- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-07-2017

(raw materials / closing price /% change)

Oil 46.93 +0.02%

Gold 1,243.90 -0.13%

(index / closing price / change items /% change)

Nikkei +123.73 20144.59 +0.62%

TOPIX +11.14 1633.01 +0.69%

Hang Seng +68.05 26740.21 +0.26%

CSI 300 +18.13 3747.88 +0.49%

Euro Stoxx 50 -0.79 3499.49 -0.02%

FTSE 100 +56.96 7487.87 +0.77%

DAX -4.80 12447.25 -0.04%

CAC 40 -16.85 5199.22 -0.32%

DJIA -28.97 21611.78 -0.13%

S&P 500 -0.38 2473.45 -0.02%

NASDAQ +4.96 6390.00 +0.08%

S&P/TSX +19.93 15264.64 +0.13%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1631 +0,99%

GBP/USD $1,2972 -0,38%

USD/CHF Chf0,95095 -0,43%

USD/JPY Y111,84 -0,02%

EUR/JPY Y130,10 +0,96%

GBP/JPY Y145,086 -0,41%

AUD/USD $0,7955 +0,05%

NZD/USD $0,7400 +0,60%

USD/CAD C$1,25873 -0,11%

08:30 United Kingdom PSNB, bln June -5.99 -4.3

12:30 Canada Retail Sales YoY May 7%

12:30 Canada Retail Sales, m/m May 0.8% 0.2%

12:30 Canada Retail Sales ex Autos, m/m May 1.5% 0.0%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y June 0.9%

12:30 Canada Consumer price index, y/y June 1.3% 1.1%

12:30 Canada Consumer Price Index m / m June 0.1% 0.0%

17:00 U.S. Baker Hughes Oil Rig Count July 765

Major US stock indexes finished the session almost unchanged, which was due to the fall of the industrial goods sector and the disappointing returns of some large companies.

As the report presented by the Federal Reserve Bank of Philadelphia showed, the index of business activity in the production sector fell in June, reaching a level of 19.5 points compared to 27.6 points in June. Economists had expected a decline to 24 points. The index is the results of a survey of manufacturers in Philadelphia for their attitude to the current economic situation. The indicator is published a little earlier than the index of purchasing managers ISM and can give an idea of what the indicator of business activity at the national level will be. The values of the index above zero indicate an expansion in the industry, below zero the reduction.

In addition, the number of Americans applying for unemployment benefits declined in mid-July and fluctuated at almost 44-year low, reflecting the healthiest labor market in the last ten years. Initial applications for unemployment benefits in the period from July 9 to July 15 fell by 15,000 to 233,000, taking into account seasonal fluctuations, the report of the Ministry of Labor said on Thursday. This corresponds to the second level since the recession of 2007-09.

Most components of the DOW index recorded a rise (17 out of 30). Leader of the growth were shares of NIKE, Inc. (NKE, + 2.27%). Outsider was the shares of The Home Depot, Inc. (HD, -4.01%).

Most sectors of S & P completed the auction in positive territory. The healthcare sector grew most (+ 0.8%). The largest decrease was registered in the sector of industrial goods (-0.5%).

At closing:

DJIA -0.11% 21.616.44 -24.31

Nasdaq + 0.08% 6,390.00 +4.96

S & P -0.00% 2,473.76 -0.07

In July 2017, the DG ECFIN flash estimate of the consumer confidence indicator remained broadly flat in the EU (-0.1 points to -2.3) and decreased slightly in the euro area (-0.4 points to -1.7) compared to June.

EURUSD: 1.1400 (EUR 745m) 1.1500 (835m)

USDJPY: 111.45-55 (USD 1.25bln) 111.65 (460m) 112.00 (390m)

GBPUSD: 1.3000 (GBP 360m) 1.3100 (400m) 1.3400 (395m)

EURGBP: 0.8785 (EUR 440m) 0.8800 (1.2bln) 0.8810 (870m) 0.8850 (770m)

U.S. stock-index futures rose slightly as investors focused on latest data from the U.S. labour market, Q2 earnings reports and the European Central Bank and the Bank of Japan's decisions to leave their policies unchanged.

Global Stocks:

Nikkei 20,144.59 +123.73 +0.62%

Hang Seng 26,740.21 +68.05 +0.26%

Shanghai 26,740.21 +68.05 +0.26%

S&P/ASX 5,761.45 +29.33 +0.51%

FTSE 7,482.56 +51.65 +0.70%

CAC 5,220.64 +4.57 +0.09%

DAX 12,509.52 +57.47 +0.46%

Crude $47.63 (+0.66%)

Gold $1,237.80 (-0.34%)

Manufacturing activity in the region continues to grow but at a slower pace, according to results from the July Manufacturing Business Outlook Survey.

The diffusion indexes for general activity, new orders, shipments, employment, and work hours remained positive but fell from their readings in June. Respondents also reported a moderation of price pressures this month. Firms remained generally optimistic about future growth. More than one-third of the manufacturers expect to add to their payrolls over the next six months.

The index for current manufacturing activity in the region decreased from a reading of 27.6 in June to 19.5 this month. The index has been positive for 12 consecutive months, but July's reading is the lowest since November. Thirty-seven percent of the firms indicated increases in activity in July, down from 42 percent last month. The shipments index decreased 16 points, while the new orders index fell 24 points. Nearly 31 percent of the respondents reported a rise in new orders this month, down from 45 percent in June. Both the delivery times and unfilled orders indexes were positive for the ninth consecutive month, suggesting longer delivery times and increases in unfilled orders.

(company / ticker / price / change ($/%) / volume)

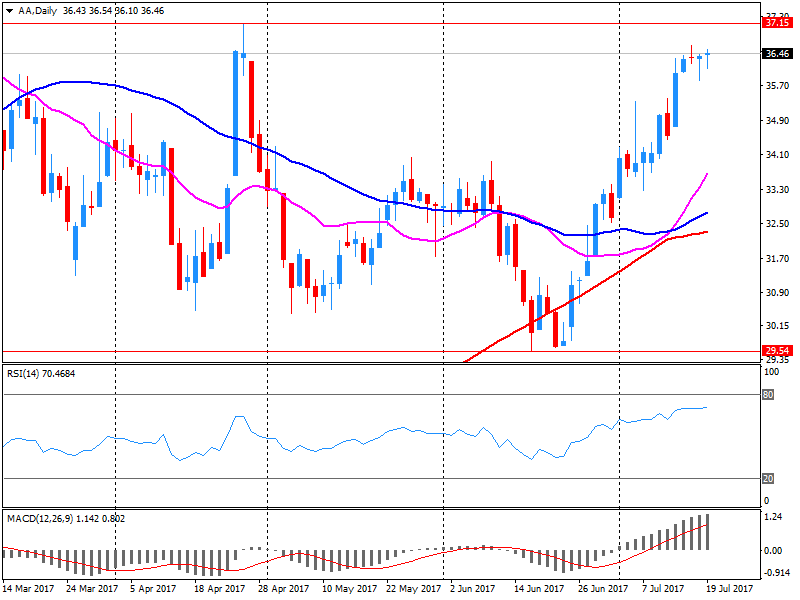

| ALCOA INC. | AA | 35.65 | -0.85(-2.33%) | 17410 |

| ALTRIA GROUP INC. | MO | 73.15 | -0.40(-0.54%) | 2720 |

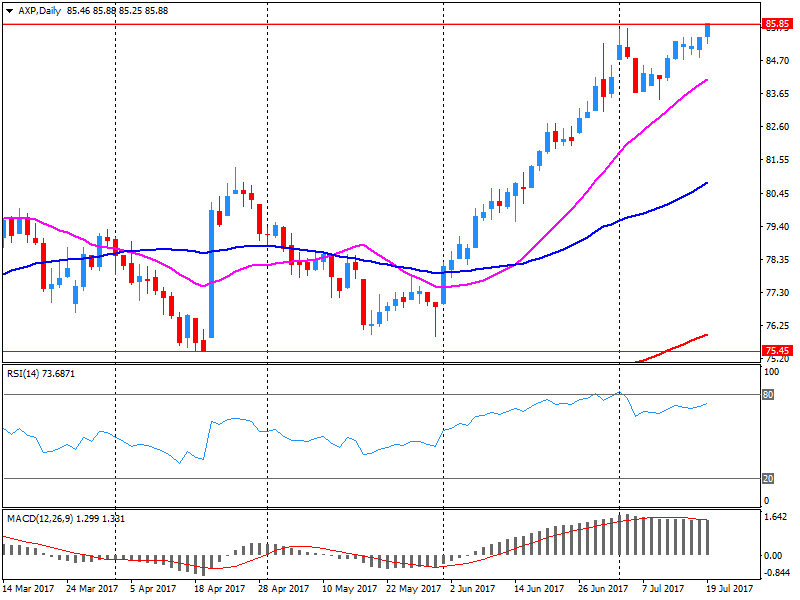

| American Express Co | AXP | 84.3 | -1.63(-1.90%) | 14991 |

| Apple Inc. | AAPL | 151.29 | 0.27(0.18%) | 55953 |

| AT&T Inc | T | 36.25 | 0.12(0.33%) | 18564 |

| Barrick Gold Corporation, NYSE | ABX | 16.12 | -0.01(-0.06%) | 16107 |

| Boeing Co | BA | 211.25 | 0.37(0.18%) | 430 |

| Cisco Systems Inc | CSCO | 32 | 0.10(0.31%) | 1269 |

| Citigroup Inc., NYSE | C | 66.55 | -0.15(-0.22%) | 867 |

| E. I. du Pont de Nemours and Co | DD | 85.58 | 0.23(0.27%) | 1455 |

| Exxon Mobil Corp | XOM | 81 | 0.15(0.19%) | 4670 |

| Ford Motor Co. | F | 11.75 | 0.07(0.60%) | 62153 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.15 | 0.04(0.31%) | 3318 |

| General Electric Co | GE | 27 | 0.06(0.22%) | 46449 |

| Google Inc. | GOOG | 973 | 2.11(0.22%) | 1484 |

| Hewlett-Packard Co. | HPQ | 18.95 | 0.25(1.34%) | 15411 |

| Home Depot Inc | HD | 153 | -0.30(-0.20%) | 4056 |

| International Business Machines Co... | IBM | 147.6 | 0.07(0.05%) | 2290 |

| Johnson & Johnson | JNJ | 135.5 | 0.29(0.21%) | 425 |

| McDonald's Corp | MCD | 154.3 | 0.41(0.27%) | 603 |

| Microsoft Corp | MSFT | 74.15 | 0.29(0.39%) | 101380 |

| Nike | NKE | 59.15 | 1.38(2.39%) | 31701 |

| Pfizer Inc | PFE | 33.33 | -0.29(-0.86%) | 3955 |

| Starbucks Corporation, NASDAQ | SBUX | 57.98 | -0.13(-0.22%) | 7898 |

| Tesla Motors, Inc., NASDAQ | TSLA | 326.75 | 1.49(0.46%) | 40150 |

| The Coca-Cola Co | KO | 44.85 | 0.02(0.04%) | 850 |

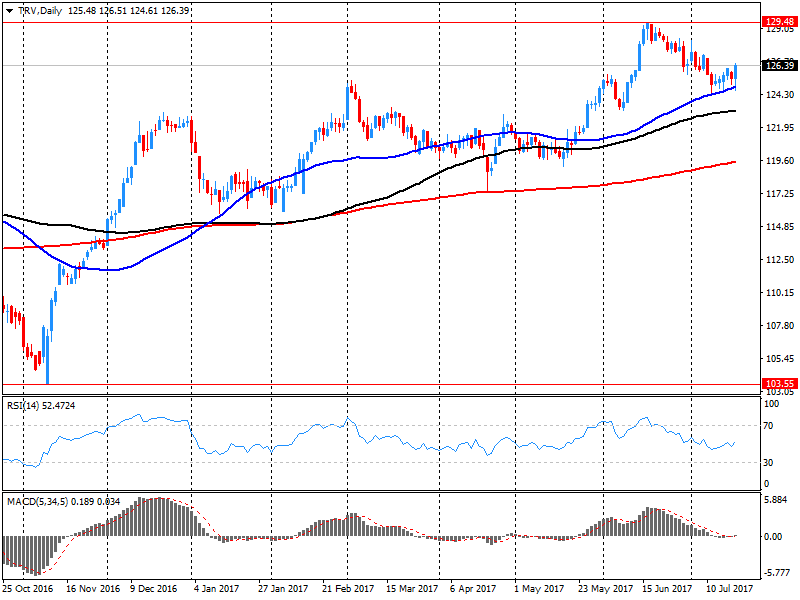

| Travelers Companies Inc | TRV | 124.5 | -1.96(-1.55%) | 401 |

| Twitter, Inc., NYSE | TWTR | 20.18 | 0.06(0.30%) | 4893 |

| Visa | V | 98.8 | 0.55(0.56%) | 18976 |

| Wal-Mart Stores Inc | WMT | 75.64 | -0.23(-0.30%) | 815 |

| Walt Disney Co | DIS | 106.85 | 0.03(0.03%) | 394 |

| Yandex N.V., NASDAQ | YNDX | 31.01 | -0.09(-0.29%) | 1050 |

-

Draghi says headline inflation dampened by energy prices

-

Global recovery should lend support to trade

-

Global recorvery supporting euro zone exports

-

Sluggish reforms dampen growth prospects

-

Cyclical momentum raises chances of stronger upswing

-

Headline inflation likely to remain at current levels in coming months

-

Downside risks relate to global factors

Tesla (TSLA) initiated with a Neutral at Citigroup; target $357

-

Monetary policy has continued to secure very favourable financing conditions needed

-

Growth yet to translate into stronger inflation dynamics

-

Considers risks to growth outlook broadly balanced

Johnson & Johnson (JNJ) resumed with a Outperform at Credit Suisse; target $148

Pfizer (PFE) downgraded to Neutral from Outperform at Credit Suisse

NIKE (NKE) upgraded Overweight from Equal-Weight at Morgan Stanley; target $68

HP (HPQ) upgraded to Outperform at RBC Capital Mkts; target raised to $22 from $21

Travelers (TRV) reported Q2 FY 2017 earnings of $1.92 per share (versus $2.20 in Q2 FY 2016), missing analysts' consensus estimate of $2.14.

The company's quarterly revenues amounted to $6.351 bln (+4.7% y/y), generally in-line with analysts' consensus estimate of $6.314 bln.

TRV fell to $124.50 (-1.55%).in pre-market trading.

American Express (AXP) reported Q2 FY 2017 earnings of $1.47 per share (versus $2.10 in Q2 FY 2016), beating analysts' consensus estimate of $1.44.

The company's quarterly revenues amounted to $8.307 bln (+0.9% y/y), beating analysts' consensus estimate of $8.205 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $5.60-5.80 analysts' consensus estimate of $5.70.

AXP fell to $84.90 (-1.2%) in pre-market trading.

"At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively.

The Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases".

Alcoa (AA) reported Q2 FY 2017 earnings of $0.62 per share (versus $0.15 in Q2 FY 2016), beating analysts' consensus estimate of $0.58.

The company's quarterly revenues amounted to $2.859 bln (+23.1% y/y), slightly missing analysts' consensus estimate of $2.879 bln.

AA fell to $35.70 (-2.19%) in pre-market trading.

-

Says very important to keep United States oriented towards open free trade

In the 3 months to June 2017, the quantity bought (volume) in the retail industry is estimated to have increased by 1.5%, with increases seen across all store types.

The growth for Quarter 2 (Apr to June) 2017 follows a decline of 1.4% in Quarter 1 (Jan Mar) 2017, meaning we are broadly at the same level as at the start of 2017.

Compared with May 2017, the quantity bought increased by 0.6%, with non-food stores providing the main contribution.

Feedback from retailers suggests that warmer weather in addition to the introduction of summer clothing helped boost clothing sales.

Average store prices (including petrol stations) increased by 2.7% on the year following a rise of 3.2% in May 2017; the fall is a consequence of slowing fuel prices.

Online sales (excluding automotive fuel) increased year-on-year by 15.9% and by 1.8% on the month, accounting for approximately 16.2% of all retail spending.

This reflected surpluses for goods (€26.9 billion), primary income (€11.4 billion) and services (€2.6 billion), which were partly offset by a deficit for secondary income (€10.7 billion).

The 12-month cumulated current account for the period ending in May 2017 recorded a surplus of €348.7 billion (3.2% of euro area GDP), compared with one of €371.0 billion (3.5% of euro area GDP) for the 12 months to May 2016 (see Table 1 and Chart 1). This development was due to decreases in the surpluses for goods (from €364.9 billion to €348.0 billion) and services (from €65.4 billion to €49.1 billion), and an increase in the deficit for secondary income (from €121.4 billion to €142.0 billion). These were partly offset by an increase in the surplus for primary income (from €62.1 billion to €93.6 billion).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1605 (5063)

$1.1588 (2722)

$1.1568 (2975)

Price at time of writing this review: $1.1515

Support levels (open interest**, contracts):

$1.1450 (1007)

$1.1417 (2400)

$1.1379 (2781)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 4 is 68455 contracts (according to data from July, 19) with the maximum number of contracts with strike price $1,1500 (5063);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3134 (2201)

$1.3112 (2249)

$1.3082 (1699)

Price at time of writing this review: $1.3021

Support levels (open interest**, contracts):

$1.2968 (346)

$1.2940 (384)

$1.2907 (1226)

Comments:

- Overall open interest on the CALL options with the expiration date August, 4 is 26966 contracts, with the maximum number of contracts with strike price $1,3100 (3031);

- Overall open interest on the PUT options with the expiration date August, 4 is 25655 contracts, with the maximum number of contracts with strike price $1,2800 (2958);

- The ratio of PUT/CALL was 0.95 versus 0.92 from the previous trading day according to data from July, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

In the first six months of 2017, both exports (+ 4.4%) and imports (+ 4.8%) rose considerably. While the former record a new record, the imports record the highest value in 8 years. In both trading directions, the chemical-pharmaceutical products made a significant contribution to overall growth. The trade balance closed with a surplus of 19 billion francs.

In June 2017 the index of producer prices for industrial products rose by 2.4% compared with the corresponding month of the preceding year. In May 2017 the annual rate of change all over had been 2.8%, as reported by the Federal Statistical Office.

Compared with the preceding month May 2017 the overall index remained unchanged in June 2017 (-0.2% in May and +0.4 in April).

In June 2017 the price indices of all main industrial groups increased compared with June 2016: Prices of non-durable consumer goods rose by 3.9%, prices of intermediate goods by 3.2%. Energy prices rose by 1.6%, though the development of prices of the different energy carriers diverged. Prices of electricity increased by 4.3% and prices of petroleum products by 1.6%, whereas prices of natural gas (distribution) decreased by 6.1%. Prices of durable consumer goods and prices of capital goods increased each by 1.0%.

Seasonally adjusted estimates (monthly change):

Employment increased 14,000 to 12,166,900. Full-time employment increased 62,000 to 8,356,000 and part-time employment decreased 48,000 to 3,810,800.

Unemployment increased 13,100 to 728,100. The number of unemployed persons looking for full-time work increased 9,200 to 500,600 and the number of unemployed persons only looking for part-time work increased 3,900 to 227,500.

Unemployment rate remained steady at 5.6%, following a revised may 2017 estimate.

Participation rate increased by 0.1 pts to 65%.

Monthly hours worked in all jobs increased 8.9 million hours (0.5%) to 1,703.5 million hours.

Trend estimates (monthly change):

Employment increased 26,400 to 12,160,100.

Unemployment decreased 3,700 to 726,800.

Unemployment rate decreased less than 0.1 pts to 5.6%.

Participation rate remained steady at 64.9%.

Monthly hours worked in all jobs increased 6.2 million hours (0.4%) to 1,691.5 million hours.

"At the Monetary Policy Meeting held today, the Policy Board of the Bank of Japan decided upon the following.

(1) Yield curve control The Bank decided, by a 7-2 majority vote, to set the following guideline for market operations for the intermeeting period. The short-term policy interest rate: The Bank will apply a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank. The long-term interest rate:

The Bank will purchase Japanese government bonds (JGBs) so that 10-year JGB yields will remain at around zero percent. With regard to the amount of JGBs to be purchased, the Bank will conduct purchases at more or less the current pace -- an annual pace of increase in the amount outstanding of its JGB holdings of about 80 trillion yen -- aiming to achieve the target level of the long-term interest rate specified by the guideline.

(2) Guidelines for asset purchases With regard to asset purchases other than JGB purchases, the Bank decided, by a 7-2 majority vote, to set the following guidelines.

a) The Bank will purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs) so that their amounts outstanding will increase at annual paces of about 6 trillion yen and about 90 billion yen, respectively.

b) As for CP and corporate bonds, the Bank will maintain their amounts outstanding at about 2.2 trillion yen and about 3.2 trillion yen, respectively".

Equity markets in Asia extended overnight gains in the U.S. early Thursday, lifted by expectations of upbeat earnings reports and higher oil prices, though investor caution over central-bank action has capped the upside. Investors were awaiting central-bank decisions by the Bank of Japan - which maintained its monetary policy Thursday and pushed back its inflation goal - and the European Central Bank, due later in the day. While the banks were widely expected to stand pat, the focus now is on any fresh guidance from the ECB toward tighter monetary policy.

European stocks finished with solid gains Wednesday, carried by well-received corporate earnings reports including from Swedish appliance maker Electrolux AB, while a more than $4 billion deal drew Reckitt Benckiser Group PLC shares higher .

U.S. stock-index gauges on Wednesday carved out fresh all-time highs, with the Dow joining the S&P 500 and Nasdaq at records. Better-than-expected results from Morgan Stanley helped to reaffirm optimism about the current economy and earnings season-factors crucial to supporting current levels considered lofty.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.