- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-07-2018

| Raw materials | Closing price | % change |

| Oil | 69.40 | +0.93% |

| Gold | 1,223.30 | -0.37% |

| Index | Change items | Closing price | % change |

| Nikkei | -29.51 | 22764.68 | -0.13% |

| TOPIX | -1.62 | 1749.59 | -0.09% |

| Hang Seng | -106.56 | 28010.86 | -0.38% |

| CSI 300 | -2.98 | 3428.34 | -0.09% |

| Euro Stoxx 50 | -13.44 | 3471.64 | -0.39% |

| FTSE 100 | +7.69 | 7683.97 | +0.10% |

| DAX | -79.65 | 12686.29 | -0.62% |

| CAC 40 | -30.37 | 5417.07 | -0.56% |

| DJIA | -134.79 | 25064.50 | -0.53% |

| S&P 500 | -11.13 | 2804.49 | -0.40% |

| NASDAQ | -29.15 | 7825.30 | -0.37% |

| Pare | Closed | % change |

| EUR/USD | $1,1635 | -0,07% |

| GBP/USD | $1,3016 | -0,44% |

| USD/CHF | Chf0,99894 | +0,04% |

| USD/JPY | Y112,43 | -0,36% |

| EUR/JPY | Y130,92 | -0,35% |

| GBP/JPY | Y146,333 | -0,81% |

| AUD/USD | $0,7357 | -0,52% |

| NZD/USD | $0,6748 | -0,67% |

| USD/CAD | C$1,32661 | +0,74% |

The main US stock indices have moderately decreased amid a multitude of weak quarterly reports and a continuing tension due to the trade war.

Investors' attention was also attracted by the statements of US President Trump, who noted that he would not like to see a further increase in the Fed's rates. "I am dissatisfied with this rate hike," Trump said, "In the past, US presidents tried to refrain from commenting on monetary policy." The Fed has raised rates twice this year and has planned two more increases by the end of the year. "Trump said his displeasure is due to the fact that each time the economic situation improves, "they want to raise rates again." He noted that he will not interfere in the work of the Fed.

A certain influence on the course of trading was provided by the US data. The report presented by the Federal Reserve Bank of Philadelphia showed that the index of business activity in the production sector increased in July, reaching a level of 25.7 points compared to 19.9 points in June. Economists had expected the growth of the indicator only to the level of 21.5 points.

At the same time, in June the index of leading indicators (LEI) from the Conference Board increased by 0.5 percent to 109.8 (2016 = 100), after an unchanged value in May and growth of 0.4% in April. "LEI increased in June, indicating continued steady growth in the US economy," said Ataman Ozildirim, director of business cycles and growth research at the Conference Board. "The broad growth of leading indicators, with the exception of housing permits, which once again declined, does not imply a significant slowdown in growth in the short term."

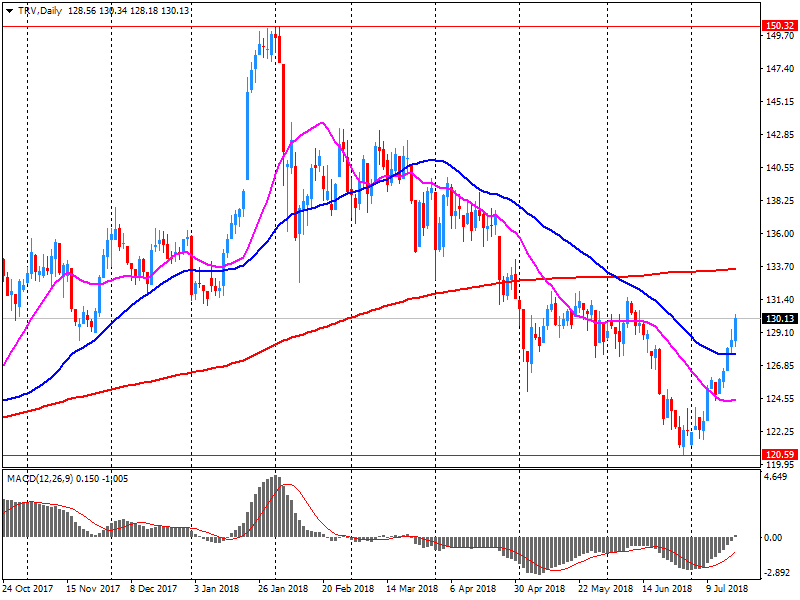

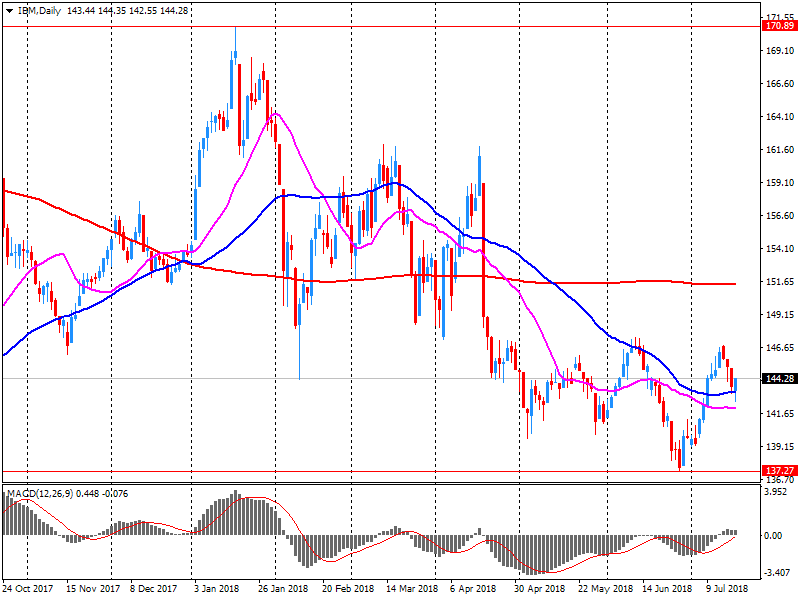

Most of the components of DOW finished trading in the red (21 of 30). The leader of growth was the shares of International Business Machines Corporation (IBM, + 3.25%). Outsider were the shares of The Travelers Companies, Inc. (TRV, -3.81%).

Most S & P sectors recorded a decline. The largest decline was shown by the financial sector (-0.8%). The utilities sector grew most (+ 0.7%).

At closing:

Dow 25,064.50 -134.79 -0.53%

S&P 500 2,804.49 -11.13 -0.40%

Nasdaq 100 7,825.30 -29.15 -0.37%

-

Kingdom Is Not Moving to Substantially Oversupply Oil Market

U.S. stock-index futures fell on Thursday, as investors assessed mixed bag of earnings.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,764.68 | -29.51 | -0.13% |

| Hang Seng | 28,010.86 | -106.56 | -0.38% |

| Shanghai | 2,772.98 | -14.28 | -0.51% |

| S&P/ASX | 6,262.70 | +17.60 | +0.28% |

| FTSE | 7,690.33 | +14.05 | +0.18% |

| CAC | 5,424.51 | -22.93 | -0.42% |

| DAX | 12,710.52 | -55.42 | -0.43% |

| Crude | $68.23 | | -0.77% |

| Gold | $1,212.20 | | -1.28% |

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 47.2 | -0.76(-1.58%) | 6952 |

| ALTRIA GROUP INC. | MO | 56.6 | -0.83(-1.45%) | 46377 |

| Amazon.com Inc., NASDAQ | AMZN | 1,830.50 | -12.42(-0.67%) | 39060 |

| American Express Co | AXP | 99.59 | -3.39(-3.29%) | 8003 |

| Apple Inc. | AAPL | 190 | -0.40(-0.21%) | 112676 |

| AT&T Inc | T | 31.74 | 0.03(0.09%) | 12620 |

| Barrick Gold Corporation, NYSE | ABX | 12.23 | -0.29(-2.32%) | 24226 |

| Boeing Co | BA | 359 | -1.23(-0.34%) | 4806 |

| Caterpillar Inc | CAT | 139.15 | -1.11(-0.79%) | 3516 |

| Chevron Corp | CVX | 120.5 | -1.03(-0.85%) | 960 |

| Cisco Systems Inc | CSCO | 42.75 | 0.54(1.28%) | 64551 |

| Citigroup Inc., NYSE | C | 69.55 | -0.30(-0.43%) | 21485 |

| Deere & Company, NYSE | DE | 139.5 | 0.29(0.21%) | 530 |

| Exxon Mobil Corp | XOM | 81.65 | -0.57(-0.69%) | 1664 |

| Facebook, Inc. | FB | 208.75 | -0.61(-0.29%) | 48995 |

| Ford Motor Co. | F | 10.89 | 0.02(0.18%) | 55428 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.47 | -0.61(-3.57%) | 117655 |

| General Electric Co | GE | 13.73 | -0.02(-0.15%) | 28792 |

| General Motors Company, NYSE | GM | 39.95 | 0.08(0.20%) | 4454 |

| Goldman Sachs | GS | 231 | -0.24(-0.10%) | 3224 |

| Google Inc. | GOOG | 1,190.49 | -5.39(-0.45%) | 3299 |

| Intel Corp | INTC | 51.55 | -0.17(-0.33%) | 36549 |

| International Business Machines Co... | IBM | 147.6 | 3.08(2.13%) | 125199 |

| Johnson & Johnson | JNJ | 127.3 | -0.50(-0.39%) | 500 |

| JPMorgan Chase and Co | JPM | 111.15 | -0.38(-0.34%) | 12212 |

| McDonald's Corp | MCD | 157.5 | -0.43(-0.27%) | 1009 |

| Microsoft Corp | MSFT | 104.85 | -0.27(-0.26%) | 106453 |

| Nike | NKE | 76.1 | -0.49(-0.64%) | 5800 |

| Pfizer Inc | PFE | 37.56 | -0.10(-0.27%) | 1635 |

| Procter & Gamble Co | PG | 78.28 | -0.72(-0.91%) | 6477 |

| Starbucks Corporation, NASDAQ | SBUX | 51.01 | -0.14(-0.27%) | 2152 |

| Tesla Motors, Inc., NASDAQ | TSLA | 316.8 | -7.05(-2.18%) | 119494 |

| The Coca-Cola Co | KO | 45 | -0.12(-0.27%) | 110 |

| Travelers Companies Inc | TRV | 126 | -4.00(-3.08%) | 3689 |

| Twitter, Inc., NYSE | TWTR | 43.13 | -0.21(-0.48%) | 66189 |

| UnitedHealth Group Inc | UNH | 255.5 | 0.08(0.03%) | 722 |

| Verizon Communications Inc | VZ | 51 | -0.14(-0.27%) | 4262 |

| Visa | V | 141.38 | 0.48(0.34%) | 11528 |

| Wal-Mart Stores Inc | WMT | 87.9 | -0.17(-0.19%) | 700 |

| Walt Disney Co | DIS | 111.1 | 0.41(0.37%) | 16529 |

| Yandex N.V., NASDAQ | YNDX | 37.77 | -0.29(-0.76%) | 5770 |

IBM (IBM) target lowered to $178 from $182 at Stifel

IBM (IBM) target lowered to $172 from $175 at BMO Capital Mkts

IBM (IBM) target lowered to $185 from $198 at Morgan Stanley

IBM (IBM) target lowered to $150 from $160 at Deutsche Bank

Tesla (TSLA) downgraded to Underperform from Hold at Needham

Procter & Gamble (PG) downgraded to Neutral from Buy at UBS

Employment in Canada increased by 2,900 jobs from April to May according to the May ADP Canada National Employment Report.

"Job growth in Canada slowed in the month of May," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. "While construction and trade were detractors from the overall growth, we saw improved growth in information, education, and leisure and hospitality."

Regional manufacturing activity continued to expand in July, according to results from this month's Manufacturing Business Outlook Survey. All the broad indicators remained positive, with the general activity and new orders indexes improving this month. The survey's price indexes suggest widespread increases for purchased inputs, and more firms reported price increases for their own manufactured goods. Expectations for the next six months continued to moderate but remain positive overall.

The diffusion index for current general activity increased 6 points this month. Over 44 percent of the manufacturers reported increases in overall activity this month, while 19 percent reported decreases.

In the week ending July 14, the advance figure for seasonally adjusted initial claims was 207,000, a decrease of 8,000 from the previous week's revised level. This is the lowest level for initial claims since December 6, 1969 when it was 202,000. The previous week's level was revised up by 1,000 from 214,000 to 215,000. The 4-week moving average was 220,500, a decrease of 2,750 from the previous week's revised average. The previous week's average was revised up by 250 from 223,000 to 223,250.

"Thank you to Novartis for not increasing your prices on prescription drugs. Likewise to Pfizer. We are making a big push to actually reduce the prices, maybe substantially, on prescription drugs".

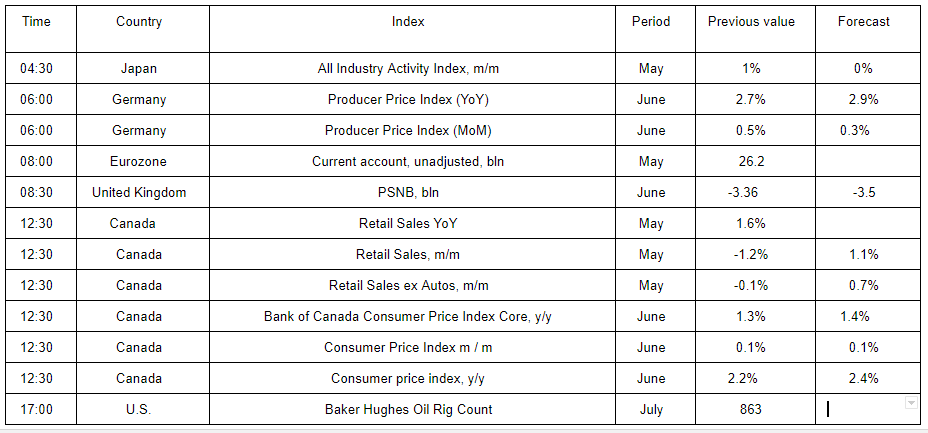

American Express (AXP) reported Q2 FY 2018 earnings of $1.84 per share (versus $1.47 in Q2 FY 2017), beating analysts' consensus estimate of $1.81.

The company's quarterly revenues amounted to $10.002 bln (+9.0% y/y), generally in-line with analysts' consensus estimate of $10.047 bln.

AXP closed Wednesday's trading session at $102.98 (+1.81%).

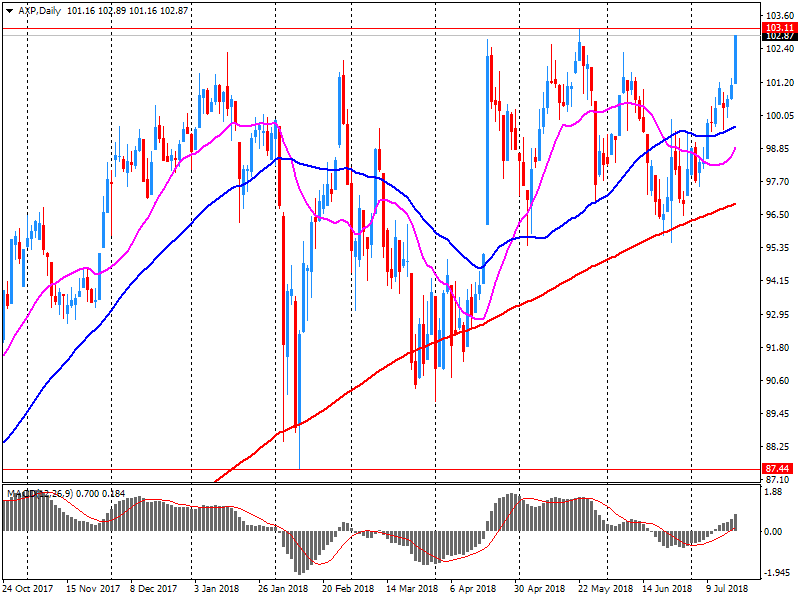

Alcoa (AA) reported Q2 FY 2018 earnings of $1.52 per share (versus $0.62 in Q2 FY 2017), beating analysts' consensus estimate of $1.32.

The company's quarterly revenues amounted to $3.579 bln (+25.2% y/y), beating analysts' consensus estimate of $3.494 bln.

AA closed Wednesday's trading session at $47.96 (-0.12%).

Travelers (TRV) reported Q2 FY 2018 earnings of $1.81 per share (versus $1.92 in Q2 FY 2017), missing analysts' consensus estimate of $2.39.

The company's quarterly revenues amounted to $6.695 bln (+5.4% y/y), generally in-line with analysts' consensus estimate of $6.664 bln.

TRV fell to $127.00 (-2.31%) in pre-market trading.

eBay (EBAY) reported Q2 FY 2018 earnings of $0.53 per share (versus $0.45 in Q2 FY 2017), beating analysts' consensus estimate of $0.51.

The company's quarterly revenues amounted to $2.640 bln (+9.10% y/y), generally in-line with analysts' consensus estimate of $2.662 bln.

The company also issued guidance for Q3, projecting EPS of $0.54-$0.56 (versus analysts' consensus estimate of $0.56) and revenues of $2.64-$2.69 bln (versus analysts' consensus estimate of $2.73 bln).

For the full 2018, the company forecast EPS of $2.28-$2.32 (versus analysts' consensus estimate of $2.27) and revenues of $10.75-$10.85 bln (versus analysts' consensus estimate of $10.95 bln).

EBAY fell to $35.56 (-6.30%) in pre-market trading.

IBM (IBM) reported Q2 FY 2018 earnings of $3.08 per share (versus $2.97 in Q2 FY 2017), beating analysts' consensus estimate of $3.04.

The company's quarterly revenues amounted to $20.003 bln (+3.7% y/y), generally in-line with analysts' consensus estimate of $19.846 bln.

IBM rose to $148.70 (+2.89%) in pre-market trading.

In the three months to June 2018, the quantity bought in retail sales increased by 2.1%; the largest increase since February 2015, with growth across all main sectors.

Food stores saw the strongest three-month on three-month growth since May 2001 at 2.2%, with feedback from supermarkets suggesting that the continued good weather and World Cup celebrations had encouraged food and drink sales.

While hot weather and World Cup celebrations increased food store sales, it was suggested by retailers that these factors resulted in a decrease in footfall in non-food stores; which, along with non-store retailing, resulted in a monthly decline of 0.5% in the quantity bought.

The decline of 0.5% in June 2018, when compared with the previous month, also followed two months of strong growth in April and May 2018.

Online sales as a total of all retailing remained unchanged at 18.0%; online spending in clothing and footwear stores continued to achieve new record proportions of online retailing, for the fourth consecutive month, at 17.5%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1795 (3308)

$1.1768 (2673)

$1.1721 (155)

Price at time of writing this review: $1.1622

Support levels (open interest**, contracts):

$1.1602 (3213)

$1.1568 (3880)

$1.1528 (2520)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 13 is 87262 contracts (according to data from July, 18) with the maximum number of contracts with strike price $1,1850 (5233);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3245 (703)

$1.3187 (727)

$1.3134 (105)

Price at time of writing this review: $1.3047

Support levels (open interest**, contracts):

$1.3008 (2085)

$1.2980 (2202)

$1.2947 (1641)

Comments:

- Overall open interest on the CALL options with the expiration date August, 13 is 23898 contracts, with the maximum number of contracts with strike price $1,3600 (3206);

- Overall open interest on the PUT options with the expiration date August, 13 is 26475 contracts, with the maximum number of contracts with strike price $1,2950 (2166);

- The ratio of PUT/CALL was 1.11 versus 1.16 from the previous trading day according to data from July, 18.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Japan posted a merchandise trade surplus of 721.408 billion yen in June, according to rttnews - up 66.5 percent on year.

That exceeded expectations for a surplus of 531.2 billion yen following the 578.3 billion yen deficit in May.

Exports advanced an annual 6.7 percent to 7.052 trillion yen - shy of forecasts for 7.0 percent and down from 8.1 percent in the previous month.

Exports to Asia were up 8.6 percent on year to 3.883 trillion yen, while exports to China alone advanced an annual 11.1 percent to 1.385 trillion yen.

Exports to the United States dipped 0.9 percent on year to 1.291 trillion yen, while exports to the European Union climbed 9.3 percent to 793.684 billion yen.

Imports were up just 2.5 percent on year to 6.330 trillion yen versus expectations for a gain of 5.3 percent and down sharply from 14.0 percent a month earlier.

-

Wage Increases Were Modest to Moderate, On Balance

-

Some Districts Report Labor Shortages 'Were Constraining Growth'

-

Prices Rose at Modest to Moderate Pace On Average

-

Tariffs Contributed to Price Increases for Metals, Lumber

-

St. Louis District Described Economic Growth as 'Slight'

-

Dallas District Sees 'Strong' Growth Partly Because of Energy Sector

-

Most Districts Said Firms Reported Difficulty Finding Qualified Labor

The growth trend in exports recorded since the beginning of 2017 also continued in the Q2 2018 continues unabated. Thus, exports rose to a renewed Quarterly high - the fifth in a row. Meanwhile, the imports stopped, after the steep Increase in the previous quarters, a breather at a high level. In the Trade balance resulted in a surplus of 4.6 billion francs. In the second quarter of 2018, exports rose seasonally adjusted by 1.4 percent (real: + 1.8 percent) continued to rise: they reached a level of 55.7 billion Franken the fifth quarterly high in succession.

The trend unemployment rate was 5.4% in the month of June 2018, according to latest figures released by the Australian Bureau of Statistics (ABS) today.

"Over the year to June, the unemployment rate declined by 0.2 percentage points. This continues a gradual decrease in the trend unemployment rate from late 2014 and is the lowest rate since January 2013," said the Chief Economist for the ABS, Bruce Hockman.

Trend employment increased by around 27,000 persons in June 2018 and the growth was evenly split between full-time and part-time employment, with both increasing by over 13,000 persons. The net increase of 27,000 persons comprised well over 300,000 people entering employment, and more than 300,000 leaving employment in the month.

The trend participation rate remained steady at 65.6 per cent in June 2018, after the May figure was revised up.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.