- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-07-2018

"China, the European Union and others have been manipulating their currencies and interest rates lower, while the U.S. is raising rates while the dollars gets stronger and stronger with each passing day - taking away our big competitive edge. As usual, not a level playing field…"

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 41.4 | -0.16(-0.39%) | 9447 |

| ALTRIA GROUP INC. | MO | 56.9 | -0.04(-0.07%) | 1662 |

| Amazon.com Inc., NASDAQ | AMZN | 1,820.41 | 7.44(0.41%) | 38399 |

| American Express Co | AXP | 100 | -0.17(-0.17%) | 3019 |

| Apple Inc. | AAPL | 191.65 | -0.23(-0.12%) | 112944 |

| AT&T Inc | T | 31.33 | 0.06(0.19%) | 58387 |

| Barrick Gold Corporation, NYSE | ABX | 12.48 | 0.14(1.13%) | 5900 |

| Boeing Co | BA | 353.01 | -2.32(-0.65%) | 6386 |

| Caterpillar Inc | CAT | 138.51 | -0.91(-0.65%) | 2886 |

| Chevron Corp | CVX | 121.49 | -0.18(-0.15%) | 2350 |

| Cisco Systems Inc | CSCO | 42.23 | -0.17(-0.40%) | 17515 |

| Citigroup Inc., NYSE | C | 68.8 | -0.19(-0.28%) | 10736 |

| Exxon Mobil Corp | XOM | 81.67 | -0.34(-0.41%) | 2305 |

| Facebook, Inc. | FB | 208.67 | 0.58(0.28%) | 115045 |

| FedEx Corporation, NYSE | FDX | 236.03 | -0.52(-0.22%) | 140 |

| Ford Motor Co. | F | 10.73 | 0.06(0.56%) | 88807 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.05 | 0.25(1.58%) | 33330 |

| General Electric Co | GE | 13.71 | -0.02(-0.15%) | 8467846 |

| General Motors Company, NYSE | GM | 39.48 | 0.17(0.43%) | 2530 |

| Goldman Sachs | GS | 228.9 | -0.73(-0.32%) | 2766 |

| Google Inc. | GOOG | 1,185.51 | -1.45(-0.12%) | 4869 |

| Home Depot Inc | HD | 202.05 | -0.58(-0.29%) | 1277 |

| HONEYWELL INTERNATIONAL INC. | HON | 151.1 | 3.56(2.41%) | 26958 |

| Intel Corp | INTC | 51.85 | -0.13(-0.25%) | 39512 |

| International Business Machines Co... | IBM | 149.1 | -0.14(-0.09%) | 6110 |

| Johnson & Johnson | JNJ | 125.65 | -0.29(-0.23%) | 3349 |

| JPMorgan Chase and Co | JPM | 109.5 | -0.39(-0.35%) | 9719 |

| Merck & Co Inc | MRK | 62.19 | -0.32(-0.51%) | 779 |

| Microsoft Corp | MSFT | 108.09 | 3.69(3.53%) | 793084 |

| Nike | NKE | 76.6 | -0.35(-0.45%) | 7047 |

| Pfizer Inc | PFE | 37.29 | -0.07(-0.19%) | 1018 |

| Procter & Gamble Co | PG | 78.61 | -0.12(-0.15%) | 3013 |

| Starbucks Corporation, NASDAQ | SBUX | 51.15 | -0.19(-0.37%) | 5997 |

| Tesla Motors, Inc., NASDAQ | TSLA | 320.7 | 0.47(0.15%) | 29993 |

| The Coca-Cola Co | KO | 45.15 | 0.04(0.09%) | 5133 |

| Travelers Companies Inc | TRV | 124.45 | -0.73(-0.58%) | 305 |

| Twitter, Inc., NYSE | TWTR | 43.4 | -0.04(-0.09%) | 59429 |

| United Technologies Corp | UTX | 130.1 | -0.26(-0.20%) | 2015 |

| Verizon Communications Inc | VZ | 50.63 | -0.12(-0.24%) | 1983 |

| Visa | V | 140 | -0.13(-0.09%) | 6667 |

| Wal-Mart Stores Inc | WMT | 87.57 | -0.15(-0.17%) | 3333 |

| Walt Disney Co | DIS | 112.4 | 0.27(0.24%) | 8885 |

| Yandex N.V., NASDAQ | YNDX | 36.71 | 0.22(0.60%) | 12051 |

Amazon (AMZN) target raised to $2100 from $1900 at Telsey Advisory Group

-

More Rate Rises Could Invert Bond Market Yield Curve

Sales rose in 8 of 11 subsectors, representing 70% of retail trade.

Higher sales at motor vehicle and parts dealers and at gasoline stations were the main contributors to the gain in May. Excluding these two subsectors, retail sales were up 0.9%.

After removing the effects of price changes, retail sales in volume terms increased 2.0%.

Sales at motor vehicle and parts dealers (+3.7%) made almost a full rebound following a 3.8% decline in April, which had unseasonably cool temperatures and inclement weather in many parts of the country.

The Consumer Price Index (CPI) rose 2.5% on a year-over-year basis in June, following a 2.2% increase in May. This is the largest year-over-year increase in the CPI since February 2012.

This month's year-over-year CPI increase follows a year of gradual acceleration in consumer price inflation, from a recent low of 1.0% year over year in June 2017. This trend reflects increases in prices for gasoline and food purchased from restaurants, as well as offsetting factors such as lower price inflation for electricity and telephone services. These movements coincide with recent improvements in the economy and the labour market, as well as an increase in oil prices.

Seven of eight major components rose year over year. The transportation index (+6.6%) was the largest contributor to the year-over-year increase, while the household operations, furnishings and equipment index (-0.1%) was the lone major component to decline.

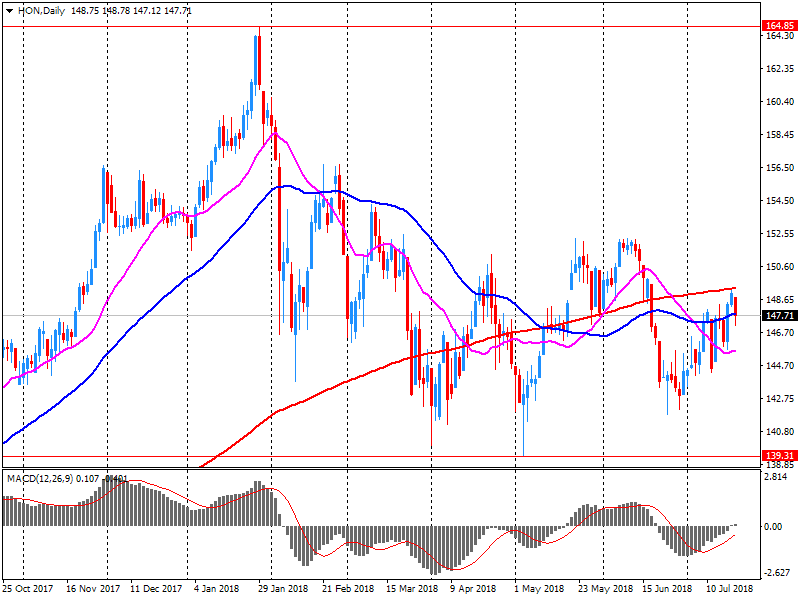

Honeywell (HON) reported Q2 FY 2018 earnings of $2.12 per share (versus $1.80 in Q2 FY 2017), beating analysts' consensus estimate of $2.01.

The company's quarterly revenues amounted to $10.919 bln (+8.3% y/y), beating analysts' consensus estimate of $10.801 bln.

The company also raised guidance for FY 2018, projecting EPS of $8.05-8.15 (versus analysts' consensus estimate of $8.02 and its prior guidance of $8.05-8.15) and revenues $43.1-43.6 bln (versus analysts' consensus estimate of $43.14 bln and its prior guidance of $42.7-43.5 bln).

HON rose to $152.00 (+3.02%) in pre-market trading.

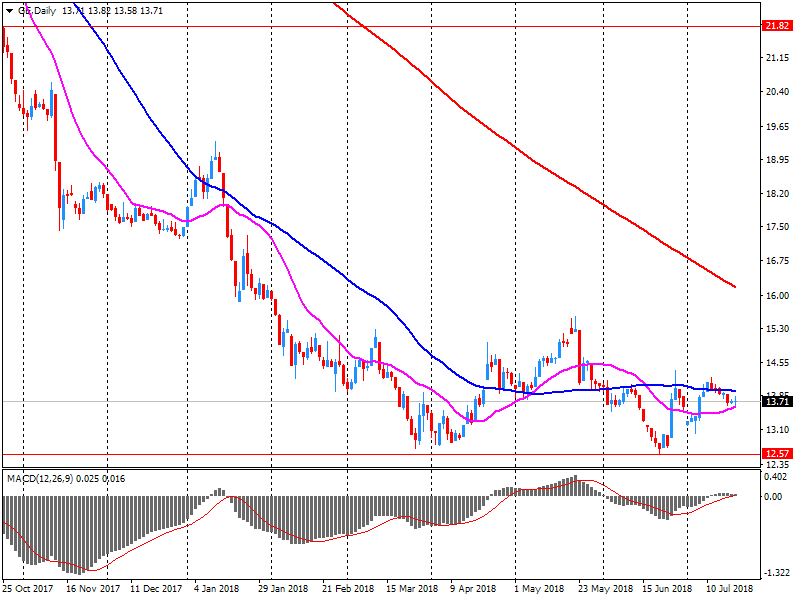

General Electric (GE) reported Q2 FY 2018 earnings of $0.19 per share (versus $0.21 in Q2 FY 2017), beating analysts' consensus estimate of $0.17.

The company's quarterly revenues amounted to $30.104 bln (+3.5% y/y), beating analysts' consensus estimate of $29.393 bln.

The company also reaffirmed guidance for FY 2018, projecting EPS of $1.00-1.07versus analysts' consensus estimate of $0.94.

GE rose to $13.92 (+1.38%) in pre-market trading.

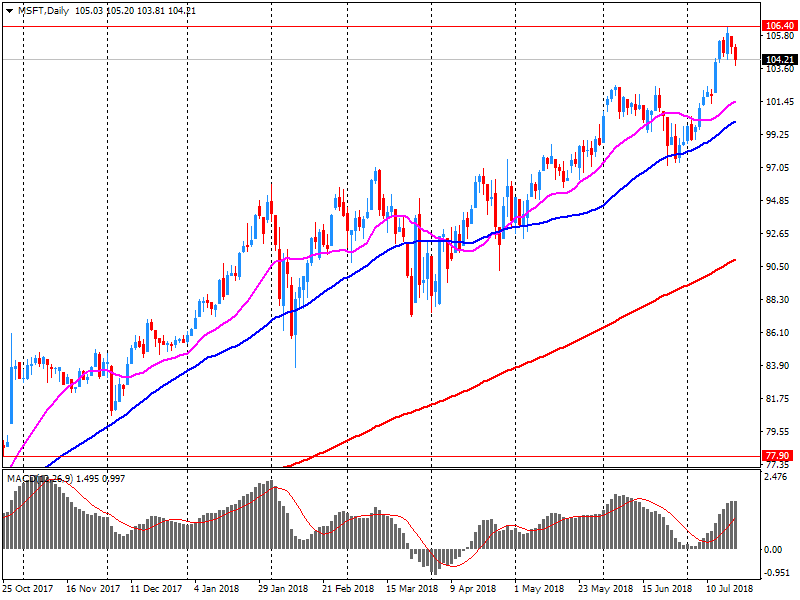

Microsoft (MSFT) reported Q2 FY 2018 earnings of $1.14 per share (versus $0.75 in Q2 FY 2017), beating analysts' consensus estimate of $1.08.

The company's quarterly revenues amounted to $30.085 bln (+17.5% y/y), beating analysts' consensus estimate of $29.227 bln.

MSFT rose to $107.85 (+3.30%) in pre-market trading.

Public sector net borrowing (excluding public sector banks) in the latest full financial year (April 2017 to March 2018) was £39.4 billion; that is, £6.3 billion less than in the previous financial year (April 2016 to March 2017) and £5.8 billion less than official (Office for Budget Responsibility) expectations; this is the lowest net borrowing since the financial year ending March 2007.

Public sector net borrowing (excluding public sector banks) decreased by £0.8 billion to £5.4 billion in June 2018, compared with June 2017; this is the lowest June net borrowing since 2016.

Public sector net debt (excluding public sector banks) was £1,792.3 billion at the end of June 2018, equivalent to 85.2% of gross domestic product (GDP), an increase of £33.0 billion (or a decrease of 1.0 percentage points as a ratio of GDP) on June 2017.

His comments, which sent the dollar down, departed from a convention in which presidents have refrained from speaking specifically on monetary policy.

In the 12-month period to May 2018, the current account recorded a surplus of €406 billion (3.6% of euro area GDP), compared with one of €360 billion (3.2% of euro area GDP) in the 12-month period to May 2017.

In the financial account, euro area residents made net acquisitions of foreign portfolio investment securities of €548 billion in the 12-month period to May 2018 (increasing from €476 billion in the 12 months to May 2017), while non-residents' net purchases of euro area portfolio investment securities amounted to €216 billion in the 12 months to May 2018 (up from €189 billion in the 12-month period to May 2017).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1792 (3613)

$1.1770 (3026)

$1.1727 (886)

Price at time of writing this review: $1.1648

Support levels (open interest**, contracts):

$1.1601 (3135)

$1.1566 (3769)

$1.1527 (2500)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 13 is 86931 contracts (according to data from July, 19) with the maximum number of contracts with strike price $1,1850 (5145);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3197 (437)

$1.3166 (705)

$1.3118 (288)

Price at time of writing this review: $1.3012

Support levels (open interest**, contracts):

$1.2957 (2191)

$1.2928 (1635)

$1.2896 (2325)

Comments:

- Overall open interest on the CALL options with the expiration date August, 13 is 23817 contracts, with the maximum number of contracts with strike price $1,3600 (3206);

- Overall open interest on the PUT options with the expiration date August, 13 is 27078 contracts, with the maximum number of contracts with strike price $1,2950 (2325);

- The ratio of PUT/CALL was 1.14 versus 1.11 from the previous trading day according to data from July, 19.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Consumer prices in Japan were up 0.7 percent on year in June, the Ministry of Internal Affairs and Communications said on Friday.

That was unchanged from the May reading, although it was shy of expectations for 0.8 percent.

Core CPI, which excludes food prices, was up an annual 0.8 percent - in line with expectations and up from 0.7 percent in the previous month.

Both overall and core CPI were up 0.1 percent on month.

In June 2018 the index of producer prices for industrial products rose by 3.0% compared with the corresponding month of the preceding year. In May the annual rate of change all over had been 2.7%, as reported by the Federal Statistical Office (Destatis).

Compared with the preceding month May the overall index rose by 0.3% in June 2018 (+0.5% in May 2018 and in April 2018).

In June 2018 the price indices of all main industrial groups increased compared with June 2017: Energy prices were up 6.2%, though the development of prices of the different energy carriers diverged. Prices of petroleum products were up 16.9%, whereas prices of electricity increased by 7.5% and prices of natural gas (distribution) rose by 2.5%. Prices of intermediate goods were up 3.2%. Prices of non-durable consumer goods rose by 0.5% and of durable consumer goods by 1.6%, whereas prices of capital goods increased by 1.3%.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.