- Analytics

- News and Tools

- Market News

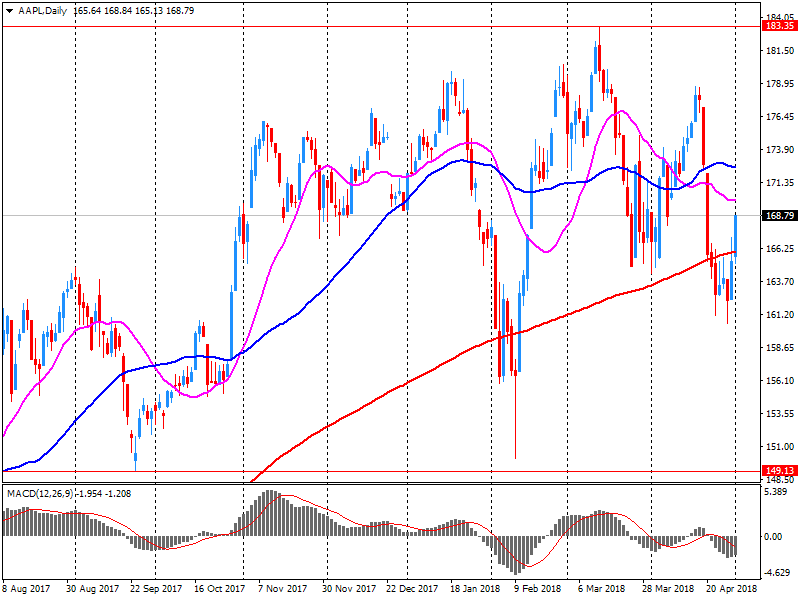

Analytics, News, and Forecasts for CFD Markets: stock news — 02-05-2018.

| index | closing price | change items | % change |

| Nikkei | -35.25 | 22472.78 | -0.16% |

| TOPIX | -2.66 | 1771.52 | -0.15% |

| Hang Seng | -84.57 | 30723.88 | -0.27% |

| CSI 300 | +6.77 | 3763.65 | +0.18% |

| KOSPI | -9.77 | 2505.61 | -0.39% |

| Euro Stoxx 50 | +17.53 | 3553.79 | +0.50% |

| FTSE 100 | +22.84 | 7543.20 | +0.30% |

| DAX | +190.14 | 12802.25 | +1.51% |

| CAC 40 | +8.72 | 5529.22 | +0.16% |

| DJIA | -174.07 | 23924.98 | -0.72% |

| S&P 500 | -19.13 | 2635.67 | -0.72% |

| NASDAQ | -29.81 | 7100.90 | -0.42% |

The main US stock indexes have moderately decreased, the reason for this was the fall in the shares of the health sector, as well as the results of the May meeting of the Fed.

As a result of a two-day meeting, the US Federal Reserve, as expected, left the key interest rate in the range of 1.5% -1.75%. In the accompanying statement, the Central Bank noted a slowdown in household spending compared to the high rate of the fourth quarter, but pointed to the continued strong growth of companies' investments in fixed assets. Also, the Fed noted a strong increase in the number of jobs. Meanwhile, this time the Fed did not begin to declare that "it closely follows the dynamics of inflation." This change reflects an increase in inflationary pressures in the United States. In addition, the Fed noted that the annual inflation approached the target level of the Central Bank, which is 2%. In general, the Fed's rhetoric allows investors to count on raising rates during the June meeting.

A certain influence on the course of trading also provided statistics on the United States. As shown by data from Automatic Data Processing (ADP), the growth rate of employment in the private sector of the US slowed in March, and almost coincided with the forecasts. According to the report, in April the number of employed increased by 204 thousand people compared with the figure for March at 241 thousand. Analysts had expected that the number of employed will increase by 200 thousand.

Most DOW components recorded a decline (24 out of 30). Outsider were the shares of Verizon Communications Inc. (VZ, -2.58%). The leader of growth was the shares of Apple Inc. (AAPL, + 4.38%).

Almost all sectors of S & P finished trading in the red. The health sector showed the greatest decline (-1.1%). Only the base materials sector grew (+ 0.1%).

At closing:

Dow 23,924.98 -174.07 -0.72%

S&P 500 2,635.67 -19.13 -0.72%

Nasdaq 100 7,100.90 -29.81 -0.42%

U.S. stock-index futures were flat on Wednesday, as investors were cautious ahead of the announcement of the outcomes of the Federal Open Market Committee's May meeting at 18:00 GMT. Apple's (AAPL) solid quarterly results underpinned Nasdaq futures.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,472.78 | -35.25 | -0.16% |

| Hang Seng | 30,723.88 | -84.57 | -0.27% |

| Shanghai | 30,723.88 | -84.57 | -0.27% |

| S&P/ASX | 6,050.20 | +35.00 | +0.58% |

| FTSE | 7,552.53 | +32.17 | +0.43% |

| CAC | 5,525.53 | +5.03 | +0.09% |

| DAX | 12,766.10 | +153.99 | +1.22% |

| Crude | $67.32 | | +0.10% |

| Gold | $1,309.60 | | +0.21% |

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 1,581.40 | -0.86(-0.05%) | 34282 |

| AMERICAN INTERNATIONAL GROUP | AIG | 56.38 | 0.07(0.12%) | 193 |

| Apple Inc. | AAPL | 175.59 | 6.49(3.84%) | 1999979 |

| AT&T Inc | T | 32.61 | 0.07(0.22%) | 25538 |

| Barrick Gold Corporation, NYSE | ABX | 13.47 | 0.03(0.22%) | 3730 |

| Boeing Co | BA | 329.01 | -0.53(-0.16%) | 4624 |

| Caterpillar Inc | CAT | 144.43 | 0.01(0.01%) | 1853 |

| Chevron Corp | CVX | 124.87 | 0.01(0.01%) | 4206 |

| Cisco Systems Inc | CSCO | 44.76 | -0.07(-0.16%) | 66902 |

| Citigroup Inc., NYSE | C | 68.12 | -0.13(-0.19%) | 5671 |

| Deere & Company, NYSE | DE | 135.6 | 0.23(0.17%) | 318 |

| Facebook, Inc. | FB | 173.8 | -0.06(-0.03%) | 77832 |

| Ford Motor Co. | F | 11.28 | 0.02(0.18%) | 33358 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.19 | 0.24(1.61%) | 45733 |

| General Electric Co | GE | 14.13 | 0.08(0.57%) | 102630 |

| General Motors Company, NYSE | GM | 36.57 | 0.15(0.41%) | 10903 |

| Goldman Sachs | GS | 235.87 | -0.80(-0.34%) | 3386 |

| Google Inc. | GOOG | 1,033.55 | -3.76(-0.36%) | 3083 |

| Home Depot Inc | HD | 184.73 | 0.10(0.05%) | 936 |

| Intel Corp | INTC | 53.11 | -0.22(-0.41%) | 76604 |

| International Business Machines Co... | IBM | 144.82 | -0.18(-0.12%) | 3416 |

| Johnson & Johnson | JNJ | 126.25 | 0.24(0.19%) | 2587 |

| JPMorgan Chase and Co | JPM | 108.56 | -0.22(-0.20%) | 6380 |

| McDonald's Corp | MCD | 163.3 | -0.14(-0.09%) | 2006 |

| Merck & Co Inc | MRK | 57.95 | -0.03(-0.05%) | 2422 |

| Microsoft Corp | MSFT | 94.75 | -0.25(-0.26%) | 67941 |

| Nike | NKE | 67.88 | -0.22(-0.32%) | 2917 |

| Pfizer Inc | PFE | 35.35 | -0.05(-0.14%) | 9514 |

| Procter & Gamble Co | PG | 72.05 | 0.09(0.13%) | 9868 |

| Starbucks Corporation, NASDAQ | SBUX | 57.93 | -0.20(-0.34%) | 4003 |

| Tesla Motors, Inc., NASDAQ | TSLA | 299.1 | -0.82(-0.27%) | 32345 |

| The Coca-Cola Co | KO | 42.5 | -0.09(-0.21%) | 3936 |

| Twitter, Inc., NYSE | TWTR | 30.02 | -0.28(-0.92%) | 54433 |

| United Technologies Corp | UTX | 119.19 | 0.23(0.19%) | 3344 |

| Verizon Communications Inc | VZ | 48.59 | -0.23(-0.47%) | 1923 |

| Visa | V | 128.34 | 0.83(0.65%) | 41077 |

| Wal-Mart Stores Inc | WMT | 87.46 | 0.05(0.06%) | 2388 |

| Walt Disney Co | DIS | 100.31 | 0.25(0.25%) | 3818 |

| Yandex N.V., NASDAQ | YNDX | 33.15 | -0.48(-1.43%) | 14989 |

Alcoa (AA) initiated with a Buy at Jefferies; target $65

Apple (AAPL) target lowered to $204 from $210 at Maxim Group

MasterCard (MA) reported Q1 FY 2018 earnings of $1.50 per share (versus $1.00 in Q1 FY 2017), beating analysts' consensus estimate of $1.24.

The company's quarterly revenues amounted to $3.580 bln (+30,9% y/y), beating analysts' consensus estimate of $3.255 bln.

MA rose to $187.00 (+3.74%) in pre-market trading.

Apple (AAPL) reported Q2 FY 2018 earnings of $2.73 per share (versus $2.10 in Q2 FY 2017), beating analysts' consensus estimate of $2.68.

The company's quarterly revenues amounted to $61.137 bln (+15.6% y/y), generally in-line with analysts' consensus estimate of $60.940 bln.

The company said its iPhone shipments amounted to 52.2 mln in Q2 versus analysts' consensus estimate of 52 mln and 50.8 mln in the corresponding period of the previous year.

Apple also issued upside guidance for Q3, projecting revenues of $51.5-53.5 bln (versus analysts' consensus estimate of $51.51 bln) and gross margins of 38.0-38.5% (versus analysts' consensus estimate of 38.4% and the companies year-ago result of 38.5%).

In addition, the company decided to add $100 bln to share repurchase and raise dividend 16% to $0.73/share.

AAPL rose to $174.75 (+3.34%) in pre-market trading.

European stocks posted a modest loss on Tuesday, as most of the region's markets were closed for the May Day holiday. The Stoxx Europe 600 index SXXP, -0.08% snapped a three-day win streak and ended marginally lower, down about 0.1% at 385.03, after finishing Monday trade up 0.2%.

U.S. stocks closed mostly higher on Tuesday, as a sharp rally in technology stocks helped the S&P 500 and the Nasdaq shake off an early decline. However, the Dow fell for a third straight session as caution remained high ahead of the conclusion of a Federal Reserve policy meeting and fresh developments in global trade.

Asia-Pacific stock moves were muted in early trading Wednesday, after most overseas benchmarks saw little change the previous day. Most markets in the region were closed Tuesday for the Labor Day holiday, and Japan will be closed Thursday and Friday.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.