- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-02-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | New Zealand | ANZ Business Confidence | February | -13.2 | -7.9 |

| 00:30 | Australia | Private Capital Expenditure | Quarter IV | -0.2% | 0.4% |

| 07:00 | United Kingdom | Nationwide house price index, y/y | February | 1.9% | 2.3% |

| 07:00 | United Kingdom | Nationwide house price index | February | 0.5% | 0.4% |

| 09:00 | Eurozone | Private Loans, Y/Y | January | 3.7% | 3.7% |

| 09:00 | Eurozone | M3 money supply, adjusted y/y | January | 5% | 5.3% |

| 10:00 | Eurozone | Consumer Confidence | February | -8.1 | -6.6 |

| 10:00 | Eurozone | Industrial confidence | February | -7.3 | -7.3 |

| 10:00 | Eurozone | Economic sentiment index | February | 102.8 | 102.8 |

| 10:00 | Eurozone | Business climate indicator | February | -0.23 | -0.28 |

| 10:30 | United Kingdom | MPC Member Cunliffe Speaks | |||

| 13:30 | U.S. | Continuing Jobless Claims | February | 1726 | 1715 |

| 13:30 | Canada | Current Account, bln | Quarter IV | -9.86 | -9 |

| 13:30 | U.S. | Initial Jobless Claims | February | 210 | 212 |

| 13:30 | U.S. | Durable Goods Orders | January | 2.4% | -1.5% |

| 13:30 | U.S. | Durable Goods Orders ex Transportation | January | -0.1% | 0.2% |

| 13:30 | U.S. | Durable goods orders ex defense | January | -2.5% | 1.3% |

| 13:30 | U.S. | GDP, q/q | Quarter IV | 2.1% | 2.1% |

| 15:00 | U.S. | Pending Home Sales (MoM) | January | -4.9% | 2% |

| 16:30 | U.S. | FOMC Member Charles Evans Speaks | |||

| 20:30 | U.S. | FOMC Member Mester Speaks | |||

| 23:30 | Japan | Tokyo CPI ex Fresh Food, y/y | February | 0.7% | 0.6% |

| 23:30 | Japan | Unemployment Rate | January | 2.2% | 2.2% |

| 23:30 | Japan | Tokyo Consumer Price Index, y/y | February | 0.6% | 0.8% |

| 23:50 | Japan | Retail sales, y/y | January | -2.6% | -1.1% |

| 23:50 | Japan | Industrial Production (YoY) | January | -3.1% | -9.5% |

| 23:50 | Japan | Industrial Production (MoM) | January | 1.2% | 0.2% |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | New Zealand | ANZ Business Confidence | February | -13.2 | -7.9 |

| 00:30 | Australia | Private Capital Expenditure | Quarter IV | -0.2% | 0.4% |

| 07:00 | United Kingdom | Nationwide house price index, y/y | February | 1.9% | 2.3% |

| 07:00 | United Kingdom | Nationwide house price index | February | 0.5% | 0.4% |

| 09:00 | Eurozone | Private Loans, Y/Y | January | 3.7% | 3.7% |

| 09:00 | Eurozone | M3 money supply, adjusted y/y | January | 5% | 5.3% |

| 10:00 | Eurozone | Consumer Confidence | February | -8.1 | -6.6 |

| 10:00 | Eurozone | Industrial confidence | February | -7.3 | -7.3 |

| 10:00 | Eurozone | Economic sentiment index | February | 102.8 | 102.8 |

| 10:00 | Eurozone | Business climate indicator | February | -0.23 | -0.28 |

| 10:30 | United Kingdom | MPC Member Cunliffe Speaks | |||

| 13:30 | U.S. | Continuing Jobless Claims | February | 1726 | 1715 |

| 13:30 | Canada | Current Account, bln | Quarter IV | -9.86 | -9 |

| 13:30 | U.S. | Initial Jobless Claims | February | 210 | 212 |

| 13:30 | U.S. | Durable Goods Orders | January | 2.4% | -1.5% |

| 13:30 | U.S. | Durable Goods Orders ex Transportation | January | -0.1% | 0.2% |

| 13:30 | U.S. | Durable goods orders ex defense | January | -2.5% | 1.3% |

| 13:30 | U.S. | GDP, q/q | Quarter IV | 2.1% | 2.1% |

| 15:00 | U.S. | Pending Home Sales (MoM) | January | -4.9% | 2% |

| 16:30 | U.S. | FOMC Member Charles Evans Speaks | |||

| 20:30 | U.S. | FOMC Member Mester Speaks | |||

| 23:30 | Japan | Tokyo CPI ex Fresh Food, y/y | February | 0.7% | 0.6% |

| 23:30 | Japan | Unemployment Rate | January | 2.2% | 2.2% |

| 23:30 | Japan | Tokyo Consumer Price Index, y/y | February | 0.6% | 0.8% |

| 23:50 | Japan | Retail sales, y/y | January | -2.6% | -1.1% |

| 23:50 | Japan | Industrial Production (YoY) | January | -3.1% | -9.5% |

| 23:50 | Japan | Industrial Production (MoM) | January | 1.2% | 0.2% |

FXStreet reports that Finance Minister Tito Mboweni presented the National Budget for 2020 today. Nearly all short-term projections have worsened against the promise to improve the budget in the longer term, strategists at TD Securities report. USD/ZAR trades at 15.114.

“Real GDP is expected to expand less than previously projected in the October 2019 MTBPS and the February 2019 budget. On the other hand, expenditure is expected to rise to 36% of GDP in 2020/21 from 35.7% at the end of this FY.”

“The debt trajectory isn't improving through to 2022/23. During this period, debt/GDP actually worsens by 0.3% to 71.6%.”

“This budget only guarantees at least two more years of additional macro and financial deterioration under the current projections.”

“It is very hard to envisage a scenario where Moody's retains South Africa's investment grade rating. A downgrade may occur in March or in November. But the cumulative likelihood that South Africa is downgraded to junk this year is probably no less than 75% now.”

“We think USD/ZAR should move higher, not lower, and so should SAGB yields. We continue to forecast the ZAR at 15.15 by the end of this quarter, but higher at 16.50 by year-end.”

The U.S. Energy Information Administration (EIA) revealed on Wednesday that crude inventories increased by 0.452 million barrels in the week ended February 21. Economists had forecast an advance of 2.467 million barrels.

At the same time, gasoline stocks declined by 2.691 million barrels, while analysts had expected a drop of 2.245 million barrels. Distillate stocks fell by 2.114 million barrels, while analysts had forecast a decrease of 1.713 million barrels.

Meanwhile, oil production in the U.S. was unchanged at 13.000 million barrels a day.

U.S. crude oil imports averaged 6.2 million barrels per day last week, down by 330,000 barrels per day from the previous week.

Economists had forecast the sales pace of 710,000 last month.

December's sales pace was revised up to 708,000 units (+2.3 percent m-o-m) from the originally reported 694,000 units (-0.4 percent m-o-m).

According to the report, the January climb in purchases of new homes was due to gains in three of four U.S. regions, led by the Midwest (30.3 percent m-o-m) and West (+23.5 percent m-o-m).

In y-o-y terms, new home sales recorded an 18.6 percent jump in January.

- There is not much time to strike a deal

- Modern trade deals are about ensuring high standards for social and labour fields

- There should be no problem for UK to agree on ground rules

- Every preferential trade deal set terms for opening up markets

- There is not single template for EU's trade deals

- UK is not Canada

- EU ready to offer UK "super preferential" access to EU markets

- But EU cannot give the market access to UK without strong fair competition guarantees

U.S. stock-index futures rose slightly on Wednesday after four days of declines on concerns the coronavirus outbreak would dent global economic growth.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,426.19 | -179.22 | -0.79% |

| Hang Seng | 26,696.49 | -196.74 | -0.73% |

| Shanghai | 2,987.93 | -25.12 | -0.83% |

| S&P/ASX | 6,708.10 | -158.50 | -2.31% |

| FTSE | 7,002.87 | -15.01 | -0.21% |

| CAC | 5,690.29 | +10.61 | +0.19% |

| DAX | 12,788.29 | -2.20 | -0.02% |

| Crude oil | $49.30 | | -1.20% |

| Gold | $1,634.60 | | -0.93% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 150 | 3.15(2.15%) | 15159 |

| ALCOA INC. | AA | 14.66 | 0.16(1.10%) | 7789 |

| ALTRIA GROUP INC. | MO | 42.4 | -0.09(-0.21%) | 7830 |

| Amazon.com Inc., NASDAQ | AMZN | 1,977.25 | 4.51(0.23%) | 82422 |

| American Express Co | AXP | 121 | 0.10(0.08%) | 8598 |

| AMERICAN INTERNATIONAL GROUP | AIG | 45.32 | 0.08(0.18%) | 3061 |

| Apple Inc. | AAPL | 289.01 | 0.93(0.32%) | 565569 |

| AT&T Inc | T | 37.18 | -0.17(-0.46%) | 104000 |

| Boeing Co | BA | 307.48 | 3.34(1.10%) | 36025 |

| Caterpillar Inc | CAT | 130.3 | 1.30(1.01%) | 8551 |

| Chevron Corp | CVX | 101.12 | 0.41(0.41%) | 11051 |

| Cisco Systems Inc | CSCO | 43.02 | 0.28(0.66%) | 101783 |

| Citigroup Inc., NYSE | C | 70.4 | 0.97(1.40%) | 57582 |

| Deere & Company, NYSE | DE | 166.8 | 0.15(0.09%) | 909 |

| E. I. du Pont de Nemours and Co | DD | 47.99 | 0.52(1.10%) | 3086 |

| Exxon Mobil Corp | XOM | 54.6 | 0.40(0.74%) | 57661 |

| Facebook, Inc. | FB | 198 | 1.23(0.63%) | 162160 |

| FedEx Corporation, NYSE | FDX | 146.9 | 1.30(0.89%) | 4791 |

| Ford Motor Co. | F | 7.32 | 0.09(1.24%) | 207603 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.8 | 0.07(0.65%) | 26739 |

| General Electric Co | GE | 11.36 | 0.04(0.35%) | 280267 |

| General Motors Company, NYSE | GM | 32.1 | 0.35(1.10%) | 23154 |

| Goldman Sachs | GS | 219.7 | 2.09(0.96%) | 6097 |

| Google Inc. | GOOG | 1,393.00 | 4.55(0.33%) | 11609 |

| Hewlett-Packard Co. | HPQ | 23.28 | -0.07(-0.30%) | 12424 |

| Home Depot Inc | HD | 238.99 | 1.61(0.68%) | 14942 |

| Intel Corp | INTC | 60.07 | 0.34(0.57%) | 74168 |

| International Business Machines Co... | IBM | 142.7 | 0.99(0.70%) | 15979 |

| International Paper Company | IP | 39.24 | 0.01(0.03%) | 360 |

| Johnson & Johnson | JNJ | 144.15 | -0.50(-0.35%) | 14657 |

| JPMorgan Chase and Co | JPM | 127.1 | 0.84(0.67%) | 24120 |

| McDonald's Corp | MCD | 211.67 | -0.43(-0.20%) | 26401 |

| Merck & Co Inc | MRK | 80.3 | 0.03(0.04%) | 7272 |

| Microsoft Corp | MSFT | 169.18 | 1.11(0.66%) | 515433 |

| Nike | NKE | 92.41 | -0.49(-0.53%) | 21163 |

| Pfizer Inc | PFE | 34 | 0.07(0.21%) | 31059 |

| Procter & Gamble Co | PG | 121.03 | -0.40(-0.33%) | 21590 |

| Starbucks Corporation, NASDAQ | SBUX | 82.76 | 0.57(0.69%) | 19859 |

| Tesla Motors, Inc., NASDAQ | TSLA | 790 | -9.91(-1.24%) | 407083 |

| The Coca-Cola Co | KO | 57.6 | -0.22(-0.38%) | 45713 |

| Travelers Companies Inc | TRV | 131.49 | 0.70(0.54%) | 609 |

| Twitter, Inc., NYSE | TWTR | 35.28 | 0.07(0.20%) | 66317 |

| United Technologies Corp | UTX | 140 | 1.19(0.86%) | 3845 |

| UnitedHealth Group Inc | UNH | 264.5 | 1.11(0.42%) | 6528 |

| Verizon Communications Inc | VZ | 57.35 | 0.23(0.40%) | 30800 |

| Visa | V | 187.12 | -1.28(-0.68%) | 175097 |

| Wal-Mart Stores Inc | WMT | 114.7 | 0.31(0.27%) | 6907 |

| Walt Disney Co | DIS | 126.75 | -1.44(-1.12%) | 221566 |

| Yandex N.V., NASDAQ | YNDX | 40.43 | 0.37(0.92%) | 221188 |

- Says ECB will reach out to people during strategy review

- Level of trust in euro is critically important

- Welcomes latest German plans to pause debt brake

Home Depot (HD) target raised to $244 from $230 at Telsey Advisory Group

NIKE (NKE) downgraded to Hold from Buy at HSBC Securities; target $112

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:45 | France | Consumer confidence | February | 104 | 103 | 104 |

| 09:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | February | 8.3 | 7.7 |

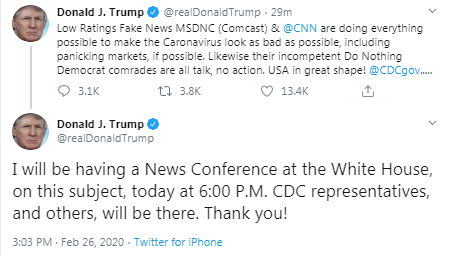

USD recovered slightly in the European session on Wednesday, as market participants lowered their expectations that the U.S. Federal Reserve will cut its interest rates to support the U.S. economy.

Fed Vice Chair Richard Clarida stated on Tuesday that the regulator continued to monitor the impact of the coronavirus on the U.S. economy but still too early to assess the growth impact from the epidemic, or whether it will lead to a material change in its outlook. This gave rise to thoughts the dovish Fed bets being priced in by the markets may not materialize, supporting the USD.

Against a basket of its rivals, the U.S. dollar edged 0.2% higher to 99.16, recovering from a two-week low of 98.876, hit in the previous session.

However, the market sentiment remained cautious amid the global spread of the coronavirus. On this backdrop, commodity currencies like AUD and NZD saw selling pressure.

FXStreet notes that risk appetite made another attempt at stabilization overnight, but this reversed as European contagion concerns became more entrenched. The US will release new home sales at 15:00 GMT. EUR/USD trades at 1.087, economists at TD Securities report.

“Interestingly, vol markets have started to wake up with vols at several tenors back to multi-month highs. This has put EUR/USD's small rebound over the last several days in jeopardy.”

“The failure to achieve a 1.09 handle suggests near-term momentum is returning to the downside. This returns us to a sell-on-rallies posture as we think a re-test of this month's lows at 1.0778 could be in view.”

“We expect new home sales to rebound to 730k in Jan, following the three consecutive declines that brought the level below the 700k mark. The level stood at 694k for Dec.”

Chris Turner, the Head of FX Strategy at ING, notes that two-year German vs. US sovereign yield spreads have narrowed inside 200 basis points for the first time since summer 2017.

"Over recent years, rate spreads have had a decreasing relevance for EUR/USD (largely because they were so wide in the dollar’s favour).

The global impact from Covid-19 will probably hit Europe’s open economy more than the US, yet we should still be a little careful about a EUR/USD upside correction.

Certainly, it looks like investors are buying short term upside EUR/USD protection in the FX options market. Look out for a speech by European Central Bank President Christine Lagarde at 1430CET today and we could see EUR/USD drifting to the 1.0890/1.0900 area."

Lowe's (LOW) reported Q4 FY 2019 earnings of $0.94 per share (versus $0.80 per share in Q4 FY 2018), beating analysts' consensus estimate of $0.91 per share.

The company's quarterly revenues amounted to $16.027 bln (+2.4% y/y), roughly in line with analysts' consensus estimate of $16.130 bln.

The company also issued downside guidance for FY 2020, projecting EPS of $6.45-6.65 (versus analysts' consensus estimate of $6.66) and revenues of +2.5-3.0% y/y to $73.95-74.3 bln (versus analysts' consensus estimate of $74.39 bln).

LOW fell to $115.00 (-2.97%) in pre-market trading.

The Mortgage Bankers Association (MBA) reported on Wednesday the mortgage application volume in the U.S. rose 1.5 percent in the week ended February 21, following a 6.4 percent decrease in the previous week.

According to the report, refinance applications fell 0.8 percent, while applications to purchase a home surged 5.7 percent.

Meanwhile, the average fixed 30-year mortgage rate dropped to 3.73 percent from 3.77 percent.

"Last week appears to have been the calm before the storm. Weaker readings on economic growth caused a slight drop in mortgage rates, bringing them back to their level two weeks ago, but applications overall moved 1.5 percent higher," noted Mike Fratantoni, MBA's senior vice president and chief economist. "As fears regarding the coronavirus have increased, Treasury yields have dropped to record lows this week amid the ensuing financial market volatility. Next week's results will show the impact this drop in Treasurys had on mortgage activity."

- But the risks of coronavirus epidemic resurgence in certain regions cannot be ignored

- Coronavirus outbreak situation in the Hubei and Wuhan provinces are still dire

- ECB will consider various options for inflation target

- Inflation range may make ECB policy more credible

- There continues to be uncertainty about exactly what "close to, but below" means

- Have to consider whether current CPI data is helping to communicate the ECB's objectives in the most effective way

FXStreet notes that Kiwi has stabilized, while the USD remains under pressure as bond yields fall and equities sell-off. Economists at ANZ Research analyzes the NZD/USD pair, which is trading at 0.6298.

“NZD/USD – along with AUD/USD – held steady overnight as the G4 currencies repriced.”

“Support at 0.63 seems rock-solid, but New Zealand has always been vulnerable to global shocks and we see that as the predominant risk direction on COVID-19 news.”

Chris Turner, the Head of FX Strategy at ING, notes that the market currently prices the first full 25 basis point cut from the Federal Reserve at the 10 June meeting.

"And listening to the Fed’s Richard Clarida last night ("it is too soon to even speculate about the size and persistence of these effects"), it seems the Fed is in no hurry to act.

However, there seems little tolerance in the US for sharp falls in equities and were US equity benchmarks 15% off their highs, versus 7% off their highs now, the Fed might seriously consider pulling the trigger at the 18 March meeting.

That is the signal coming from US bond markets right now, where US five-year Treasury yields could be the first part of the curve to hit the 1.00% threshold. We think lowered global growth expectations, flatter yield curves and expectations that President Trump retains the White House are all dollar positives.

Yet an extreme US equity sell-off that would prompt an early Fed cut could be a short-term dollar negative. The balance of risks suggests DXY holds 99 support."

FXStreet reports that It is not surprising that the Australian dollar has underperformed among G10 currencies, as the Covid-19 outbreak has dominated market attention over the past month, with only NZD weaker. Meanwhile the British pound has limited its decline against a dominant USD to about -1%. Sean Callow, Senior Currency Strategist at Westpac Institutional Bank, analyzes the AUD/GBP outlook.

"Markets were divided on the BoE steady decision but we expected the steady 0.75% bank rate, given the post-election surge in UK business confidence and ongoing strength in the labour market."

"The UK economy will also feel some impact from Covid-19, but not nearly as much as Australia's, where 78% of exports head to Asia. The RBA's clear reluctance to cut rates again lends some support to AUD by keeping market pricing for a cut to 0.5% below 50% until May."

"Also providing some insulation for A$ as Australia's trade surpluses shrink is an overhang of short A$ positions, implying plenty of bad news is priced in."

"We expect disappointing Australian growth and unemployment data to force the RBA to resume easing policy, keeping AUD trending lower against the pound, eyeing AUD/GBP 0.50 or GBP/AUD 2.00 multi-week."

FXStreet reports that the Japanese economy ended 2019 on a negative note as consumer spending was hit by the VAT hike introduced in October. The start of 2020 looks difficult given the Coronavirus outbreak and the close economic relations between Japan and China, in the opinion of Louis Boisset from BNP Paribas.

"Japan experienced a sharp contraction in GDP in the fourth quarter of 2019. GDP fell by -1.6% (QoQ, non-annualised), its biggest contraction since the - 1.9% fall in the second quarter of 2014."

"The Japanese economy suffered from two sizeable shocks in the final quarter of 2019. Having delayed its implementation, the authorities decided at last to increase VAT from 8% to 10% in October 2019. The fourth quarter was also affected by a typhoon which did significant damage to domestic demand."

"Consumer spending is seeing a structural slowdown in Japan, with virtually no growth on average since the VAT hike in 2014. This trend was notably related to the downward trend in nominal wages."

"The economic weakness in late 2019 is already hitting the trends for 2020, with a negative carry-over growth effect. Given its close relations with China, the effect of the Coronavirus outbreak on Japan could be significant and will have two channels of transmission: trade and tourism. It now looks possible that Japan's economy will contract this year."

ECB policymakers held "heated discussions" last week about changing the bank's inflation target as part of a broader strategy review

"Is our monetary policy target - (inflation of) just under 2% - where it should be? Should it be less, should it be more? Should it be symmetrical? Should it be asymmetrical? ... We had heated discussions about that last week in the (Governing) Council," Holzmann told.

Holzmann has said he prefers an inflation target of 1.5%, a point he repeated on Wednesday, arguing against colleagues who he said believe it is acceptable to keep the existing target while being happy with 1.5%.

FXStreet reports that a large number of economic sectors have been struggling with the impact of the Covid-19 epidemic on Chinese consumer demand, transport, tourist flows and industrial production chains. Christine Peltier from BNP Paribas reviews the actions taken by the People's Bank of China (PBoC).

"Over the past month, PBOC has loosened monetary and credit conditions in order to support local corporates, help them cover their cash requirements et encourage a rapid recovery in activity."

"PBOC has injected a large amount of liquidity into the financial system, reduced interest rates - monetary rates, medium-term lending facility rate and benchmark lending rate - and announced special loans to firms directly affected by the virus outbreak.

"As a result, the weighted average lending rate, which has declined since Q2 2018 (from 5.94% to 5.44% at end-2019 in nominal terms), should continue to fall in H1 2020. Yet, the acceleration in domestic credit growth should prove to be very moderate."

FXStreet reports that сrude oil prices fell for a third straight session as the spreading of the coronavirus raised concerns of further hits to demand, analysts at ANZ reports.

"The number of infections in the Middle East rose, with most cases linked to Iran. This saw Bahrain temporarily halt flights from Dubai and Sharjah, transit points for Iran travellers."

"OPEC tried to talk down the impact, with Secretary-General, Mohammad Barkindo, suggesting demand will continue to grow. Saudi Aramco CEO, Amin Nasser, said the outbreak will have only a short-term impact on markets."

"Supply-side issues continue to bubble away in the background. Libya's oil output stood at just122kb/d as of 23 February, down from 1.22mb/d before force majeure was declared on 18 January."

Bloomberg reports that now that 10-year Treasury yields have sunk to a record low, Wall Street analysts see plenty of scope for even lower rates -- possibly much lower, depending on the severity of the economic hit from the coronavirus.

The global borrowing benchmark touched 1.3055% Tuesday as investors sought the safety of U.S. government debt amid plummeting stocks. The rate breached the previous all-time low set in 2016. Thirty-year yields also fell to unprecedented levels, and traders ramped up bets that the Federal Reserve will ease policy by mid-year to support the economy.

Yields can continue sliding as long as investors pile into safe assets to offset riskier holdings, said Jim Caron, fixed-income money manager at Morgan Stanley Investment Management. Bank of America Corp. strategists Paul Ciana and Bruno Braizinha say the 10-year is certain to hit 1.25% by the end of June, while FHN Financial's Chris Low points to a worst-case scenario that may send it below 1% later this year.

"The market is at a turning point," Braizinha said in an interview. If more virus cases are reported and weak economic data come in, "we can reach the 1.25% level relatively quickly."

eFXdata reports that Citi discusses GBP outlook and maintains a structural bullish bias in the medium-term.

"EU member states are due to finalize their negotiating priorities for a future trade deal with Britain. It will say that a trade deal should be based on EU rules in some areas as "a reference point". Meanwhile, UK ministers will also meet to discuss the government's opening stance for negotiations. The final agreement is due to be published online and presented in Parliament on Thursday. Chatter here could be a source of short term volatility for GBP," Citi notes.

"Bigger picture, we maintain our structurally bullish view on GBP as 1) political risks recede and economic recovery carries on 2) long term investors are still structurally underweight GBP and UK assets," Citi adds.

FXStreet reports that further downside could drag AUD/USD to the mid-0.6500s in the next weeks, noted FX Strategists at UOB Group.

24-hour view: "AUD traded between 0.6586 and 0.6622, lower and narrower than our expected sideway-trading range of 0.6590/0.6635. The price action offers no fresh clues and AUD could continue to trade sideways. Expected range for today, 0.6580/0.6625."

Next 1-3 weeks: "AUD eked out a fresh low of 0.6585 (one pip below last Friday's 0.6586 low) before recovering. For now, there is no change in our view from Friday (14 Feb, spot at 0.6615) wherein the risk for AUD is on the downside. That said, AUD has declined considerably since the start of the year and we have a relatively modest downside 'target' of 0.6550. On the upside, a breach of 0.6680 (no change in 'strong resistance' level) would indicate the current downward pressure has eased."

According to the report from Insee, in February 2020, households' confidence in the economic situation has been stable. The synthetic index has stayed at 104, above its long-term average (100). Economists had expected a decrease to 103.

In February, households' opinion balance on their future financial situation has lost two points but remains slightly above its long-term average. The balance related to their past financial situation has gained one point and remains above its long-term average. In addition, the share of households considering it is a suitable time to make major purchases has slightly decreased compared to the previous month: the corresponding balance has lost one point but remains above its average.

In February, households' opinion balance on their expected saving capacity has increased by one point and remains clearly above its long-term average. Household' opinion balance related to their current saving capacity has also gained one point, after four months of stability. The corresponding balance stays above its long-term average. In contrast, the share of households considering it is a suitable time to save kept declining in February (-1 point). The corresponding balance therefore remains below its long-term average.

Households' fears about the unemployment trend have declined markedly in February: the corresponding balance, at its lowest level since July 2007, has lost twelve points.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Australia | Construction Work Done | Quarter IV | -0.4% | -1% | -3% |

In today's Asian trading, the dollar strengthened against the Euro and the yen, while the South Korean currency fell 0.5% against the dollar on news of an increase in the number of coronavirus infections in the country.

The ICE Dollar index, which shows the value of the dollar against six major world currencies, rose by 0.13% compared to the previous day.

Seoul reported 169 new cases of a new type of coronavirus per day, the Yonhap news Agency reported on Wednesday. Thus, the total number of cases of COVID-19 infection in the country was 1,146 thousand people.

In China, 52 cases of death from pneumonia caused by a new type of coronavirus (COVID-19) were registered over the past day, and 406 new cases were identified, the state health Committee of China reported. Since December, the number of victims of the coronavirus was 2,715 thousand people, 78,064 thousand cases of the disease were registered.

As of Wednesday morning, February 26, in the world, except for the mainland of China, the number of infected with the COVID-9 coronavirus reached 2,903 thousand, an increase of 465 detected cases per day, the Hong Kong newspaper South China Morning Post reported.

FXStreet reports that FX Strategists at UOB Group noted that a move above 1.3070 should leave the mid-1.2800s as an interim low in Cable.

24-hour view: "The rapid improvement in upward momentum that sent GBP to high of 1.3018 was unexpected. The swift advance appears to be running ahead of itself but there is room for GBP to probe the 1.3030 resistance. For today, a rise beyond 1.3070 is not expected. On the downside, a breach of 1.2950 (minor support at 1.2980) would indicate the current upward pressure has eased."

Next 1-3 weeks: "We highlighted on Monday (24 Feb, spot at 1.2950) that an "interim bottom is in place" and expected GBP to 'trade sideways between 1.2850 and 1.3030'. While GBP is approaching the top of the expected range at 1.3030, there is no marked improvement in momentum. That said, a move above 1.3030 is not ruled out but only a clear break of 1.3070 would indicate that last week's low at 1.2849 could hold for longer than expected."

eFXdata reports that Credit Agricole Research discusses EUR outlook and sees a scope for further consolidation over the coming week.

"The Euro has been stabilizing of late, partly on the back of improving fundamentals as for instance reflected in yesterday's better than expected German ifo business climate survey. This is regardless of increasing worries over the coronavirus outbreak becoming a serious downside risk to the Eurozone's growth outlook, a development that led to markets starting to price in further ECB monetary policy easing later this year," CACIB notes.

"While we believe that excessive short positioning implies most negatives with respect to the monetary policy outlook are in the price we advise against chasing the single currency lower from here. If anything, we anticipate further stabilizing price developments in the weeks to come," CACIB adds.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0976 (1601)

$1.0944 (2135)

$1.0922 (3494)

Price at time of writing this review: $1.0872

Support levels (open interest**, contracts):

$1.0850 (2300)

$1.0822 (2664)

$1.0785 (2462)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 6 is 1115179 contracts (according to data from February, 25) with the maximum number of contracts with strike price $1,1200 (6357);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3094 (3889)

$1.3067 (2228)

$1.3046 (972)

Price at time of writing this review: $1.2989

Support levels (open interest**, contracts):

$1.2940 (1634)

$1.2911 (2482)

$1.2876 (3591)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 28793 contracts, with the maximum number of contracts with strike price $1,3050 (3889);

- Overall open interest on the PUT options with the expiration date March, 6 is 30544 contracts, with the maximum number of contracts with strike price $1,2800 (3672);

- The ratio of PUT/CALL was 1.06 versus 1.08 from the previous trading day according to data from February, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 54.6 | -2.45 |

| WTI | 49.97 | -2.57 |

| Silver | 17.99 | -3.28 |

| Gold | 1635.118 | -1.39 |

| Palladium | 2696.81 | 2.29 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -781.33 | 22605.41 | -3.34 |

| Hang Seng | 72.35 | 26893.23 | 0.27 |

| KOSPI | 24.57 | 2103.61 | 1.18 |

| ASX 200 | -111.7 | 6866.6 | -1.6 |

| FTSE 100 | -138.95 | 7017.88 | -1.94 |

| DAX | -244.75 | 12790.49 | -1.88 |

| CAC 40 | -112.19 | 5679.68 | -1.94 |

| Dow Jones | -879.44 | 27081.36 | -3.15 |

| S&P 500 | -97.68 | 3128.21 | -3.03 |

| NASDAQ Composite | -255.67 | 8965.61 | -2.77 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.66004 | -0.03 |

| EURJPY | 119.891 | -0.2 |

| EURUSD | 1.08807 | 0.27 |

| GBPJPY | 143.236 | 0.09 |

| GBPUSD | 1.29997 | 0.56 |

| NZDUSD | 0.63201 | -0.28 |

| USDCAD | 1.32776 | -0.09 |

| USDCHF | 0.97586 | -0.32 |

| USDJPY | 110.181 | -0.47 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.