- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-01-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Trimmed Mean CPI y/y | Quarter IV | 1.6% | 1.5% |

| 00:30 | Australia | CPI, y/y | Quarter IV | 1.7% | 1.7% |

| 00:30 | Australia | Trimmed Mean CPI q/q | Quarter IV | 0.4% | 0.4% |

| 00:30 | Australia | CPI, q/q | Quarter IV | 0.5% | 0.6% |

| 05:00 | Japan | Consumer Confidence | January | 39.1 | 40.8 |

| 07:00 | United Kingdom | Nationwide house price index, y/y | January | 1.4% | 1.5% |

| 07:00 | United Kingdom | Nationwide house price index | January | 0.1% | 0.3% |

| 07:00 | Germany | Gfk Consumer Confidence Survey | February | 9.6 | 9.6 |

| 09:00 | Eurozone | Private Loans, Y/Y | December | 3.5% | 3.6% |

| 09:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | January | 12.5 | |

| 09:00 | Eurozone | M3 money supply, adjusted y/y | December | 5.6% | 5.5% |

| 13:30 | U.S. | Goods Trade Balance, $ bln. | December | -62.99 | -68.75 |

| 15:00 | U.S. | Pending Home Sales (MoM) | December | 1.2% | 0.4% |

| 15:30 | U.S. | Crude Oil Inventories | January | -0.405 | |

| 19:00 | U.S. | Fed Interest Rate Decision | 1.75% | 1.75% | |

| 19:00 | U.S. | FOMC Statement | |||

| 19:30 | U.S. | Federal Reserve Press Conference | |||

| 21:45 | New Zealand | Trade Balance, mln | December | -753 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Trimmed Mean CPI y/y | Quarter IV | 1.6% | 1.5% |

| 00:30 | Australia | CPI, y/y | Quarter IV | 1.7% | 1.7% |

| 00:30 | Australia | Trimmed Mean CPI q/q | Quarter IV | 0.4% | 0.4% |

| 00:30 | Australia | CPI, q/q | Quarter IV | 0.5% | 0.6% |

| 05:00 | Japan | Consumer Confidence | January | 39.1 | 40.8 |

| 07:00 | United Kingdom | Nationwide house price index, y/y | January | 1.4% | 1.5% |

| 07:00 | United Kingdom | Nationwide house price index | January | 0.1% | 0.3% |

| 07:00 | Germany | Gfk Consumer Confidence Survey | February | 9.6 | 9.6 |

| 09:00 | Eurozone | Private Loans, Y/Y | December | 3.5% | 3.6% |

| 09:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | January | 12.5 | |

| 09:00 | Eurozone | M3 money supply, adjusted y/y | December | 5.6% | 5.5% |

| 13:30 | U.S. | Goods Trade Balance, $ bln. | December | -62.99 | -68.75 |

| 15:00 | U.S. | Pending Home Sales (MoM) | December | 1.2% | 0.4% |

| 15:30 | U.S. | Crude Oil Inventories | January | -0.405 | |

| 19:00 | U.S. | Fed Interest Rate Decision | 1.75% | 1.75% | |

| 19:00 | U.S. | FOMC Statement | |||

| 19:30 | U.S. | Federal Reserve Press Conference | |||

| 21:45 | New Zealand | Trade Balance, mln | December | -753 |

- No final decision has been made

James Knightley, the Chief International Economist at ING, notes that U.S. durable goods orders increased 2.4% m-o-m in December, "which was well ahead of expectations, but the details paint a much darker picture."

"Strip out defense (which rose 90.2% MoM!) and durable goods orders were down 2.5% following a 0.5% drop in November. Civilian aircraft orders fell 74.7% MoM following a 28.4% decline in November, which of course reflects the problems at Boeing. The cessation of production of the 737-Max earlier this month has meant less orders for the 600 or so different part suppliers while actual Boeing aircraft orders slumped to just 3 for December versus 63 in November."

"Nonetheless, it isn't just about Boeing. Non-defence capital goods orders ex aircraft slumped 0.9% versus expectations of a 0.4% rise. This is significant because it strips out the volatile components of the report (defence and aircraft, obviously) and has a much stronger correlation with investment spending in the US. The chart below shows an uptick in the YoY rate of growth, but we would caution that it reflects a very weak reading at the same time last year (coinciding with the start of the December 2018-January 2019 government shutdown) and we, unfortunately, strongly suspect that it will be back in negative YoY growth again next month."

"Investment spending was disappointing through 2019. The uncertainty generated by the trade war, the weakness in global demand and the effects of a strong dollar may all have played a part in this. Now that US-China trade relations are on a better footing this could provide a platform for stronger numbers in 2020, but we don't see it as a transformational agreement that will unleash an investment boom."

The latest survey from the Federal Reserve Bank of Richmond revealed on Tuesday that the U.S. fifth district's manufacturing rebounded in January.

According to the report, the composite manufacturing index surged from -5 in December to 20 in January (the highest level since September 2018), as its three major components - shipments (29 from -6 in December), new orders (13 from -13), and employment (20 from 7) - rose. In addition, local business conditions index recorded its largest increase since February 2013 (to 16 in January from -6 in December). Moreover, manufacturers were optimistic that conditions would continue to strengthen in the coming months, the Richmond Fed said. At the same time, the survey respondents reported declines in the average growth rates of both price paid (1.21 from 1.73) and prices received (1.31 from 1.60), and said they expected the growth rate of prices paid to rise and that of prices received to fall in the near future.

Economists had expected a reading of +9. A reading above 0 signals expansion, while a reading below 0 indicates contraction.

The Conference Board announced on Tuesday its U.S. consumer confidence gauge rose 3.4 points to 131.6 in January 2020 from 128.2 in December 2019.

Economists had expected consumer confidence to come in at 128.0.

December's consumer confidence reading was revised up from originally estimated 126.5.

The survey showed that the expectations index rose from 100.0 last month to 102.5 this month, while the present situation index increased from 170.5 to 175.3.

Lynn Franco, Senior Director of Economic Indicators at The Conference Board, noted: "Consumer confidence increased in January, following a moderate advance in December, driven primarily by a more positive assessment of the current job market and increased optimism about future job prospect." She also suggested that "optimism about the labor market should continue to support confidence in the short-term and, as a result, consumers will continue driving growth and prevent the economy from slowing in early 2020."

S&P reported on Tuesday its Case-Shiller Home Price Index, which tracks home prices in 20 U.S. metropolitan areas, rose 2.6 percent y-o-y in November, following an unrevised 2.2 percent y-o-y increase in October.

Economists had expected an advance of 2.4 percent y-o-y.

Phoenix (+5.9 percent y-o-y), Charlotte (+5.2 percent y-o-y) and Tampa (+5.0 percent y-o-y) recorded the highest y-o-y gains in November.

Meanwhile, the S&P/Case-Shiller U.S. National Home Price Index, which measures all nine U.S. census divisions, surged 3.5 percent y-o-y in November, up from 3.2 percent y-o-y in the previous month.

"The U.S. housing market was stable in November," noted Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. "With the month's 3.5% increase in the national composite index, home prices are currently 59% above the trough reached in February 2012, and 15% above their pre-financial crisis peak. November's results were broad-based, with gains in every city in our 20-city composite," he added.

U.S. stock-index futures rose on Tuesday, pointing to a rebound for Wall Street after the market's biggest sell-off in more than three months on Monday on corners about the impact of the coronavirus outbreak on the global economy.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 23,215.71 | -127.80 | -0.55% |

| Hang Seng | - | - | - |

| Shanghai | - | - | - |

| S&P/ASX | 6,994.50 | -96.00 | -1.35% |

| FTSE | 7,447.15 | +35.10 | +0.47% |

| CAC | 5,892.00 | +28.98 | +0.49% |

| DAX | 13,270.11 | +65.34 | +0.49% |

| Crude oil | $53.29 | | +0.28% |

| Gold | $1,574.30 | | -0.20% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 172.56 | -3.07(-1.75%) | 95370 |

| ALCOA INC. | AA | 15.05 | 0.18(1.21%) | 21439 |

| ALTRIA GROUP INC. | MO | 49.87 | 0.10(0.20%) | 174 |

| Amazon.com Inc., NASDAQ | AMZN | 1,839.20 | 10.86(0.59%) | 33866 |

| Apple Inc. | AAPL | 312.73 | 3.78(1.22%) | 505222 |

| AT&T Inc | T | 38.34 | 0.09(0.24%) | 31449 |

| Boeing Co | BA | 318.88 | 2.28(0.72%) | 38941 |

| Caterpillar Inc | CAT | 136.9 | 1.17(0.86%) | 24551 |

| Chevron Corp | CVX | 111 | 0.61(0.55%) | 25304 |

| Cisco Systems Inc | CSCO | 47.64 | 0.17(0.36%) | 37766 |

| Citigroup Inc., NYSE | C | 77.35 | 0.64(0.83%) | 8326 |

| E. I. du Pont de Nemours and Co | DD | 57.74 | 0.35(0.61%) | 998 |

| Exxon Mobil Corp | XOM | 65.21 | 0.47(0.73%) | 57201 |

| Facebook, Inc. | FB | 216.7 | 1.83(0.85%) | 63325 |

| FedEx Corporation, NYSE | FDX | 149.8 | 1.31(0.88%) | 4833 |

| Ford Motor Co. | F | 8.96 | 0.07(0.79%) | 52245 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.03 | 0.13(1.19%) | 39575 |

| General Electric Co | GE | 11.57 | 0.13(1.14%) | 241807 |

| General Motors Company, NYSE | GM | 33.61 | 0.20(0.60%) | 13510 |

| Goldman Sachs | GS | 240.17 | 2.03(0.85%) | 28126 |

| Google Inc. | GOOG | 1,444.25 | 10.35(0.72%) | 6993 |

| Hewlett-Packard Co. | HPQ | 21.87 | 0.29(1.34%) | 29367 |

| Home Depot Inc | HD | 232.05 | 0.86(0.37%) | 22743 |

| Intel Corp | INTC | 66.22 | 0.53(0.81%) | 82382 |

| International Business Machines Co... | IBM | 139.5 | 0.88(0.63%) | 26789 |

| International Paper Company | IP | 42.75 | 0.17(0.40%) | 3700 |

| Johnson & Johnson | JNJ | 149 | 0.25(0.17%) | 44484 |

| JPMorgan Chase and Co | JPM | 133 | 0.97(0.73%) | 30612 |

| McDonald's Corp | MCD | 209.99 | 0.65(0.31%) | 24284 |

| Merck & Co Inc | MRK | 86.5 | 0.40(0.46%) | 24567 |

| Microsoft Corp | MSFT | 164 | 1.72(1.06%) | 166338 |

| Nike | NKE | 100.35 | 0.11(0.11%) | 26288 |

| Pfizer Inc | PFE | 39.36 | -0.80(-1.99%) | 1225424 |

| Procter & Gamble Co | PG | 125.81 | 0.12(0.10%) | 22758 |

| Starbucks Corporation, NASDAQ | SBUX | 89.61 | 0.88(0.99%) | 12801 |

| Tesla Motors, Inc., NASDAQ | TSLA | 568.28 | 10.26(1.84%) | 200007 |

| The Coca-Cola Co | KO | 57.6 | 0.12(0.21%) | 26177 |

| Twitter, Inc., NYSE | TWTR | 33.05 | 0.27(0.82%) | 30483 |

| United Technologies Corp | UTX | 148.75 | -2.28(-1.51%) | 57777 |

| UnitedHealth Group Inc | UNH | 285 | 0.91(0.32%) | 23381 |

| Verizon Communications Inc | VZ | 60.2 | 0.29(0.48%) | 23967 |

| Visa | V | 203.15 | 1.46(0.72%) | 22392 |

| Wal-Mart Stores Inc | WMT | 116.02 | 0.16(0.14%) | 23391 |

| Walt Disney Co | DIS | 136.89 | 0.99(0.73%) | 60150 |

| Yandex N.V., NASDAQ | YNDX | 44.93 | 0.37(0.82%) | 847 |

Economists had forecast a 0.4 percent m-o-m increase.

According to the report, orders for durable goods excluding transportation edged down 0.1 percent m-o-m in December, following a revised 0.4 percent m-o-m decrease in November (originally unchanged m-o-m) and missing market expectations of 0.2 percent m-o-m rise.

Meanwhile, orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, dropped 0.9 percent m-o-m in December after a revised 0.1 percent gain m-o-m in November (originally a 0.2 percent m-o-m advance). That marked the largest monthly fall since April. Economists had called for a zero percent m-o-m changed in core capital goods orders in December.

Shipments of these core capital goods decreased 0.4 percent m-o-m in December after an unrevised 0.3 percent m-o-m decline in the prior month.

FXStreet reports that according to Piotr Matys, Senior Emerging Markets FX Strategist at Rabobank, the CEEMEA currencies remain driven by the latest news regarding China’s coronavirus.

“In the early hours of trading we witnessed signs of stabilisation following yesterday’s sell-off in stocks (the S&P 500 Index plunged 1.57%). However, this proved short-lived as travel restrictions announced by Hong Kong instead of improving sentiment spooked the markets, which are already on edge.”

“It is fair to assume, therefore, that the worst may yet to come. Any positive impact on the CEEMEA currencies of the phase one trade deal could be fully offset by rising concerns that the coronavirus will have serious negative implications not only for China, but for the global economy as well.“

“The plunge in oil prices to the lowest level so far this year provided USD/RUB with sufficient upside traction to reach the December 23 high at 63.1057. Unless fresh news from China provide concrete evidence that the virus is under control, the path of the least resistance will remain to the upside with 64.49 as the next potential target for USD/RUB.”

3M (MMM) reported Q4 FY 2019 earnings of $1.95 per share (versus $2.31 per share in Q4 FY 2018), missing analysts' consensus estimate of $2.10 per share.

The company's quarterly revenues amounted to $8.111 bln (+2.1% y/y), roughly in line with analysts' consensus estimate of $8.121 bln.

The company also issued guidance for FY 2020, projecting EPS of $9.30-9.75 (versus analysts' consensus estimate of $9.61) and revenues of $32-$32.74 bln (versus analysts' consensus estimate of $33.7 bln).

MMM fell to $172.99 (-1.50%) in pre-market trading.

Pfizer (PFE) reported Q4 FY 2019 earnings of $0.55 per share (versus $0.64 per share in Q4 FY 2018), missing analysts' consensus estimate of $0.58 per share.

The company's quarterly revenues amounted to $12.688 bln (-9.2% y/y), roughly in line with analysts' consensus estimate of $12.728 bln.

The company also issued guidance for FY 2020, projecting EPS of $2.82-$2.92 (versus analysts' consensus estimate of $2.82) and revenues of $48.5-$50.5 bln (versus analysts' consensus estimate of $48.93 bln).

PFE fell to $39.40 (-1.89%) in pre-market trading.

United Tech (UTX) reported Q4 FY 2019 earnings of $1.94 per share (versus $1.95 per share in Q4 FY 2018), beating analysts' consensus estimate of $1.84 per share.

The company's quarterly revenues amounted to $19.551 bln (+8.4% y/y), beating analysts' consensus estimate of $19.341 bln.

UTX fell to $150.00 (-0.68%) in pre-market trading.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:00 | Switzerland | Trade Balance | December | 2.2 | 2.0 | |

| 11:00 | United Kingdom | CBI retail sales volume balance | January | 3 |

JPY appreciated against most major counterparts during the European session as demand for safe havens remains strong amid concerns about the economic fallout from the coronavirus outbreak in China.

The latest reports from Chinese health authorities reveals that the outbreak has already killed 106 people and infected 4,515. The majority of the reported cases are in mainland China.

Meanwhile, CHF, another safe-haven currency, traded mixed against its major rivals, hovering little changed against EUR, raising against GBP and slightly falling against JPY and USD.

Aside from the coronavirus headlines, the franc was also slightly influenced by the Swiss trade data for December. The Federal Customs Administration reported Switzerland's exports fell by a real 3.4 percent m/m in December, following a 0.4 percent m/m decline in November. Meanwhile, its imports rose 0.2 percent m/m in December, after a 0.1 percent m/m drop in the previous month. On a q/q basis, exports fell by a real 2.3 percent in the fourth quarter, while imports declined 3.4 percent. As a result, the Swiss trade surplus rose to CHF 6.5 bln in the fourth quarter from CHF 5.8 bln in the previous quarter. In 2019, exports and imports recorded declines of 1.2 percent and 1.0 percent, respectively, and the trade surplus rose to CHF 37.3 bln from CHF 31.4 bln in 2018.

Elsewhere, GBP fell against its major counterparts following the release of the Confederation of British Industry's (CBI) survey of retailers, which showed retail sales volume balance stood at 0 in January 2020, unchanged from December 2019. That marked the third consecutive month of flat sales volumes. In addition, retailers expect sales volumes to remain unchanged (0) in the year to February. Economists had forecast the reading to increase to 3. The report also revealed that orders placed on suppliers decreased further in the year to January (to -17 from -10 in December), and are expected to decline at a similar pace next month (-19).

FXStreet reports that according to FX Strategists at UOB Group, USD/JPY could extend the downside to the 108.40 region in the next weeks.

24-hour view: “USD gapped lower upon opening yesterday and plummeted to a low of 108.72 before ending the day at 108.89 (-0.35%). Severely oversold conditions suggest further sustained weakness is unlikely. USD is more likely to consolidate and trade sideways, expected to be between 108.70 and 109.25.”

Next 1-3 weeks: “While we indicated last Thursday (23 Jan, spot at 109.55) that the risk for USD ‘has shifted to the downside’, the manner by which it cracked 109.00 came as a surprise (USD gapped lower upon opening yesterday and dropped to 108.72). The price action suggests USD could weaken further to 108.40. At this stage, the prospect for further weakness to 108.00 is not high. Only a move above 109.50 would indicate the current weakness has stabilized.”

FXStreet reports that FX Strategists at UOB Group noted further losses are seen in the Aussie dollar in the short-term horizon.

24-hour view: “The large and rapid decline in AUD (0.6759, -0.96%) is accompanied by strong momentum. However, the decline is deep in oversold territory and while a dip below the overnight low of 0.6752 would not be surprising, the next support at 0.6725 is likely out of reach. On the upside, only a move above 0.6795 would indicate that current weakness in AUD has stabilized (minor resistance is at 0.6780).

Next 1-3 weeks: “Our latest narrative for AUD was from last Wednesday (22 Jan, spot at 0.6845) wherein the ‘odds for AUD to move below 0.6820 have increased but there is another solid support at 0.6790’. After hovering a few days above 0.6820, AUD sliced through both 0.6820 and 0.6790 yesterday (27 Jan) and plunged to a low of 0.6752. The rapid improvement in momentum suggests further weakness in AUD. That said, severely oversold conditions indicate that the 2019 low at 0.6670 may not come into the picture. All in, AUD is expected to stay on the back foot unless it can reclaim the ‘strong resistance’ level at 0.6830.”

- Says the most important task at present is virus prevention and control

- Believes that WHO and the international community will give a calm and objective assessment of the virus

- Does not think foreigners should be evacuated

- Says policy is aimed at BoJ's objectives, not to help government's fiscal policy

- Monetary policy is to achieve price stability and financial system stability

- It is important for the government to maintain trust in its finances

The Confederation of British Industry (CBI) reported on Monday its latest survey of retailers showed retail sales volume balance stood at 0 in January 2020, unchanged from December 2019. That marked the third consecutive month of flat sales volumes. In addition, retailers expect sales volumes to remain unchanged (0) in the year to February.

Economist had forecast the reading to increase to 3.

The report also revealed that orders placed on suppliers decreased further in the year to January (to -17 from -10 in December), and are expected to decline at the similar pace next month (to -19). Elsewhere, stock levels in relation to sales increased above the long-run average in the year to January.

Meanwhile, wholesaling sales volumes returned to expansion in the year to January (+26 versus -10 in December) and are seen to grow in February (+15).

Anna Leach, CBI Deputy Chief Economist noted: "2020 looks set to be another tough year for the sector as growth in households' disposable income is set to remain modest and retailers continue to battle longer-term issues such as digital disruption and the cumulative burden of policy costs. The upcoming Budget provides an opportunity for the Chancellor to support retailers, primarily by fixing the broken business rates system."

FXStreet reports that the Australia and New Zealand Banking Group (ANZ) analysts assess the impact of the China coronavirus outbreak on the Australian debt markets.

"The outbreak of a coronavirus strain in the Chinese city of Wuhan is having a growing impact on market sentiment.

Bond yields have fallen sharply in the past ten days or so. 3y and 10y ACGB yields are closing in on previous historical lows.

The rally in the 10y ACGB has outpaced that of the front-end, with the curve flattening. This reflects both the proximity of the RBA's effective lower bound (ELB) and the strength of the US rally.

We think it is far too early to start looking for the rebound in yields that will almost certainly follow news that the virus is contained. It seems more likely that historic lows in the 3y and 10y ACGB yields will be reached in the meantime, with the curve bull flattening."

CNBC reports that according to an energy analyst, there's a "bear stampede" in the oil market as a new coronavirus spreads, but that may not be directly comparable to the sell-off in 2003 associated with the outbreak of severe acute respiratory syndrome (SARS).

Oil futures slid for a sixth session on Tuesday amid reports of a rising number of cases and casualties.

"It is based on a lot of fear and panic," Vandana Hari, founder and CEO of energy markets consultancy Vanda Insights, told CNBC's "Capital Connection". "That fear and panic will probably not die down anytime soon."

"It's natural, very human to ... hark back to SARS," she said. "However, when it comes to the oil market, I don't think it's entirely comparable."

Energy prices also slumped during the SARS outbreak in 2003. But she said there was "another, much bigger influence" in the oil market back then - the U.S. invasion of Iraq.

The novel coronavirus also appears to be less severe, she said, noting that the virus has not spread the way SARS did outside of China.

While Hari called the fall in oil prices "premature" and "overdone," she also said there were "bearish leanings" in the market before the outbreak began. That includes the dying down of U.S.-Iran tensions and a mild winter, she said.

eFXdata reports that TD Research discusses the current market conditions and flags a scope for further rally in the near-term.

"The market takes a step back from the reflation narrative, reflecting a mix of stretched positioning, excessive momentum, and frothy valuations. We think this backdrop is a reset of excess rather than a rejection of it. The global growth data hasn't turned fast enough to justify the optimism priced in across markets. January PMIs showed more stability, but a noticeable lift-off remains absent," TD notes.

"The outbreak of the coronavirus has turned into the catalyst for the correction in risk assets. We note that our simple tracking model that shows MSCI World versus the global PMIs implies a +20% gap. Furthermore, our positioning tracking for the broad USD shows shorts sitting in the 90th percentile of the past year's range. Coupled with rich valuations, the USD has some room to rally in the very short-run," TD adds.

FXStreet reports that in opinion of Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, Cable could shed further ground and visit the 1.2900 zone.

"GBP/USD charted an outside day to the downside on Friday and it is possible that it will react back to its 1.2902 uptrend near term. This will need to hold for scope for a deeper recovery to the 1.3285 Fibonacci retracement to be seen."

"The market is currently underpinned by the 1.2902 uptrend and the December low at 1.2908. Failure here would put the 200 day moving average at 1.2690 back on the plate. We have no strong bias."

FXStreet reports that Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, noted the outlook on the pair is now neutral to negative.

"EUR/USD last week eroded the 3 month uptrend. The intraday Elliott wave signals remain slightly negative and this leaves attention on the downside to initially the 1.0981 29th November low. More importantly it has left our bias neutral to negative. Very near term we note the 13 counts on the intraday charts and suspect that we will see a small rebound ahead of further weakness. This should terminate around 1.1075."

"Below 1.0980 will imply a retest of 1.0879, the October low."

Six euro zone banks failed to meet the European Central Bank's capital requirements and were ordered to strengthen their balance sheets or tighten controls.

The ECB's annual review of banks shows that many lenders are struggling to make money in the face of ultra-low interest rates, high costs associated with their branches, and a string of money-laundering scandals.

The euro zone's top banking supervisors kept both their mandatory capital requirements and their" guidance", which is not mandatory, unchanged from the previous year, at an average of 2.1% and 1.5%, respectively.

However, six out of the 109 banks did not meet the capital recommendations, compared with one firm last year, and they will have to raise their tier 1 capital ratio (CET1) if they want to avoid new restrictions from the Supervisory authority.

FXStreet reports that according to analysts at Rabobank, global stocks are in a risk-off mode amid escalating concerns about the coronavirus and the beginning of 2020 has started to look alarmingly similar to 2018.

"Back then the US stocks extended their impressive 2017 gains in the first few weeks of trading only to plunge at the end of January and sustain heavy losses in the first half of February. In that period the S&P 500 Index plunged almost 12% from the peak to trough on the back of rising concerns that inflation may rise much faster than initially anticipated forcing the Fed to accelerate the pace of monetary policy tightening. It was just a taste of what was to come as 2018 proved to be a tumultuous year for the US equities which set record highs in September only to end the year deep in the red."

"Back to 2020, global stocks are in a risk off mode amid escalating concerns about the coronavirus. The S&P 500 Index plunged 1.57% on Monday trimming its year-to-date gains to just 0.40%. One could argue that this is just a correction from seriously stretched levels that will ultimately prove as an opportunity to buy stocks on the back of an assumption that the Chinese officials will, eventually, get on top of the coronavirus."

"Looking more broadly at the EM space, the pace of capital inflows into risky assets slowed down last week when concerns about the coronavirus increased. Exchange-traded funds focused on emerging markets attracted USD 311.7mn in the week ending January 14 - this was significantly lower than USD 3.16bn in the previous week. The impressive run of 16 consecutive weeks of inflows may come to an end if risk aversion continues to rise."

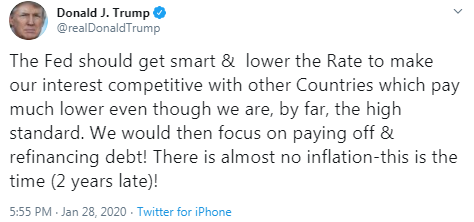

CNBC reports that the Fed is not expected to take any action on its benchmark fed funds rate this week, but it is likely to reassure markets that it is watching the outbreak of the coronavirus and other geopolitical uncertainties.

Fed Chairman Powell is slated to brief the press after the Fed releases its statement Wednesday afternoon, and it is in those comments investors will likely get the most insight into the Fed's thinking.

"They might say something about paying attention to global developments, but I wouldn't expect them to do anything at this point," said Ed Keon, chief investment strategist at QMA. Strategists expect the Fed has been watching tensions in the Middle East and now the coronavirus.

"They're looking at the global economy and it doesn't look like it will have much affect at the moment," he said.

On the policy side, the Fed is expected to hold rates steady and not signal any other moves.

"I think the Fed will be silent," said Joseph Quinlan, head of CIO market strategy at Merrill and Bank of America Private Bank. "They've come into 2020 with their work done. This is a political year. They've done their job when it comes to cutting rates. I think they're in wait-and-see mode."

BlackRock's Rick Rieder said he will be listening for how the Fed describes inflation since it has said it is willing to let it run "hotter" than its 2% target, though the measure it watches has not yet met the target. He, too, is looking for clarification on the Fed's plans for its T-bill buying program. He expects the Fed to discuss it by mid-second quarter.

eFXdata reports that Citi discusses its expectations for the RBA and the RBNZ policy trajectory throughout this year.

"Citi analysts still expect the RBA will need to provide more stimulus to the economy but push their 25bp rate cut forecast from February to May 2020. This is now in line with current market pricing," Citi notes.

"With activity indicators being on balance better than expected, some improvement in the outlook for global trading partners and CPI inflation higher than expected and importantly above the RBNZ's forecast, Citi analysts retain their forecast for no change to the OCR this year," Citi adds.

During today's Asian trading, the dollar rose slightly, while other major currency pairs remained stable.

Meanwhile, the Australian dollar fell to a 3-month low against a basket of 10 major world currencies on fears of a new type of coronavirus spreading. The New Zealand dollar fell to its lowest level since December 11.

The virus may give the us dollar a boost in the coming days, according to Bank of New York Mellon analyst John Velis. The yen's outperformance is a logical response to the coronavirus outbreak, but "concerns about the spread" of the negative effects of the infection could weaken the Japanese currency and the Euro against the dollar in a few days, he said.

If the virus continues to spread, the question will be whether the yen can avoid sales amid concerns about transmission. This could speak in favor of strengthening the Euro, but "Europe is in an unstable position", its economy showed only tentative signs of passing the bottom, given the latest weak data from Germany, said Velis.

"If China ends up being half-closed for business, I see no reason to buy euros," he added.

The ICE Dollar index, which shows the value of the US dollar against six major world currencies, rose 0.03% compared to the previous day.

FXStreet reports that economist Lee Sue Ann at UOB Group reviewed the developments from the latest ECB meeting.

"In its first monetary policy decision of the year, the European Central Bank (ECB) kept interest rates unchanged - the main refinancing operations, as well as interest rates on the marginal lending facility and the deposit facility at 0.00%, 0.25% and -0.50% respectively. The ECB also maintained its asset purchase programme (APP) at a monthly pace of €20 billion."

"The ECB also launched the long-awaited Monetary Strategy Review, the first one since 2003, and one of the first moves announced by ECB President Christine Lagarde upon starting her tenure. It was hardly impressive, though and the details were disappointingly thin. Aimed to be completed by December 2020, Lagarde said the ECB would reconsider the inflation target that defines its core price-stability mandate, along with the effectiveness and potential side-effects of the tools used to achieve it. The framework also set up a battle over how much central banks should do to tackle climate change by promising to examine "how other considerations, such as financial stability, employment and environmental sustainability, can be relevant in pursuing the ECB's mandate."

"Given the continued softness in the Eurozone economy, and the exceptional extent of monetary policy measures already in place, we expect the ECB to keep its policy rates and asset purchase programme (APP) unchanged through end-2021."

EUR/USD

Resistance levels (open interest**, contracts)

$1.1157 (2402)

$1.1116 (1600)

$1.1084 (318)

Price at time of writing this review: $1.1018

Support levels (open interest**, contracts):

$1.0984 (1861)

$1.0944 (927)

$1.0897 (684)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 7 is 56686 contracts (according to data from January, 27) with the maximum number of contracts with strike price $1,1350 (4630);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3223 (1266)

$1.3154 (1817)

$1.3108 (1114)

Price at time of writing this review: $1.3037

Support levels (open interest**, contracts):

$1.3014 (2659)

$1.2990 (1201)

$1.2960 (3252)

Comments:

- Overall open interest on the CALL options with the expiration date February, 7 is 24355 contracts, with the maximum number of contracts with strike price $1,3600 (3910);

- Overall open interest on the PUT options with the expiration date February, 7 is 21779 contracts, with the maximum number of contracts with strike price $1,3000 (3252);

- The ratio of PUT/CALL was 0.89 versus 0.89 from the previous trading day according to data from January, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 58.64 | -1.36 |

| WTI | 52.65 | -0.59 |

| Silver | 18.06 | -0.99 |

| Gold | 1581.78 | 0.02 |

| Palladium | 2265.15 | -5.74 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -483.67 | 23343.51 | -2.03 |

| FTSE 100 | -173.93 | 7412.05 | -2.29 |

| DAX | -371.91 | 13204.77 | -2.74 |

| CAC 40 | -161.24 | 5863.02 | -2.68 |

| Dow Jones | -453.93 | 28535.8 | -1.57 |

| S&P 500 | -51.84 | 3243.63 | -1.57 |

| NASDAQ Composite | -175.6 | 9139.31 | -1.89 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.6759 | -0.77 |

| EURJPY | 119.984 | -0.12 |

| EURUSD | 1.10186 | -0.1 |

| GBPJPY | 142.16 | -0.15 |

| GBPUSD | 1.30554 | -0.07 |

| NZDUSD | 0.65438 | -0.6 |

| USDCAD | 1.31923 | 0.31 |

| USDCHF | 0.96945 | -0.07 |

| USDJPY | 108.887 | -0.06 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.