- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 31-10-2017

(raw materials / closing price /% change)

Oil 54.60 +0.83%

Gold 1,271.90 -0.45%

(index / closing price / change items /% change)

Nikkei -0.06 22011.61 +0.00%

TOPIX -4.88 1765.96 -0.28%

Hang Seng -90.65 28245.54 -0.32%

CSI 300 -3.00 4006.72 -0.07%

Euro Stoxx 50 +11.77 3673.95 +0.32%

FTSE 100 +5.27 7493.08 +0.07%

DAX +12.03 13229.57 +0.09%

CAC 40 +9.66 5503.29 +0.18%

DJIA +28.50 23377.24 +0.12%

S&P 500 +2.43 2575.26 +0.09%

NASDAQ +28.71 6727.67 +0.43%

S&P/TSX +22.81 16025.59 +0.14%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1645 -0,03%

GBP/USD $1,3283 +0,58%

USD/CHF Chf0,99672 +0,21%

USD/JPY Y113,64 +0,43%

EUR/JPY Y132,37 +0,42%

GBP/JPY Y150,938 +1,00%

AUD/USD $0,7655 -0,41%

NZD/USD $0,6884 +0,18%

USD/CAD C$1,28885 +0,47%

00:45 New Zealand Employment Change, q/q Quarter III -0.2% 0.8% 1.1%

00:45 New Zealand Unemployment Rate Quarter III 4.8% 4.7% 4.6%

01:30 Australia AIG Manufacturing Index October 54.2 51.1

03:00 Italy Bank Holiday

03:00 France Bank holiday

03:30 Japan Manufacturing PMI (Finally) October 52.9 52.5

04:45 China Markit/Caixin Manufacturing PMI October 51.0 51.0

10:00 United Kingdom Nationwide house price index, y/y October 2.0% 2.2%

10:00 United Kingdom Nationwide house price index October 0.2% 0.2%

11:30 Switzerland Manufacturing PMI October 61.7 61.5

12:30 United Kingdom Purchasing Manager Index Manufacturing October 55.9 55.8

15:15 U.S. ADP Employment Report October 135 200

16:45 U.S. Manufacturing PMI (Finally) October 53.1 54.5

17:00 U.S. Construction Spending, m/m September 0.5% -0.1%

17:00 U.S. ISM Manufacturing October 60.8 59.5

17:30 U.S. Crude Oil Inventories October 0.856 -2.575

21:00 U.S. Fed Interest Rate Decision 1.25% 1.25%

21:00 U.S. FOMC Statement

22:30 U.S. Total Vehicle Sales, mln October 18.57 17.5

23:15 Canada BOC Gov Stephen Poloz Speaks

Major US stock indices slightly increased due to a rise in the price of shares of Mondelez and Kellogg after the publication of quarterly reports.

Some support for the market was also provided by statistics on the United States. As it became known that the growth in house prices accelerated in August, which indicates that despite the slowdown in sales in recent months, the demand for housing remains strong. The national housing price index from S & P / Case-Shiller, covering the whole country, grew by 6.1% in the 12 months ending August, higher than the 5.9% increase compared to the same period last year in July .

However, the data published by the Managers Association in Chicago showed that in October the index of purchasing managers in Chicago improved to 66.2 points from 65.2 points in September. The latter value was the highest since March 2011. Experts expected that the index will drop to 61.0 points.

In addition, the Conference Board consumer confidence index improved significantly in October after recording a slight increase in September. The index now stands at 125.9 (1985 = 100), compared with 120.6 in September (revised from 119.8). The index of the current situation increased from 146.9 to 151.1, and the index of expectations increased from 103.0 last month to 109.1.

Components of the DOW index finished trading mixed (16 in positive territory, 14 in negative territory). The leader of growth was shares of Intel Corporation (INTC, + 2.77%). Outsider were shares of General Electric Company (GE, -1.27%).

Almost all sectors of the S & P index recorded an increase. The consumer goods sector grew most (+ 1.0%). Only the financial sector declined (-0.1%).

At closing:

DJIA + 0.12% 23,377.11 +28.37

Nasdaq + 0.43% 6,727.67 +28.71

S & P + 0.09% 2.575.26 + 2.43

The Chicago Business Barometer rose to 65.2 in September, up from 58.9 in August, hitting the highest level in three months and the second highest level in more than three years.

Optimism among firms about business conditions was bolstered in September after August's flat showing, with each of the Barometer's sub-components strengthening. A marked rise in Order Backlogs, up to a 29-year high, was among the month's highlights. September's survey result left the Q3 calendar average of the Barometer at 61.0, virtually unchanged from Q2's three-year high of 61.1.

The Industrial Product Price Index (IPPI) declined 0.3% in September, mainly due to lower prices for motorized and recreational vehicles and meat, fish, and dairy products. Higher prices for energy and petroleum products mostly offset the declines observed elsewhere.

The Raw Materials Price Index (RMPI) edged down 0.1%, primarily due to lower prices for animals and animal products. Higher prices for crude energy products mostly offset the decline.

The IPPI was down 0.3% in September, following a 0.4% increase in August. Of the 21 major commodity groups, 16 were down, 4 were up and 1 was unchanged.

Among the four major commodity groups that saw higher prices in September, energy and petroleum products (+4.4%) posted the largest increase. This growth was primarily due to higher prices for motor gasoline (+3.8%), light fuel oil (+5.7%) and diesel fuel (+4.8%). This was the largest increase for energy and petroleum products since December 2016, when prices rose 5.5%. The IPPI excluding energy and petroleum products decreased 0.9%.

Real gross domestic product (GDP) edged down 0.1% in August, after being essentially unchanged in July. Declines in manufacturing and mining, quarrying and oil and gas extraction more than offset increases in most sectors (12 out of 20).

Goods-producing industries contracted for the second consecutive month, declining 0.7% in August in part due to temporary reduced capacity in the manufacturing and the mining, quarrying and oil and gas extraction sectors. Services-producing industries edged up 0.1%.

Following a 0.2% dip in July, the manufacturing sector contracted 1.0% in August as both durable and non-durable manufacturing declined.

Non-durable manufacturing decreased 2.0% following three consecutive months of growth as the majority of subsectors registered declines. Chemical manufacturing dropped 7.3%, its largest decline in the last 20 years, as all industry groups declined. Declines reflected in part some lost capacity due to plant maintenance shutdowns and lower demand from export markets for basic chemicals and pharmaceutical and medicinal products. There were notable decreases in manufacturing of petroleum and coal products (-3.1%) and plastic and rubber products (-2.5%). Food (+1.2%) and beverage and tobacco product manufacturing (+3.4%) were the only non-durable subsectors to increase.

EURUSD: 1.1600 (EUR 1.2bln) 1.1625 (360m) 1.1650 (330m) 1.1700 (650m) 1.1800(2.2bln)

USDJPY: 112.00 (USD 900m) 112.70-75 (910m) 113.00 (610m) 114.00 (380m) 114.70 (650m)

GBPUSD: Ntg of note

AUDUSD: 0.7550 (AUD 410m) 0.7685 (260m) 0.7800 (400m)

U.S. stock-index futures rose slightly on Tuesday following a fresh set of earnings reports, while investors awaited the outcomes of the FOMC's October meeting, as well as a decision on the next Fed chair.

Global Stocks:

Nikkei 22,011.61 -0.06 0.00%

Hang Seng 28,245.54 -90.65 -0.32%

Shanghai 3,394.50 +4.17 +0.12%

S&P/ASX 5,909.02 -10.06 -0.17%

FTSE 7,492.11 +4.30 +0.06%

CAC 5,505.19 +11.56 +0.21%

DAX 13,229.57 +12.03 +0.09%

Crude $54.15 (0.00%)

Gold $1,272.40 (-0.41%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 47.5 | 0.08(0.17%) | 1311 |

| ALTRIA GROUP INC. | MO | 64.5 | 0.45(0.70%) | 6714 |

| Amazon.com Inc., NASDAQ | AMZN | 1,112.60 | 1.75(0.16%) | 26748 |

| Apple Inc. | AAPL | 168.35 | 1.63(0.98%) | 331657 |

| AT&T Inc | T | 33.62 | 0.08(0.24%) | 10468 |

| Barrick Gold Corporation, NYSE | ABX | 14.66 | -0.03(-0.20%) | 6078 |

| Caterpillar Inc | CAT | 136.61 | 0.12(0.09%) | 1621 |

| Chevron Corp | CVX | 116 | 1.61(1.41%) | 467 |

| Citigroup Inc., NYSE | C | 73.8 | 0.02(0.03%) | 1105 |

| Deere & Company, NYSE | DE | 134.62 | 2.32(1.75%) | 765 |

| Exxon Mobil Corp | XOM | 83.8 | 0.26(0.31%) | 200 |

| Facebook, Inc. | FB | 180.4 | 0.53(0.29%) | 121111 |

| Ford Motor Co. | F | 12.15 | 0.05(0.41%) | 66779 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.87 | -0.07(-0.50%) | 30267 |

| General Electric Co | GE | 20.37 | -0.04(-0.20%) | 46877 |

| General Motors Company, NYSE | GM | 43.25 | -0.12(-0.28%) | 3410 |

| Google Inc. | GOOG | 1,019.00 | 1.89(0.19%) | 1091 |

| HONEYWELL INTERNATIONAL INC. | HON | 144.26 | -0.38(-0.26%) | 255 |

| Intel Corp | INTC | 45.2 | 0.83(1.87%) | 863310 |

| JPMorgan Chase and Co | JPM | 101.65 | 0.24(0.24%) | 817 |

| Merck & Co Inc | MRK | 54.83 | 0.12(0.22%) | 6085 |

| Microsoft Corp | MSFT | 84.11 | 0.22(0.26%) | 28950 |

| Nike | NKE | 54.45 | -0.82(-1.48%) | 51384 |

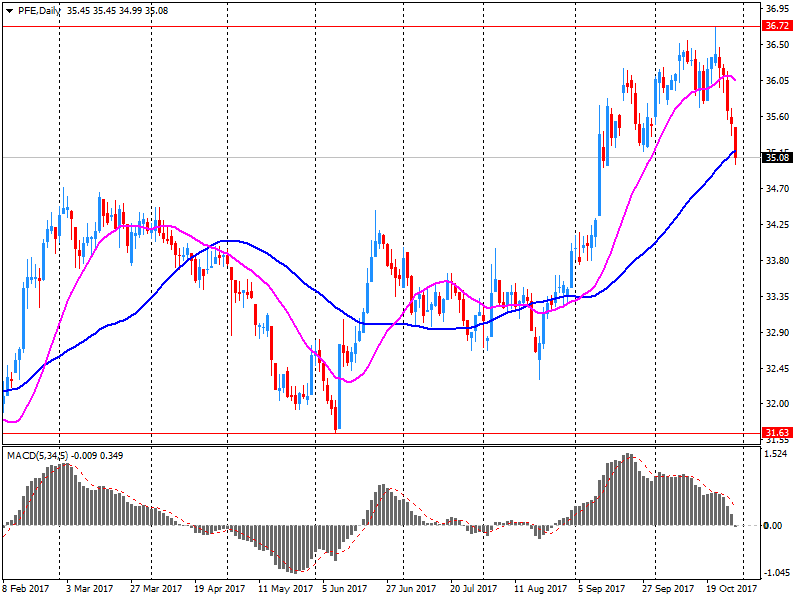

| Pfizer Inc | PFE | 35.07 | -0.08(-0.23%) | 130844 |

| Procter & Gamble Co | PG | 86.6 | 0.33(0.38%) | 10875 |

| Tesla Motors, Inc., NASDAQ | TSLA | 321.15 | 1.07(0.33%) | 18103 |

| The Coca-Cola Co | KO | 46.19 | 0.33(0.72%) | 33252 |

| Verizon Communications Inc | VZ | 47.88 | 0.05(0.10%) | 908 |

| Visa | V | 110.47 | 0.43(0.39%) | 7597 |

| Walt Disney Co | DIS | 98.15 | 0.11(0.11%) | 1657 |

| Yandex N.V., NASDAQ | YNDX | 32.89 | -0.21(-0.63%) | 700 |

Microsoft (MSFT) upgraded to Buy from Hold at Argus

Merck (MRK) upgraded to Hold from Underperform at Jefferies

MasterCard (MA) reported Q3 FY 2017 earnings of $1.34 per share (versus $1.08 in Q3 FY 2016), beating analysts' consensus estimate of $1.23.

The company's quarterly revenues amounted to $3.400 bln (+18.1% y/y), beating analysts' consensus estimate of $3.281 bln.

MA rose to $150.50 (+1.04%) in pre-market trading.

Pfizer (PFE) reported Q3 FY 2017 earnings of $0.67 per share (versus $0.61 in Q3 FY 2016), beating analysts' consensus estimate of $0.65.

The company's quarterly revenues amounted to $13.168 bln (+0.9% y/y), generally in-line with analysts' consensus estimate of $13.175 bln.

The company also raised guidance for FY2017 EPS to $2.58-2.62 from $2.54-2.60 versus analysts' consensus estimate of $2.56, as well as for FY2017 revenues to $52.4-53.1 bln from $52.0-54.0 bln versus analysts' consensus estimate of $52.76 bln.

PFE rose to $35.38 (+0.65%) in pre-market trading.

Seasonally adjusted GDP rose by 0.6% in both the euro area (EA19) and in the EU28 during the third quarter of 2017, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union. In the second quarter of 2017, GDP had grown by 0.7% in both zones. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 2.5% in both the euro area and in the EU28 in the third quarter of 2017, after +2.3% and +2.4% respectively, in the previous quarter.

The euro area (EA19) seasonally-adjusted unemployment rate was 8.9% in September 2017, down from 9.0% in August 2017 and from 9.9% in September 2016. This is the lowest rate recorded in the euro area since January 2009. The EU28 unemployment rate was 7.5% in September 2017, stable compared to August 2017 and down from 8.4% in September 2016. This remains the lowest rate recorded in the EU28 since November 2008. These figures are published by Eurostat, the statistical office of the European Union.

Euro area annual inflation is expected to be 1.4% in October 2017, down from 1.5% in September 2017, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in October (3.0%, compared with 3.9% in September), followed by food, alcohol & tobacco (2.4%, compared with 1.9% in September), services (1.2%, compared with 1.5% in September) and non-energy industrial goods (0.4%, compared with 0.5% in September).

-

Cenbank has all tools to maintain financial stability if needed

EUR/USD: 1.1800 (2.17bn), 1.1700 (650m), 1.1650 (320m), 1.1625 (360m), 1.1600 (1.1bn)

USD/JPY: 114.69/70 (650m), 114.00 (375m), 113.00 (615m), 112.75 (905m), 112.00 (885m)

AUD/USD: 0.7800 (400m), 0.7685 (260m), 0.7550 (405m)

Options levels on tuesday, October 31, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1761 (2068)

$1.1721 (2037)

$1.1688 (1083)

Price at time of writing this review: $1.1636

Support levels (open interest**, contracts):

$1.1565 (6169)

$1.1531 (4182)

$1.1490 (3368)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 115972 contracts (according to data from October, 30) with the maximum number of contracts with strike price $1,2000 (9810);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3299 (1268)

$1.3273 (4311)

$1.3255 (1258)

Price at time of writing this review: $1.3217

Support levels (open interest**, contracts):

$1.3188 (2166)

$1.3146 (1655)

$1.3114 (2802)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 44062 contracts, with the maximum number of contracts with strike price $1,3200 (4311);

- Overall open interest on the PUT options with the expiration date November, 3 is 37383 contracts, with the maximum number of contracts with strike price $1,3000 (3189);

- The ratio of PUT/CALL was 0.85 versus 0.85 from the previous trading day according to data from October, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Over a year, the Consumer Price Index (CPI) should increase by 1.1% in October 2017, after +1.0% in the previous month, according to the provisional estimate made at the end of the month. This third consecutive rise in year-on-year inflation should result from an acceleration in food prices and a lesser drop in manufactured product prices. Energy prices should slow down slightly after two months of sharp acceleration. Services prices should rise at the same pace than in the previous month.

Over one month, consumer prices should recover slightly (+0.1%) after a moderate downturn in September. This drop should come from a rebound in food prices and a lesser fall in services prices. Energy prices should increase at the same pace than in September: a rise in town gas prices should be offset by a slowdown in petroleum product prices. On the other hand, manufactured product prices should decelerate sharply after an increase in September.

In Q3 2017, gross domestic product (GDP) in volume terms kept increasing: +0.5%, after +0.6% in Q2.

Household consumption expenditure slightly accelerated (+0.5% after +0.3%) while total gross fixed capital formation (GFCF) remained dynamic (+0.8% after +1.0%). All in all, final domestic demand excluding changes in inventories increased: it contributed by +0.6 points to GDP growth in Q3 2017.

The foreign trade balance contributed negatively to GDP growth (−0.6 points after +0.6 points): imports accelerated sharply (+2.5% after +0.2%) while exports decelerated significantly (+0.7% after +2.3%). Conversely, changes in inventories contributed positively to GDP growth (+0.5 points after −0.5 points).

In comparison with Q3 2016, GDP rose by 2.2%; such a growth rate had not been observed since 2011

Asian stock markets were lacking direction early Tuesday, with Japan's benchmark index underperforming as investors were cautious amid a stronger yen and the central bank's latest monetary policy announcement. As was widely expected, the Bank of Japan announced during the trading day that it would stand pat on interest rates.

European stocks scored the highest close in five months Monday, with much of the action centered around Spanish equities after the central government in Madrid took control of the Catalonia region following its push for independence.

U.S. stocks closed lower Monday as a report that the House of Representatives is considering phasing in a cut to corporate taxes rather than enacting them immediately weighed on investors' confidence. Tax cuts are the centerpiece in President Donald Trump's business-friendly agenda and are viewed as critical to sustaining the stock market's record-setting rally.

-

Says australians exempt from ban on housing purchases

Both measures for the General Economic Situation decreased, while the measure for Personal Financial Situation over the last 12 months and the Major Purchase Index increased. The score for Personal Financial situation over the next 12 months stayed the same.

Joe Staton, Head of Market Dynamics at GfK, says:

"It's no surprise that the Overall Index Score continues to bump along in negative territory this month. As concerns about the wider economic prospects for the UK economy dampen our outlook, consumers are showing no real 'get-up-and-go'. The tiny shift up a point in how we view our personal finances over the past year is counter-intuitive given rising living costs, an imminent interest rate rise, and the reality that we earn less in real terms in 2017 than in early 2006".

The index went up further to 52.4 in September, the highest level since May 2012. The index readings in recent months show that the manufacturing sector and the economy in China have continued to improve.

It is noteworthy to recognize the discrepancy by size of enterprises. After dropping slightly from 52.9 in July to 52.8 in August, the PMI of 'large enterprises' rose to 53.8 in September, indicating that the growth in 'large enterprises' has accelerated recently.

-

BoJ maintains 10-year JGB yield target around zero pct

-

Pledge to buy JGBs so that its holdings increase at annual pace of around 80 trln yen

-

Board member Kataoka makes no proposal on expanding monetary stimulus

-

Kataoka opposed decision on yield curve control

-

BoJ maintains its forecast inflation to reach 2 pct during fiscal 2019/20 at quarterly review of its economic, price forecasts

-

Board member Kataoka says BoJ should ease if domestic factors lead to delay in hitting price target

-

Median real gdp forecast for fiscal 2019/20 at +0.7 pct vs +0.7 pct projected in july

-

Japan core cpi expected +1.8 pct in fy2019/20 vs +1.8 pct projected in july

-

Risks to economy roughly balanced

-

Inflation expectations remain on weak note

-

Momentum towards 2 pct price target is intact but still lacks strength

At the Monetary Policy Meeting held today, the Policy Board of the Bank of Japan decided upon the following.

"Yield curve control The Bank decided, by an 8-1 majority vote, to set the following guideline for market operations for the intermeeting period.

The short-term policy interest rate: The Bank will apply a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank. The long-term interest rate:

The Bank will purchase Japanese government bonds (JGBs) so that 10-year JGB yields will remain at around zero percent. With regard to the amount of JGBs to be purchased, the Bank will conduct purchases at more or less the current pace -- an annual pace of increase in the amount outstanding of its JGB holdings of about 80 trillion yen -- aiming to achieve the target level of the long-term interest rate specified by the guideline."

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.