- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 03-01-2018.

(index / closing price / change items /% change)

Nikkei -19.04 22764.94 -0.08%

TOPIX -1.47 1817.56 -0.08%

Hang Seng +45.64 30560.95 +0.15%

CSI 300 +23.99 4111.39 +0.59%

Euro Stoxx 50 +19.69 3509.88 +0.56%

FTSE 100 +23.01 7671.11 +0.30%

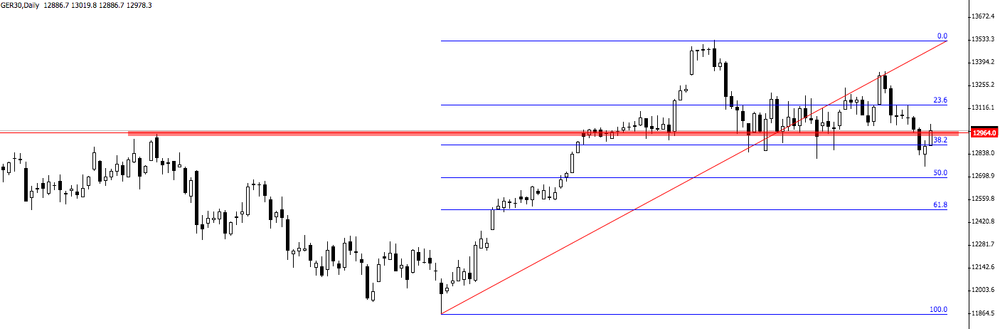

DAX +106.82 12978.21 +0.83%

CAC 40 +42.68 5331.28 +0.81%

DJIA +98.67 24922.68 +0.40%

S&P 500 +17.25 2713.06 +0.64%

NASDAQ +58.63 7065.53 +0.84%

S&P/TSX +61.56 16371.55 +0.38%

Major US stock indexes completed the session on positive territory, supported by the growth of shares in the conglomerate sector and the core resources sector.

In addition, according to a report published by the Institute for Supply Management (ISM), in December, activity in the US manufacturing sector grew, contrary to the forecasts of economists, who suggested deterioration. The PMI index for the manufacturing sector was 59.7 points in December against 58.2 points in November. Analysts had expected that this figure would drop to 58.1 points. The value of the ISM index greater than 50 is usually considered as an indicator of growth in production activity, and less than 50, respectively, of the fall.

Quotes of oil jumped by about 2%, reaching new 2.5-year highs, as the sustainability of production in the US and Russia was counterbalanced by continued tensions in Iran. Carsten Fritch, an analyst at Commerzbank, warned that prices may face correction, so the support provided by the riots in Iran will weaken if the situation does not begin to affect the volume of oil production, which has not yet happened, or the US will reapply sanctions.

Most components of the DOW index finished trading in positive territory (23 out of 30). The leader of growth was the shares of International Business Machines Corporation (IBM, + 2.87%). Outsider were shares of Intel Corporation (INTC, -3.72%).

Almost all sectors of the S & P index recorded an increase. The conglomerate sector grew most (+ 1.5%). The decrease was shown only by the utilities sector (-0.7%).

At closing:

DJIA + 0.40% 24,922.68 +98.67

Nasdaq + 0.84% 7,065.53 +58.63

S & P + 0.64% 2,713.06 +17.25

U.S. stock-index futures advanced on Wednesday as signs of strong global economic growth boosted risk-on sentiment among investors.

Global Stocks:

Nikkei -

Hang Seng 30,560.95 +45.64 +0.15%

Shanghai 3,370.10 +21.77 +0.65%

S&P/ASX 6,070.40 +9.10 +0.15%

FTSE 7,654.38 +6.28 +0.08%

CAC5,313.47 +24.87 +0.47%

DAX 12,936.80 +65.41 +0.51%

Crude $60.78 (+0.68%)

Gold $1,317.60 (+0.11%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 55.19 | 0.02(0.04%) | 1085 |

| Amazon.com Inc., NASDAQ | AMZN | 1,188.00 | -1.01(-0.08%) | 7105 |

| American Express Co | AXP | 99.25 | 0.31(0.31%) | 362 |

| Apple Inc. | AAPL | 172.58 | 0.32(0.19%) | 199252 |

| AT&T Inc | T | 38.61 | 0.07(0.18%) | 15743 |

| Barrick Gold Corporation, NYSE | ABX | 15.17 | -0.03(-0.20%) | 39991 |

| Boeing Co | BA | 296.99 | 0.15(0.05%) | 119966 |

| Caterpillar Inc | CAT | 157.5 | 0.46(0.29%) | 4336 |

| Chevron Corp | CVX | 127.89 | 0.31(0.24%) | 5757 |

| Cisco Systems Inc | CSCO | 38.95 | 0.09(0.23%) | 778823 |

| Citigroup Inc., NYSE | C | 74.38 | 0.02(0.03%) | 410 |

| Deere & Company, NYSE | DE | 157 | -1.01(-0.64%) | 332 |

| Exxon Mobil Corp | XOM | 85.09 | 0.06(0.07%) | 7883 |

| Facebook, Inc. | FB | 181.65 | 0.23(0.13%) | 34660 |

| FedEx Corporation, NYSE | FDX | 258.75 | 1.15(0.45%) | 1665 |

| Ford Motor Co. | F | 12.61 | -0.05(-0.39%) | 33054 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.6 | -0.17(-0.86%) | 28178 |

| General Electric Co | GE | 18.24 | 0.26(1.45%) | 544097 |

| General Motors Company, NYSE | GM | 41.95 | 0.15(0.36%) | 3939 |

| Goldman Sachs | GS | 255.5 | -0.17(-0.07%) | 772 |

| Home Depot Inc | HD | 188.25 | 0.22(0.12%) | 1199 |

| HONEYWELL INTERNATIONAL INC. | HON | 153.42 | -0.29(-0.19%) | 262613 |

| Intel Corp | INTC | 45.47 | -1.38(-2.95%) | 1357182 |

| International Business Machines Co... | IBM | 156.7 | 2.45(1.59%) | 61766 |

| Johnson & Johnson | JNJ | 139.24 | 0.01(0.01%) | 1498 |

| JPMorgan Chase and Co | JPM | 107.88 | -0.07(-0.06%) | 2806 |

| McDonald's Corp | MCD | 174.24 | 1.02(0.59%) | 848 |

| Microsoft Corp | MSFT | 86 | 0.05(0.06%) | 832612 |

| Nike | NKE | 63.59 | 0.10(0.16%) | 5123 |

| Pfizer Inc | PFE | 36.5 | 0.06(0.16%) | 1569 |

| Procter & Gamble Co | PG | 90.84 | 0.19(0.21%) | 1200 |

| Tesla Motors, Inc., NASDAQ | TSLA | 319.99 | -0.54(-0.17%) | 14013 |

| Travelers Companies Inc | TRV | 132.01 | 0.03(0.02%) | 325 |

| Twitter, Inc., NYSE | TWTR | 24.53 | 0.02(0.08%) | 11701 |

| United Technologies Corp | UTX | 129.8 | 1.64(1.28%) | 4398 |

| Verizon Communications Inc | VZ | 53.58 | 0.05(0.09%) | 562770 |

| Visa | V | 114.75 | 0.24(0.21%) | 1901 |

| Wal-Mart Stores Inc | WMT | 99 | 0.41(0.42%) | 2660 |

| Walt Disney Co | DIS | 112.22 | 0.42(0.38%) | 7702 |

| Yandex N.V., NASDAQ | YNDX | 33.5 | -0.14(-0.42%) | 562 |

American Express (AXP) initiated with a Buy at Deutsche Bank

UnitedHealth (UNH) initiated with a Buy at Goldman; target $269

Honeywell (HON) downgraded to Sector Perform from Outperform at RBC Capital Mkts

United Tech (UTX) upgraded to Outperform from Sector Perform at RBC Capital Mkts

Walt Disney (DIS) upgraded to Buy from Neutral at Rosenblatt

IBM (IBM) upgraded to Outperform from Sector Perform at RBC Capital Mkts

U.K. stocks slipped from record highs on Tuesday, as the pound ignored worse-than-expected British manufacturing data and rallied against the dollar. The FTSE 100 index UKX, -0.52% fell 0.5% to close at 7,648.10, easing back from the all-time closing high scored on Friday, the last trading session of 2017. The London benchmark logged a 7.6% gain for the full year, for its second straight year of advances.

U.S. stocks kicked off 2018 on a positive note Tuesday, with major indexes rallying to record levels in a broad rally that saw five of the 11 primary sectors gaining more than 1% on the day. The energy sector was a particular outperformer, jumping 1.8%, while both consumer discretionary and material names were up 1.5%.

Asian equities extended gains after a rally in technology companies boosted U.S. stocks to record highs. Bonds fell in Australia and New Zealand following a drop in Treasuries, while crude oil held above $60 a barrel in New York.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.