- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-02-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 | Japan | Leading Economic Index | December | 90.8 | 91.6 |

| 05:00 | Japan | Coincident Index | December | 94.7 | 94.7 |

| 07:00 | Germany | GDP (YoY) | Quarter IV | 0.6% | 0.4% |

| 07:00 | Germany | GDP (QoQ) | Quarter IV | 0.2% | 0% |

| 11:00 | United Kingdom | CBI retail sales volume balance | February | 4 | |

| 14:00 | U.S. | Housing Price Index, m/m | December | 0.2% | 0.3% |

| 14:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | December | 2.6% | 2.8% |

| 14:45 | U.S. | FOMC Member Kaplan Speak | |||

| 15:00 | U.S. | Richmond Fed Manufacturing Index | February | 20 | 13 |

| 15:00 | U.S. | Consumer confidence | February | 131.6 | 132 |

| 17:15 | Canada | Gov Council Member Lane Speaks | |||

| 20:00 | U.S. | FOMC Member Clarida Speaks |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 | Japan | Leading Economic Index | December | 90.8 | 91.6 |

| 05:00 | Japan | Coincident Index | December | 94.7 | 94.7 |

| 07:00 | Germany | GDP (YoY) | Quarter IV | 0.6% | 0.4% |

| 07:00 | Germany | GDP (QoQ) | Quarter IV | 0.2% | 0% |

| 11:00 | United Kingdom | CBI retail sales volume balance | February | 4 | |

| 14:00 | U.S. | Housing Price Index, m/m | December | 0.2% | 0.3% |

| 14:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | December | 2.6% | 2.8% |

| 14:45 | U.S. | FOMC Member Kaplan Speak | |||

| 15:00 | U.S. | Richmond Fed Manufacturing Index | February | 20 | 13 |

| 15:00 | U.S. | Consumer confidence | February | 131.6 | 132 |

| 17:15 | Canada | Gov Council Member Lane Speaks | |||

| 20:00 | U.S. | FOMC Member Clarida Speaks |

According to ActionForex, analysts at Wells Fargo Securities note that COVID-19 has spread outside of China, which presents more risk to American supply chains, and the economically important U.S. transportation equipment industry has high exposure as well.

"News this weekend suggests that COVID-19 is starting to spread outside of China, with the number of confirmed cases in Japan and South Korea jumping. Although China claims the top spot as the most important country for American imports (more than $450 billion in 2019), the United States imported more than $140 billion worth of goods from Japan last year and nearly $80 billion from Korea (top chart). Together, these three countries accounted for more than 25% of total American imports last year."

"Nearly 60% of furniture imports originate from these three countries with China accounting for the vast majority. Because furniture is generally a final good (i.e., it is not used in the production of other goods), there would not be significant supply chain implications in the United States if furniture factories in China, Japan and Korea were to shut down for a significant length of time. But the United States imports more than 50% of its computer and electronic products, some of which are used as intermediate inputs, from China, Japan and Korea. These three countries are also important suppliers of electrical equipment, plastics, fabricated metal products, and machinery, to name a few."

"The chemical industry accounts for more than 12% of industrial production in the United States. A shutdown in this industry would have devastating consequences for overall American industrial production. But the industry sources only 3% of its inputs from China, Japan and Korea, so it is not overly exposed to these countries."

"However, the transportation equipment industry is more vulnerable. Not only does it import roughly 7% of its overall inputs from China, Japan and Korea, but it has a 10% weight in overall U.S. industrial production."

"A prolonged production halt in these countries could therefore have adverse effects on the U.S. transportation sector and total U.S. production."

"U.S. output exposure remains manageable, with only a few industries both importing a sizeable share of inputs from the exposed countries and representing a large share of production. But, the situation remains quite fluid, and we will continue to monitor the implications of the viruses spread."

FXStreet reports that analysts at TD Securities note the yellow metal entered into new territory — dry-powder positioning, which measures per-trader exposure, is off the charts.

“With more than 56bp of rate cuts priced in by year-end and equities deeply in the red following some signs of herding into momentum trades in tech stocks, the fear factor has further driven a swarm of safe-haven flows towards gold.”

“The structural bid in gold should keep investment capital flowing towards the yellow metal, driven by real rate suppression from global central banks who remain willing to let inflation overshoot for some time.”

“The risk of a near-term pullback is as high as its ever been. In this context, we expect flows from CTAs to remain muted as algorithmic trend followers remain well-positioned for the precious metal bull market.”

- Virus has pandemic potential, but is not a pandemic yet

FXStreet notes that the Italian real GDP contracted by 0.3% q-o-q in the final quarter of 2019. Economists at Rabobank expect the economy to be broadly stagnant in 2020 and to contract in 2021.

“We still forecast economic growth to be broadly stagnant in the first quarter of this year. The prospect of yet another contraction and hence a recession cannot be ruled out.”

“We expect the slowdown to continue in 2021, with growth of private expenditure even turning negative in 2021. We expect the economy to be broadly stagnant in 2020 and to slightly contract in 2021.”

“We expect growth of private consumption and housing investment to slow over the coming two years.”

“Given the large internal divisions, the government’s very weak majority in the Senate and the busy regional election calendar in spring, we expect little meaningful legislation to improve the country’s very weak longer-term growth perspective and public finances.”

FXStreet notes that the focus of the coming week will center around Friday's GDP report for Q4 (expenditure) and December (industry-level). Rounding out the week are the BoC's Lane on Tuesday and payroll employment (Dec) on Thursday. Strategists at TD Securities share their forecast.

“The market is looking for a 0.3% (saar) increase for Q4, in line with the Bank's projections from the January MPR, though we are slightly more downbeat and look for a flat print. This isn't enough of a surprise to put a rate cut on the table for next week's meeting but given broader sentiment it should put more focus on the April meeting.”

“The Canadian economy likely came to a standstill in the fourth quarter, with our final growth tracking 0.0% (q/q, annualized).

“We will also hear from the BoC's Lane when he gives a speech on digital currencies, but we don't expect any implications for near term policy.”

“Turning to the monthly figures TD looks for industry-level GDP to increase by 0.1% in December on a relatively strong showing from the services sector.”

U.S. stock-index futures plunged on Monday, as a spike of coronavirus cases outside China stoked fears that the virus outbreak poses a bigger threat to global growth than first envisaged.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 23,386.74 | -92.41 | -0.39% |

| Hang Seng | 26,820.88 | -487.93 | -1.79% |

| Shanghai | 3,031.23 | -8.44 | -0.28% |

| S&P/ASX | 6,978.30 | -160.70 | -2.25% |

| FTSE | 7,153.04 | -250.88 | -3.39% |

| CAC | 5,798.52 | -231.20 | -3.83% |

| DAX | 13,047.93 | -531.40 | -3.91% |

| Crude oil | $51.09 | | -4.29% |

| Gold | $1,678.00 | | +1.77% |

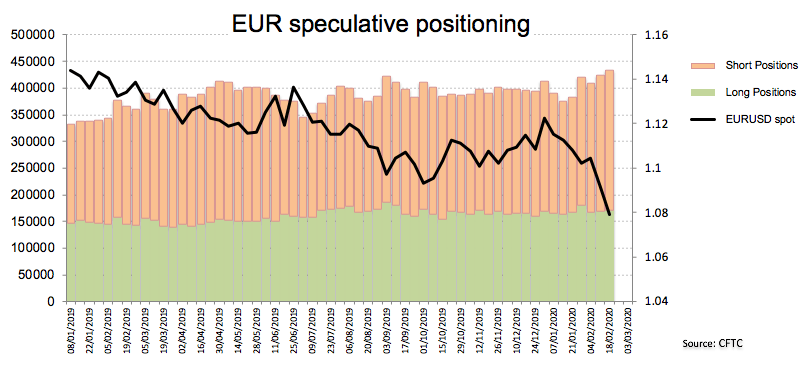

FXStreet offers the main highlights of the latest CFTC Positioning Report for the week ended on February 18th:

- Speculators added more contracts to their already multi-month net short position during last week, taking it to the highest level since late May 2019 at around 91.5K contracts. Poor results from the euro docket vs. a resilient US economy added to the view of a 'looser for longer' ECB, all in combination with unabated concerns around the COVID-19 have been playing heavily against EUR as of late.

- Exactly on the opposite side, USD net longs rose to the highest level since November 19th 2019, as the speculative community continued to seek shelter in the greenback amidst unremitting fears surrounding the Chinese coronavirus. Also lending support to the buck, US data releases kept surprising to the upside, sustaining the "appropriate" stance from the Fed, while market participants appear to have started to price in the likeliness of a steady Fed for the foreseeable future (say no further "insurance" cuts this year).

- Net longs in the British pound increased to 5-week highs on the back of speculations that some sort of fiscal stimulus package could be in the pipeline. However, this could prove to be insufficient to sustain some lasting recovery in the quid against the backdrop of a cautious BoE, political uncertainty and upcoming tough EU-UK trade negotiations (due to start in March).

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 155 | -1.93(-1.23%) | 17797 |

| ALCOA INC. | AA | 15.35 | -0.75(-4.66%) | 17082 |

| ALTRIA GROUP INC. | MO | 45 | -0.89(-1.94%) | 23804 |

| Amazon.com Inc., NASDAQ | AMZN | 2,029.00 | -66.97(-3.20%) | 147612 |

| American Express Co | AXP | 130.7 | -4.20(-3.11%) | 19071 |

| AMERICAN INTERNATIONAL GROUP | AIG | 47.2 | -1.40(-2.88%) | 4375 |

| Apple Inc. | AAPL | 300.97 | -12.08(-3.86%) | 1131454 |

| AT&T Inc | T | 38 | -0.55(-1.43%) | 152294 |

| Boeing Co | BA | 321 | -9.38(-2.84%) | 102968 |

| Caterpillar Inc | CAT | 133.2 | -4.01(-2.92%) | 26855 |

| Chevron Corp | CVX | 106.1 | -2.91(-2.67%) | 16469 |

| Cisco Systems Inc | CSCO | 45.36 | -0.94(-2.02%) | 175589 |

| Citigroup Inc., NYSE | C | 73.41 | -3.03(-3.96%) | 65530 |

| Deere & Company, NYSE | DE | 171.39 | -6.04(-3.40%) | 4856 |

| E. I. du Pont de Nemours and Co | DD | 50.81 | -1.62(-3.09%) | 7736 |

| Exxon Mobil Corp | XOM | 57.35 | -1.78(-3.01%) | 143022 |

| Facebook, Inc. | FB | 204.39 | -5.79(-2.75%) | 207595 |

| FedEx Corporation, NYSE | FDX | 156.7 | -6.55(-4.01%) | 7659 |

| Ford Motor Co. | F | 7.75 | -0.14(-1.77%) | 596188 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.26 | -0.68(-5.70%) | 64498 |

| General Electric Co | GE | 11.68 | -0.57(-4.65%) | 690300 |

| General Motors Company, NYSE | GM | 33.55 | -1.10(-3.18%) | 39740 |

| Goldman Sachs | GS | 223 | -7.62(-3.30%) | 18232 |

| Google Inc. | GOOG | 1,442.00 | -43.11(-2.90%) | 25558 |

| Hewlett-Packard Co. | HPQ | 22.1 | -0.60(-2.64%) | 17491 |

| Home Depot Inc | HD | 239.43 | -5.91(-2.41%) | 18666 |

| HONEYWELL INTERNATIONAL INC. | HON | 173 | -6.88(-3.82%) | 1109 |

| Intel Corp | INTC | 62.59 | -1.75(-2.72%) | 224126 |

| International Business Machines Co... | IBM | 145.53 | -4.31(-2.88%) | 31980 |

| International Paper Company | IP | 42.1 | -1.17(-2.70%) | 3565 |

| Johnson & Johnson | JNJ | 146.2 | -2.78(-1.87%) | 23469 |

| JPMorgan Chase and Co | JPM | 130.48 | -5.33(-3.92%) | 70897 |

| McDonald's Corp | MCD | 209.6 | -6.27(-2.90%) | 21023 |

| Merck & Co Inc | MRK | 80.51 | -1.83(-2.22%) | 17573 |

| Microsoft Corp | MSFT | 169 | -9.59(-5.37%) | 1164661 |

| Nike | NKE | 96.3 | -3.95(-3.94%) | 43709 |

| Pfizer Inc | PFE | 35.1 | -0.62(-1.74%) | 56186 |

| Procter & Gamble Co | PG | 125.4 | -1.30(-1.03%) | 14548 |

| Starbucks Corporation, NASDAQ | SBUX | 84.89 | -2.47(-2.83%) | 45463 |

| Tesla Motors, Inc., NASDAQ | TSLA | 840.98 | -60.02(-6.66%) | 626632 |

| The Coca-Cola Co | KO | 59.5 | -0.63(-1.05%) | 80978 |

| Travelers Companies Inc | TRV | 133.81 | -1.35(-1.00%) | 4683 |

| Twitter, Inc., NYSE | TWTR | 36.81 | -1.50(-3.92%) | 117705 |

| United Technologies Corp | UTX | 148.02 | -3.50(-2.31%) | 7740 |

| UnitedHealth Group Inc | UNH | 288 | -13.43(-4.46%) | 18127 |

| Verizon Communications Inc | VZ | 57.73 | -0.47(-0.80%) | 40076 |

| Visa | V | 199.18 | -9.63(-4.61%) | 134175 |

| Wal-Mart Stores Inc | WMT | 116.1 | -2.48(-2.09%) | 18202 |

| Walt Disney Co | DIS | 133.95 | -5.02(-3.61%) | 129387 |

| Yandex N.V., NASDAQ | YNDX | 43 | -1.54(-3.46%) | 3485 |

Exxon Mobil (XOM) target lowered to $58 from $65 at Cowen

The Chicago Federal Reserve announced on Monday the Chicago Fed national activity index (CFNAI), a weighted average of 85 different economic indicators, came in at -0.25 in January 2020, up from a revised -0.51 in December 2019 (originally -0.35), pointing to an uptick in economic growth.

Economists had forecast the index to come in at -0.92 in January.

At the same time, the index's three-month moving average rose to -0.09 in January from -0.23 in December.

According to the report, all four broad categories of indicators that make up the index improved from December, but only one of the four categories made a positive contribution to the gauge in January.

Production-related indicators made a negative contribution of -0.23 to the CFNAI in January, up from -0.34 in December. The contribution of the sales, orders, and inventories category to the CFNAI edged up to -0.02 in January from -0.06 in December. Employment-related indicators contributed -0.03 to the CFNAI in January, up from -0.12 in December. Meanwhile, the contribution of the personal consumption and housing category to the CFNAI ticked up to +0.03 in January from a neutral value in December.

Statistics Canada reported on Monday the wholesale sales rose 0.9 percent m-o-m to CAD63.89 million in December, following a revised 1.1 percent m-o-m decrease in November (originally a 1.2 percent m-o-m decline).

Economists had forecast a 0.5 m-o-m gain for December.

According to the report, higher sales were recorded in four of seven subsectors, accounting for 63 percent of total wholesale sales. The December advance was led by gains in the motor vehicle and motor vehicle parts and accessories (+1.9 percent m-o-m) and the miscellaneous subsector (+2.5 percent m-o-m).

In y-o-y terms, wholesale sales grew 1.5 percent in December. In the fourth quarter, however, sales dropped 1.5 percent, following 14 consecutive quarterly increases. For 2019, wholesale sales rose 2.3 percent, compared to 3.7 percent in 2018 and 7.5 percent in 2017.

Says he is buyers on balance when stocks are down

A "good number" of businesses that he owned were impacted by coronavirus in short term

He believes "something else" other than coronavirus will be "front and center" six months from now

U.S. economy is strong, although softer

Low rates are good for stocks, but bad for insurance companies

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 09:00 | Germany | IFO - Current Assessment | February | 99.2 | 98.6 | 98.9 |

| 09:00 | Germany | IFO - Expectations | February | 92.9 | 92.2 | 93.4 |

| 09:00 | Germany | IFO - Business Climate | February | 96.0 | 95.3 | 96.1 |

USD, CHF and JPY gain in the European session on Monday as the number of coronavirus cases outside China climbed, increasing fears over the coronavirus's impact on the global economy and making investors fleeing to safe-haven assets.

South Korea raised its coronavirus alert to the “highest level” on Sunday, with the latest surge in numbers bringing the total infected to more than 760, making it the country with the most cases outside mainland China.

Outside of Asia, Italy has been worst hit by the virus so far, with more than 200 confirmed cases and four deaths.

Meanwhile, China reported 409 new cases on the mainland, down from 648 a day earlier, taking the total number of infections to 77,150 cases; the death toll increased by 150 to 2,592.

World Health Organization (WHO) is now worried about the increasing number of coronavirus cases without any clear link to the epicenter of the outbreak in China.

Market participants expect the disruption from the coronavirus outbreak to hit global economic growth.

- Takes three to six weeks in severe cases

- On the severity of cases, nearly 80% are mild, 13.8% severe, 6.1% critical

- Around 3,000 medical workers have been infected by the virus

- Average age of people confirmed as infected with coronavirus is 51; 80% of infected patients range from 30 to 65 years old

- Reported decline of 80% in virus cases in China is "real"; a lot of "compelling field data" supports this

- Death rate is 3% to 4% nationally, outside of Wuhan it is around 0.7%

Carsten Brzeski, Chief Economist ING Germany, notes that Germany’s most prominent leading indicator just surprised with a better-than-expected reading in February, increasing to 96.1, from 96.0 in January.

"However, given that in the past, the Ifo index has more often reacted with a lag of one or two months to adverse global events, today’s reading should be taken with a pinch of salt. Also, don’t forget that the Ifo index had dropped surprisingly in January. Today’s reading is still lower than the December reading. A bit striking is the fact that the expectations component increased, while the current assessment component dropped."

"The manufacturing sector remains Germany's Achilles’ heel. While there were tentative signals of a bottoming out at the turn of the year with inventories dropping from high levels, the economic impact from the coronavirus will delay any such bottoming out. In fact, it increasingly looks as if things in the manufacturing sector will first get worse before getting better."

"Accounting for roughly 6% of total German exports, weaker Chinese demand will leave its marks on the economy and could accentuate troubles in the automotive industry. However, disruptions to the supply chain could have an even more adverse effect on the German economy. Some 10% of intermediate goods originate in China, mainly for the automotive and pharmaceutical industry."

"Finally, Chinese tourists have become an important driver of consumption in Germany, accounting for almost half of annual duty-free sales. Often Chinese tourists visit Germany as part of a business trip, making chances of a rebound later this year less likely."

- Will reduce interest rates on loans to small and micro businesses

- Will keep monetary policy more flexible, appropriate

FXStreet notes that since the start of this year AUD/USD has dropped over 6%. While the move is currently looking a little over-extended, judging by the current tone of the news-flow the AUD is still vulnerable to further falls over the medium-term, according to analysts at Rabobank.

“As low wage inflation and soft price pressures have been symptomatic of the issues facing RBA policymakers for some time, the fall in the value of the AUD will not be totally unwelcome at the central bank – though the pace of the drop this year may be of some concern.”

“The RBA will meet for its next policy meeting on March 3. Last week the minutes of the February 4 meeting were released. The minutes highlighted that ‘members reviewed the case for a further reduction in the cash rate at the present meeting’, which was taken by the market as a dovish signal.”

“Any sign in next week’s meeting that policy-makers’ concerns regarding coronavirus are escalating will increase the risk of another 25 bps reduction in rates in the coming months. This will increase downside potential for AUD/USD towards 0.65.”

FXStreet notes that coronavirus risks intensified again over the weekend, leaving FX markets with a distinct risk-off tone at the start of the week. Analysts at TD Securities analyze the EUR/USD pair outlook.

“With a fairly light data and event risk calendar, we expect the outbreak to remain the key sentiment driver this week.”

“The uptick of cases in Italy keeps downside risks in view for EUR/USD, but spot is already oversold, suggesting some further consolidation may be necessary.”

“We like selling EUR/USD on rallies from here and think a squeeze towards 1.10 would offer an attractive entry point for shorts. Ahead of this, 1.0879 remains the key attractor to the upside.”

FXStreet reports that FX Strategists at UOB Group remain positive on USD/CNH, although a test of tops beyond 7.08 appears unlikely in the near-term at least.

24-hour view: "Our view that "there is room for advance in USD to extend to 7.0600" did not materialize as it eased off slightly from a high of 7.0567. The underlying tone still appears firm and we continue to see chance for USD to probe the 7.0600 resistance. That said, the prospect for a sustained rise above this level is not high. Support is at 7.0380 followed by 7.0280."

Next 1-3 weeks: "We noted on Wednesday (19 Feb, spot at 7.0100) that the 'consolidation phase could be close to an end'. However, the manner by which USD blew above the early February peak of 7.0230 was not exactly expected. From here, further USD strength is likely but at this stage, it is too early to anticipate a move the December's peak at 7.0865 (there is another resistance at 7.0660). For the next few days, the 'strong support' level at 7.0150 is likely strong enough to hold."

Bloomberg reports that the Swiss National Bank appears to have stepped up its interventions to prevent the franc from strengthening last week, as haven assets around the world got a fillip from rising risk aversion.

The amount of cash commercial banks hold at the central bank, known as sight deposits, rose by 2.1 billion francs last week, the largest increase since early January, data on Monday showed.

Along with negative interest rates, interventions are part of the SNB's toolkit to prevent an undue strengthening of the franc. Swiss officials rarely say when they've been in the market, and so analysts closely scrutinize the sight deposit data for clues.

"It looks like the SNB intervened," said Credit Suisse economist Maxime Botteron. Still, activity appears to have been lower than in August, when the central bank was last suspected of launching a barrage of interventions to prevent the franc from strengthening, he said.

While markets in risk-off mode, "we've got to prepare for more interventions," Botteron also said.

FXStreet reports that coronavirus has continued to dominate headlines. The key uncertainty for the NZ economy is how long the related disruptions to travel and trade persist. NZD/USD is trading at 0.63140 as remains vulnerable in the opinion of analysts at Westpac Institutional Bank.

"NZD/USD remains vulnerable to pandemic-led fall below 0.6300 as nearterm data confirms effects."

"Potential for rebound to 0.6600 in Q2 as NZ economic outperformance is recognised and USD weakens on Fed easing prospects."

eFXdata reports that ANZ Research discusses AUD outlook and adopts a mildly bearish bias over the coming week, and a mildly bullish bias over the coming month.

"The AUD has fallen to a multi-year low, as growth differentials and concerns over the global growth outlook weigh. Asset prices and sentiment, more broadly, remain elevated, despite mounting risks as the spread of COVID-19 is scrutinised. While the aggregate numbers have been positive, isolated pockets of contagion are more worrisome and pose further downside risks to growth. We continue to favour defensive positioning as the growth outlook frays," ANZ notes.

"In the current environment, AUD will remain a liquid proxy for global risk, as markets assess the impact of COVID-19," ANZ adds.

FXStreet reports that FX Strategists at UOB Group noted that extra gains are likely in USD/JPY on a break above the 112.40 level.

24-hour view: "The sudden and sharp retreat in USD came as a surprise as it dropped to a low of 111.46 last Friday (before extending its decline upon opening this morning). Upward momentum has eased and USD is likely taking a breather after its frenetic rally last week. In other words, USD is likely to trade sideways for today, expected to be between 111.20 and 112.00."

Next 1-3 weeks: "While we indicated yesterday (20 Feb, spot at 111.25) that the "abrupt and powerful rally in USD could extend to 112.00", the speeded up price action wherein USD rocketed to a high of 112.21 was not exactly expected (USD gained a whopping +2.05% over the past two days, the largest 2-day gain since Sep 2017). From here, all eyes are on the solid mid-term resistance at 112.40. A break of this critical level could spur further USD gains towards 113.30 in the coming days. Only a move below 111.20 ('strong support' level was at 110.30 yesterday) would indicate that the current rally has run out of gas."

According to the report from Ifo Institute for Economic Research, the German IFO Business Climate Index came in at 96.1 in February, stronger than last month's 95.9 and beating the estimates (95.3). Current Economic Assessment arrived at 98.9 points as compared to last month's 99.1 and 98.6 anticipated. The IFO Expectations Index - indicating firms' projections for the next six months, came in at 93.4 for February, up from previous month's 92.9 reading. Economists had expected a decrease to 92.2.

"The German economy seems unaffected by developments surrounding the coronavirus," Ifo President Clemens Fuest said in a statement, sticking to a first-quarter growth forecast of 0.2%.

FXStreet reports that as part of the Federal Reserve's strategy review, the introduction of a target range for inflation is being discussed. Such a range could provide flexibility in the conduct of monetary policy and it could also take into account past shortfalls in inflation. William De Vijlder from BNP Paribas dissect the FED's strategy.

"In theory, the question of a target range for inflation looks simple. Rather than having a precise numerical target for inflation (2%), a range would offer some flexibility. Hence, it would calm down expectations of policy easing or tightening as soon as inflation strays from the target."

"The Fed staff's briefing actually discussed not one but three ranges. Given the variability of inflation, there is an uncertainty range. Within that range, no action would be warranted because of the noise in the measurement of inflation."

"There is also an operational range: the FOMC could, under certain circumstances, prefer to be above its longer-term target, e.g. to make up for a past period of very low inflation."

"Finally, there is an indifference range, whereby deviations of inflation from target would not trigger a policy response."

FXStreet reports that FX Strategists at UOB Group now expect EUR/USD to trade within a consolidative fashion for the time being.24-hour view:

"We expected EUR to 'dip below the major 1.0770 support' last Friday but were of the view 'a sustained drop below this level is not expected'. However, EUR only touched 1.0781 before rebounding strongly and sharply during NY hours (high of 1.0863). The rapid recovery appears to be running ahead of itself and EUR is unlikely to strengthen much further. From here, EUR is more likely to consolidate and trade sideways at these higher levels, expected to be between 1.0800 and 1.0875."

Next 1-3 weeks: "While we noted last Friday (21 Feb, spot at 1.0795) that 'downward momentum appears to be struggling and EUR has to break the major 1.0770 support before a move to 1.0740 can be expected', the sudden and sharp rebound that touched a high of 1.0863 came as a surprise. The break of the 'strong resistance' level at 1.0845 indicates that the weak phase in EUR that started in early February has ended. From here, EUR is deemed to have moved into a consolidation phase and is expected to trade sideways within a relatively broad range of 1.0770/1.0900."

The US dollar rose 0.35% against the major currencies, reacting to news of the spread of coronavirus and increased mortality in South Korea, Italy and the middle East. This news also led to a drop in oil prices and a rise in gold prices.

The number of people infected with the new coronavirus outside China, according to the world health organization (who), reached 1,769 on Sunday, according to the organization's daily report.

According to who, the number of confirmed cases in the world outside of China increased by 367 per day. In total, cases of infection outside the PRC were recorded in 28 countries. The total number of deaths is 17, and six people died from COVID-19 during the day.

According to who, 2445 people have already become victims of the new coronavirus in China, and the total number of infected people has reached 77042. Earlier, the Chinese Ministry of health reported that more than 22.8 thousand people were cured of the disease in the country. The number of cases of coronavirus infection worldwide exceeded 78.8 thousand.

FXStreet reports that GBP/USD last week failed at the 55 day moving average at 1.3055 and reacted lower but on Friday the cable can overcome the short-term downtrend, as Commerzbank's Karen Jones notes.

"The cable remains capable of overcoming the short term downtrend at 1.3066. The intraday Elliott wave is implying that this is the end of the down move, the RSI has not confirmed the new low and we have not closed below the 1.2872 low."

"For now, we suspect a bounce higher and beyond that we are neutral. Only above the downtrend would negate downside pressure for recovery to initially 1.3285 and the 2015-2020 resistance line at 1.3402."

CNBC reports that U.S. officials will have a better idea of how the coronavirus outbreak will impact the economy in "three or four weeks," U.S. Treasury Secretary Steven Mnuchin said Sunday.

Speaking to CNBC at the G-20 summit in Riyadh, Mnuchin said it was difficult to make strong predictions about the economic impact of the outbreak right now.

"I think we're going to need another three or four weeks to see how the virus reacts, until we really have good statistical data," he said.

"Although the rate the virus spreads at is quite significant, the mortality rate is quite small. It's something we're monitoring carefully, one of the discussions we're having here is that countries should be prepared, but I think we're at a point where it's too early to either say this is very concerning or it's not concerning."

Mnuchin also told CNBC he did not believe the Chinese government was aware of the coronavirus danger when a delegation traveled to the White House for the signing of the Sino-U.S. "phase one" trade deal in January.

"I think the Chinese government reacted much quicker than they have in previous situations," he said. "There's no question that China's major focus is now controlling the virus and the approach of phase two (of the trade deal) will definitely slow down a little bit."

When asked if the U.S. had a backup plan in place in terms of a fiscal response to the virus outbreak, Mnuchin said there was "no question about it." However, he reiterated that it was too early to predict how the coronavirus - formally named COVID-19 - would affect the global economy.

eFXdata reports that CIBC Research discusses AUD outlook and adopts a neutral bias over the coming weeks. CIBC targets AUD/USD at 0.67 by end of Q1 and at 0.68 by end of Q2.

"The combination of the bushfires and coronavirus fears saw AUD/USD fall over 5.0% from the highs seen at the beginning of this year. This month, AUD/USD pared some of those losses, as the initial shock of the virus has now calmed. In addition, the RBA policy decision was less dovish than the market expected, with the Bank reiterating that it was comfortable remaining on hold for now. Rate cut expectations were postponed from Q2 2020 to Q4 after the meeting, thereby establishing a bottom for the currency," CIBC notes.

"We caution that there are near-term headwinds facing the AUD, especially as the full ramifications of the coronavirus and the bushfires are not yet known. We remain neutral on the AUD in the coming weeks, as we wait to see how these events feed through to hard data," CIBC adds.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0965 (1368)

$1.0929 (2086)

$1.0904 (3678)

Price at time of writing this review: $1.0817

Support levels (open interest**, contracts):

$1.0784 (2633)

$1.0743 (3115)

$1.0720 (2331)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 6 is 112845 contracts (according to data from February, 21) with the maximum number of contracts with strike price $1,1200 (6385);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3051 (2189)

$1.3027 (1023)

$1.3009 (366)

Price at time of writing this review: $1.2934

Support levels (open interest**, contracts):

$1.2904 (2503)

$1.2872 (3592)

$1.2834 (2942)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 28525 contracts, with the maximum number of contracts with strike price $1,3050 (3916);

- Overall open interest on the PUT options with the expiration date March, 6 is 30607 contracts, with the maximum number of contracts with strike price $1,2800 (3709);

- The ratio of PUT/CALL was 1.07 versus 1.07 from the previous trading day according to data from February, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 58.36 | -1.1 |

| WTI | 53.33 | -0.5 |

| Silver | 18.47 | 0.65 |

| Gold | 1643.556 | 1.5 |

| Palladium | 2697.26 | 0.15 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -92.41 | 23386.74 | -0.39 |

| Hang Seng | -300.35 | 27308.81 | -1.09 |

| KOSPI | -32.66 | 2162.84 | -1.49 |

| ASX 200 | -23.5 | 7139 | -0.33 |

| FTSE 100 | -32.72 | 7403.92 | -0.44 |

| DAX | -84.67 | 13579.33 | -0.62 |

| CAC 40 | -32.58 | 6029.72 | -0.54 |

| Dow Jones | -227.57 | 28992.41 | -0.78 |

| S&P 500 | -35.48 | 3337.75 | -1.05 |

| NASDAQ Composite | -174.38 | 9576.59 | -1.79 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.66258 | 0.2 |

| EURJPY | 121.027 | 0.12 |

| EURUSD | 1.08469 | 0.59 |

| GBPJPY | 144.552 | 0.12 |

| GBPUSD | 1.29568 | 0.61 |

| NZDUSD | 0.635 | 0.31 |

| USDCAD | 1.32233 | -0.25 |

| USDCHF | 0.97809 | -0.62 |

| USDJPY | 111.56 | -0.48 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.