- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-02-2018

The main US stock indexes rose significantly, as the rise in the price of shares in the utilities sector and the technology segment helped to compensate for losses caused by fears about an increase in interest rates.

Looking back at the recent stock market sell-off and concerns over inflation, the Fed said it expects growth to remain stable and that there will not be serious risks on the horizon that could halt the planned rates of interest rate hikes. "Short-term changes in interest rates are the best way to implement policies." The changes in the Fed's guidelines may reduce the need for bond purchases, "the Fed's monetary policy report said." Inflationary expectations may be lower than previously thought. "Low core inflation remains" a mystery "".

Quotes of oil rose by more than 1%, helped by the reduction in production in Libya and optimistic comments from Saudi Arabia that efforts to reduce reserves through oil production constraints are working. Oil reversed early losses after news of the closure of the El Fel oil field in Libya, which produces 70,000 barrels per day. The extraction in Libya, which is a member of OPEC, is about 1 million barrels per day, although it remains unstable due to riots.

Almost all components of the DOW index recorded a rise (28 out of 30). The leader of growth was shares of Intel Corporation (INTC, + 4.21%). Outsider were shares of General Electric Company (GE ,, -0.89%).

All sectors of S & P finished trading in positive territory. The utilities sector grew most (+ 2.3%).

At closing:

Dow + 1.39% 25,309.99 +347.51

Nasdaq + 1.77% 7.337.39 +127.30

S & P + 1.60% 2.747.30 +43.34

U.S. stock-index futures advanced on Friday as the U.S. Treasury yields retreated for the second straight day, with investors also focusing on the speeches of the Fed's policy-makers for their views on the prospects of the interest rates.

Global Stocks:

Nikkei 21,892.78 +156.34 +0.72%

Hang Seng 31,267.17 +301.49 +0.97%

Shanghai 3,289.24 +20.68 +0.63%

S&P/ASX 5,999.80 +48.90 +0.82%

FTSE 7,242.83 -9.56 -0.13%

CAC 5,311.19 +1.96 +0.04%

DAX 12,494.79 +32.88 +0.26%

Crude $62.74 (-0.05%)

Gold $1,331.60 (-0.08%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 236.11 | 0.11(0.05%) | 305 |

| ALCOA INC. | AA | 48.25 | 0.24(0.50%) | 1000 |

| Amazon.com Inc., NASDAQ | AMZN | 1,496.50 | 11.16(0.75%) | 77888 |

| AMERICAN INTERNATIONAL GROUP | AIG | 60.25 | 0.29(0.48%) | 1000 |

| Apple Inc. | AAPL | 173.65 | 1.15(0.67%) | 167318 |

| AT&T Inc | T | 36.65 | 0.18(0.49%) | 714 |

| Barrick Gold Corporation, NYSE | ABX | 12.45 | -0.03(-0.24%) | 10760 |

| Boeing Co | BA | 358.11 | 2.19(0.62%) | 3898 |

| Caterpillar Inc | CAT | 160.6 | 1.74(1.10%) | 3870 |

| Cisco Systems Inc | CSCO | 43.22 | 0.28(0.65%) | 31128 |

| Citigroup Inc., NYSE | C | 76.69 | 0.42(0.55%) | 11419 |

| Deere & Company, NYSE | DE | 164.72 | 0.56(0.34%) | 302 |

| Exxon Mobil Corp | XOM | 76.25 | 0.39(0.51%) | 4892 |

| Facebook, Inc. | FB | 180.14 | 1.15(0.64%) | 82891 |

| FedEx Corporation, NYSE | FDX | 248.87 | 3.44(1.40%) | 960 |

| Ford Motor Co. | F | 10.68 | 0.05(0.47%) | 9790 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.18 | 0.02(0.10%) | 20998 |

| General Electric Co | GE | 14.61 | 0.11(0.76%) | 111727 |

| Goldman Sachs | GS | 263 | 1.57(0.60%) | 8120 |

| Google Inc. | GOOG | 1,114.99 | 8.36(0.76%) | 8569 |

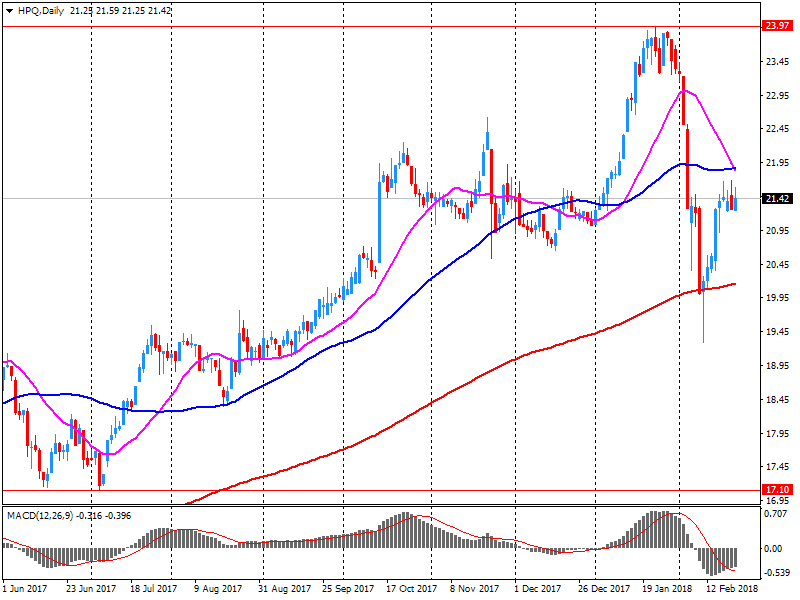

| Hewlett-Packard Co. | HPQ | 22.5 | 1.11(5.19%) | 64249 |

| Home Depot Inc | HD | 186.65 | 1.18(0.64%) | 2795 |

| Intel Corp | INTC | 46.22 | 0.42(0.92%) | 21170 |

| International Business Machines Co... | IBM | 154 | 0.82(0.54%) | 2116 |

| Johnson & Johnson | JNJ | 130.36 | 0.45(0.35%) | 20161 |

| JPMorgan Chase and Co | JPM | 115.56 | 0.58(0.50%) | 5200 |

| McDonald's Corp | MCD | 161.55 | 0.89(0.55%) | 504 |

| Merck & Co Inc | MRK | 54.84 | 0.27(0.49%) | 47331 |

| Microsoft Corp | MSFT | 92.41 | 0.68(0.74%) | 33133 |

| Nike | NKE | 67.25 | 0.12(0.18%) | 604 |

| Pfizer Inc | PFE | 35.97 | 0.23(0.64%) | 72386 |

| Starbucks Corporation, NASDAQ | SBUX | 55.45 | 0.05(0.09%) | 1616 |

| Tesla Motors, Inc., NASDAQ | TSLA | 348.72 | 2.55(0.74%) | 30871 |

| The Coca-Cola Co | KO | 43.56 | 0.04(0.09%) | 1166 |

| Twitter, Inc., NYSE | TWTR | 32.29 | 0.18(0.56%) | 46214 |

| United Technologies Corp | UTX | 133.75 | 0.17(0.13%) | 38723 |

| Verizon Communications Inc | VZ | 48.05 | 0.18(0.38%) | 3930 |

| Visa | V | 121 | 0.62(0.52%) | 1177 |

| Wal-Mart Stores Inc | WMT | 93.25 | 0.48(0.52%) | 28021 |

HP (HPQ) target raised to $27 from $25 at Maxim Group

FedEx (FDX) upgraded to Outperform from Mkt Perform at Bernstein

The Consumer Price Index (CPI) rose 1.7% on a year-over-year basis in January, following a 1.9% increase in December. Excluding energy, the CPI increased 1.7%, matching the gain in December.

Prices were up in all eight major components in the 12 months to January, with the transportation (+3.2%) and shelter (+1.4%) indexes contributing the most to the gain.

Consumers paid 3.2% more for transportation in January, following a 4.9% increase in December. Growth in this index was moderated by the purchase of passenger vehicles index, which increased less on a year-over-year basis in January (+1.4%) than in December (+3.7%). Gasoline prices rose 7.8% in January, after a 12.2% gain in December.

Food prices were 2.3% higher in January on a year-over-year basis, after rising 2.0% in December. This gain, the largest year-over-year movement in the food index since April 2016, was led by higher prices for food purchased from restaurants, which were up 3.7% in January after increasing 2.9% in December. Year-over-year growth in the fresh vegetables (+9.0%) and fresh fruit (+2.8%) indexes intensified in January.

HP Inc. (HPQ) reported Q1 FY 2018 earnings of $0.48 per share (versus $0.38 in Q1 FY 2017), beating analysts' consensus estimate of $0.42.

The company's quarterly revenues amounted to $14.517 bln (+14.5% y/y), beating analysts' consensus estimate of $13.471 bln.

The company also issues upside forecasts for Q2 and FY2018, projecting EPS of $0.45-0.49 (versus analysts' consensus estimate of $0.44) and of $1.90-2.00 (versus analysts' consensus estimate of $1.81), respectively.

HPQ rose to $22.71 (+6.17%) in pre-market trading.

Euro area annual inflation rate was 1.3% in January 2018, down from 1.4% in December 2017. In January 2017, the rate was 1.8%. European Union annual inflation was 1.6% in January 2018, down from 1.7% in December 2017. A year earlier the rate was 1.7%. These figures come from Eurostat, the statistical office of the European Union.

The lowest annual rates were registered in Cyprus (-1.5%), Greece (0.2%) and Ireland (0.3%). The highest annual rates were recorded in Lithuania and Estonia (both 3.6%) and Romania (3.4%). Compared with December 2017, annual inflation fell in twenty-one Member States, remained stable in one and rose in six.

In January 2018, the highest contribution to the annual euro area inflation rate came from services (+0.56 percentage point), followed by food, alcohol & tobacco (+0.39 pp), energy (+0.22 pp) and non-energy industrial goods (+0.15 pp).

-

There will be some areas such as automotive where we can agree to align our regulations with the EU after brexit

EUR/USD

Resistance levels (open interest**, contracts)

$1.2407 (2552)

$1.2383 (1181)

$1.2352 (540)

Price at time of writing this review: $1.2293

Support levels (open interest**, contracts):

$1.2254 (2200)

$1.2225 (5684)

$1.2192 (3309)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 9 is 129184 contracts (according to data from February, 22) with the maximum number of contracts with strike price $1,2400 (6354);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4093 (1859)

$1.4046 (3690)

$1.4014 (1335)

Price at time of writing this review: $1.3930

Support levels (open interest**, contracts):

$1.3876 (1794)

$1.3852 (714)

$1.3823 (2303)

Comments:

- Overall open interest on the CALL options with the expiration date March, 9 is 49690 contracts, with the maximum number of contracts with strike price $1,3900 (3690);

- Overall open interest on the PUT options with the expiration date March, 9 is 46732 contracts, with the maximum number of contracts with strike price $1,3900 (2303);

- The ratio of PUT/CALL was 0.94 versus 0.95 from the previous trading day according to data from February, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The German economy continued to grow at the end of 2017. As the Federal Statistical Office (Destatis), the gross domestic product (GDP) increased by 0.6% - upon price, seasonal and calendar adjustment - in the fourth quarter of 2017 compared with the previous quarter.

The economic situation in Germany in 2017 was characterised by steady and strong growth (+0.9% in the first quarter, +0.6% in the second quarter and +0.7% in the third quarter). For the whole year of 2017, this was an increase of 2.2% (calendar-adjusted: +2.5%), as reported by the Federal Statistical Office. The provisional annual GDP result released in January has thus been confirmed.

Overall nationwide consumer prices in Japan were up 1.4 percent on year in January, the Ministry of Internal Affairs and Communications said on Friday, cited by rttnews.

That exceeded forecasts for 1.3 percent and was up from 1.0 percent in December.

Core CPI, which excludes food prices, advanced an annual 0.9 percent - above expectations for 0.8 percent and unchanged from the previous month.

On a monthly basis, overall inflation added 0.4 percent and core CPI gained 0.2 percent.

European stocks closed slightly lower on Thursday, after paring losses into close as U.S. stocks rebounded after upbeat data on the labor market. Stocks had opened in deep negative territory, tracking late-session losses in the U.S. on Wednesday that came after minutes from the Federal Reserve's meeting last month suggested more interest-rate hikes are in the pipeline.

U.S. stock futures climbed Friday, building on gains in the prior session amid signs of an increased appetite for perceived riskier assets such as equities. Dow futures rose 160 points, or 0.7%, to 25,175, while S&P 500 futures gained 14.5 points, or 0.5%, to 2,726. Nasdaq 100 futures rose 32.50 points, or 0.5%, to 6,820.50. The Dow and S&P 500 closed higher on Thursday, inspired by upbeat labor-market data and after St. Louis Federal Reserve President James Bullard tried to cool expectations over faster-than-expected interest rates.

Asian stocks advanced in morning trading Friday, rebounding from broad selling a day earlier, after the Dow Jones Industrial Average reversed some of its midweek pullback. Rebounds are a broad theme across asset classes as the week comes to an end. Oil prices rose about 1.5% Thursday, helping Asian energy stocks Friday, while the yen gained momentum yesterday following its own recent pause.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.