- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-08-2018

| Raw materials | Closing price | % change |

| Oil | 66.63 | -0.85% |

| Gold | 1,201.10 | +0.18% |

| Index | Change items | Closing price | % change |

| Nikkei | +498.65 | 22356.08 | +2.28% |

| TOPIX | +27.45 | 1710.95 | +1.63% |

| CSI 300 | -17.43 | 3372.91 | -0.51% |

| KOSPI | +10.46 | 2258.91 | +0.47% |

| FTSE 100 | -30.81 | 7611.64 | -0.40% |

| DAX | +0.13 | 12358.87 | +0.00% |

| CAC 40 | -8.91 | 5403.41 | -0.16% |

| DJIA | +112.22 | 25299.92 | +0.45% |

| S&P 500 | +18.03 | 2839.96 | +0.64% |

| NASDAQ | +51.19 | 7870.90 | +0.65% |

| Pare | Closed | % change |

| EUR/USD | $1,1345 | -0,53% |

| GBP/USD | $1,2720 | -0,33% |

| USD/CHF | Chf0,99368 | +0,09% |

| USD/JPY | Y111,22 | +0,43% |

| EUR/JPY | Y126,18 | -0,10% |

| GBP/JPY | Y141,463 | +0,11% |

| AUD/USD | $0,7239 | -0,47% |

| NZD/USD | $0,6571 | -0,10% |

| USD/CAD | C$1,30564 | -0,53% |

Major US stock indices grew moderately after three days of losses, as favorable earnings reports raised optimism, and bank stocks recovered after the Turkish lira retracement.

The rate of the Turkish currency demonstrates a significant increase, as concern about the economic crisis in Turkey has weakened slightly after the central bank of the country announced many measures aimed at stabilizing the situation on the foreign exchange market.

In addition, the Ministry of Labor said that import prices did not change in July, after they fell by -0.1% in June (revised from -0.4%). Economists had expected that import prices would grow by 0.1%. Prices remained unchanged, as fuel import prices rose by 1.6% in July after they rose by 1.3% in June, while prices for other goods, except fuel, fell by -0.3 % The second month in a row. Meanwhile, export prices in July fell by -0.5%, after rising by 0.2% in June. Economists predicted that export prices will grow by 0.2% compared to the initial growth of 0.3%.

Most DOW components recorded a rise (21 out of 30). The growth leader was Walgreens Boots Alliance, Inc. (WBA, + 3.05%). Outsider were shares of Intel Corporation (INTC, -0.71%).

All sectors of S & P finished trading in positive territory. The conglomerate sector grew most (+ 0.7%).

At closing:

Dow 25,299.92 +112.22 +0.45%

S&P 500 2,839.96 +18.03 +0.64%

Nasdaq 100 7,870.89 +51.19 +0.65%

U.S. stock-index futures rose moderately on Tuesday, as global financial markets rebounded, due to a recovery in the Turkish lira, while the gains in technology stocks lifted the sentiment.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,356.08 | +498.65 | +2.28% |

| Hang Seng | 27,752.93 | -183.64 | -0.66% |

| Shanghai | 2,781.16 | -4.71 | -0.17% |

| S&P/ASX | 6,299.60 | +47.40 | +0.76% |

| FTSE | 7,631.83 | -10.62 | -0.14% |

| CAC | 5,418.60 | +6.28 | +0.12% |

| DAX | 12,371.47 | +12.73 | +0.10% |

| Crude | $68.15 | | +1.41% |

| Gold | $1,203.40 | | +0.38% |

(company / ticker / price / change ($/%) / volume)

| Apple Inc. | AAPL | 209.99 | 1.12(0.54%) | 100040 |

| Caterpillar Inc | CAT | 135.08 | 0.06(0.04%) | 1289 |

| Chevron Corp | CVX | 123.4 | 0.96(0.78%) | 807 |

| Cisco Systems Inc | CSCO | 44.01 | 0.26(0.59%) | 7948 |

| Citigroup Inc., NYSE | C | 69.47 | 0.31(0.45%) | 37013 |

| Deere & Company, NYSE | DE | 137.35 | 0.44(0.32%) | 200 |

| Deere & Company, NYSE | DE | 137.35 | 0.44(0.32%) | 200 |

| Ford Motor Co. | F | 9.53 | 0.07(0.74%) | 144239 |

| General Motors Company, NYSE | GM | 36.31 | 0.15(0.41%) | 3015 |

| Google Inc. | GOOG | 1,242.00 | 6.99(0.57%) | 2079 |

| Home Depot Inc | HD | 198.59 | 4.45(2.29%) | 386790 |

| HONEYWELL INTERNATIONAL INC. | HON | 152.45 | 0.10(0.07%) | 230 |

| Intel Corp | INTC | 48.75 | 0.30(0.62%) | 5491 |

| McDonald's Corp | MCD | 158.5 | 0.36(0.23%) | 556 |

| Merck & Co Inc | MRK | 66.9 | 0.18(0.27%) | 1050 |

| Microsoft Corp | MSFT | 108.71 | 0.50(0.46%) | 16224 |

| Nike | NKE | 80.35 | 0.20(0.25%) | 865 |

| Pfizer Inc | PFE | 40.82 | 0.01(0.02%) | 6059 |

| Starbucks Corporation, NASDAQ | SBUX | 51.9 | 0.09(0.17%) | 2761 |

| Tesla Motors, Inc., NASDAQ | TSLA | 356.5 | 0.09(0.03%) | 135385 |

| Twitter, Inc., NYSE | TWTR | 33.35 | 0.55(1.68%) | 194746 |

| Walt Disney Co | DIS | 112.25 | 0.13(0.12%) | 2458 |

| Yandex N.V., NASDAQ | YNDX | 32.58 | 0.54(1.69%) | 4430 |

Prices for U.S. imports recorded no change in July, the U.S. Bureau of Labor Statistics reported today, after edging down 0.1 percent in June. Falling nonfuel prices in July offset higher fuel prices. U.S. export prices decreased 0.5 percent in July following a 0.2-percent increase in June. The July decline was driven by a drop in agricultural export prices.

Prices for import fuel advanced 1.6 percent in July following a 1.3-percent increase in June and a 6.5-percent rise in May. In July, increasing prices for petroleum and natural gas contributed to the rise in fuel prices. Petroleum prices advanced 0.9 percent in July, after rising 1.4 percent in June and 7.8 percent in May. Prices for natural gas increased 36.7 percent in July, the first monthly advance since January and the largest since the index rose 43.2 percent in November 2006.

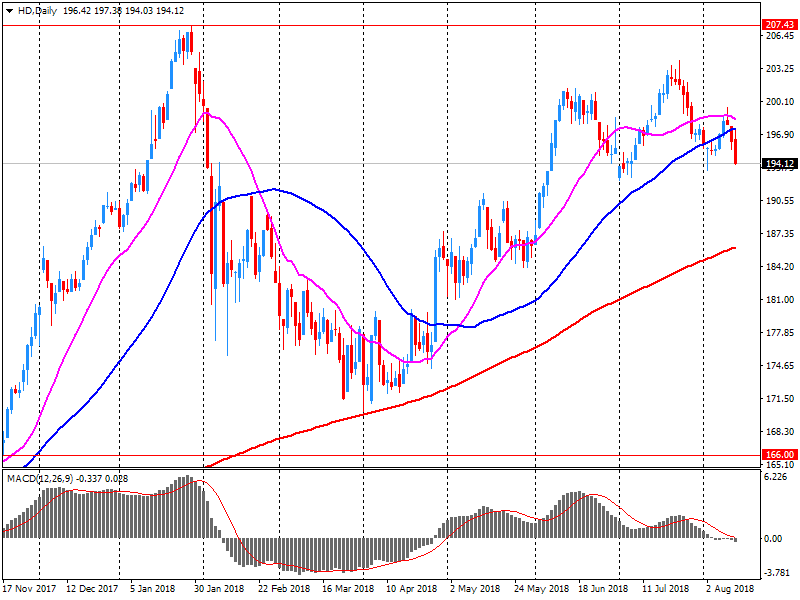

Home Depot (HD) reported Q2 FY 2018 earnings of $3.05 per share (versus $2.25 in Q2 FY 2017), beating analysts' consensus estimate of $2.85.

The company's quarterly revenues amounted to $30.463 bln (+8.4% y/y), beating analysts' consensus estimate of $30.035 bln.

The company also issued mixed guidance for FY 2018, projecting EPS of $9.42 (versus analysts' consensus estimate of $9.46 and its prior forecast of $9.31) and revenues of $108.0 bln (versus analysts' consensus estimate of $107.9 bln and its prior guidance of ~$107.5 bln).

HD rose to $198.12 (+2.05%) in pre-market trading.

Seasonally adjusted GDP rose by 0.4% in both the euro area (EA19) and the EU28 during the second quarter of 2018, compared with the previous quarter, according to a flash estimate published by Eurostat.

In the first quarter of 2018, GDP had also grown by 0.4% both in the euro area and in the EU28. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 2.2% in both the euro area and the EU28 in the second quarter of 2018, after +2.5% and +2.4% respectively in the previous quarter.

In June 2018 compared with May 2018, seasonally adjusted industrial production fell by 0.7% in the euro area (EA19) and by 0.4% in the EU28, according to estimates from Eurostat. In May 2018, industrial production rose by 1.4% in the euro area and by 1.3% in the EU28. In June 2018 compared with June 2017, industrial production increased by 2.5% in the euro area and by 2.6% in the EU28.

The decrease of 0.7% in industrial production in the euro area in June 2018, compared with May 2018, is due to production of capital goods falling by 2.9%, non-durable consumer goods by 0.6%, intermediate goods by 0.5% and durable consumer goods by 0.4%, while production of energy rose by 0.5%. In the EU28, the decrease of 0.4% is due to production of capital goods falling by 2.0%, intermediate goods by 0.3%, durable consumer goods by 0.2% and non-durable consumer goods by 0.1%, while production of energy rose by 0.5%

-

"Turkey Faces An Explicit Economic Atta We're Taking All Technical Measures Needed"

Latest estimates show that average weekly earnings in nominal terms (that is, not adjusted for price inflation) increased by 2.7% excluding bonuses, and by 2.4% including bonuses, compared with a year earlier.

Latest estimates show that average weekly earnings increased by 0.4% excluding bonuses, and by 0.1% including bonuses, compared with a year earlier.

Estimates from the Labour Force Survey show that, between January to March 2018 and April to June 2018, the number of people in work increased, the number of unemployed people decreased but the number of people aged from 16 to 64 years not working and not seeking or available to work (economically inactive) increased.

There were 32.39 million people in work, 42,000 more than for January to March 2018 and 313,000 more than for a year earlier.

The unemployment rate (the number of unemployed people as a proportion of all employed and unemployed people) was 4.0%; it has not been lower since December 1974 to February 1975.

The Producer and Import Price Index increased in July 2018 by 0.1% compared with the previous month, reaching 103.3 points (December 2015 = 100). The rise is due in particular to higher prices for watches, petroleum and natural gas. Compared with July 2017, the price level of the whole range of domestic and imported products rose by 3.6%.

In July 2018, the Consumer Prices Index (CPI) declined by 0.1%, after a stability in June. This slight drop came from a seasonal fall in manufactured product prices (−2.8%) due to summer sales, partly offset by a rebound in services prices (+1.1%), essentially in airfares with the beginning of school holidays. Energy prices slowed down (+0.5% after +0.9%). Finally, food prices recovered slightly (+0.1% after −0.2%).

Seasonally adjusted, consumer prices accelerated to +0.3% after a stability in June.

Year on year, consumer prices rose by 2.3%, that is 0.3 points of percentage more than in the previous month. This stronger inflation resulted essentially from a year-on-year acceleration in energy prices, and to a lesser extent, in service prices and tobacco prices. The lesser drop in manufactured product prices also contributed to the rise in inflation. Finally, the year-on-year inflation in food prices was unchanged.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1627 (2089)

$1.1558 (4478)

$1.1508 (873)

Price at time of writing this review: $1.1426

Support levels (open interest**, contracts):

$1.1364 (10552)

$1.1342 (4640)

$1.1315 (6450)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 7 is 132949 contracts (according to data from August, 13) with the maximum number of contracts with strike price $1,1500 (10552);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2984 (3460)

$1.2948 (667)

$1.2887 (317)

Price at time of writing this review: $1.2795

Support levels (open interest**, contracts):

$1.2746 (2806)

$1.2723 (3177)

$1.2705 (2713)

Comments:

- Overall open interest on the CALL options with the expiration date September, 7 is 34606 contracts, with the maximum number of contracts with strike price $1,2950 (3460);

- Overall open interest on the PUT options with the expiration date September, 7 is 31096 contracts, with the maximum number of contracts with strike price $1,2900 (3177);

- The ratio of PUT/CALL was 0.90 versus 0.87 from the previous trading day according to data from August, 13.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Retail sales in China jumped 8.8 percent on year in July, according to rttnews.

That was shy of forecasts for a gain of 9.1 percent and down from 9.0 percent in June.

The bureau also noted that industrial production advanced an annual 6.0 percent - unchanged from a month earlier but again beneath forecasts for 6.3 percent.

Also, fixed asset investment was up 5.5 percent on year - missing expectations for 6.0 percent - which would have been unchanged from the previous month.

Consumer prices in Germany were 2.0% higher in July 2018 than in July 2017. The inflation rate - measured by the consumer price index - thus decreased slightly again. In the preceding two months, the inflation rate had been just over two percent (June 2018: +2.1%; May 2018: +2.2%). Compared with June 2018, the consumer price index rose by 0.3% in July 2018. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 30 July 2018.

The development of energy product prices had a considerable effect on the inflation rate in July 2018. The year-on-year increase in energy prices in July 2018 (+6.6%) was slightly higher than in June 2018: (+6.4%). The main reason for the price increase is the relatively low price a year ago (statistical base effect). Especially heating oil prices were up on a year earlier (+28.5%).

The German economy continues to grow. In the second quarter of 2018, the gross domestic product (GDP) rose 0.5% on the previous quarter after adjustment for price, seasonal and calendar variations. The Federal Statistical Office (Destatis) also reports that GDP growth in the first quarter of 2018 had been slightly smaller (+0.4%).

The quarter-on-quarter comparison (price-, seasonally and calendar-adjusted) shows that positive contributions came from domestic demand. Final consumption expenditure of both households and general government increased. Capital formation was up, too. There was a slight increase in fixed capital formation in machinery and equipment, in construction and in other fixed assets compared with the first quarter of 2018. According to provisional calculations, the price-adjusted development of foreign trade was characterised by increasing exports and an even stronger rise in imports.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.