- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 30-06-2017

The main US stock indexes were on a positive territory for most of the session, but during the last minutes of trading the quotes fell sharply, as a result of which the auctions ended without a single dynamic. The main support for the market was provided by shares of the industrial segment and conglomerate sector.

Investors also evaluated a block of important data. The Commerce Department report showed that consumer spending, accounting for more than two-thirds of US economic activity, rose 0.1% last May, while consumer prices, excluding food and energy, rose 1.4% since May 2016. The slower growth in consumer spending followed strong performance in April and March. The economy is still on track to return to stronger growth in the second quarter after a modest expansion in the first three months of the year. At the same time, the price index for personal consumption expenditure (PCE) fell 0.1% in May from April, and when food and energy were excluded, it grew by 0.1%. The growth rate over the 12-month period for so-called core inflation has slowed since February, although Fed Chairman Janet Yellen said earlier this month that the fall was likely to be temporary.

At the same time, the final research results submitted by Thomson-Reuters and the Michigan Institute showed that in June US consumers felt more pessimistic about the economy than last month. According to the data, in June the consumer sentiment index fell to 95.1 points compared to the final reading for May of 97.1 points and the preliminary value for June of 94.5 points. It was predicted that the index will be 94.5 points.

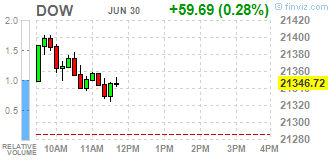

Most components of the DOW index finished trading in positive territory. (25 out of 30). Leader of the growth were shares of NIKE, Inc. (NKE, + 10.91%). Outsider were shares of The Goldman Sachs Group, Inc. (GS, -0.89%).

All sectors of S & P recorded a rise. The conglomerate sector grew more than others (+ 1.9%).

At closing:

Dow + 0.29% 21.349.63 +62.60

Nasdaq -0.06% 6,140.42 -3.93

S & P + 0.15% 2.423.41 +3.71

Major U.S. stock-indexes demonstrated slim gains, buoyed by gains in the industrial and consumer discretionary sectors. Meanwhile, the technology sector struggled to hold its ground. It is expected that the market can see a rush of activity during the final minutes of trading as portfolios undergo month-end and quarter-end adjustments.

Most of Dow stocks in positive area (19 of 30). Top gainer - NIKE, Inc. (NKE, +8.80%). Top loser - Merck & Co., Inc. (MRK, -0.40%).

A majority of S&P sectors in positive area. Top gainer - Conglomerates (+0.81%). Top loser - Financials (-0.19%).

At the moment:

Dow 21290.00 +35.00 +0.16%

S&P 500 2421.50 +1.50 +0.06%

Nasdaq 100 5663.75 +10.75 +0.19%

Crude Oil 45.35 +0.42 +0.93%

Gold 1243.50 -2.30 -0.18%

U.S. 10yr 2.28 +0.01

Although consumer confidence slipped to its lowest level since Trump was elected, the overall level still remains quite favorable. The average level of the Sentiment Index during the first half of 2017 was 96.8, the best half-year average since the second half of 2000, and the partisan gap between Democrats and Republicans stood at 39 Index-points in June, nearly identical to the 38 point gap in February.

The partisan divide still meant that June's Sentiment Index of 95.1 was nearly equal to both the average (95.7) between the optimism of Republicans and the pessimism of Democrats and the value for Independents (94.6). Surprisingly, the optimism among Republicans and Independents has largely resisted declines in the past several months despite the decreased likelihood that Trump's agenda will be passed in 2017.

Q2 2017 Chicago Business Barometer 61.1 Vs 55.1 Q1 2017.

New Orders Highest Since May 2014.

Order Backlogs Highest Since July 1994.

The MNI Chicago Business Barometer increased to 65.7 in June from 59.4 in May, the highest level in over three years.

EURUSD: 1.1300 (EUR 750m) 1.1320-30 (715m) 1.1340-50 (1bln) 1.1400-10 (1.9bln)

USDJPY: 111.00 (USD 810m) 111.50 (430m) 111.90-112.00 (555m) 112.40 (330m)113.00-05 (732m)

GBPUSD: 1.2940-50 (GBP 185m) 1.3000 (430m)

EURGBP: 0.8710-20 (EUR 595m) 0.8800 (300m)

AUDUSD: 0.7540-50 (AUD 240m) 0.7635 (635m) 0.7700 (765m) 0.7750 (650m)

USDCAD: 1.2980 (USD 290m)

U.S. stock-index futures were flat after the stock market demonstrated significant declines in the previous session due to heavy selling pressure in the technology sector. Investors also assessed the May data on consumer income/spending in the U.S.

Stocks:

Nikkei 20,033.43 -186.87 -0.92%

Hang Seng 25,764.58 -200.84 -0.77%

Shanghai 3,191.06 +3.00 +0.09%

S&P/ASX 5,721.49 -96.61 -1.66%

FTSE 7,363.29 +12.97 +0.18%

CAC 5,173.22 +18.87 +0.37%

DAX 12,409.83 -6.36 -0.05%

Crude $45.18 (+0.56%)

Gold $1,242.50 (-0.26%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 975.01 | -0.92(-0.09%) | 14121 |

| Apple Inc. | AAPL | 143.54 | -0.14(-0.10%) | 121510 |

| AT&T Inc | T | 37.71 | 0.09(0.24%) | 1261 |

| Barrick Gold Corporation, NYSE | ABX | 15.82 | -0.08(-0.50%) | 45558 |

| Caterpillar Inc | CAT | 106.1 | 0.46(0.44%) | 765 |

| Chevron Corp | CVX | 104.5 | 0.38(0.37%) | 600 |

| Citigroup Inc., NYSE | C | 67.4 | 0.42(0.63%) | 15045 |

| Deere & Company, NYSE | DE | 122.33 | 0.42(0.34%) | 4341 |

| Exxon Mobil Corp | XOM | 81 | 0.30(0.37%) | 4768 |

| Facebook, Inc. | FB | 150.9 | -0.14(-0.09%) | 91164 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.1 | 0.02(0.17%) | 3961 |

| General Electric Co | GE | 27.12 | 0.10(0.37%) | 14728 |

| Goldman Sachs | GS | 225.65 | 1.24(0.55%) | 3582 |

| Google Inc. | GOOG | 918.01 | 0.22(0.02%) | 8239 |

| Intel Corp | INTC | 33.48 | -0.06(-0.18%) | 8284 |

| International Business Machines Co... | IBM | 154.51 | 0.38(0.25%) | 3460 |

| JPMorgan Chase and Co | JPM | 91.68 | 0.53(0.58%) | 14840 |

| Microsoft Corp | MSFT | 68.48 | -0.01(-0.01%) | 41269 |

| Nike | NKE | 56.34 | 3.17(5.96%) | 372207 |

| Pfizer Inc | PFE | 33.68 | 0.05(0.15%) | 5805 |

| Procter & Gamble Co | PG | 88.08 | 1.09(1.25%) | 438 |

| Tesla Motors, Inc., NASDAQ | TSLA | 362.2 | 1.45(0.40%) | 137171 |

| The Coca-Cola Co | KO | 45.27 | 0.44(0.98%) | 727 |

| Twitter, Inc., NYSE | TWTR | 17.66 | 0.01(0.06%) | 29935 |

| Verizon Communications Inc | VZ | 44.6 | 0.19(0.43%) | 3544 |

| Visa | V | 94.6 | 0.18(0.19%) | 2094 |

| Yandex N.V., NASDAQ | YNDX | 26.79 | 0.16(0.60%) | 100 |

The Industrial Product Price Index (IPPI) declined 0.2% in May, mainly due to lower prices for energy and petroleum products. The Raw Materials Price Index (RMPI) fell 1.8%, primarily due to lower prices for crude energy products.

The IPPI declined 0.2% in May, after rising 0.6% in April. This was the first decline in the IPPI since August 2016. Of the 21 major commodity groups, 3 were down, 17 were up and 1 was unchanged.

The decline in the IPPI was mainly due to lower prices for energy and petroleum products (-3.5%). Motor gasoline (-3.3%), light fuel oils (-6.9%) and diesel fuel (-5.6%) were the main contributors to the decline in this product group. The IPPI excluding energy and petroleum products rose 0.4%.

To a lesser extent, primary non-ferrous metal products (-0.7%) also contributed to the decrease in the IPPI. The decline in this product group was largely attributable to lower prices for unwrought precious metals and precious metal alloys (-2.5%), particularly unwrought silver and silver alloys (-5.9%).

Nike (NKE) target raised to $63 from $62 at Telsey Advisory Group

After increasing 0.5% in March, real gross domestic product (GDP) rose 0.2% in April as 14 out of 20 sectors grew.

Service-producing industries increased 0.3% on widespread growth across sectors. Goods-producing industries were essentially unchanged as growth in mining, quarrying, and oil and gas extraction was largely offset by a decline in manufacturing.

The mining, quarrying, and oil and gas extraction sector (+1.2%) grew for the third time in four months in April. Support activities for mining and oil and gas extraction registered double-digit growth for a second consecutive month, increasing 11% as both drilling and rigging services expanded.

Oil and gas extraction declined 0.8% in April as a decrease in non-conventional oil extraction more than offset growth in conventional oil and gas extraction. The decline in non-conventional oil extraction in April was largely the result of ongoing production difficulties at an upgrader facility in Alberta, following a fire and explosion there in March.

Personal income increased $67.1 billion (0.4 percent) in May according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $71.7 billion (0.5 percent) and personal consumption expenditures (PCE) increased $7.3 billion (0.1 percent).

Real DPI increased 0.6 percent in May and Real PCE increased 0.1 percent. The PCE price index decreased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The largest contributor to the increase in real PCE in May was spending for services, specifically electricity and gas.

Personal outlays increased $9.5 billion in May. Personal saving was $791.0 billion in May and the personal saving rate, personal saving as a percentage of disposable personal income, was 5.5 percent.

Nike (NKE) reported Q4 FY 2017 earnings of $0.60 per share (versus $0.49 in Q4 FY 2016), beating analysts' consensus of $0.50.

The company's quarterly revenues amounted to $8.677 bln (+5.3% y/y), generally in-line with analysts' consensus estimate of $8.625 bln.

NKE rose to $56.00 (+5.32%) in pre-market trading.

-

Revising up risks related to non financial companies debt

-

Increased market risks in latest half-year report on french financial system risks

-

Recent improvements in near-term growth outlook for advanced economies are not expected to be sustained over medium-term

-

Medium term growth potential still below 2% in advanced economies

Euro area annual inflation is expected to be 1.3% in June 2017, down from 1.4% in May 2017, according to a flash estimate from Eurostat, the statistical office of the European Union.

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in June (1.9%, compared with 4.5% in May), followed by services (1.6%, compared with 1.3% in May), food, alcohol & tobacco (1.4%, compared with 1.5% in May) and non-energy industrial goods (0.4%, compared with 0.3% in May).

The UK's current account deficit was £16.9 billion in Quarter 1 (Jan to Mar) 2017, a widening of £4.8 billion from a deficit of £12.1 billion in Quarter 4 (Oct to Dec) 2016, due predominantly to a widening in the deficit on trade; the current account deficit in Quarter 1 2017 equated to 3.4% of gross domestic product (GDP) at current market prices, up from 2.4% in Quarter 4 2016.

The total trade deficit widened to £8.8 billion in Quarter 1 2017 following a sharp narrowing of the deficit in Quarter 4 2016 (£4.8 billion); this was due to a widening in the deficit on trade in goods and a narrowing in the surplus on trade in services.

The largest contribution to the month-on-month growth came from distribution, hotels and restaurants, which contributed 0.20 percentage points of which retail trade contributed 0.17 percentage points.

In the 3 months to April 2017, services output increased by 0.2% compared with the 3 months ending January 2017.

The slowdown in 3-month on 3-month growth since October 2016 is driven mainly by the distribution, hotels and restaurants, and the transport, storage and communication components.

Gross domestic product (GDP) and its components are little changed from the previous estimates published on 25 May 2017.

UK GDP in volume terms was estimated to have increased by 0.2% between Quarter 4 (Oct to Dec) 2016 and Quarter 1 (Jan to Mar) 2017, unrevised from the previous estimate published on 25 May 2017; growth was driven by output from the business services and finance, and construction industries, partially offset by declines in some consumer-focused industries.

UK GDP growth in volume terms increased by 2.0% between Quarter 1 2016 and Quarter 1 2017, unrevised from the previous estimate.

GDP in current prices increased by 0.7% between Quarter 4 2016 and Quarter 1 2017, unrevised from the previous estimate.

GDP per head in volume terms was flat between Quarter 4 2016 and Quarter 1 2017.

The KOF Economic Barometer, with a new reading of 105.5, points visibly above its long-term average in June 2017. The strongest impulses contributing positively to the dynamics of the Barometer stem from manufacturing. At the same time, slightly negative impacts come from the indicators of the constructing sector as well as from the ones for the export development.

Within the manufacturing sector, the improved outlook manifests itself primarily in the wood-processing, food and metal industries. These positive dynamics are somewhat compensated by a more negative outlook by architects.

The improved sentiment in the manufacturing sector is primarily the result of a more optimistic judgment of the incoming orders in June 2017. However, it also reflects an improvement of the indicators for the overall business climate and competitiveness, which has increased again compared to the previous month.

In May 2017, household expenditure on goods increased by 1.0% in volume*, after +0.4% in April. Car and clothing purchases bounced back sharply. In contrast, spending on energy and food products slowed down.

Purchases of engineered goods picked up (+1.5% after −1.1%), driven by spending on durables (+1.0% after −0.9%) and on clothing.

In May, car purchases bounced back (+2.0% after −1.0%), notably new and used vehicules, as well as recreational vehicules (mortorhomes). Spending on household durables other than cars was stable after a decline of 0.9% in April: a decrease in purchases of consumer electronics was offset by a rise in communication equipment (notably smartphones). Furthermore, purchases of cameras dropped, as in April.

Over a year, the Consumer Price Index (CPI) should decelerate slighty in June 2017 (+0.7% after +0.8% in May), according to the provisional estimate made at the end of the month. This slight decrease in year-on-year inflation should be due to a further slowdown in energy prices. Services prices are set to rise at the same pace as in May. On the other hand, food prices should accelerate and manufactured product prices should decline less strongly than in the previous month.

Over one month, consumer prices should be stable, as in May. This stability should come from a fall in energy prices and a seasonal downturn in food prices, offset by a rise in services prices due to a rebound in transport services. Manufactured product prices should grow barely, as in the two previous months.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1518 (2527)

$1.1502 (2224)

$1.1487 (3639)

Price at time of writing this review: $1.1426

Support levels (open interest**, contracts):

$1.1378 (2537)

$1.1337 (1252)

$1.1292 (1787)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date July, 7 is 74345 contracts (according to data from June, 28) with the maximum number of contracts with strike price $1,1100 (4520);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3101 (2059)

$1.3075 (2091)

$1.3056 (2686)

Price at time of writing this review: $1.3008

Support levels (open interest**, contracts):

$1.2948 (633)

$1.2917 (766)

$1.2879 (2093)

Comments:

- Overall open interest on the CALL options with the expiration date July, 7 is 34690 contracts, with the maximum number of contracts with strike price $1,2950 (2686);

- Overall open interest on the PUT options with the expiration date July, 7 is 32254 contracts, with the maximum number of contracts with strike price $1,2800 (3732);

- The ratio of PUT/CALL was 0.93 versus 0.94 from the previous trading day according to data from June, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The manufacturing sector in China continued to expand in June, and at a faster pace, the latest survey from the National Bureau of Statistics cited by rttnews, with a manufacturing PMI score of 51.7.

That beat forecasts for 51.0, and it's up from 51.2 in May.

It also moves farther above the boom-or-bust line of 50 that separates expansion from contraction.

The bureau also said that its non-manufacturing PMI came in with a score of 54.9, up from 54.5 in the previous month.

According to provisional data turnover in retail trade in May 2017 was in real terms 4.8% and in nominal terms 6.3% larger than that in May 2016. The number of days open for sale was 25 in May 2017 and 24 in May 2016.

Compared with the previous year, turnover in retail trade was in the first five months of 2017 in real terms 1.7% and in nominal terms 3.5% larger than in in the corresponding period of the previous year.

European stocks ended with sharp losses on Thursday, as a rally by the euro reversed earlier optimism, hitting industrials, utilities and consumer shares. Even as shares of European banks and basic materials companies rose, boosted by the outcome of U.S. bank stress tests and a weaker U.S. dollar, respectively, key regional benchmarks failed to follow them higher.

U.S. stocks tumbled Thursday, with the S&P 500 and Dow industrials logging their worst one-day declines since May as the technology sector resumed its selloff, overshadowing advances in financials.

The wild ride for global stock markets continued Friday, with Asian equities declining following selling in the U.S. and Europe. The drop in Asia reversed yesterday's gains, which followed declines earlier in the week.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.