- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-07-2019

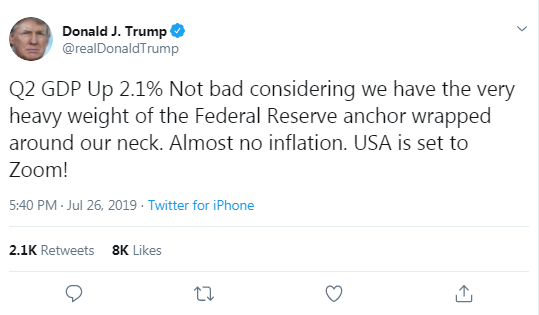

- Cheers the strength of the U.S.economy after the release of stronger-than-forecast growth data

Anders Svendsen, the analyst at Nordea Markets, suggests that market expectations for the future Fed funds path are already dovish (more than 100bp are priced in) by now and the Fed will likely have to deliver either 50bp or a liquidity-adding trick to spur a dovish reaction.

- “We have said earlier that a bet on 50bp made sense from a risk/reward perspective ahead of the July FOMC meeting – that is probably no longer the case.

- However, EUR/USD is still stuck in a downtrend as the liquidity outlook has turned USD positive after the recent US budget deal. The Fed will have to be very dovish to turn the EUR/USD trend towards our 3-month target of 1.15-1.16.

- Also, markets will be hoping for a liquidity adding trick or two from the Fed as liquidity will otherwise be withdrawn over the next six to eight weeks as QT still has not ended (1 October) and as the US Treasury will rebuild its cash balance via higher-than-usual issuance activity now that the debt ceiling is no longer a constraint.

- As long as liquidity is withdrawn, LIBOR/OIS spreads could widen, while the USD could remain bid alongside slightly weaker risk appetite.

- In general, we have preferred to bet on the Fed going big, but our conviction is less firm than a week or two back.”

Josh Nye, the senior economist at the Royal Bank of Canada (RBC), notes that the U.S. GDP surged by 2.2% in Q2, slightly above expectations.

- “As expected, today’s GDP report was the opposite of Q1 with stronger domestic spending growth but a drag from trade and inventories that held headline growth to 2.1%. Any concerns about the health of the US consumer should be dispelled by today’s release—consumer spending was up more than 4% in Q2, making up for softer gains in the prior two quarters.

- We argued that today’s report wouldn’t explain why the Fed is set to lower rates next week. But there are a few data points here that policymakers can point to as justifying a pre-emptive move.

- Business fixed investment declined in Q2 for the first time in three years—a sign that trade tensions and slowing global growth are generating uncertainty for businesses. And the core PCE deflator, the key price measure from today’s report, was up an annualized 1.8% in Q2—below 2% for a fourth consecutive quarter.

- The Fed sounds increasingly frustrated with inflation falling short of its target, so expect these numbers to be pointed to next Wednesday.”

U.S. stock-index futures rose on Friday, as investors reacted positively to solid earnings from big tech companies such as Alphabet (GOOG) and Intel (INDC), as well as advance estimate for U.S. Q2 GDP, which revealed the country's economy grew at a better-than-expected clip in the second quarter.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,658.15 | -98.40 | -0.45% |

Hang Seng | 28,397.74 | -196.56 | -0.69% |

Shanghai | 2,944.54 | +7.18 | +0.24% |

S&P/ASX | 6,793.40 | -24.60 | -0.36% |

FTSE | 7,536.71 | +47.66 | +0.64% |

CAC | 5,608.58 | +30.53 | +0.55% |

DAX | 12,390.44 | +28.34 | +0.23% |

Crude oil | $56.52 | +0.89% | |

Gold | $1,419.40 | +0.33% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 178.93 | 0.80(0.45%) | 552 |

ALCOA INC. | AA | 22.9 | 0.05(0.22%) | 1244 |

ALTRIA GROUP INC. | MO | 49.78 | 0.19(0.38%) | 675 |

Amazon.com Inc., NASDAQ | AMZN | 1,945.02 | -28.80(-1.46%) | 81361 |

American Express Co | AXP | 126.3 | -0.85(-0.67%) | 703 |

Apple Inc. | AAPL | 207.62 | 0.60(0.29%) | 53295 |

AT&T Inc | T | 33.73 | -0.08(-0.24%) | 20185 |

Boeing Co | BA | 347.6 | -0.49(-0.14%) | 11984 |

Caterpillar Inc | CAT | 134.11 | -0.60(-0.45%) | 1374 |

Chevron Corp | CVX | 125.9 | 0.27(0.21%) | 158 |

Cisco Systems Inc | CSCO | 56.73 | 0.11(0.19%) | 18127 |

Citigroup Inc., NYSE | C | 72 | 0.61(0.85%) | 36889 |

Exxon Mobil Corp | XOM | 75.17 | 0.24(0.32%) | 454 |

Facebook, Inc. | FB | 200.2 | -0.51(-0.25%) | 126130 |

FedEx Corporation, NYSE | FDX | 174.5 | -1.37(-0.78%) | 887 |

Ford Motor Co. | F | 9.6 | 0.04(0.42%) | 65580 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.45 | 0.03(0.26%) | 13150 |

General Electric Co | GE | 10.41 | -0.02(-0.19%) | 69588 |

Goldman Sachs | GS | 220.19 | 0.21(0.10%) | 4408 |

Google Inc. | GOOG | 1,229.98 | 97.86(8.64%) | 65342 |

Intel Corp | INTC | 54.15 | 1.99(3.82%) | 781695 |

International Business Machines Co... | IBM | 150.62 | 0.23(0.15%) | 445 |

International Paper Company | IP | 46 | 0.01(0.02%) | 300 |

Johnson & Johnson | JNJ | 131.5 | 0.38(0.29%) | 1915 |

JPMorgan Chase and Co | JPM | 116.1 | 0.39(0.34%) | 7824 |

McDonald's Corp | MCD | 218.2 | 3.76(1.75%) | 273991 |

Merck & Co Inc | MRK | 81.7 | -0.05(-0.06%) | 7018 |

Microsoft Corp | MSFT | 140.35 | 0.16(0.11%) | 56295 |

Nike | NKE | 87.36 | 0.08(0.09%) | 406 |

Pfizer Inc | PFE | 42.69 | 0.02(0.05%) | 2795 |

Procter & Gamble Co | PG | 113.46 | 0.69(0.61%) | 1429 |

Starbucks Corporation, NASDAQ | SBUX | 96.75 | 5.77(6.34%) | 129365 |

Tesla Motors, Inc., NASDAQ | TSLA | 226.55 | -2.27(-0.99%) | 68224 |

The Coca-Cola Co | KO | 53.14 | 0.07(0.13%) | 498 |

Twitter, Inc., NYSE | TWTR | 40.54 | 2.42(6.35%) | 4764511 |

UnitedHealth Group Inc | UNH | 251 | 2.30(0.92%) | 744 |

Verizon Communications Inc | VZ | 56.52 | 0.16(0.28%) | 2829 |

Visa | V | 181.81 | 0.22(0.12%) | 7986 |

Wal-Mart Stores Inc | WMT | 112.39 | 0.17(0.15%) | 1244 |

Walt Disney Co | DIS | 143.68 | 0.47(0.33%) | 13359 |

Yandex N.V., NASDAQ | YNDX | 40.2 | 1.79(4.66%) | 59964 |

The Commerce

Department released on Friday its "advance" estimate for the U.S.

gross domestic product (GDP) for the second quarter of 2019, which revealed the

U.S. economy grew more than expected in the reviewed period.

According to

the estimate, the U.S. real GDP increased at an annual rate of 2.1 percent

q-o-q last quarter, after rising by 3.1 percent q-o-q in the first quarter of

2019.

Economists had

expected GDP to boost by 1.8 percent.

According to

the report, the gain in real GDP in the second quarter reflected positive

contributions from personal consumption expenditures (PCE), federal government

spending, and state and local government spending that, however, were partly

offset by negative contributions from private inventory investment, exports,

nonresidential fixed investment and residential fixed investment. Imports,

which are a subtraction in the calculation of GDP, rose.

At the same

time, the acceleration in real GDP growth in the second quarter reflected

downturns in inventory investment, exports, and nonresidential fixed

investment, which were partly offset by accelerations in PCE and federal

government spending.

Deutsche Bank's analysts note that Mario Draghi remains the best leading indicator of ECB policy as he sharpened the dovish message at Sintra and yesterday he persuaded the Council to take a significant step towards delivering on this message.

“As we suspected, efforts to strengthen the commitment to price stability by elevating the symmetry of the inflation target played a significant role. This evolution of the reaction function was just one element in today’s communications, however.

The Council also formally endorsed the full set of policy options by tasking the Committees to study the possibilities for further easing using rates/mitigation, asset purchases and forward guidance. As expected, we are heading towards a policy easing package in September.

The latest policy communications were a tale of two halves, however. In a departure from the norm, the Policy Decision statement was used to convey the primary policy message. There was an opportunity for Draghi to reinforce the dovish tone in the press conference, but the Q&A did not achieve this. If anything, the effect was the opposite. In that sense, Draghi has only half delivered on Sintra. He now has seven weeks to convince the Council to keep with him and deliver a strong enough easing package. Given his powers of persuasion, we don’t doubt him.

We are updating slightly our baseline expectation for what the ECB will announce in the coming months. We continue to expect a 10bp deposit rate cut and tiering in September and a further 10bp cut in December.

New net asset purchases we thought were a close call but were not in our baseline – we thought the ECB would have a preference for upgrading forward guidance first. In light of both the breadth of the Policy Decision statement – a sign of Draghi’s powers of persuasion – and the worrying signals on the external side of the economy from the latest PMI and Ifo data and the ECB's sensitivity to this, we are including new net asset purchases in our baseline view for September.

We expect EUR30bn per month for a minimum 9-12 months split evenly between public and private assets. New QE is still a close call. If data and events surprise to the upside in the meantime, the ECB could stall on this element of the easing package.”

McDonald's (MCD) reported Q2 FY 2019 earnings of $2.05 per share (versus $1.99 in Q2 FY 2018), in line with analysts’ consensus estimate.

The company’s quarterly revenues amounted to $5.341 bln (-0.2% y/y), generally in line with analysts’ consensus estimate of $5.335 bln.

MCD rose to $220.00 (+2.59%) in pre-market trading.

Twitter (TWTR) reported Q2 FY 2019 earnings of $0.05 per share (versus $0.17 in Q2 FY 2018), missing analysts’ consensus estimate of $0.19.

The company’s quarterly revenues amounted to $0.841 bln (+18.4% y/y), beating analysts’ consensus estimate of $0.828 bln.

Twitter also reported 139 million monetizable daily users (mDAU) (versus estimate of 137 mln), compared to 122 mln in the same period of the previous year and 134 mln in the previous quarter.

TWTR rose to $40.34 (+5.82%) in pre-market trading.

James Knightley, the chief international economist at ING, notes that several analysts have made the case for the Fed going early and aggressively to head off the risks to US growth with a 50bp move on 31 July.

- "However, recent firm data has put pay to that view with the implied probability of such action drifting lower over the past couple of weeks. St Louis Fed President James Bullard, who is perceived to be one of the most dovish members of the FOMC having voted for a rate cut in June, has also downplayed that prospect. He said last Friday that “I’d like to go 25bp at the upcoming meeting”. Moreover, we have to remember that at the June FOMC meeting, the median forecast of FOMC members had no rate cuts for this year and only one for next. The newsflow hasn't deteriorated over the intervening period, so based on this we expect just a precautionary 25bp rate cut next Wednesday."

Starbucks (SBUX) reported Q2 FY 2019 earnings of $0.78 per share (versus $0.62 in Q2 FY 2018), beating analysts’ consensus estimate of $0.73.

The company’s quarterly revenues amounted to $6.823 bln (+8.1% y/y), beating analysts’ consensus estimate of $6.666 bln.

The company also issued upside guidance for FY 2019, projecting EPS of $2.80-2.82 versus analysts’ consensus estimate of $2.80.

SBUX rose to $97.00 (+6.62%) in pre-market trading.

Intel (INTC) reported Q2 FY 2019 earnings of $1.06 per share (versus $1.04 in Q2 FY 2018), beating analysts’ consensus estimate of $0.90.

The company’s quarterly revenues amounted to $16.505 bln (-2.7% y/y), beating analysts’ consensus estimate of $15.698 bln.

The company also issued upside guidance for Q3 FY 2019, projecting EPS of approx. $1.24 versus analysts’ consensus estimate of $1.16 and revenues of approx. $18.0 bln versus analysts’ consensus estimate of $17.76 bln.

It raised FY 2019 EPS guidance to approx. $4.40 (from $4.35) versus analysts’ consensus estimate of $4.22 and FY 2019 revenues guidance to approx. $69.5 bln (from $69.0 bln) versus analysts’ consensus estimate of $68.32 bln.

In addition, Intel confirmed that Apple (AAPL) will acquire the majority of the company's smartphone modem business for $1 bln.

INTC rose to $54.54 (+4.56%) in pre-market trading.

Analysts at Rabobank note the advance estimate of U.S. Q2 GDP will take the spotlight today, ahead of the FOMC meeting next week.

- “The Bloomberg consensus survey is calling for a 1.8% growth rate (s.a., annualized) in the second quarter of the year, down from the 3.1% seen in Q1. However, with well-entrenched expectations that the Fed will take out an ‘insurance cut’ next week, today’s GDP is unlikely going to change the market consensus about the upcoming Fed meeting.

- A poor GDP release could again spur some market participants to increase their expectations of a 50bp cut, but a large majority expects the FOMC to deliver a regular 25bp rate reduction, us included. Risks of a follow-up cut later in the year remain elevated, though.”

Amazon (AMZN) reported Q2 FY 2019 earnings of $5.22 per share (versus $5.07 in Q2 FY 2018), missing analysts’ consensus estimate of $5.63.

The company’s quarterly revenues amounted to $63.404 bln (+19.9% y/y), beating analysts’ consensus estimate of $62.593 bln.

The company also issued guidance for Q3 FY 2019, projecting revenues of $66-70 bln versus analysts’ consensus estimate of $67.36 bln and operating income of $2.1-3.1 bln versus analysts’ consensus estimate of $4.38 bln and compared with $3.7 bln in Q3 FY 2018.

AMZN fell to $1,945.02 (-1.46%) in pre-market trading.

Alphabet (GOOG) reported Q2 FY 2019 earnings of $14.21 per share (versus $11.75 in Q2 FY 2018), beating analysts’ consensus estimate of $11.38.

The company’s quarterly revenues amounted to $38.944 bln (+19.3% y/y), beating analysts’ consensus estimate of $38.213 bln.

The company also announced a $25 bln share repurchase on Class C capital stock (GOOG).

GOOG rose to $1,230.00 (+8.65%) in pre-market trading.

- Says that Johnson spoke to France's Macron

- Johnson told Macron what he wants to achieve on Brexit

- Both agreed to stay in contact

- Says that Johnson will note withdrawal agreement needs to be reopened

- To also note that backstop must be abolished

- Says in all calls with EU leaders, Johnson will be stressing desire for a deal

- His comments seem designed to set UK on a collision course with the EU

- UK PM Johnson's approach taken by Johnson is not the basis for an agreement

- It's fair to say that Boris Johnson hasn't gotten a warm reception among European lawmakers after just a day in charge

- Yesterday was a very bad day from a Brexit negotiation perspective

Danske Bank's analysts note that at yesterday's meeting Mario Draghi sent a strong signal to the market that further stimulus is on its way to help the ailing economy.

- “As we expected, the ECB adjusted the forward guidance as a first step, opening up the possibility of policy rates remaining 'at present or lower levels' at least through H1 20. In our view, this has set the scene for a deposit rate cut, which we expect to be announced at the September meeting (we expect a 20bp rate cut), paired with a restart of the QE programme and extended forward guidance. Markets are currently pricing 12bp of cut in September.

- The ECB's assessment of the inflation and economic outlook and risks was broadly unchanged. While resilience is still apparent in the service and construction sectors, Draghi stressed the outlook was getting worse and worse, especially in manufacturing. This means the expected rebound in H2 19 is now less likely with incoming data. The risk of recession was seen as 'pretty low' (from 'very low' in June).”

ECB meeting largely met expectations, indicating a very likely rate cut in September

Forward guidance change reaffirms markets being fully priced for September

Suggests that a 10 bps deposit rate cut will be delivered

Detail on other potential stimulus measures is not clear, but ECB are clearly making preparations in that regard

Expects a cut will be delivered in September as part of a broader stimulus package

"We expect that the cut in September will be followed by a tiered deposit rate to mitigate the pressure on banks and that asset purchases of sovereign bonds will be restarted. Our expectation is for the ECB to introduce a €30bn per month program in December lasting for a year at this stage. For that to occur, the ECB will need to increase their self-imposed issuer limits from the current 33% given German Bunds are already at that limit. For example, given €1.6tn of Bunds outstanding, a new issuer limit of 45% would allow room for the purchase of ~€200bn bunds, and with Bunds representing roughly 25% of purchases, that would create room for ~€800bn of total sovereign European bonds." Westpac said.

As the trade war between China and the United States continues, the ongoing tariff battle remains an important risk facing markets.

That will eventually fade once the two countries reach a provisional deal, according to a BNP Paribas economist, but they’ll leave behind a “cold tech war.”

“We’re likely to get a temporary agreement in the coming months,” said Chi Lo, senior economist at BNP Paribas. He told that if Beijing and Washington can agree to a temporary deal then they can “set the stage for longer-term negotiation on more deep-rooted issues.”

Lo said, given his expectation of a temporary pact, the continued trade war will no longer have such a big impact on “the macro risk in terms of market volatility,” in the coming months.

But the effect of the trade dispute will linger on and hurt tech, Lo said. He predicted that disagreements in the technology sector will probably get even “colder” in the coming months — or even coming years. “There will be more focused trade war risk on the tech sector going forward. But then the overall market sensitivity to overall trade war risk may fade a bit,” said the economist.

Danske Bank analysts note that at yesterday's meeting Mario Draghi sent a strong signal to the market that further stimulus is on its way to help the ailing economy.

“As we expected, the ECB adjusted the forward guidance as a first step, opening up the possibility of policy rates remaining 'at present or lower levels' at least through H1 20. In our view, this has set the scene for a deposit rate cut, which we expect to be announced at the September meeting (we expect a 20bp rate cut), paired with a restart of the QE programme and extended forward guidance. Markets are currently pricing 12bp of cut in September. The ECB's assessment of the inflation and economic outlook and risks was broadly unchanged. While resilience is still apparent in the service and construction sectors, Draghi stressed the outlook was getting worse and worse, especially in manufacturing. This means the expected rebound in H2 19 is now less likely with incoming data. The risk of recession was seen as 'pretty low' (from 'very low' in June).”

Britain will hold an emergency budget in the autumn and hopes a faster growing economy will allow it to pay for spending pledges, a junior interior minister said on Friday.

Prime Minister Boris Johnson took office on Wednesday promising a raft of spending pledges including increasing police numbers by 20,000 to help cut crime.

"The prime minister has also announced there's going to be an emergency budget in the autumn which will be designed to stimulate the economy," Kit Malthouse told.

"What you hope is that a more strongly growing economy will produce greater tax revenue which we can pay for some of the things that we want to do," he said.

Malthouse said a pledge to boost police numbers would cost about 500 million pounds in the first year.

MUFG Research discusses USD/JPY tactical outlook and adopts a neutral bias, expecting the pair to trade in 106.50-109.50 range in the near-term.

"We expect that the BoJ will likely stay the course on monetary policy with no surprises. Japanese investors have been buying foreign bonds with JPY forward hedges. Negative yields will probably keep supporting their foreign bond buying. We expect the FOMC to cut policy rates by 25bps, but this has already been priced in and is unlikely to have much impact. Fed Chair Powell may strike a neutral stance in his comments after the meeting, but this depends on any political pressure. US Treasury yields would support a stronger USD, and the 109.00-level could come into view. But expectations of more easing are diminishing in the US stock market, and USD/JPY will likely be top-heavy. High-level talks between the US and China will be important, but are not likely to impact USD/JPY much," MUFG adds.

According to the report from Istat, in July 2019, the consumer confidence index got better again moving from 109.8 to 113.4.

Economists had expected a decrease to 109.6. The improvement was due to the positive trend of all its components. More specifically, the economic one rose from 121.4 to 129.7, the personal one from 105.6 to 108.0, the current one from 107.6 to 111.1 and, finally, the future one from 112.6 to 117.4.

With regard to the business confidence climate, the related index (IESI, Istat Economic Sentiment Indicator) increased from 99.3 to 101.2. The confidence index in manufacturing slipped from 100.7 to 100.1. The confidence index in construction rose from 140.9 to 142.8. The market services confidence index improved from 98.9 to 101.1. The retail trade confidence index rose from 105.2 to 109.9. In particular, the index actually grew from 105.8 to 111.5 in the large scale distribution and weakened from 104.4 to 104.0 in the small and medium scale one.

2019 inflation seen at 1.3% (previously 1.4%)

2020 inflation seen at 1.4% (previously 1.5%)

2021 inflation seen at 1.5% (previously 1.6%)

Longer-term inflation projection cut to 1.7% from 1.8%.

2019 real GDP growth seen at 1.2% (unchanged)

2020 real GDP growth seen at 1.3% (previously 1.4%)

2021 real GDP growth seen at 1.4% (unchanged)

Longer-term GDP growth is seen at 1.4%.

Karen Jones, analyst at Commerzbank, notes that EUR/USD pair has sold off to, tested and reversed from 1.1110/06 the April and May lows.

“We would consider a close above 1.1176/81 (mid-June low and March low) enough of a trigger to signal recovery to the 55 day ma lies 1.1243 and highs last week at 1.1285.Yesterdays spike lower was exhaustive and despite an impressive rally it was not enough to confirm reversal – there is more work to do. Below 1.1100 will introduce scope to the 1.0980 2018-2019 support line, which in turn guards the 78.6% retracement at 1.0814/78.6% retracement. Initial resistance lies at 1.1285, the 11th July high and this guards the more important 55 week ma at 1.1382. The market will need to regain the 55 week ma at 1.1382 to generate upside interest.”

Analysts at Bank of New Zealand (BNZ) offer a sneak peek at what to expect from Friday’s US Q2 Preliminary GDP report due on the cards at 12:30 GMT.

“Durable goods orders data in the US were stronger than expected, including a lift for the core measure. But, for today's data to come: While this was pleasing to see, advanced estimates on trade and inventories suggested that these components will act as a bigger-than-expected drag on Q2 GDP. Placing downside risk to the consensus annualized 1.8% estimate - already on track for the weakest quarterly growth in over two years.”

Japanese Economy Minister Toshimitsu Motegi is making preparations to meet with U.S. Trade Representative Robert Lighthizer in Washington on Aug. 1 for ministerial-level trade talks, two sources familiar with the matter said. The meeting will take into account any progress made at bilateral working-level talks taking place from July 24.

U.S. President Donald Trump has pressured Tokyo to speed up talks for a two-way trade deal that would open up Japan's market for U.S. goods, particularly in areas of agriculture, and fix what he sees as a huge bilateral trade imbalance.

Japan is wary of making any concessions on political sensitive areas like agriculture and instead wants to prod the United States into cutting tariffs on auto parts.

Bilateral trade negotiations are expected to speed up ahead of an expected visit by Japanese Prime Minister Shinzo Abe to New York in September, where he is expected to meet Trump.

According to the report from Insee, in July 2019, households’ confidence in the economic situation has increased for the seventh consecutive month. The synthetic index has gained 1 point. At 102, it is slightly above its long term average (100) and is back to its early 2018 level. The index was expected to remain at 101.

In July, the share of households considering it is a suitable time to make major purchases has increased for the seventh consecutive month. The corresponding balance has gained 3 points and remains above its long term average.

In addition, households’ opinion balance on their future personal situation has been virtually stable: it has gained 1 point and thus exceeds slightly its long term average. Households’ opinion balance regarding their past financial situation has also gained 1 point and reaches its long term average.

In July, households’ opinion balances on their current and expected saving capacities have been virtually stable. Both balances have gained 1 point and stand clearly above their long term average.

The share of households considering it is a suitable time to save has also been virtually stable: the corresponding balance has lost 1 point and clearly remains below its long term average.

In line with the almost unanimous consensus, analysts at TD Securities are expecting the CBR to cut its Key Rate by 25bps to 7.25% at today's Board Meeting.

“Since the June meeting, inflation developments have been positive with CPI inflation falling to 4.7% y/y in June from a prior 5.1%; the ruble has been firm, with USDRUB down about 2.0%; and, of course, the global financial environment is becoming increasingly dovish with the Fed likely to cut at the end of this month. Governor Nabiullina has said that the CBR will assess the option of a 50bps cut at today's meeting, but we think the CBR will maintain their cautious stance and stick with 25bps increments.”

According to the report from Federal Statistical Office (Destatis), the index of import prices decreased by 2.0% in June 2019 compared to the corresponding month of the preceding year. Economists had expected a 1.5% decrease. In May 2019 and in April 2019 the annual rates of change were -0.2% and +1.4%, respectively. From May 2019 to June 2019 the index fell by 1.4%. Economists had expected a 0.8% decrease.

The index of import prices, excluding crude oil and mineral oil products, decreased in June 2019 by 1.5% compared to June 2018 and in comparison with May 2019 it fell by 0.7%.

The index of export prices increased by 0.2% in June 2019 compared to the corresponding month of the preceding year. In May 2019 and in April 2019 the annual rates of change were +0.7% and +1.3%, respectively. From May 2019 to June 2019 the index fell by 0.2%.

U.S. firms are keen to participate in China's import expo despite trade frictions between the two countries, China's assistant commerce minister Ren Hongbin said on Friday.

The second China International Import Expo (CIIE), to be held on Nov. 5-10, will bring thousands of foreign firms together with Chinese buyers in a bid to demonstrate the importing potential of the world's second-biggest economy.

"For the United States, even through there are some bilateral trade frictions, it cannot stop U.S. firms from attaching importance to the Chinese market and their great enthusiasm for the Chinese market," Ren told a news conference.

China held its first import expo in Shanghai last year and signed $57.8 billion worth of deals. Ren said it is hard to predict the size of deals for the import expo this year.

The number of U.S. firms participating in this year's import fair will surpass last year's level of more than 170, Ren said.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1276 (2978)

$1.1245 (1523)

$1.1222 (375)

Price at time of writing this review: $1.1146

Support levels (open interest**, contracts):

$1.1117 (3494)

$1.1081 (4576)

$1.1040 (2723)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 9 is 74357 contracts (according to data from July, 25) with the maximum number of contracts with strike price $1,1100 (4576);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2667 (1691)

$1.2591 (821)

$1.2536 (351)

Price at time of writing this review: $1.2443

Support levels (open interest**, contracts):

$1.2395 (2420)

$1.2363 (2053)

$1.2325 (773)

Comments:

- Overall open interest on the CALL options with the expiration date August, 9 is 16306 contracts, with the maximum number of contracts with strike price $1,3000 (2051);

- Overall open interest on the PUT options with the expiration date August, 9 is 17716 contracts, with the maximum number of contracts with strike price $1,2450 (2420);

- The ratio of PUT/CALL was 1.09 versus 1.08 from the previous trading day according to data from July, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 62.93 | -0.08 |

| WTI | 55.87 | -0.02 |

| Silver | 16.38 | -1.09 |

| Gold | 1414.093 | -0.77 |

| Palladium | 1527.88 | -0.57 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 46.98 | 21756.55 | 0.22 |

| Hang Seng | 70.26 | 28594.3 | 0.25 |

| KOSPI | -7.82 | 2074.48 | -0.38 |

| ASX 200 | 41.3 | 6818 | 0.61 |

| FTSE 100 | -12.41 | 7489.05 | -0.17 |

| DAX | -160.79 | 12362.1 | -1.28 |

| Dow Jones | -128.99 | 27140.98 | -0.47 |

| S&P 500 | -15.89 | 3003.67 | -0.53 |

| NASDAQ Composite | -82.96 | 8238.54 | -1 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69528 | -0.32 |

| EURJPY | 121.087 | 0.49 |

| EURUSD | 1.11469 | 0.04 |

| GBPJPY | 135.277 | 0.21 |

| GBPUSD | 1.24531 | -0.23 |

| NZDUSD | 0.66604 | -0.57 |

| USDCAD | 1.31576 | 0.17 |

| USDCHF | 0.99057 | 0.63 |

| USDJPY | 108.621 | 0.45 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.