensus estimate of $1.70.

The company's quarterly revenues amounted to $14.548 bln (+9.1% y/y), beating analysts' consensus estimate of $14.113 bln.

DIS fell to $101.00 (-0.78%) in pre-market trading.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.