- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-07-2018

| Raw materials | Closing price | % change |

| Oil | 69.44 | +1.34% |

| Gold | 1,231.80 | +0.51% |

| Index | Change items | Closing price | % change |

| Nikkei | +103.77 | 22614.25 | +0.46% |

| TOPIX | +6.62 | 1753.48 | +0.38% |

| CSI 300 | -3.96 | 3577.75 | -0.11% |

| KOSPI | -7.17 | 2273.03 | -0.31% |

| FTSE 100 | -50.79 | 7658.26 | -0.66% |

| DAX | -110.06 | 12579.33 | -0.87% |

| CAC 40 | -7.78 | 5426.41 | -0.14% |

| DJIA | +172.16 | 25414.10 | +0.68% |

| S&P 500 | +25.67 | 2846.07 | +0.91% |

| NASDAQ | +91.47 | 7932.24 | +1.17% |

| Pare | Closed | % change |

| EUR/USD | $1,1723 | +0,34% |

| GBP/USD | $1,3185 | +0,32% |

| USD/CHF | Chf0,99127 | -0,23% |

| USD/JPY | Y110,86 | -0,30% |

| EUR/JPY | Y129,96 | +0,04% |

| GBP/JPY | Y146,141 | 0,00% |

| AUD/USD | $0,7442 | +0,28% |

| NZD/USD | $0,6833 | +0,40% |

| USD/CAD | C$1,30482 | -0,83% |

Major US stock indices have grown significantly, helped by news that US President Trump has made concessions from the European Union, which will avoid a trade war. Additional support for the indices also had a surge in the services sector and the technology sector.

In addition, investors assessed the statistics on the United States. The Commerce Department reported that sales of new homes in the US fell by 5.3% in June, despite a tight housing market, where buyers are far superior to sellers. According to the report, sales of new buildings amounted to 631 000, which is less than the May revised figure of 666 000. Sales of new homes this year increased by 6.9%. At the regional level, sales of new buildings in the Northeast increased by 36.8%, while in the South, the Midwest and the West, there was a decline. The Midwest recorded the biggest drop, while sales of new homes fell by 13%. The average selling price fell by 4.2% compared to the previous year and amounted to 302 100 US dollars.

Quotes of oil rose by about 1% after data showed that crude oil stocks in the US fell significantly more than expected, easing fears over the excess supply. The Ministry of Energy of the United States reported that, as a result of last week, there was a decline in oil, gasoline and distillate stocks. In the week of July 14-20, oil reserves fell by 6.147 million barrels, to 404.937 million barrels. Analysts had expected a decrease of 2.331 million barrels.

Most of the components of DOW finished trading in positive territory (25 out of 30). The leader of growth was shares of Microsoft Corporation (MSFT, + 2.94%). Outsider were the shares of Verizon Communications Inc. (VZ, -1.18%).

All sectors of S & P recorded a rise. The services sector grew most (+ 1.3%).

At closing:

Dow 25,414.10 +172.16 +0.68%

S&P 500 2,846.07 +25.67 +0.91%

Nasdaq 100 7,932.24 +91.47 +1.17%

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6.1 million barrels from the previous week. At 404.9 million barrels, U.S. crude oil inventories are about 3% below the five year average for this time of year.

Total motor gasoline inventories decreased by 2.3 million barrels last week and are about 4% above the five year average for this time of year. Finished gasoline and blending components inventories both decreased last week.

Distillate fuel inventories decreased by 0.1 million barrels last week and are about 13% below the five year average for this time of year. Propane/propylene inventories decreased by 0.8 million barrels last week and are about 12% below the five year average for this time of year. Total commercial petroleum inventories decreased last week by 9.7 million barrels last week.

Sales of new single-family houses in June 2018 were at a seasonally adjusted annual rate of 631,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.3 percent below the revised May rate of 666,000, but is 2.4 percent above the June 2017 estimate of 616,000.

The median sales price of new houses sold in June 2018 was $302,100. The average sales price was $363,300.

U.S. stock-index futures fell slightly on Wednesday, as investors digested a mixed batch of earnings/guidance, while awaiting the meeting between President Trump and EU Commission President Jean-Claude Juncker, during which they will discuss trade issues.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,614.25 | +103.77 | +0.46% |

| Hang Seng | 28,920.90 | +258.33 | +0.90% |

| Shanghai | 2,904.37 | -1.19 | -0.04% |

| S&P/ASX | 6,247.60 | -18.20 | -0.29% |

| FTSE | 7,645.02 | -64.03 | -0.83% |

| CAC | 5,425.52 | -8.67 | -0.16% |

| DAX | 12,609.51 | -79.88 | -0.63% |

| Crude | $68.61 | | +0.13% |

| Gold | $1,240.50 | | +0.48% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 200.49 | -0.19(-0.09%) | 1684 |

| ALCOA INC. | AA | 42.42 | -0.07(-0.16%) | 300 |

| ALTRIA GROUP INC. | MO | 57.91 | -0.08(-0.14%) | 520 |

| Amazon.com Inc., NASDAQ | AMZN | 1,827.00 | -2.24(-0.12%) | 24058 |

| Apple Inc. | AAPL | 192.75 | -0.25(-0.13%) | 17415 |

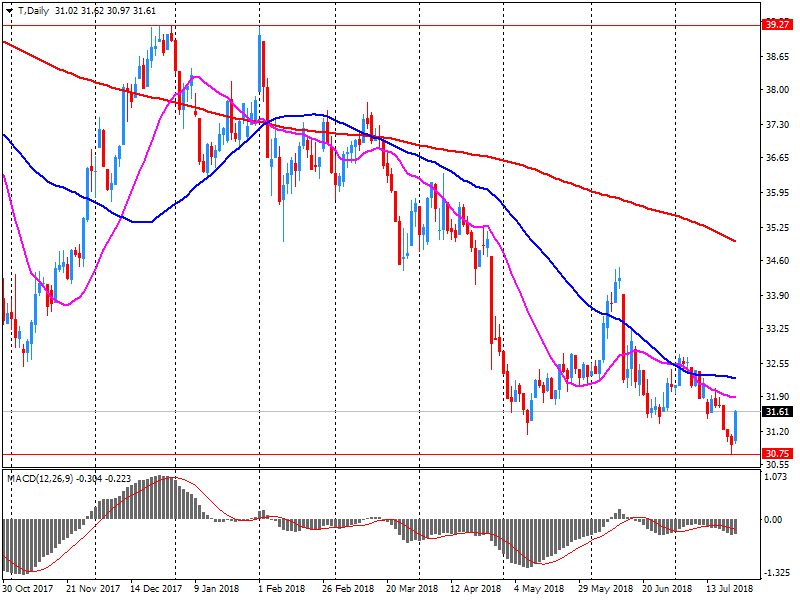

| AT&T Inc | T | 31.32 | -0.36(-1.14%) | 187992 |

| Barrick Gold Corporation, NYSE | ABX | 11.98 | 0.12(1.01%) | 16014 |

| Boeing Co | BA | 344 | -14.27(-3.98%) | 204964 |

| Caterpillar Inc | CAT | 137.5 | -0.47(-0.34%) | 2369 |

| Chevron Corp | CVX | 124 | 0.15(0.12%) | 555 |

| Cisco Systems Inc | CSCO | 42.25 | -0.14(-0.33%) | 3196 |

| Citigroup Inc., NYSE | C | 70.7 | -0.37(-0.52%) | 14533 |

| Deere & Company, NYSE | DE | 139.87 | 0.03(0.02%) | 4750 |

| Exxon Mobil Corp | XOM | 82.78 | -0.23(-0.28%) | 1553 |

| Facebook, Inc. | FB | 215.04 | 0.37(0.17%) | 113567 |

| FedEx Corporation, NYSE | FDX | 238.53 | 1.70(0.72%) | 115 |

| Ford Motor Co. | F | 10.29 | -0.28(-2.65%) | 765007 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.29 | 0.22(1.37%) | 119581 |

| General Electric Co | GE | 13.07 | -0.05(-0.38%) | 79496 |

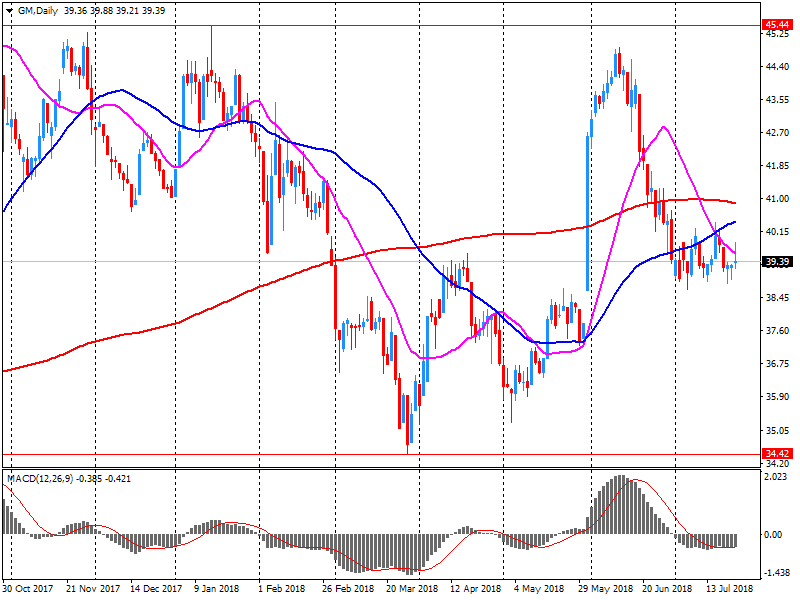

| General Motors Company, NYSE | GM | 37.38 | -2.10(-5.32%) | 585639 |

| Home Depot Inc | HD | 201.71 | -0.28(-0.14%) | 800 |

| International Business Machines Co... | IBM | 145.8 | -0.58(-0.40%) | 257 |

| Johnson & Johnson | JNJ | 129.28 | -0.08(-0.06%) | 1891 |

| JPMorgan Chase and Co | JPM | 113.6 | -0.55(-0.48%) | 2521 |

| McDonald's Corp | MCD | 157.95 | 0.01(0.01%) | 898 |

| Merck & Co Inc | MRK | 63.5 | 0.08(0.13%) | 1680 |

| Microsoft Corp | MSFT | 107.6 | -0.06(-0.06%) | 23457 |

| Nike | NKE | 75.71 | 0.18(0.24%) | 229 |

| Pfizer Inc | PFE | 37.83 | 0.13(0.34%) | 512 |

| Procter & Gamble Co | PG | 78.9 | -0.09(-0.11%) | 200 |

| Starbucks Corporation, NASDAQ | SBUX | 50.92 | -0.25(-0.49%) | 1000 |

| Tesla Motors, Inc., NASDAQ | TSLA | 294.7 | -2.73(-0.92%) | 38106 |

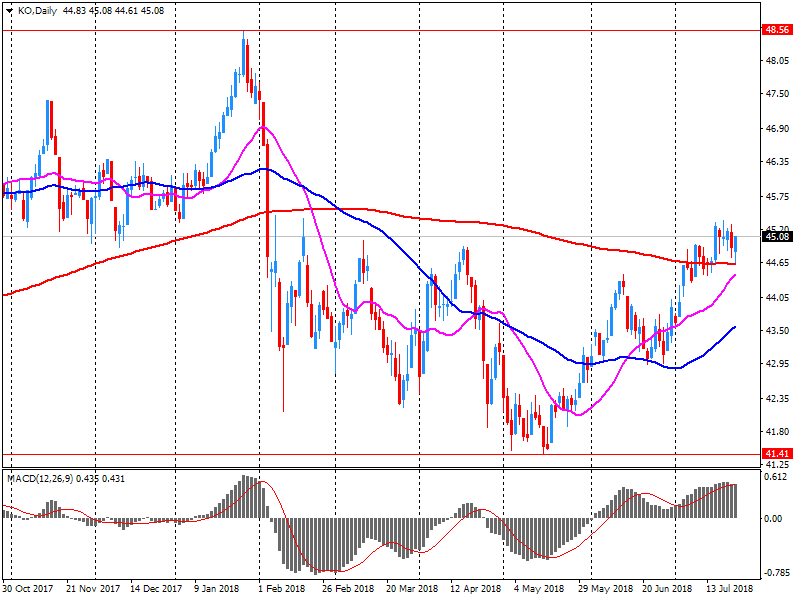

| The Coca-Cola Co | KO | 45.75 | 0.49(1.08%) | 121562 |

| Twitter, Inc., NYSE | TWTR | 42.06 | -0.11(-0.26%) | 33918 |

| United Technologies Corp | UTX | 134.15 | -0.09(-0.07%) | 861 |

| Verizon Communications Inc | VZ | 51.4 | -0.11(-0.21%) | 3052 |

| Visa | V | 140.15 | 0.12(0.09%) | 12983 |

| Wal-Mart Stores Inc | WMT | 87.43 | -0.53(-0.60%) | 11864 |

| Yandex N.V., NASDAQ | YNDX | 37.55 | 0.26(0.70%) | 2982 |

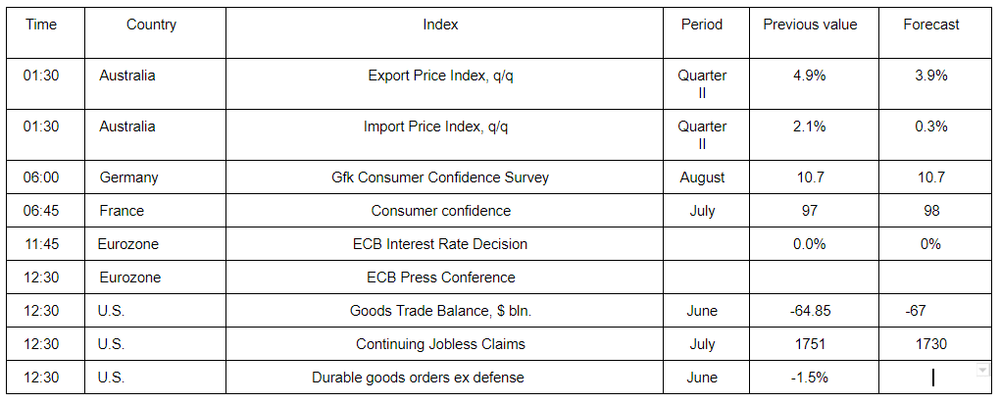

Freeport-McMoRan (FCX) reported Q2 FY 2018 earnings of $0.59 per share (versus $0.17 in Q2 FY 2017), beating analysts' consensus estimate of $0.51.

The company's quarterly revenues amounted to $5.168 bln (+39.3% y/y), beating analysts' consensus estimate of $4.966 bln.

FCX rose to $16.47 (+2.49%) in pre-market trading.

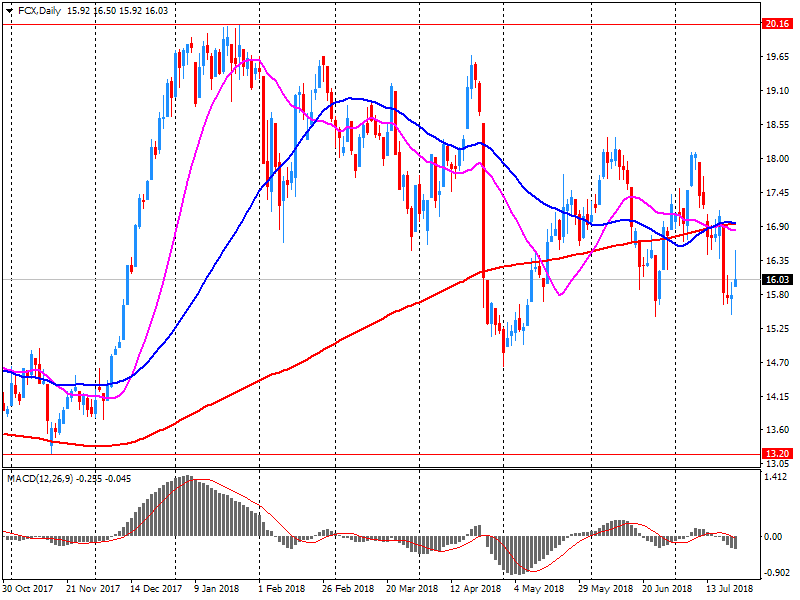

Boeing (BA) reported Q2 FY 2018 earnings of $3.33 per share (versus $2.55 in Q2 FY 2017), beating analysts' consensus estimate of $3.25.

The company's quarterly revenues amounted to $24.258 bln (+5.2% y/y), generally in-line with analysts' consensus estimate of $24.022 bln.

The guidance reaffirmed FY 2018 EPS guidance of $14.30-14.50 (versus analysts' consensus estimate of $14.53) and raised FY 2018 revenue guidance to $97-99 bln from $96-98 bln (versus analysts' consensus estimate of $97.78 bln).

BA fell to $347.00 (-3.15%) in pre-market trading.

General Motors (GM) reported Q2 FY 2018 earnings of $1.81 per share (versus $1.89 in Q2 FY 2017), beating analysts' consensus estimate of $1.80.

The company's quarterly revenues amounted to $36.800 bln (-0.5% y/y), generally in-line with analysts' consensus estimate of $36.618 bln.

The company also issued downside guidance for FY 2018, projecting EPS of ~$6 versus analysts' consensus estimate of $6.41.

GM fell to $37.76 (-4.36%) in pre-market trading.

Coca-Cola (KO) reported Q2 FY 2018 earnings of $0.61 per share (versus $0.59 in Q2 FY 2017), beating analysts' consensus estimate of $0.60.

The company's quarterly revenues amounted to $8.900 bln (-8.3% y/y), beating analysts' consensus estimate of $8.539 bln.

The company reaffirmed guidance for FY 2018, projecting EPS of $2.06-2.10 versus analysts' consensus estimate of $2.08.

KO fell to $45.20 (-0.13%) in pre-market trading.

AT&T (T) reported Q2 FY 2018 earnings of $0.91 per share (versus $0.79 in Q2 FY 2017), beating analysts' consensus estimate of $0.89.

The company's quarterly revenues amounted to $38.986 bln (-2.1% y/y), beating analysts' consensus estimate of $38.447 bln.

The company also issued upside guidance for FY 2018, projecting EPS at high end of $3.50 range versus analysts' consensus estimate of $3.38.

T fell to $31.47 (-0.66%) in pre-market trading.

The index fell to 101.7 points in July from 101.8 points in June. Companies were slightly more satisfied with their current business situation, but scaled back their business expectations slightly. The German economy continues to expand, but at a slower pace.

In manufacturing, the index fell for the sixth consecutive month due to far poorer assessments of the current business situation. The indicator nevertheless remains significantly above its long-term average. Manufacturers' business expectations, by contrast, remained slightly optimistic. Demand picked up, but at a slower pace than last month. Capacity utilisation was unchanged at 87.7 percent.

In the services sector the business climate improved. Service providers upwardly revised their assessments of both the current business situation and their business expectations. This was partly due to stronger demand for services.

Retail sales growth expanded at a healthy pace in the year to July, albeit at a slightly slower rate than in the previous month, according to the latest monthly CBI Distributive Trades Survey.

The survey of 111 firms, of which 50 were retailers, showed that sales also stayed above average for the time of year. But orders placed on suppliers fell, disappointing expectations of continued growth.

The outlook for the coming month is less upbeat, with retailers expecting sales volumes and orders to flatten out.

Growth in online sales also slowed somewhat in the year to July, to a pace around the long-run average. Sales growth is expected to ease slightly further in the year to August.

The number of mortgage approvals by the main high street banks in June fell by 2.1 per cent compared to the same month a year earlier. Within this only remortgaging approvals increased and were 3.4 per cent higher than for the same period a year earlier, this was offset by the 4.7 per cent fall in house purchase approvals and 4.3 per cent fall in other secured borrowing.

Credit card spending was 4.7 per cent higher than a year earlier, with outstanding levels of card borrowing having grown by 5.6 per cent over the year. Outstanding overdraft borrowing was 5.8 per cent lower compared to the same time last year.

Personal deposits grew by 1.3 per cent in the last 12 months. Deposits held in instant access accounts were 4.2 per cent higher than a year earlier.

The annual growth rate of the broad monetary aggregate M3 increased to 4.4% in June 2018 from 4.0% in May, averaging 4.1% in the three months up to June. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate M1, which comprises currency in circulation and overnight deposits, stood at 7.4% in June, compared with 7.5% in May.

The annual growth rate of short-term deposits other than overnight deposits (M2-M1) was -0.9% in June, compared with -1.7% in May. The annual growth rate of marketable instruments (M3-M2) was -2.4% in June, compared with -5.1% in May.

Looking at the components' contributions to the annual growth rate of M3, the narrower aggregate M1 contributed 4.8 percentage points (as in the previous month), short-term deposits other than overnight deposits (M2-M1) contributed -0.3 percentage point (up from -0.5 percentage point) and marketable instruments (M3-M2) contributed -0.1 percentage point (up from -0.3 percentage point).

Sterling rises slightly after U.K. Prime Minister Theresa May said Tuesday that she'll take control of Brexit negotiations, a move that decreases the probability of a hard Brexit and hence supports the pound. But ING says "we don't expect yesterday's sterling recovery to have legs." ING adds: "We see sterling upside as limited and short-lived as we view yesterday's announcement as just formalizing what has been already the case with PM May being the key decision maker in the Brexit process." The GBP/USD is up 0.2% at 1.3168, while the EUR/GBP is down 0.1% at 0.8881. - via WSJ

EUR/USD

Resistance levels (open interest**, contracts)

$1.1797 (4062)

$1.1774 (2493)

$1.1746 (802)

Price at time of writing this review: $1.1693

Support levels (open interest**, contracts):

$1.1656 (3150)

$1.1623 (3351)

$1.1584 (3512)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 13 is 87232 contracts (according to data from July, 24) with the maximum number of contracts with strike price $1,1850 (5336);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3258 (723)

$1.3233 (500)

$1.3201 (304)

Price at time of writing this review: $1.3163

Support levels (open interest**, contracts):

$1.3112 (1973)

$1.3087 (1742)

$1.3056 (2046)

Comments:

- Overall open interest on the CALL options with the expiration date August, 13 is 23879 contracts, with the maximum number of contracts with strike price $1,3600 (3206);

- Overall open interest on the PUT options with the expiration date August, 13 is 27301 contracts, with the maximum number of contracts with strike price $1,2950 (2265);

- The ratio of PUT/CALL was 1.14 versus 1.13 from the previous trading day according to data from July, 24.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

June 2018 monthly values are actual and compared with June 2017.

-

Goods exports rose $217 million (4.6 percent) to $4.9 billion. This was a new high for a June month, with the previous high in the same month a year ago ($4.7 billion).

-

Goods imports rose $573 million (13 percent) to $5.0 billion, a new high for a June month, with the previous high in June 2017.

-

The monthly trade balance was a deficit of $113 million (2.3 percent of exports).

-

This is the second deficit for a June month in the last decade.

"The European Union is coming to Washington tomorrow to negotiate a deal on Trade. I have an idea for them. Both the U.S. and the E.U. drop all Tariffs, Barriers and Subsidies! That would finally be called Free Market and Fair Trade! Hope they do it, we are ready - but they won't!".

The Consumer Price Index (CPI) rose 0.4 per cent in the June quarter 2018, according to the latest Australian Bureau of Statistics (ABS) figures. This follows a rise of 0.4 per cent in the March quarter 2018.

The most significant price rises this quarter are automotive fuel (+6.9 per cent), medical and hospital services (+3.1 per cent), and tobacco (+2.8 per cent). These rises are partially offset by falls in domestic holiday travel and accommodation (-2.7 per cent), motor vehicles (-2.0 per cent) and vegetables (-2.9 per cent).

The CPI rose 2.1 per cent through the year to June quarter 2018, having increased 1.9 per cent through the year to March quarter 2018.

Chief Economist for the ABS, Bruce Hockman, said, "Annual CPI growth is 2.1 per cent in the June quarter 2018, the second annual rise above 2.0 per cent since September quarter 2014. Most of this annual growth is due to strength in fuel, electricity and tobacco. Annual growth in prices of discretionary goods such as clothing and footwear, and furniture and household equipment remain subdued."

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.