- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-04-2018

The major stock indexes of the US ended the session on negative territory amid a fall in the share of consumer goods producers, and as energy companies suffered from a drop in oil prices after President Donald Trump criticized OPEC for artificially high prices.

Recall Trump wrote in his Twitter: "It seems that OPEC has again taken on its own." Despite the record oil reserves around the world, including sea tankers packed to the brim with black gold, oil prices are INCREDIBLY high! It's wrong and unacceptable! ". Trump's tweets were published after representatives of the leading oil-producing countries at a meeting in Saudi Arabia confirmed their determination to keep production restrictions.

Most components of the DOW index recorded a decline (24 out of 30). Outsider were the shares of Apple Inc. (AAPL, -4.02%). The leader of growth was shares of General Electric Company (GE, + 3.93%) ..

Almost all sectors of S & P finished trading in the red. The largest decrease was shown by the consumer goods sector (-1.7%). Only the conglomerate sector grew (+ 1.1%).

At closing:

Dow -0.82% 24.462.94 -201.95

Nasdaq -1.27% 7,146.13 -91.93

S & P-0.85% 2,670.14 -22.99

-

Support continuation of very accommodative monentary policy in Europe

U.S. stock-index futures flat on Friday, as strong quarterly results from General Electritwc (GE; +5.8%) and Honeywell (HON; +2.3%) were overshadowed by a plunge in crude oil prices after the U.S. President Trump's critics of OPEC in Twitter for artificially high prices.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,162.24 | -28.94 | -0.13% |

| Hang Seng | 30,418.33 | -290.11 | -0.94% |

| Shanghai | 3,071.47 | -45.90 | -1.47% |

| S&P/ASX | 5,868.80 | -12.20 | -0.21% |

| FTSE | 7,352.09 | +23.17 | +0.32% |

| CAC | 5,401.71 | +10.07 | +0.19% |

| DAX | 12,530.35 | -37.07 | -0.29% |

| Crude | $67.85 | | -0.70% |

| Gold | $1,343.60 | | -0.39% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 219.26 | -0.26(-0.12%) | 1166 |

| ALCOA INC. | AA | 61.47 | 2.07(3.48%) | 91523 |

| ALTRIA GROUP INC. | MO | 61 | -0.50(-0.81%) | 4904 |

| Amazon.com Inc., NASDAQ | AMZN | 1,557.62 | 29.78(1.95%) | 146299 |

| American Express Co | AXP | 98.33 | 3.18(3.34%) | 22091 |

| Apple Inc. | AAPL | 174.73 | -3.11(-1.75%) | 467644 |

| AT&T Inc | T | 35.2 | -0.01(-0.03%) | 4800 |

| Barrick Gold Corporation, NYSE | ABX | 13.3 | 0.04(0.30%) | 4370 |

| Boeing Co | BA | 340 | -1.00(-0.29%) | 2311 |

| Caterpillar Inc | CAT | 156.03 | 0.08(0.05%) | 2826 |

| Chevron Corp | CVX | 124.68 | 0.86(0.69%) | 1057 |

| Cisco Systems Inc | CSCO | 44.49 | -0.14(-0.31%) | 3688 |

| Citigroup Inc., NYSE | C | 68.9 | -0.08(-0.12%) | 3314 |

| Exxon Mobil Corp | XOM | 79.74 | 0.52(0.66%) | 5167 |

| Facebook, Inc. | FB | 166.1 | -0.26(-0.16%) | 47522 |

| FedEx Corporation, NYSE | FDX | 253.1 | -2.43(-0.95%) | 202 |

| Ford Motor Co. | F | 11.2 | 0.02(0.18%) | 55556 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.29 | 0.11(0.57%) | 9723 |

| General Electric Co | GE | 13.7 | 0.04(0.29%) | 52196 |

| General Motors Company, NYSE | GM | 38.8 | -0.13(-0.33%) | 602 |

| Goldman Sachs | GS | 253.2 | -0.80(-0.32%) | 2809 |

| Google Inc. | GOOG | 1,072.39 | 0.31(0.03%) | 6487 |

| Home Depot Inc | HD | 179.8 | -0.05(-0.03%) | 1768 |

| HONEYWELL INTERNATIONAL INC. | HON | 150 | 0.63(0.42%) | 658 |

| Intel Corp | INTC | 52.83 | -0.78(-1.45%) | 167937 |

| International Business Machines Co... | IBM | 149.1 | 0.31(0.21%) | 40569 |

| Johnson & Johnson | JNJ | 127.64 | -0.08(-0.06%) | 1612 |

| JPMorgan Chase and Co | JPM | 109.45 | 0.13(0.12%) | 2667 |

| McDonald's Corp | MCD | 161.7 | -0.11(-0.07%) | 412 |

| Microsoft Corp | MSFT | 96.45 | 0.01(0.01%) | 52249 |

| Pfizer Inc | PFE | 36.43 | -0.06(-0.16%) | 7460 |

| Procter & Gamble Co | PG | 75.75 | -1.73(-2.24%) | 84531 |

| Starbucks Corporation, NASDAQ | SBUX | 59.4 | -0.10(-0.17%) | 2850 |

| Tesla Motors, Inc., NASDAQ | TSLA | 292.28 | -1.07(-0.36%) | 24075 |

| Twitter, Inc., NYSE | TWTR | 31.4 | -0.14(-0.44%) | 114957 |

| Visa | V | 124.5 | 0.02(0.02%) | 1400 |

| Wal-Mart Stores Inc | WMT | 88.02 | 0.45(0.51%) | 11310 |

| Walt Disney Co | DIS | 101.4 | 0.19(0.19%) | 429 |

| Yandex N.V., NASDAQ | YNDX | 35.7 | 0.72(2.06%) | 172493 |

Procter & Gamble (PG) downgraded to Neutral from Buy at BofA/Merrill

Procter & Gamble (PG) downgraded to Hold from Buy at Deutsche Bank

Twitter (TWTR) upgraded to Buy from Neutral at MKM Partners; target $40

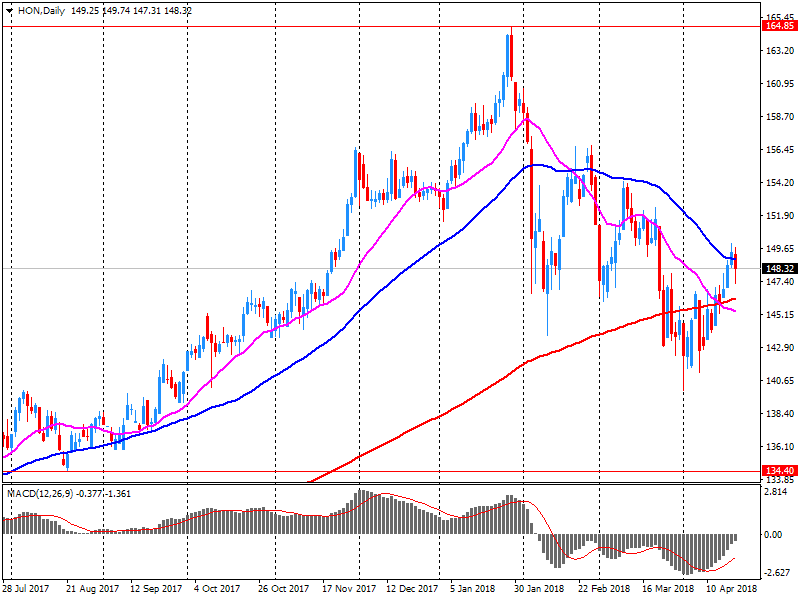

Honeywell (HON) reported Q1 FY 2018 earnings of $1.95 per share (versus $1.66 in Q1 FY 2017), beating analysts' consensus estimate of $1.90.

The company's quarterly revenues amounted to $10.392 bln (+9.5% y/y), beating analysts' consensus estimate of $10.028 bln.

The company raised FY2018 EPS guidance to $7.85-8.05 from $7.75-8.00 (versus analysts' consensus estimate of $7.95) and increased FY 2018 revenues guidance to $42.7-43.5 bln from $41.8-42.5 bln (versus analysts' consensus estimate of $42.23 bln).

For Q2, the company projects EPS of $1.97-2.03 versus analysts' consensus estimate of $2.00 and revenues of $10.7-10.8 bln versus analysts' consensus estimate of $10.6 bln.

HON rose to $150.50 (+1.60%) in pre-market trading.

Higher sales at new car dealers and general merchandise stores were the main contributors to the gain.

Sales were up in 4 of 11 subsectors, representing 47% of retail trade. Excluding sales at motor vehicle and parts dealers, retail sales were unchanged.

After removing the effects of price changes, retail sales in volume terms increased 0.3%.

Motor vehicle and parts dealers (+1.4%) was the largest contributor in dollar terms to the increase in February. Both new (+1.8%) and used car (+3.0%) dealers reported gains after posting declines in January.

Sales at general merchandise stores (+2.0%) increased for the fourth time in five months.

After three consecutive monthly declines, sales at building material and garden equipment and supplies

dealers rose 2.1%.

The Consumer Price Index (CPI) rose 2.3% on a year-over-year basis in March, following a 2.2% increase in February. This was the largest year-over-year increase since October 2014. Excluding gasoline, the CPI increased 1.8%, matching the gain in February.

Seven of eight major components increased on a year-over-year basis in March. The clothing and footwear index (-0.1%) was the lone major component to decline year over year.

For the second consecutive month, energy prices rose more on a year-over-year basis. Gasoline prices were 17.1% higher compared with March 2017, and were the largest contributor to the gain in energy prices.

The price of services was up 2.7% year over year in March. Passenger vehicle insurance premiums rose 1.4% in the 12 months to March. Recent interest rate increases continue to impact the mortgage interest cost index (+2.8%), which posted its eighth consecutive year-over-year rise.

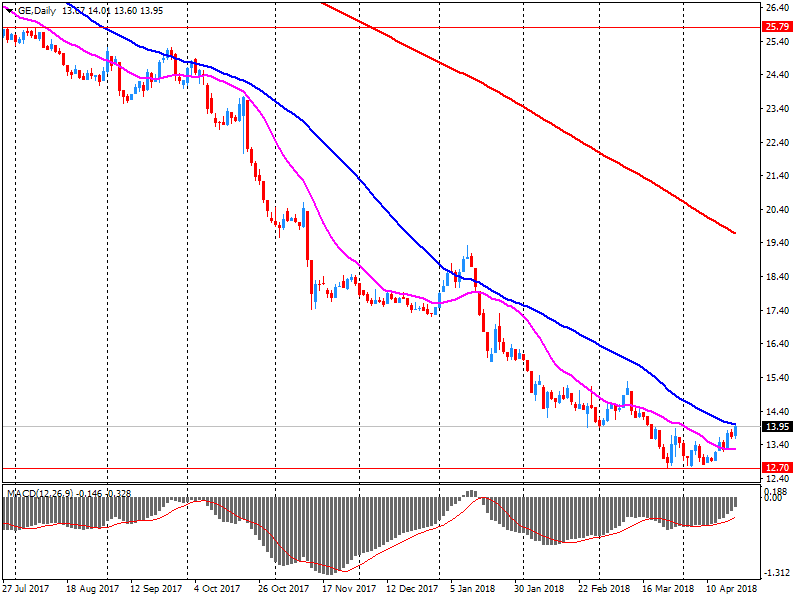

General Electric (GE) reported Q1 FY 2018 earnings of $0.16 per share (versus $0.21 in Q1 FY 2017), beating analysts' consensus estimate of $0.11.

The company's quarterly revenues amounted to $28.660 bln (+6.6% y/y), beating analysts' consensus estimate of $27.260 bln.

The company also reaffirmed guidance for FY 2018, projecting EPS of $1.00-1.07 versus analysts' consensus estimate of $0.95.

GE rose to $14.77 (5.58%) in pre-market trading.

-

We continue to monitor rising production from non-participating countries such as U.S. shale

-

OPEC, non-OPEC compliance with cuts in march was 149 pct

-

Expects labour market inflation pressures to be a bit greater than boe forecast in february

-

"Quite a wide range" of tightening paths would count as gradual vs past average of 100 bps over 8 months

-

Neutral interest rate in UK is not static, likely to be around 2 pct over next few years

-

Pace of further UK rate increases likely to be "gradual", not "glacial"

EUR/USD

Resistance levels (open interest**, contracts)

$1.2460 (3700)

$1.2419 (1397)

$1.2393 (215)

Price at time of writing this review: $1.2338

Support levels (open interest**, contracts):

$1.2302 (3705)

$1.2269 (3844)

$1.2231 (4240)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date May, 4 is 77456 contracts (according to data from April, 19) with the maximum number of contracts with strike price $1,2250 (4240);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4198 (1969)

$1.4177 (931)

$1.4146 (883)

Price at time of writing this review: $1.4061

Support levels (open interest**, contracts):

$1.4012 (1200)

$1.3983 (1860)

$1.3950 (1658)

Comments:

- Overall open interest on the CALL options with the expiration date May, 4 is 21599 contracts, with the maximum number of contracts with strike price $1,4400 (3404);

- Overall open interest on the PUT options with the expiration date May, 4 is 25094 contracts, with the maximum number of contracts with strike price $1,3850 (2494);

- The ratio of PUT/CALL was 1.16 versus 1.11 from the previous trading day according to data from April, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

In March 2018 the index of producer prices for industrial products rose by 1.9% compared with the corresponding month of the preceding year. In February the annual rate of change all over had been 1.8%, as reported by the Federal Statistical Office (Destatis).

Compared with the preceding month February the overall index rose slightly by 0.1% in March 2018 (-0.1% in February 2018 and +0.5% in January 2018).

In March 2018 the price indices of all main industrial groups increased compared with March 2017: Energy prices were up 2.4%, though the development of prices of the different energy carriers diverged. Prices of electricity increased by 5.5%, whereas prices of petroleum products were up 1.3% and prices of natural gas (distribution) rose by 0.2%. Prices of intermediate goods were up 2.3%. Prices of non-durable consumer goods rose by 1.4% and of durable consumer goods by 1.3%, whereas prices of capital goods increased by 1.2%.

Overall consumer prices in Japan were up 1.1 percent on year in March, says rttnews.

That was in line with expectations and down from 1.5 percent in February.

Core CPI, which excludes volatile food prices, gained an annual 0.9 percent - again matching forecasts and down from 1.0 percent in the previous month.

On a monthly basis, overall inflation fell 0.4 percent and core CPI was down 0.1 percent.

-

Says gradual rate hikes would help avoid overheating, financial stability risks

-

Sees more than 2.5 pct gdp growth this year

-

U.S. Is "slightly beyond" full employment

-

Monetary policy and financial conditions still accommodative

-

Protectionism was focus of G20 debate on risks to global economy

-

No specific discussions on fx at G20

-

Told G20 repercussions from excess production in some emerging economies may be partly behind protectionism

-

Says still have relatively fragile situation despite weakening

-

Says franc remains a safe haven

-

Franc hitting 1.20 per euro goes in the right direction

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.