- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-10-2018

| Raw materials | Closing price | % change |

| Oil | $71.68 | +0.48% |

| Gold | $1,230.80 | +0.72% |

| Index | Change items | Closing price | % change |

| Nikkei | -423.36 | 22271.30 | -1.87% |

| TOPIX | -27.01 | 1675.44 | -1.59% |

| CSI 300 | -44.28 | 3126.45 | -1.40% |

| KOSPI | -16.73 | 2145.12 | -0.77% |

| FTSE 100 | +33.31 | 7029.22 | +0.48% |

| DAX | +90.35 | 11614.16 | +0.78% |

| CAC 40 | -0.91 | 5095.07 | -0.02% |

| DJIA | -89.44 | 25250.55 | -0.35% |

| S&P 500 | -16.34 | 2750.79 | -0.59% |

| NASDAQ | -66.15 | 7430.74 | -0.88% |

| Pare | Closed | % change |

| EUR/USD | $1,1581 | +0,20% |

| GBP/USD | $1,3152 | +0,00% |

| USD/CHF | Chf0,98692 | -0,46% |

| USD/JPY | Y111,76 | -0,39% |

| EUR/JPY | Y129,44 | -0,20% |

| GBP/JPY | Y146,99 | -0,39% |

| AUD/USD | $0,7138 | +0,33% |

| NZD/USD | $0,6592 | +1,28% |

| USD/CAD | C$1,29834 | -0,29% |

Major US stock indexes finished trading in the red, amid growing tensions between Western powers and Saudi Arabia and falling stocks of technology companies ..

In addition, investors evaluated data for the United States. The Commerce Department reported that US consumers increased their spending only marginally in September, not meeting economists 'expectations of strong growth. Sales in retail stores and restaurants grew by 0.1% compared with August, and amounted to 509 billion dollars. Since last year, sales grew by 4.7%. Economists had expected an increase of 0.7% compared with the previous month.

Oil prices have stabilized as tensions over the disappearance of a prominent Saudi journalist have heightened concerns about supply, and counterbalanced concerns about the long-term outlook for demand.

Most of the components of DOW finished trading in the red (20 of 30). Outsiders turned out to be shares of Cisco Systems, Inc. (CSCO, -2.28%). The growth leader was Walgreens Boots Alliance, Inc. (WBA, + 1.66%).

Most sectors of the S & P recorded a decline. The largest decline was shown by the technology sector (-0.9%). The conglomerate sector grew the most (+ 0.4%),

At the time of closing:

Dow 25,250.55 -89.44 -0.35%

S & P 500 2,750.79 -16.34 -0.59%

Nasdaq 100 7,430.74 -66.15 -0.88%

Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,960.8 billion, up 0.5 percent (±0.1 percent) from July 2018 and were up 4.2 percent (±1.2 percent) from August 2017.

The total business inventories/sales ratio based on seasonally adjusted data at the end of August was 1.34. The August 2017 ratio was 1.39.

U.S. stock-index futures fell slightly on Monday, as escalating tensions between Saudi Arabia and the West added to investors' worries over rising borrowing costs and the impact of tariffs.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,271.30 | -423.36 | -1.87% |

| Hang Seng | 25,445.06 | -356.43 | -1.38% |

| Shanghai | 2,568.10 | -38.82 | -1.49% |

| S&P/ASX | 5,837.10 | -58.60 | -0.99% |

| FTSE | 7,010.97 | +15.06 | +0.22% |

| CAC | 5,095.37 | -0.61 | -0.01% |

| DAX | 11,581.30 | +57.49 | +0.50% |

| Crude | $71.80 | | +0.64% |

| Gold | $1,234.60 | | +1.03% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 197.98 | -0.25(-0.13%) | 1123 |

| ALCOA INC. | AA | 35.98 | 0.31(0.87%) | 2720 |

| ALTRIA GROUP INC. | MO | 60.56 | 0.50(0.83%) | 3057 |

| Amazon.com Inc., NASDAQ | AMZN | 1,794.42 | 5.81(0.32%) | 122573 |

| Apple Inc. | AAPL | 221.15 | -0.96(-0.43%) | 269637 |

| AT&T Inc | T | 32.3 | 0.05(0.16%) | 21380 |

| Barrick Gold Corporation, NYSE | ABX | 12.73 | 0.26(2.09%) | 160836 |

| Boeing Co | BA | 359.5 | -0.61(-0.17%) | 4492 |

| Caterpillar Inc | CAT | 142.21 | 0.14(0.10%) | 2110 |

| Chevron Corp | CVX | 118.26 | 0.49(0.42%) | 996 |

| Cisco Systems Inc | CSCO | 45.81 | 0.10(0.22%) | 23169 |

| Citigroup Inc., NYSE | C | 69.9 | 0.06(0.09%) | 34190 |

| Exxon Mobil Corp | XOM | 81.5 | 0.12(0.15%) | 17055 |

| Facebook, Inc. | FB | 153.6 | -0.14(-0.09%) | 78899 |

| FedEx Corporation, NYSE | FDX | 220.12 | -0.88(-0.40%) | 1313 |

| Ford Motor Co. | F | 8.66 | 0.02(0.23%) | 35649 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.88 | 0.14(1.10%) | 4098 |

| General Electric Co | GE | 12.24 | -0.08(-0.65%) | 180274 |

| General Motors Company, NYSE | GM | 31.8 | 0.01(0.03%) | 3944 |

| Goldman Sachs | GS | 214.8 | 0.93(0.43%) | 3752 |

| Google Inc. | GOOG | 1,109.33 | -0.75(-0.07%) | 4908 |

| Home Depot Inc | HD | 192.17 | -0.30(-0.16%) | 953 |

| HONEYWELL INTERNATIONAL INC. | HON | 156.5 | 0.30(0.19%) | 246 |

| Intel Corp | INTC | 44.82 | -0.06(-0.13%) | 16676 |

| International Business Machines Co... | IBM | 140.95 | 0.10(0.07%) | 3867 |

| JPMorgan Chase and Co | JPM | 107.19 | 0.24(0.22%) | 19490 |

| McDonald's Corp | MCD | 165.11 | 1.29(0.79%) | 4949 |

| Merck & Co Inc | MRK | 69.51 | -0.30(-0.43%) | 244 |

| Microsoft Corp | MSFT | 109.23 | -0.34(-0.31%) | 132820 |

| Nike | NKE | 76 | 0.09(0.12%) | 3255 |

| Pfizer Inc | PFE | 43.44 | -0.34(-0.78%) | 7864 |

| Starbucks Corporation, NASDAQ | SBUX | 56.21 | -0.24(-0.43%) | 4688 |

| Tesla Motors, Inc., NASDAQ | TSLA | 257.81 | -0.97(-0.37%) | 26897 |

| Twitter, Inc., NYSE | TWTR | 27.94 | -0.05(-0.18%) | 33529 |

| United Technologies Corp | UTX | 129.59 | -0.04(-0.03%) | 317 |

| UnitedHealth Group Inc | UNH | 261 | 1.39(0.54%) | 5830 |

| Verizon Communications Inc | VZ | 53.57 | -0.16(-0.30%) | 1647 |

| Wal-Mart Stores Inc | WMT | 95.1 | 0.29(0.31%) | 2261 |

| Walt Disney Co | DIS | 111.72 | -0.89(-0.79%) | 14229 |

| Yandex N.V., NASDAQ | YNDX | 32.55 | -0.18(-0.55%) | 597 |

McDonald's (MCD) upgraded to Outperform from In-line at Evercore ISI

The headline general business conditions index rose two points to 21.1, pointing to a slightly faster pace of growth than in September.

New orders and shipments both picked up noticeably. Delivery times continued to lengthen, while inventories held steady. Labor market indicators pointed to a modest increase in employment levels and no change in hours worked. Price indexes edged down but remained elevated, suggesting ongoing significant increases in both input prices and selling prices. Looking ahead, firms generally remained optimistic about the six-month outlook.

Advance estimates of U.S. retail and food services sales for September 2018, adjusted for seasonal variation and holiday and trading‐day differences, but not for price changes, were $509.0 billion, an increase of 0.1 percent from the previous month, and 4.7 percent above September 2017. Total sales for the July 2018 through September 2018 period were up 5.9 percent from the same period a year ago. The July 2018 to August 2018 percent change was unrevised from up 0.1 percent.

Retail trade sales were up 0.4 percent from August 2018, and 4.4 percent (±0.5 percent) above last year. Gasoline Stations were up 11.4 percent from September 2017, while Nonstore Retailers were also up 11.4 percent from last year.

-

No Deal Brexit Is Still Unlikely

-

May Be December Before Deal

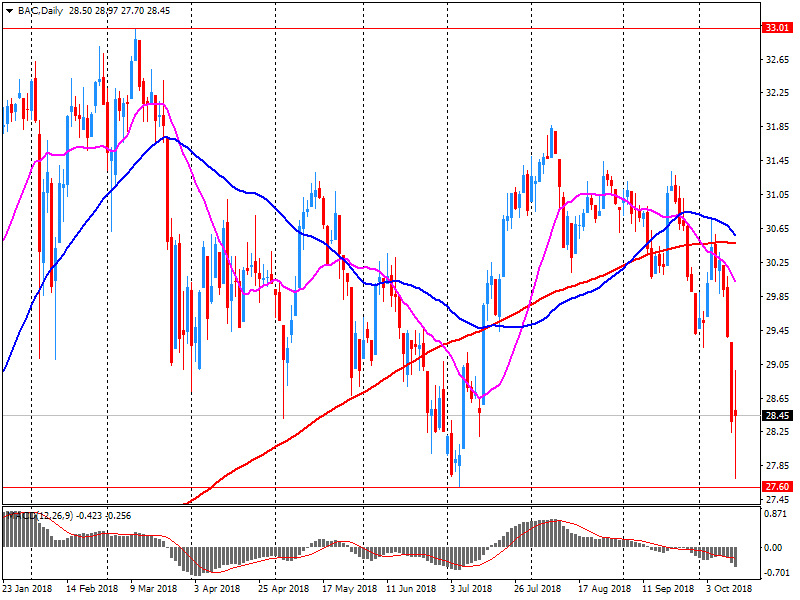

Bank of America (BAC) reported Q3 FY 2018 earnings of $0.66 per share (versus $0.48 in Q3 FY 2017), beating analysts' consensus estimate of $0.62.

The company's quarterly revenues amounted to $22.777 bln (+3.2% y/y), generally in-line with analysts' consensus estimate of $22.634 bln.

BAC fell to $28.44 (-0.07%) in pre-market trading.

October 15

Before the Open:

Bank of America (BAC). Consensus EPS $0.62, Consensus Revenues $22633.57 mln.

October 16

Before the Open:

Goldman Sachs (GS). Consensus EPS $5.34, Consensus Revenues $8429.99 mln.

Johnson & Johnson (JNJ). Consensus EPS $2.03, Consensus Revenues $20044.85 mln.

Morgan Stanley (MS). Consensus EPS $1.01, Consensus Revenues $9553.10 mln.

UnitedHealth (UNH). Consensus EPS $3.30, Consensus Revenues $56312.72 mln.

After the Close:

IBM (IBM). Consensus EPS $3.40, Consensus Revenues $19043.13 mln.

Netflix (NFLX). Consensus EPS $0.68, Consensus Revenues $3993.41 mln.

October 17

After the Close:

Alcoa (AA). Consensus EPS $0.36, Consensus Revenues $3350.57 mln.

October 18

Before the Open:

Travelers (TRV). Consensus EPS $2.27, Consensus Revenues $6832.00 mln.

After the Close:

American Express (AXP). Consensus EPS $1.77, Consensus Revenues $10051.77 mln.

October 19

Before the Open:

Honeywell (HON). Consensus EPS $1.99, Consensus Revenues $10751.30 mln.

Procter & Gamble (PG). Consensus EPS $1.10, Consensus Revenues $16506.35 mln.

A spokesman for the Democratic Unionist Party (DUP) said today that Brexit without a deal is "probably inevitable" due to the "intransigence" of the EU position.

He said that the current proposal from the EU is much worse than the result without a deal. He also noted that some "mini-agreements" can be reached without a general trade deal with the European Union.

Such comments will only add negative tones for the pound, which has dropped sharply since the beginning of the week.

The Producer and Import Price Index fell in September 2018 by 0.2% compared with the previous month, reaching 103.2 points (December 2015 = 100). The decline is due in particular to lower prices for scrap. Compared with September 2017, the price level of the whole range of domestic and imported products rose by 2.6%. These are some of the findings from the Federal Statistical Office (FSO).

The price of property coming to market has risen by a national average of 0.7% (+£2,088) this month, which is the same as the average monthly increase in September of 0.7% since 2011. The national annual rate of increase remains muted at 1.2%, but there are some positive signs for the Autumn market in regions where affordability and sentiment are good, although stretched buyer affordability or negative market sentiment in other regions are limiting price growth. Substantial price reductions in some parts of the London market over the last two years are now helping to improve sentiment and momentum, with renewed buyer activity evident at the upper end.

Federal Reserve Vice Chairman Randal Quarles said Saturday that the Fed should remain predictable, gradual and transparent in normalizing monetary policy as it considers how its decisions affect the rest of the world.

"It's not going to be in the interest of anyone in the world...for us to get behind the curve in the U.S. by moderating what we think is the right course of domestic policy," he said at the annual membership meeting of the Institute of International Finance, an association for the financial industry, in Bali, Indonesia - via DJ.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1705 (2013)

$1.1685 (953)

$1.1647 (114)

Price at time of writing this review: $1.1550

Support levels (open interest**, contracts):

$1.1517 (4449)

$1.1487 (3308)

$1.1453 (3112)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 19 is 79191 contracts (according to data from October, 12) with the maximum number of contracts with strike price $1,1600 (4449);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3303 (1031)

$1.3273 (802)

$1.3242 (314)

Price at time of writing this review: $1.3112

Support levels (open interest**, contracts):

$1.3082 (427)

$1.3028 (519)

$1.2997 (2089)

Comments:

- Overall open interest on the CALL options with the expiration date November, 19 is 23740 contracts, with the maximum number of contracts with strike price $1,3500 (3535);

- Overall open interest on the PUT options with the expiration date November, 19 is 26459 contracts, with the maximum number of contracts with strike price $1,3000 (2171);

- The ratio of PUT/CALL was 1.11 versus 1.13 from the previous trading day according to data from October, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.