- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-12-2018

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Unemployment rate | November | 5% | 5% |

| 00:30 | Australia | Changing the number of employed | November | 32.8 | 20 |

| 03:00 | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | |

| 04:30 | Japan | All Industry Activity Index, m/m | October | -0.9% | 2% |

| 06:30 | Japan | BOJ Press Conference | |||

| 07:00 | Switzerland | Trade Balance | November | 2.64 | |

| 09:00 | Eurozone | Current account, unadjusted, bln | October | 24.1 | |

| 09:30 | United Kingdom | Retail Sales (YoY) | November | 2.2% | 1.9% |

| 09:30 | United Kingdom | Retail Sales (MoM) | November | -0.5% | 0.3% |

| 11:00 | United Kingdom | CBI retail sales volume balance | December | 19 | 16 |

| 12:00 | United Kingdom | BoE Interest Rate Decision | 0.75% | 0.75% | |

| 12:00 | United Kingdom | Asset Purchase Facility | 435 | 435 | |

| 12:00 | United Kingdom | Bank of England Minutes | |||

| 13:30 | Canada | Wholesale Sales, m/m | October | -0.5% | 0.4% |

| 13:30 | U.S. | Continuing Jobless Claims | December | 1661 | 1665 |

| 13:30 | U.S. | Philadelphia Fed Manufacturing Survey | December | 12.9 | 15 |

| 13:30 | U.S. | Initial Jobless Claims | December | 206 | 216 |

| 15:00 | U.S. | Leading Indicators | November | 0.1% | 0.1% |

| 23:30 | Japan | National CPI Ex-Fresh Food, y/y | November | 1% | 1% |

| 23:30 | Japan | National Consumer Price Index, y/y | November | 1.4% |

Major US stock indexes fell sharply on Wednesday, the reason for which were the outcome of the Fed meeting.

As expected, the Fed raised the interest rate range to 2.25% -2.5% and signaled that a further increase in rates would be made at a slower rate. According to forecasts of the Central Bank, 11 out of 17 managers believe that the Fed will only need to increase rates two times next year, whereas only 7 of the 16 participants in the meeting adhered to this opinion in September. Only 6 executives believe the Fed should raise rates three times or more in 2019 against 9 executives in September. Meanwhile, the median forecast at the neutral rate was lowered to 2.75% from 3%. Thus, now the Fed is separated from this neutral level by only one rate increase. Fed officials also slightly lowered forecasts for GDP growth for the current year, to 3% from 3.1%, and for 2019, to 2.3% from 2.5%. The unemployment forecast was lowered to 4.4% from 4.5%, and the forecast for long-term GDP growth was raised to 1.9% from 1.8%.

Some attention was also attracted data on the US housing market. Housing sales in the secondary US market rose unexpectedly in November, but recorded the largest annual decline in the last 7.5 years, adding to other data that painted a grim picture of the housing market. The National Association of Realtors said that home sales on the secondary market increased by 1.9%, to a seasonally adjusted annual rate of 5.32 million units. The October sales rate was 5.22 million units. Economists had forecast that sales of homes on the secondary market would fall by 0.6%, to 5.20 million units.

In annual terms, sales in the secondary market, which account for about 90% of US home sales, fell by 7.0% in November, which was the largest annual decline since May 2011. Meanwhile, sales fell by 2.3% in the first 11 months of this year compared with the same period last year.

Almost all DOW components recorded a decline (27 of 30). Intel Corporation (INTC, -4.28%) turned out to be an outsider. The growth leader was Verizon Communications Inc. (VZ, + 0.52%).

All sectors of the S & P finished trading in the red. The service sector fell the most (-1.8%).

At the time of closing:

Dow 23,323.66 -351.98 -1.49%

S & P 500 2,506.96 -39.20 -1.54%

Nasdaq 100 6,636.83 -147.08 -2.17%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Unemployment rate | November | 5% | 5% |

| 00:30 | Australia | Changing the number of employed | November | 32.8 | 20 |

| 03:00 | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | |

| 04:30 | Japan | All Industry Activity Index, m/m | October | -0.9% | 2% |

| 06:30 | Japan | BOJ Press Conference | |||

| 07:00 | Switzerland | Trade Balance | November | 2.64 | |

| 09:00 | Eurozone | Current account, unadjusted, bln | October | 24.1 | |

| 09:30 | United Kingdom | Retail Sales (YoY) | November | 2.2% | 1.9% |

| 09:30 | United Kingdom | Retail Sales (MoM) | November | -0.5% | 0.3% |

| 11:00 | United Kingdom | CBI retail sales volume balance | December | 19 | 16 |

| 12:00 | United Kingdom | BoE Interest Rate Decision | 0.75% | 0.75% | |

| 12:00 | United Kingdom | Asset Purchase Facility | 435 | 435 | |

| 12:00 | United Kingdom | Bank of England Minutes | |||

| 13:30 | Canada | Wholesale Sales, m/m | October | -0.5% | 0.4% |

| 13:30 | U.S. | Continuing Jobless Claims | December | 1661 | 1665 |

| 13:30 | U.S. | Philadelphia Fed Manufacturing Survey | December | 12.9 | 15 |

| 13:30 | U.S. | Initial Jobless Claims | December | 206 | 216 |

| 15:00 | U.S. | Leading Indicators | November | 0.1% | 0.1% |

| 23:30 | Japan | National CPI Ex-Fresh Food, y/y | November | 1% | 1% |

| 23:30 | Japan | National Consumer Price Index, y/y | November | 1.4% |

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 0.5 million barrels from the previous week. At 441.5 million barrels, U.S. crude oil inventories are about 7% above the five year average for this time of year.

Total motor gasoline inventories increased by 1.8 million barrels last week and are about 3% above the five year average for this time of year. Finished gasoline and blending components inventories both increased last week.

Distillate fuel inventories decreased by 4.2 million barrels last week and are about 11% below the five year average for this time of year. Propane/propylene inventories decreased by 3.3 million barrels last week and are about 6% below the five year average for this time of year. Total commercial petroleum inventories decreased last week by 10.3 million barrels last week.

Three of four major U.S. regions saw gains in sales activity last month.

Total existing-home sales1, completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 1.9 percent from October to a seasonally adjusted rate of 5.32 million in November. Sales are now down 7.0 percent from a year ago (5.72 million in November 2017).

Lawrence Yun, NAR’s chief economist, says two consecutive months of increases is a welcomed sign for the market. “The market conditions in November were mixed, with good signs of stabilizing home sales compared to recent months, though down significantly from one year ago. Rising inventory is clearly taming home price appreciation.”

U.S. stock-index futures rose on Wednesday, as investors hoped that the Federal Reserve could decide to slow the pace of its interest rate hikes in 2019.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,987.92 | -127.53 | -0.60% |

Hang Seng | 25,865.39 | +51.14 | +0.20% |

Shanghai | 2,549.56 | -27.09 | -1.05% |

S&P/ASX | 5,580.60 | -8.90 | -0.16% |

FTSE | 6,761.98 | +60.39 | +0.90% |

CAC | 4,778.98 | +24.90 | +0.52% |

DAX | 10,797.70 | +56.81 | +0.53% |

Crude | $46.77 | +1.15% | |

Gold | $1,252.40 | -0.10% |

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC. | MO | 51.15 | 0.26(0.51%) | 7131 |

Amazon.com Inc., NASDAQ | AMZN | 1,550.94 | -0.54(-0.03%) | 59880 |

American Express Co | AXP | 99.56 | -1.46(-1.45%) | 2175 |

Apple Inc. | AAPL | 166.31 | 0.24(0.14%) | 101003 |

AT&T Inc | T | 29.8 | 0.05(0.17%) | 32692 |

Barrick Gold Corporation, NYSE | ABX | 13.44 | -0.44(-3.17%) | 250486 |

Boeing Co | BA | 330.59 | 2.53(0.77%) | 16345 |

Caterpillar Inc | CAT | 124.3 | 0.03(0.02%) | 4141 |

Cisco Systems Inc | CSCO | 44.15 | 0.09(0.20%) | 6899 |

Citigroup Inc., NYSE | C | 54.05 | 0.12(0.22%) | 27084 |

Exxon Mobil Corp | XOM | 72.5 | 0.50(0.69%) | 1987 |

Facebook, Inc. | FB | 141.15 | -2.51(-1.75%) | 213325 |

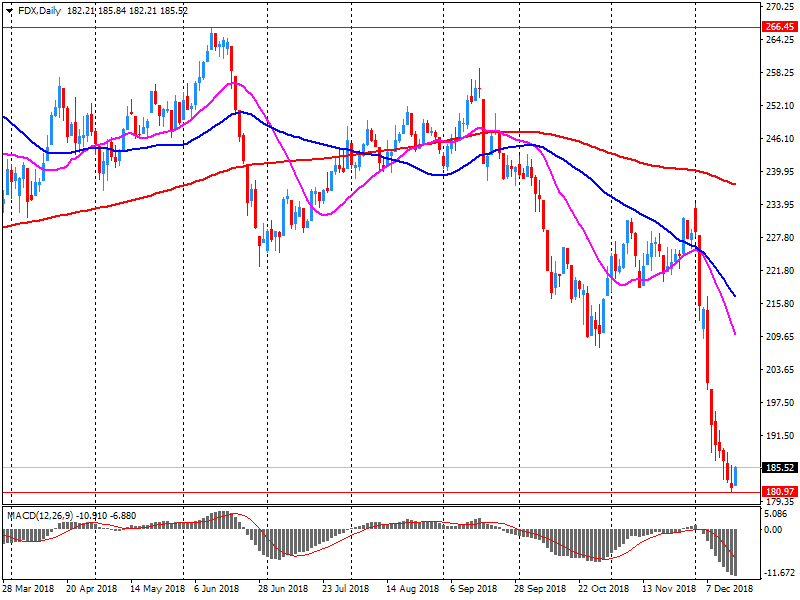

FedEx Corporation, NYSE | FDX | 170.9 | -14.11(-7.63%) | 81673 |

Ford Motor Co. | F | 8.52 | 0.05(0.59%) | 41550 |

General Electric Co | GE | 7.63 | 0.36(4.95%) | 2883965 |

General Motors Company, NYSE | GM | 35.01 | 0.11(0.32%) | 3200 |

Goldman Sachs | GS | 171.49 | -0.01(-0.01%) | 5300 |

Google Inc. | GOOG | 1,034.13 | 5.42(0.53%) | 5671 |

Home Depot Inc | HD | 170.75 | 0.71(0.42%) | 436 |

Intel Corp | INTC | 47.84 | 0.10(0.21%) | 36618 |

International Business Machines Co... | IBM | 116.9 | 0.25(0.21%) | 5976 |

Johnson & Johnson | JNJ | 130.3 | -0.12(-0.09%) | 27121 |

JPMorgan Chase and Co | JPM | 98.48 | -0.06(-0.06%) | 15750 |

McDonald's Corp | MCD | 180.4 | 0.69(0.38%) | 598 |

Merck & Co Inc | MRK | 75.08 | 0.75(1.01%) | 127 |

Microsoft Corp | MSFT | 104.25 | 0.28(0.27%) | 75276 |

Pfizer Inc | PFE | 42.99 | 0.59(1.39%) | 30357 |

Procter & Gamble Co | PG | 92.7 | 0.21(0.23%) | 301 |

Tesla Motors, Inc., NASDAQ | TSLA | 339.54 | 2.51(0.74%) | 37687 |

The Coca-Cola Co | KO | 48.33 | 0.01(0.02%) | 460 |

Twitter, Inc., NYSE | TWTR | 33.68 | -0.06(-0.18%) | 13581 |

Verizon Communications Inc | VZ | 55.66 | 0.01(0.02%) | 5747 |

Visa | V | 133 | 0.34(0.26%) | 2216 |

Walt Disney Co | DIS | 109.75 | 0.30(0.27%) | 1708 |

Yandex N.V., NASDAQ | YNDX | 27.23 | 0.03(0.11%) | 2000 |

American Express (AXP) downgraded to Neutral from Buy at Bank of America/Merrill Lynch

The U.S. current-account deficit increased to $124.8 billion (preliminary) in the third quarter of 2018 from $101.2 billion (revised) in the second quarter of 2018, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit was 2.4 percent of current-dollar gross domestic product (GDP) in the third quarter, up from 2.0 percent in the second quarter.

The $23.6 billion increase in the current-account deficit mainly reflected a $24.0 billion increase in the deficit on goods.

This is the smallest year-over-year increase in the CPI since January 2018, primarily reflecting recent declines in gasoline prices. Excluding gasoline, the CPI rose 1.9% in November.

All eight major components rose year over year. The shelter index (+2.4%) was the largest contributor to the increase. Recent interest rate increases continued to impact the mortgage interest cost index (+7.2%) in November, which recorded its largest year-over-year gain since October 2008.

Energy costs declined 1.3% compared with November 2017, following a year-over-year increase (+7.9%) in October. Gasoline prices fell 5.4% year over year, as declining global crude oil prices led to lower prices at the pump and the first 12-month decrease in the gasoline index since June 2017. Similarly, the year-over-year gain in the price of fuel oil and other fuels was smaller in November (+17.0%) than in October (+25.0%).

FedEx (FDX) reported Q2 FY 2019 earnings of $4.03 per share (versus $3.18 in Q2 FY 2018), beating analysts’ consensus estimate of $3.93.

The company’s quarterly revenues amounted to $17.800 bln (+9.1% y/y), beating analysts’ consensus estimate of $17.616 bln.

The company also issued downside guidance for FY 2019 primarily due to European weakness, projecting EPS of $15.50-16.60 versus its prior guidance of $17.20-17.80 and analysts’ consensus estimate of $17.33.

FDX fell to $170.75 (-7.71%) in pre-market trading.

U.S. Trade ambassador says China seeking to "outright steal" technology in strategic industries and dump its products on U.S. Markets. Says "this is not acceptable"

The survey of 346 manufacturers found that output growth picked up in the three months to December, rising further above the long-run average. Output expanded in 15 out of 17 sub-sectors, with growth driven predominantly by the food, drink, & tobacco, mechanical engineering, and chemicals sub-sectors. However, firms expect output growth to slow somewhat over the next three months.

Total order books remained firm in December, staying well above their long-run average. Export order books improved noticeably and are now at their strongest since January this year.

Expectations for output price inflation were slightly higher this month, above the long-run average. However, they remain below the highs seen at the turn of 2018. At the same time, the level of stocks was reported to be broadly adequate, having generally remained at this level since July.

This is the lowest annual growth for the UK since July 2013, when house prices increased by 2.3%.

House prices grew fastest in the North West region, increasing by 4.9% in the year to October 2018. House prices in London fell by 1.7% in the year to October 2018. London house prices have been falling over the year each month since July 2018.

The Bank of England November inflation report highlights that the slowdown in the London market since mid 2016 is probably due to the area being disproportionately affected by regulatory and tax changes, and also by lower net migration from the European Union.

The headline rate of output inflation for goods leaving the factory gate was 3.1% on the year to November 2018, down from 3.3% in October 2018.

The growth rate of prices for materials and fuels used in the manufacturing process slowed to 5.6% on the year to November 2018, down from 10.3% in October 2018.

All product groups provided upward contributions to output and input annual inflation.

Crude oil provided the largest contribution to the change in the annual rate of input inflation.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) 12-month inflation rate was 2.2% in November 2018, unchanged from October 2018.

The largest downward contributions to change in the 12-month rate came from falls in petrol prices and across a variety of recreational and cultural goods and services, principally games, toys and hobbies, and cultural services.

These downward effects were offset by increased tobacco prices and, to a lesser extent, price rises in a variety of other categories, for example, accommodation services and passenger sea transport.

The Consumer Prices Index (CPI) 12-month rate was 2.3% in November 2018, down from 2.4% in October 2018.

The government's budget expenditure will rise next year to 1.106 trillion riyals ($295 billion), up more than 7% from about 1.03 trillion riyals in 2018, the country's news agency reported the Saudi ministry of finance as saying on Tuesday. Revenue will increase 9% to 975 billion riyals in 2019, the government said.

As U.S. Treasury yields continue to fall in Asia trading, with the 10-year down to a multimonth low of 2.80%, odds have risen that the Fed won't raise rates on Wednesday. Fed fund futures now show a 31% chance of no move, according to the CME.

That compares with 28% a day earlier and 24% a week earlier. President Trump was back out Tuesday saying the Fed shouldn't raise. But in light of the ongoing market volatility and oil plunging further on Tuesday, may a pause be the safer call? More than a few market participants appear to be betting so. - via WSJ

Figures compare September 2018 quarter with June 2018 quarter (unless otherwise stated):

New Zealand’s seasonally adjusted current account deficit narrowed to $2.6 billion, $102 million smaller than the June 2018 quarter deficit ($2.7 billion).

The annual current account deficit widened to $10.5 billion for the year ended September 2018 (3.6 percent of GDP) from the $7.4 billion deficit for the September 2017 year (2.7 percent of GDP).

In the September 2018 quarter:

The seasonally adjusted goods deficit narrowed to $997 million (down $343 million).

The seasonally adjusted services surplus narrowed to $1.1 billion (down $344 million).

The primary income deficit narrowed to $2.6 billion (down $65 million).

The financial account recorded a net outflow of $303 million.

There was a $6.5 billion imbalance recorded in the balance of payments

Bitcoin is above $3,700, according to CoinDesk, versus $3,574 in late New York trading and $500 above the levels seen not-quite 48 hours ago. The recent volatility is more a return to normal for bitcoin, which found itself stuck a few hundred dollars either side of $6,500 for 2 months before the bottom of the range gave way on Nov. 15.

In November 2018 the index of producer prices for industrial products rose by 3.3% compared with the corresponding month of the preceding year. In October the annual rate of change all over had been 3.3%, too, as reported by the Federal Statistical Office.

Compared with the preceding month October the overall index rose by 0.1% in November 2018 (+0.3 % in October 2018 and +0.5% in September 2018).

In November 2018 the price indices of all main industrial groups increased compared with November 2017: Energy prices were up 8.9%, though the development of prices of the different energy carriers diverged. Prices of petroleum products were up 19.0%, whereas prices of natural gas (distribution) rose by 8.5% and prices of electricity increased by 8.3%. Prices of intermediate goods were up 2.4%. Prices of durable consumer goods rose by 1.8%, of capital goods by 1.5% and prices of non-durable consumer goods by 0.4%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1492 (861)

$1.1475 (208)

$1.1452 (143)

Price at time of writing this review: $1.1398

Support levels (open interest**, contracts):

$1.1354 (2818)

$1.1321 (6916)

$1.1282 (5069)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 7 is 69854 contracts (according to data from December, 18) with the maximum number of contracts with strike price $1,1500 (7114);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2841 (831)

$1.2781 (515)

$1.2727 (189)

Price at time of writing this review: $1.2674

Support levels (open interest**, contracts):

$1.2638 (1307)

$1.2615 (1315)

$1.2588 (1582)

Comments:

- Overall open interest on the CALL options with the expiration date January, 7 is 33427 contracts, with the maximum number of contracts with strike price $1,3400 (3834);

- Overall open interest on the PUT options with the expiration date January, 7 is 30449 contracts, with the maximum number of contracts with strike price $1,2450 (2890);

- The ratio of PUT/CALL was 0.91 versus 0.92 from the previous trading day according to data from December, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 55.94 | -4.93 |

| WTI | 46.21 | -6.72 |

| Silver | 14.61 | -0.2 |

| Gold | 1249.342 | 0.29 |

| Palladium | 1246.91 | -0.28 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -391.43 | 21115.45 | -1.82 |

| Hang Seng | -273.73 | 25814.25 | -1.05 |

| KOSPI | -8.98 | 2062.11 | -0.43 |

| ASX 200 | -68.8 | 5589.5 | -1.22 |

| FTSE 100 | -71.65 | 6701.59 | -1.06 |

| DAX | -31.31 | 10740.89 | -0.29 |

| Dow Jones | 82.66 | 23675.64 | 0.35 |

| S&P 500 | 0.22 | 2546.16 | 0.01 |

| NASDAQ Composite | 30.18 | 6783.91 | 0.45 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.7183 | 0.1 |

| EURJPY | 127.861 | -0.12 |

| EURUSD | 1.1363 | 0.15 |

| GBPJPY | 142.211 | -0.07 |

| GBPUSD | 1.26386 | 0.2 |

| NZDUSD | 0.68474 | 0.65 |

| USDCAD | 1.34651 | 0.43 |

| USDCHF | 0.99271 | -0.04 |

| USDJPY | 112.519 | -0.27 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.