- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-06-2017

(raw materials / closing price /% change)

Oil 43.49 +0.25%

Gold 1,245.30 -0.09%

(index / closing price / change items /% change)

Nikkei +20.68 20153.35 +0.10%

TOPIX +0.87 1612.21 +0.05%

Hang Seng +201.84 25871.89 +0.79%

CSI 300 +45.21 3668.09 +1.25%

Euro Stoxx 50 +18.08 3561.76 +0.51%

FTSE 100 +22.67 7446.80 +0.31%

DAX +37.42 12770.83 +0.29%

CAC 40 +29.63 5295.75 +0.56%

DJIA +14.79 21409.55 +0.07%

S&P 500 +0.77 2439.07 +0.03%

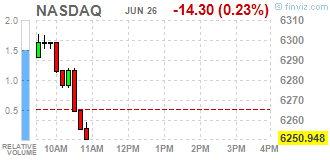

NASDAQ -18.10 6247.15 -0.29%

S&P/TSX -3.54 15316.02 -0.02%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1183 -0,09%

GBP/USD $1,2720 +0,02%

USD/CHF Chf0,9718 +0,27%

USD/JPY Y111,85 +0,52%

EUR/JPY Y125,08 +0,42%

GBP/JPY Y142,26 +0,54%

AUD/USD $0,7581 +0,18%

NZD/USD $0,7283 +0,03%

USD/CAD C$1,3248 -0,14%

08:00 Eurozone ECB President Mario Draghi Speaks

08:05 U.S. FOMC Member Williams Speaks

08:30 Australia RBA Assist Gov Debelle Speaks

08:30 United Kingdom BOE Financial Stability Report

10:00 United Kingdom CBI retail sales volume balance June 2 0

10:00 United Kingdom BOE Gov Mark Carney Speaks

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April 5.9% 5.9%

14:00 U.S. Richmond Fed Manufacturing Index June 1

14:00 U.S. Consumer confidence June 117.9 116

15:15 U.S. FOMC Member Harker Speaks

17:00 U.S. Fed Chairman Janet Yellen Speaks

21:30 U.S. FOMC Member Kashkari Speaks

The major US stock indexes ended the trading mixed, since the decline in the shares of the technology sector was opposed by the growth of the conglomerate sector.

In addition, the negative impact on the mood of investors had weak data on orders for durable goods and sluggish dynamics of oil quotes.

As it became known today, orders for non-military capital goods, with the exception of aircraft carefully monitored by the sensor for business expenses, fell by 0.2%. These so-called basic orders for capital goods were revised, and showed an increase of 0.2% in April. Earlier it was reported that they grew by 0.1%. At the same time, the supply of capital goods used to calculate equipment costs in the national GDP measurement decreased by 0.2% last month after rising 0.1% in April. Economists predicted that major orders for capital goods in May will grow by 0.3%. General orders for durable goods, goods from toasters to aircraft, which are designed for a lifetime of three years or longer, fell 1.1% after a decline of 0.9% in April.

Most components of the DOW index closed in positive territory (17 out of 30). Most fell shares of The Boeing Company (BA, -1.03%). The leader of growth was the shares of The Goldman Sachs Group (GS, + 1.66%).

Most sectors of the S & P index showed an increase. The technological sector fell most (-0.4%). The growth leader was the conglomerate sector (+ 0.9%).

At closing:

DJIA + 0.07% 21.405.55 +14.79

Nasdaq -0.29% 6.247.15 -18.10

S & P + 0.03% 2.439.07 + 0.77

Major U.S. stock-indexes demonstrated mixed dynamics on Monday. Declines in technology and health-care sectors were the major drivers of the market's sharp downward move after positive opening. Investors' sentiment was also impacted by weaker-than-expected data on durable goods orders for May and stalled oil prices.

A majority of Dow stocks in positive area (17 of 30). Top loser - Exxon Mobil Corp. (XOM, -0.65%). Top gainer - The Goldman Sachs Group (GS, +1.04%).

Most of S&P sectors in positive area.Top loser - Technology (-0.2%) и Healthcare (-0.2%). Top gainer - Utilities (+0.8%).

At the moment:

Dow 21347.00 +8.00 +0.04%

S&P 500 2438.00 +3.00 +0.12%

Nasdaq 100 5800.25 -12.00 -0.21%

Oil 42.65 -0.36 -0.84%

Gold 1245.30 -11.10 -0.88%

U.S. 10yr 2.13 -0.01

-

Family members of EU citizens lawfully in Britain who arrive before cut off date will be able to apply for settled status

-

Preserve freedoms of irish citizens in Britain

-

Those who arrive after the cut off date could still stay in Britain

-

Seek to protect the UK state pension for britons living in EU

-

Eu citizens lawfully in Britain will be treated as british citizens

EURUSD: $1.1100 (€309 mln), $1.1185 (€395 mln), $1.1200 (€525 mln)

GBPUSD: $1.2700 (£325 mln), $1.2760 (£321 mln)

USDCAD: C$1.3340 ($504 mln)

U.S. stock-index futures rose moderately, as oil prices continued to rebound, while investors assessed the May data on durable goods orders.

Stocks:

Nikkei 20,153.35 +20.68 +0.10%

Hang Seng 25,871.89 +201.84 +0.79%

Shanghai 3,186.05 +28.17 +0.89%

S&P/ASX 5,720.16 +4.29 +0.08%

FTSE 7,471.97 +47.84 +0.64%

CAC 5,318.50 +52.38 +0.99%

DAX 12,818.73 +85.32 +0.67%

Crude $43.12 (+0.26%)

Gold $1,239.70 (-1.33%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 30.9 | -0.19(-0.61%) | 1200 |

| Amazon.com Inc., NASDAQ | AMZN | 1,009.90 | 6.16(0.61%) | 31733 |

| American Express Co | AXP | 82.5 | 0.28(0.34%) | 100 |

| Apple Inc. | AAPL | 147.15 | 0.87(0.59%) | 127284 |

| AT&T Inc | T | 38 | 0.05(0.13%) | 1700 |

| Barrick Gold Corporation, NYSE | ABX | 16.19 | -0.29(-1.76%) | 50013 |

| Caterpillar Inc | CAT | 104.3 | 0.19(0.18%) | 1623 |

| Cisco Systems Inc | CSCO | 32.4 | 0.31(0.97%) | 25493 |

| Citigroup Inc., NYSE | C | 63.8 | 0.39(0.62%) | 17664 |

| Deere & Company, NYSE | DE | 124.65 | 1.05(0.85%) | 501 |

| Exxon Mobil Corp | XOM | 81.71 | 0.10(0.12%) | 3596 |

| Facebook, Inc. | FB | 155.95 | 0.88(0.57%) | 150617 |

| FedEx Corporation, NYSE | FDX | 216 | 0.65(0.30%) | 106 |

| Ford Motor Co. | F | 11.06 | 0.02(0.18%) | 22151 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.84 | 0.08(0.68%) | 10982 |

| General Electric Co | GE | 27.67 | 0.10(0.36%) | 8629 |

| Goldman Sachs | GS | 218.1 | 0.91(0.42%) | 6466 |

| Google Inc. | GOOG | 972.5 | 6.91(0.72%) | 4227 |

| Hewlett-Packard Co. | HPQ | 17.84 | 0.04(0.22%) | 410 |

| Home Depot Inc | HD | 151.98 | 0.67(0.44%) | 5708 |

| Intel Corp | INTC | 34.25 | 0.06(0.18%) | 4393 |

| Johnson & Johnson | JNJ | 136.25 | -0.18(-0.13%) | 547 |

| JPMorgan Chase and Co | JPM | 87.15 | 0.29(0.33%) | 9426 |

| McDonald's Corp | MCD | 154.75 | 0.11(0.07%) | 1301 |

| Microsoft Corp | MSFT | 71.55 | 0.34(0.48%) | 16545 |

| Nike | NKE | 52.93 | 0.08(0.15%) | 891 |

| Pfizer Inc | PFE | 34.3 | 0.13(0.38%) | 1120 |

| Tesla Motors, Inc., NASDAQ | TSLA | 386.6 | 3.15(0.82%) | 66853 |

| Twitter, Inc., NYSE | TWTR | 18.61 | 0.11(0.59%) | 87799 |

| UnitedHealth Group Inc | UNH | 186.88 | 1.63(0.88%) | 130 |

| Verizon Communications Inc | VZ | 45.44 | 0.05(0.11%) | 2760 |

| Visa | V | 95.8 | 0.22(0.23%) | 1928 |

| Wal-Mart Stores Inc | WMT | 74.95 | 0.11(0.15%) | 2130 |

| Walt Disney Co | DIS | 104.75 | 0.39(0.37%) | 2087 |

Credit Suisse (CS) resumed with a Overweight at JP Morgan

McDonald's (MCD) target raised to $175 from $165 at Wells Fargo

New Orders New orders for manufactured durable goods in May decreased $2.5 billion or 1.1 percent to $228.2 billion, the U.S. Census Bureau announced today. This decrease, down two consecutive months, followed a 0.9 percent April decrease. Excluding transportation, new orders increased 0.1 percent. Excluding defense, new orders decreased 0.6 percent. Transportation equipment, also down two consecutive months, drove the decrease, $2.7 billion or 3.4 percent to $75.4 billion.

Shipments of manufactured durable goods in May, up following two consecutive monthly decreases, increased $1.8 billion or 0.8 percent to $234.9 billion. This followed a 0.3 percent April decrease. Transportation equipment, up following four consecutive monthly decreases, led the increase, $1.5 billion or 1.9 percent to $78.8 billion.

EUR/USD

Offers: 1.1220-25 1.1235 1.1250 1.1280 1.1300

Bids: 1.1180-85 1.1150 1.1130 1.1100 1.1080 1.1050

GBP/USD

Offers: 1.2760 1.2780 1.2800 1.2830 1.2850

Bids: 1.2720 1.2700 1.2680 1.2665 1.2650 1.2630 1.2600

EUR/JPY

Offers: 125.00 125.30 125.50 125.80 126.00

Bids: 124.80 124.50 124.20 124.00 123.80 123.50

EUR/GBP

Offers: 0.8800 0.8820 0.8835 0.8850-55

Bids: 0.8770 0.8750-55 0.8720 0.8700 0.8685 0.8650

USD/JPY

Offers: 111.50 111.65 111.80 112.00 112.30 112.50

Bids: 111.20 111.00 110.80 110.50 110.30 110.00

AUD/USD

Offers: 0.7600 0.7620 0.7635 0.7650

Bids: 0.7550 0.7520 0.7500 0.7480 0.7450

-

It is European Commission's responsibility to minimize state aid to banks

The BBA's latest data from the high street banks* shows that consumer credit growth was 5.1% in May, compared with 6.4% in the previous month.

Gross mortgage borrowing totalled £13.3 billion in May. Net mortgage borrowing was 2.4% higher than a year ago.

Eric Leenders, BBA Managing Director for Retail Banking said:

"This month's figures show that in the run up to the General Election, credit growth in personal loans, cards and overdrafts has slowed, which was reflected in lower spending; with increased household costs affecting growth in deposits and saving.

Businesses appear to be weighing up their options before raising finance to fund projects or developments. After a long period of subdued company borrowing, overall growth is starting to stabilise at a modest rate."

The ifo Business Climate Index rose from 114.6 points last month to 115.1 points in June, breaking last month's record. Companies were significantly more satisfied with their current business situation this month. They also expect business to improve. Germany's economy is performing very strongly.

In manufacturing the index rose slightly. Assessments of the current business situation remained unchanged at a very high level. Manufacturers are slightly more optimistic about the short-term future. Developments in demand and order levels were very favourable. Manufacturers plan to ramp up production.

EURUSD: $1.1100 (€309 mln), $1.1185 (€395 mln), $1.1200 (€525 mln)

GBPUSD: $1.2700 (£325 mln), $1.2760 (£321 mln)

USDCAD: C$1.3340 ($504 mln)

-

Remarkable improvement in CPI has yet to be seen, it would take some time for inflation to accelerate

-

Most effective way to achieve price target is to continue current monetary policy

-

Increase in wages and prices have not been accelerating despite improvements incorporate profits, output gap

-

Firms are concerned about the increase in fixed costs amid low growth expectations

-

says strong labor market risks overheating U.S.economy

-

Financial conditions have become more favourable in recent months even as fed tightened

-

Sees U.S. inflation reaching 2-pct goal next year

-

Fed needs to raise rates to keep economy expanding as long as possible

-

Most of recent slowdown in U.S. inflation due to one-off factors

-

U.S. unemployment falling further, remaining a little above 4 pct through next year

-

Hopes to finalise a deal to prop up PM May's government

Moody's Investors Service has today upgraded Greece's long-term issuer rating as well as all senior unsecured bond and programme ratings to Caa2 and (P)Caa2 from Caa3 and (P)Caa3, respectively. The outlook has been changed to positive from stable.

Greece's short-term ratings have been affirmed, at Not Prime (NP) and (P)NP.

The key drivers for today's rating action are as follows:

1. Successful conclusion of the second review under Greece's adjustment programme and release of a tranche of €8.5 billion in the coming days. Beyond the near-term impact of allowing Greece to repay upcoming maturities, we consider the conclusion of the review to be a positive signal regarding the future path of the programme, as it required the Greek government to legislate a number of important reform measures.

2. Improved fiscal prospects on the back of 2016 fiscal outperformance, expected to lead soon to a reversal in the country's public debt ratio trend. The government posted a 2016 primary surplus of over 4% of GDP versus a target of 0.5% of GDP. Moody's expects the public debt ratio to stabilize this year at 179% of GDP, and to decline from 2018 onwards, on the back of continued substantial primary surpluses.

3. Tentative signs of the economy stabilizing. While it is too early to conclude that economic growth will be sustained, Moody's expects to see growth this year and next, after three years of stagnation and a cumulative loss in output of more than 27% since the onset of Greece's crisis.

Equities in Europe lost ground on Friday, as energy shares extended losses in what's been a dreadful week for oil prices, while investors assessed mixed signals about the eurozone economy. Stocks remained in the red as the first, or flash, reading of growth in the eurozone's manufacturing and services sector slowed for June, although the region is undergoing its best quarter of growth in six years. Markit's flash eurozone PMI composite output index came in at 55.7 in June, a five-month low.

U.S. stocks closed mostly higher on Friday, as energy shares staged a modest rebound after a recent selloff, while technology stocks extended their advance. The Nasdaq Composite COMP, +0.46% outperformed other indexes, rising 28.56 points, or 0.5%, to 6,265.25 on Friday and booking a 1.9% gain over the week, the largest in a month. The gains on the tech-heavy index were driven by a jump in biotechnology shares earlier in the week.

Tech stocks and stabilizing commodity prices helped stocks in Asia start the week on an up note amid a lack of major data releases or other market catalysts. Stabilization in commodities is helping beaten-down Australian stocks, noted Michael McCarthy chief market strategist at CMC. The S&P/ASX 200 fell 1% last week amid weakness in commodity stocks, with Australian equities notably lagging others in the region.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1297 (3235)

$1.1275 (1884)

$1.1251 (1343)

Price at time of writing this review: $1.1193

Support levels (open interest**, contracts):

$1.1136 (4006)

$1.1093 (4359)

$1.1047 (2383)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date July, 7 is 66712 contracts (according to data from June, 23) with the maximum number of contracts with strike price $1,1100 (4359);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2921 (2210)

$1.2852 (2455)

$1.2805 (1054)

Price at time of writing this review: $1.2744

Support levels (open interest**, contracts):

$1.2651 (2824)

$1.2578 (1384)

$1.2491 (1669)

Comments:

- Overall open interest on the CALL options with the expiration date July, 7 is 32224 contracts, with the maximum number of contracts with strike price $1,2800 (2485);

- Overall open interest on the PUT options with the expiration date July, 7 is 28715 contracts, with the maximum number of contracts with strike price $1,2700 (2822);

- The ratio of PUT/CALL was 0.89 versus 0.92 from the previous trading day according to data from June, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.