- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-01-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | Australia | Consumer Inflation Expectation | January | 4% | |

| 00:30 | Australia | Home Loans | November | 2.2% | -1.5% |

| 03:20 | Japan | BOJ Governor Haruhiko Kuroda Speaks | |||

| 10:00 | Eurozone | Construction Output, y/y | November | 1.8% | |

| 10:00 | Eurozone | Harmonized CPI | December | -0.2% | 0% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | December | 1% | 1% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | December | 1.9% | 1.6% |

| 11:00 | Eurozone | ECB's Lautenschläger Speech | |||

| 13:30 | U.S. | Continuing Jobless Claims | January | 1722 | 1735 |

| 13:30 | U.S. | Philadelphia Fed Manufacturing Survey | January | 9.4 | 10 |

| 13:30 | U.S. | Initial Jobless Claims | January | 216 | 220 |

| 15:45 | U.S. | FOMC Member Quarles Speaks | |||

| 21:30 | New Zealand | Business NZ PMI | December | 53.5 | |

| 23:30 | Japan | National CPI Ex-Fresh Food, y/y | December | 0.9% | 0.8% |

| 23:30 | Japan | National Consumer Price Index, y/y | December | 0.8% | 0.3% |

Major US stock indices rose moderately on Wednesday due to a rise in prices for bank shares after strong reports by Bank of America and Goldman Sachs.

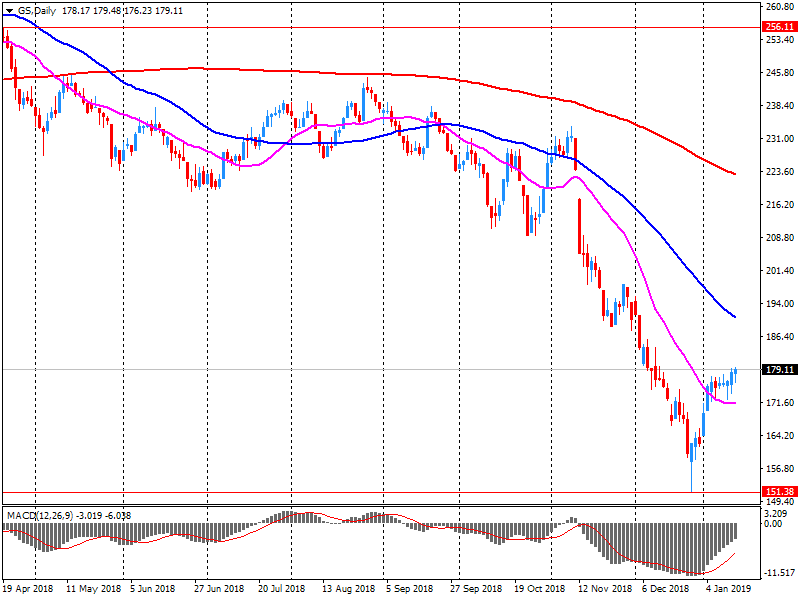

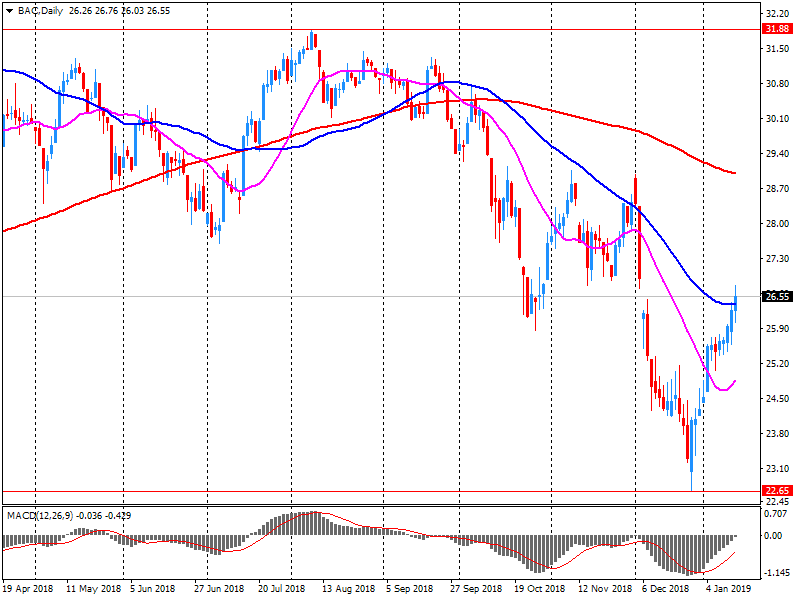

Bank of America reported a quarterly profit of $ 0.70 per share, which was $ 0.07 above the analysts' average forecast. Quarterly revenue of the bank also exceeded the average market forecast. It is worth noting that his profit has more than tripled from a year earlier. Goldman Sachs reported quarterly earnings of $ 6.04 per share, which was well above the analysts' average forecast of $ 4.78. The company's revenue also exceeded the forecast, showing an increase of 12% y / y and reaching the highest level since 2010.

Some attention was also attracted data on the US housing market. The housing market index from the National Association of Home Builders (NAHB) rose in January by 2 points, to 58 points. This happened after two months of sharp fall in sentiment, to its lowest level in the last two years. Recall that in January 2018 the index was 72 points. The value of the indicator above the level of 50 points indicates favorable prospects.

Most of the components of DOW finished trading in positive territory (17 of 30). The growth leader was The Goldman Sachs Group, Inc. (GS, + 9.92%). The outsider was Verizon Communications Inc. (VZ, -1.76%).

Most sectors of the S & P recorded an increase. The largest growth was shown by the financial sector (+ 1.5%). Consumer goods sector decreased more than the rest (-0.2%).

At the time of closing:

Dow 24,207.16 +141.57 +0.59%

S & P 500 2,616.10 +5.80 +0.22%

Nasdaq 100 7,034.69 +10.86 +0.15%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | Australia | Consumer Inflation Expectation | January | 4% | |

| 00:30 | Australia | Home Loans | November | 2.2% | -1.5% |

| 03:20 | Japan | BOJ Governor Haruhiko Kuroda Speaks | |||

| 10:00 | Eurozone | Construction Output, y/y | November | 1.8% | |

| 10:00 | Eurozone | Harmonized CPI | December | -0.2% | 0% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | December | 1% | 1% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | December | 1.9% | 1.6% |

| 11:00 | Eurozone | ECB's Lautenschläger Speech | |||

| 13:30 | U.S. | Continuing Jobless Claims | January | 1722 | 1735 |

| 13:30 | U.S. | Philadelphia Fed Manufacturing Survey | January | 9.4 | 10 |

| 13:30 | U.S. | Initial Jobless Claims | January | 216 | 220 |

| 15:45 | U.S. | FOMC Member Quarles Speaks | |||

| 21:30 | New Zealand | Business NZ PMI | December | 53.5 | |

| 23:30 | Japan | National CPI Ex-Fresh Food, y/y | December | 0.9% | 0.8% |

| 23:30 | Japan | National Consumer Price Index, y/y | December | 0.8% | 0.3% |

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.7 million barrels from the previous week. At 437.1 million barrels, U.S. crude oil inventories are about 8% above the five year average for this time of year.

Total motor gasoline inventories increased by 7.5 million barrels last week and are about 6% above the five year average for this time of year. Finished gasoline and blending components inventories both increased last week.

Distillate fuel inventories increased by 3.0 million barrels last week and are about 3% below the five year average for this time of year. Propane/propylene inventories decreased by 1.2 million barrels last week and are about 1% above the five year average for this time of year. Total commercial petroleum inventories increased last week by 5.0 million barrels last week.

U.S. stock-index futures rose slightly on Wednesday, helped by strong quarterly results from major banks like Goldman Sachs (GS) and Bank of America (BAC).

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,442.75 | -112.54 | -0.55% |

Hang Seng | 26,902.10 | +71.81 | +0.27% |

Shanghai | 2,570.42 | +0.0772 | 0.00% |

S&P/ASX | 5,835.20 | +20.60 | +0.35% |

FTSE | 6,861.48 | -33.54 | -0.49% |

CAC | 4,798.25 | +12.08 | +0.25% |

DAX | 10,908.65 | +16.86 | +0.15% |

Crude | $51.60 | -0.98% | |

Gold | $1,290.50 | +0.16% |

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 28.99 | 0.09(0.31%) | 1675 |

Amazon.com Inc., NASDAQ | AMZN | 1,683.16 | 8.60(0.51%) | 76928 |

Apple Inc. | AAPL | 153 | -0.07(-0.05%) | 202778 |

AT&T Inc | T | 30.58 | -0.02(-0.07%) | 61701 |

Cisco Systems Inc | CSCO | 44.12 | 0.10(0.23%) | 41475 |

Citigroup Inc., NYSE | C | 62.18 | 0.80(1.30%) | 138725 |

Facebook, Inc. | FB | 148.67 | -0.28(-0.19%) | 174899 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.87 | 0.30(2.59%) | 235706 |

General Electric Co | GE | 8.69 | -0.04(-0.46%) | 417054 |

Goldman Sachs | GS | 186.17 | 6.26(3.48%) | 399263 |

JPMorgan Chase and Co | JPM | 101.52 | -0.16(-0.16%) | 142677 |

Microsoft Corp | MSFT | 105.15 | 0.14(0.13%) | 102322 |

Tesla Motors, Inc., NASDAQ | TSLA | 345.78 | 1.35(0.39%) | 8115 |

Yandex N.V., NASDAQ | YNDX | 29.75 | 0.21(0.71%) | 10073 |

Citigroup (C) downgraded to Hold from Buy at Standpoint Research

Goldman Sachs (GS) reported Q4 FY 2018 earnings of $6.04 per share (versus $5.68 in Q4 FY 2017), beating analysts’ consensus estimate of $4.78.

The company’s quarterly revenues amounted to $8.080 bln (-0.5% y/y), beating analysts’ consensus estimate of $7.482 bln.

GS rose to $184.39 (+2.49%) in pre-market trading.

Prices for U.S. imports decreased 1.0 percent in December, the U.S. Bureau of Labor Statistics reported today, after a 1.9-percent fall the previous month. Lower fuel prices drove the decline in December, and nonfuel prices recorded no change. U.S. export prices fell 0.6 percent in December following a 0.8-percent drop in November.

U.S. export prices fell 0.6 percent in December following a 0.8-percent decrease in November. Nonagricultural prices declined in December, more than offsetting higher prices for agricultural goods.

Despite the December downturn, U.S. export prices increased 1.1 percent in 2018. The price index for U.S. exports has not recorded a calendar-year decrease since falling 6.6 percent in 2015.

Bank of America (BAC) reported Q4 FY 2018 earnings of $0.70 per share (versus $0.47 in Q4 FY 2017), beating analysts’ consensus estimate of $0.63.

The company’s quarterly revenues amounted to $22.891 bln (+100.7% y/y), beating analysts’ consensus estimate of $22.373 bln.

BAC rose to $27.74 (+4.48%) in pre-market trading.

Market View Of Brexit Vote Most Clearly Expressed In FX Market - Tsy Select Committee Hearing

Chinese Growth to 'Head Toward Low Sixes' This Year

China Is a Factor in Global Economic Slowdown

Markets Have Anticipated China Slowdown

The headline rate of output inflation for goods leaving the factory gate was 2.5% on the year to December 2018, down from 3.0% in November 2018.

The growth rate of prices for materials and fuels used in the manufacturing process slowed to 3.7% on the year to December 2018, down from 5.3% in November 2018.

Petroleum products and crude oil provided the largest contribution to the change in the annual rate of output and input inflation respectively.

Crude oil increased 0.4% on the year to December 2018, down from 13.1% in November 2018.

On a non-seasonally adjusted basis, average house prices in the UK fell by 0.1% between October 2018 and November 2018, compared with a decrease of 0.3% in average prices during the same period a year earlier (October 2017 and November 2017).

The strongest annual growth in house prices was in the West Midlands, increasing by 4.6% in the year to November 2018. House prices in London fell by 0.7% in the year to November 2018. London house prices have been falling over the year each month since July 2018.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) 12-month inflation rate was 2.0% in December 2018, down from 2.2% in November 2018.

The largest downward contributions to change in the 12-month rate came from falls in petrol prices and from air fares, where ticket prices rose between November and December 2018, but by less than a year ago.

These downward effects were offset by upward contributions from a variety of categories including accommodation services and, to a lesser extent, mobile phone charges, games, toys and hobbies, and food.

The Consumer Prices Index (CPI) 12-month rate was 2.1% in December 2018, down from 2.3% in November 2018.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1540 (1947)

$1.1518 (464)

$1.1502 (385)

Price at time of writing this review: $1.1393

Support levels (open interest**, contracts):

$1.1371 (2772)

$1.1342 (4081)

$1.1308 (4765)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 8 is 69751 contracts (according to data from January, 15) with the maximum number of contracts with strike price $1,1600 (5440);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3014 (1255)

$1.2993 (447)

$1.2959 (210)

Price at time of writing this review: $1.2886

Support levels (open interest**, contracts):

$1.2752 (547)

$1.2732 (206)

$1.2710 (479)

Comments:

- Overall open interest on the CALL options with the expiration date February, 8 is 22876 contracts, with the maximum number of contracts with strike price $1,3200 (1912);

- Overall open interest on the PUT options with the expiration date February, 8 is 26137 contracts, with the maximum number of contracts with strike price $1,200 (1930);

- The ratio of PUT/CALL was 1.14 versus 1.10 from the previous trading day according to data from January, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Uncertainties, Notably Related to Global Factors, Remain Prominent

There Is No Room for Complacency

Significant Amount of Monetary Policy Stimulus Is Still Needed

The ‘cautiously optimistic’ consumer mood that prevailed through 2018 has evaporated with sentiment beginning the new year with a slightly pessimistic view. At 99.6, the Index is below the 100 level, indicating that pessimists outnumber optimists, although only by a slim margin. This is the first time sub-100 reading from the survey since November 2017.

The Federal Statistical Office (Destatis) also reports that the year-on-year rate of price increase in 2018 thus was slightly higher than in the previous year (2017: +1.8%). In December 2018, the inflation rate as measured by the consumer price index decreased markedly on the previous months, reaching 1.7%.

The increase in the year-on-year rate of price increase in 2018 was mainly due to energy prices. Energy product prices in 2018 were up 4.9% on 2017, the increase being larger than a year earlier (2017: +3.1% on 2016). The largest price increases in 2018 were recorded for heating oil (+21.7%) and motor fuel prices were markedly up, too (+7.8%). In contrast to these sharp price rises for mineral oil products, moderate price developments were observed for other energy products. Excluding energy prices, the year-on-year rate of price increase in 2018 would have been +1.6%.

Eu Member States Will Have A United Position Regarding Brexit Talks

Britain Could Reverse Its Brexit Decision If It Wanted To

May's government now has three days to present an alternative plan in Parliament. That said, the opposition Labor Party leader Jeremy Corbyn will bring a vote of no-confidence in the government, which will be debated in Parliament on Wednesday.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 60.58 | 1.99 |

| WTI | 52.19 | 2.35 |

| Silver | 15.55 | -0.51 |

| Gold | 1288.942 | -0.19 |

| Palladium | 1318.24 | -0.14 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 195.59 | 20555.29 | 0.96 |

| Hang Seng | 531.96 | 26830.29 | 2.02 |

| KOSPI | 32.66 | 2097.18 | 1.58 |

| ASX 200 | 41.2 | 5814.6 | 0.71 |

| FTSE 100 | 40 | 6895.02 | 0.58 |

| DAX | 35.88 | 10891.79 | 0.33 |

| Dow Jones | 155.75 | 24065.59 | 0.65 |

| S&P 500 | 27.69 | 2610.3 | 1.07 |

| NASDAQ Composite | 117.91 | 7023.83 | 1.71 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.72018 | 0.09 |

| EURJPY | 124.04 | 0.01 |

| EURUSD | 1.14116 | -0.49 |

| GBPJPY | 139.769 | 0.45 |

| GBPUSD | 1.28587 | -0.04 |

| NZDUSD | 0.68154 | -0.06 |

| USDCAD | 1.32653 | -0.11 |

| USDCHF | 0.98754 | 0.69 |

| USDJPY | 108.69 | 0.5 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.