- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-07-2017

The major stock indexes of the United States finished trading with a rise, as weak economic data reduced the chances of an increase in rates this year. Meanwhile, the moderate forecasts of JPMorgan and Wells Fargo limited profit.

As it became known, the prices that Americans pay for goods and services remained unchanged in June, which reflects more low prices for gasoline, and also shows that the recent surge in inflation was temporary. The consumer price index, or the cost of living, did not change last month, the government said on Friday. Economists predicted an increase in the CPI by 0.1%.

In addition, retailers spending in the US declined in June for the second consecutive month. Retail sales - an indicator of consumer spending in stores, restaurants and websites - fell by 0.2% in seasonally adjusted terms in June compared to the previous month, the Ministry of Commerce said. Economists had expected growth of 0.1%. In May, retail sales decreased by 0.1%. This was the first decline in sales from July to August 2016.

Industrial production in the US increased in June stronger than analysts' forecasts, as the demand for natural resources, cars and equipment recovered, according to the Federal Reserve. Industrial production grew 0.2% after falling 0.4%, overall industrial production, which also includes mining and utilities, increased by 0.4% after rising 0.1%, and capacity utilization rose to 76.6% from 76.4%.

It is also worth noting that the preliminary results of the studies presented by Thomson-Reuters and the Michigan Institute showed that the mood sensor among US consumers fell in June more than predicted by average experts' forecasts. According to the data, in July the consumer sentiment index fell to 93.1 points compared to the final reading for June at the level of 95.1 points. According to average estimates, the index had to drop to the level of 95 points.

Almost all components of the DOW index recorded a rise (27 out of 30). Leader of growth were shares of Wal-Mart Stores, Inc. (WMT, + 1.95%). Outsider were the shares of JPMorgan Chase & Co. (JPM, -0.69%).

All sectors of S & P completed the auction in positive territory. The sector of basic materials grew most (+ 0.9%).

At closing:

Dow + 0.40% 21.639.59 +86.50

Nasdaq + 0.61% 6,312.47 +38.03

S & P + 0.45% 2,458.96 +11.13

Confidence in future economic prospects continued to slide in early July, with the Expectations Index now 10.1 Index points below its January 2017 peak. In contrast, consumers' assessments of current economic conditions regained the March 2017 peak, the highest level since the July 2005 survey. Overall, the recent data follow the same pattern repeatedly recorded around past cyclical peaks: expectations start to post significant declines while assessments of current economic conditions continue to reach new peaks. To be sure, the data do not suggest an impending recession.

Rather, the data indicate that hopes for a prolonged period of 3% GDP growth sparked by Trump's victory have largely vanished, aside from a temporary snap back expected in the 2nd quarter. The declines recorded are now consistent with just above 2% GDP growth in 2017. Much steeper declines in expectations typically precede recessions.

EURUSD: 1.1300 (EUR 1.6bln) 1.1365-75 (1.0bln) 1.1400 (545m) 1.1425-35 (790m) 1.1450 (910m) 1.1500-10 (2.1bln) 1.1550 (560m)

USDJPY: 112.00 (USD 530m) 112.25 (415m) 112.50 (265m) 113.20-30 (1bln) 113.80 (425m) 113.90-00 (1.85bln) 114.40-50 (560m) 115.00 (500m)

EURGBP: 0.8660 (EUR 305m) 0.8800 (230m)

AUDUSD: 0.7595-05 (AUD 1.1bln) 0.7630-40 (610m) 0.7750 (250m)

USDCAD: 1.2765-75 (USD 180m) 1.2810-20 (415m)

NZDUSD: 0.7150 (NZD 335m) 0.7250 (250m)

Industrial production rose 0.4 percent in June for its fifth consecutive monthly increase. Manufacturing output moved up 0.2 percent; although factory output has gone up and down in recent months, its level in June was little different from February. The index for mining posted a gain of 1.6 percent in June, just slightly below its pace in May. The index for utilities, however, remained unchanged.

For the second quarter as a whole, industrial production advanced at an annual rate of 4.7 percent, primarily as a result of strong increases for mining and utilities. Manufacturing output rose at an annual rate of 1.4 percent, a slightly slower increase than in the first quarter. At 105.2 percent of its 2012 average, total industrial production in June was 2.0 percent above its year-earlier level.

Capacity utilization for the industrial sector increased 0.2 percentage point in June to 76.6 percent, a rate that is 3.3 percentage points below its long-run (1972-2016) average.

Before the bell: S&P futures +0.04%, NASDAQ futures +0.35%

U.S. stock-index futures were slightly higher as investors analyzed a slew of important U.S. economic data and Q2 earnings reports from several big U.S. banks.

Global Stocks:

Nikkei 20,118.86 +19.05 +0.09%

Hang Seng 26,389.23 +43.06 +0.16%

Shanghai 3,222.31 +4.15 +0.13%

S&P/ASX 5,765.10 +28.33 +0.49%

FTSE 7,396.72 -16.72 -0.23%

CAC 5,238.79 +3.39 +0.06%

DAX 12,646.70 +5.37 +0.04%

Crude $46.64 (+1.22%)

Gold $1,227.60 (+0.85%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.1 | 0.09(0.25%) | 11292 |

| Amazon.com Inc., NASDAQ | AMZN | 1,002.88 | 2.25(0.22%) | 11301 |

| American Express Co | AXP | 85.1 | -0.27(-0.32%) | 2200 |

| AMERICAN INTERNATIONAL GROUP | AIG | 63.15 | -0.98(-1.53%) | 272 |

| Apple Inc. | AAPL | 147.72 | -0.05(-0.03%) | 155479 |

| AT&T Inc | T | 36.29 | 0.08(0.22%) | 6912 |

| Barrick Gold Corporation, NYSE | ABX | 15.94 | 0.23(1.46%) | 118237 |

| Boeing Co | BA | 208.2 | 1.97(0.96%) | 12056 |

| Caterpillar Inc | CAT | 108.5 | 0.03(0.03%) | 1501 |

| Chevron Corp | CVX | 104.5 | 0.37(0.36%) | 2000 |

| Cisco Systems Inc | CSCO | 31.34 | 0.07(0.22%) | 202 |

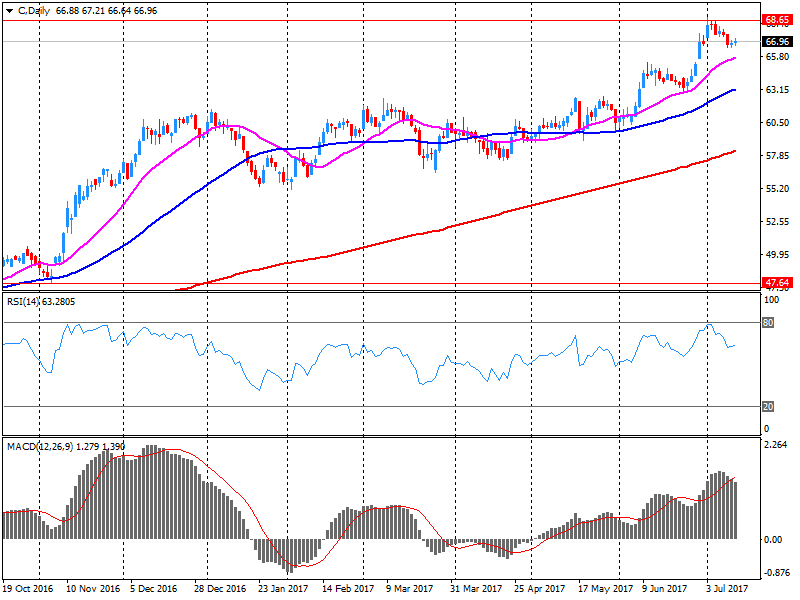

| Citigroup Inc., NYSE | C | 66.5 | -0.52(-0.78%) | 392238 |

| Exxon Mobil Corp | XOM | 81.05 | 0.08(0.10%) | 974 |

| Facebook, Inc. | FB | 159.55 | 0.29(0.18%) | 29958 |

| Ford Motor Co. | F | 11.64 | 0.04(0.34%) | 5753 |

| General Electric Co | GE | 26.83 | 0.04(0.15%) | 12522 |

| General Motors Company, NYSE | GM | 36.1 | 0.24(0.67%) | 2100 |

| Goldman Sachs | GS | 227.83 | -2.57(-1.12%) | 23073 |

| Google Inc. | GOOG | 950.43 | 3.27(0.35%) | 893 |

| Intel Corp | INTC | 34.3 | 0.06(0.18%) | 1685 |

| Johnson & Johnson | JNJ | 132.5 | 0.64(0.49%) | 634 |

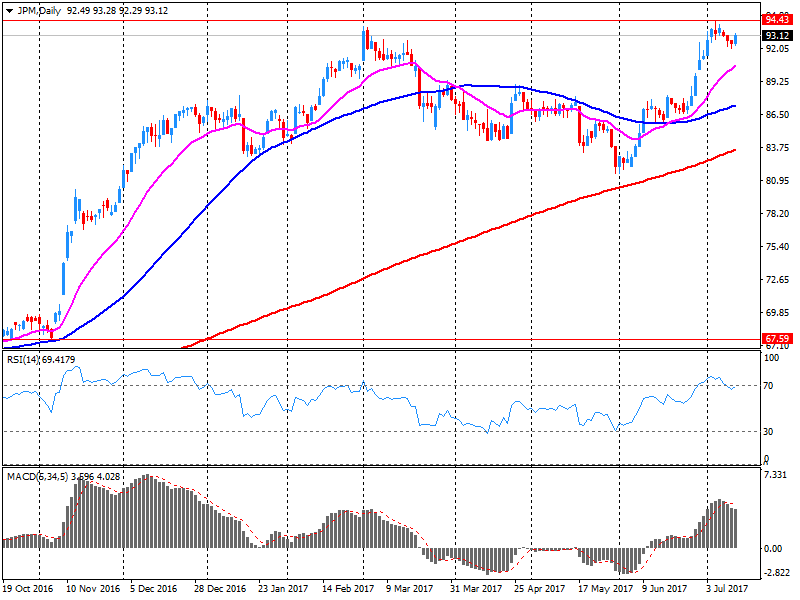

| JPMorgan Chase and Co | JPM | 91.5 | -1.60(-1.72%) | 878704 |

| McDonald's Corp | MCD | 155.11 | 0.07(0.05%) | 539 |

| Merck & Co Inc | MRK | 63.05 | 0.16(0.25%) | 200 |

| Microsoft Corp | MSFT | 71.97 | 0.20(0.28%) | 1482 |

| Procter & Gamble Co | PG | 86.73 | 0.03(0.03%) | 764 |

| Tesla Motors, Inc., NASDAQ | TSLA | 323.73 | 0.32(0.10%) | 23283 |

| Verizon Communications Inc | VZ | 43.55 | 0.06(0.14%) | 3379 |

| Visa | V | 96 | 0.06(0.06%) | 2373 |

| Wal-Mart Stores Inc | WMT | 76.2 | 1.15(1.53%) | 60622 |

| Walt Disney Co | DIS | 104.56 | 0.27(0.26%) | 838 |

| Yandex N.V., NASDAQ | YNDX | 31.6 | -0.08(-0.25%) | 19749 |

Hewlett Packard Enterprise (HPE) reinstated with a Hold at Maxim Group; target $18

Wal-Mart (WMT) upgraded and added to Conviction Buy List at Goldman

Boeing (BA) upgraded to Overweight from Neutral at JP Morgan; target raised to $240

Advance estimates of U.S. retail and food services sales for June 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $473.5 billion, a decrease of 0.2 percent from the previous month, and 2.8 percent (± 0.9 percent) above June 2016. Total sales for the April 2017 through June 2017 period were up 3.8 percent from the same period a year ago.

The April 2017 to May 2017 percent change was revised from down 0.3 percent to down 0.1 percent. Retail trade sales were down 0.1 percent from May 2017, and up 3.0 percent (± 0.7 percent) from last year. Nonstore Retailers were up 9.2 percent from June 2016, while Sporting Goods, Hobby, Book, & Music Stores were down 8.9 percent from last year.

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.6 percent.

The energy index declined again in June, falling 1.6 percent; this offset an increase in the index for all items less food and energy. All the major energy

component indexes declined, with the gasoline index falling 2.8 percent. The food index was unchanged in June, with the index for food at home declining

slightly as five of the six major grocery store food group indexes decreased.

The index for all items less food and energy rose 0.1 percent in June, its third straight such increase. The shelter index continued to rise, and the

indexes for medical care, motor vehicle insurance, education, and personal care also increased. The indexes for airline fares, used cars and trucks, wireless telephone services, and new ve

Citigroup (C) reported Q2 FY 2017 earnings of $1.28 per share (versus $1.24 in Q2 FY 2016), beating analysts' consensus estimate of $1.21.

The company's quarterly revenues amounted to $17.901 bln (+2% y/y), beating analysts' consensus estimate of $ 17.379 bln.

C rose to $67.25 (+0.34%) in pre-market trading.

JPMorgan Chase (JPM) reported Q2 FY 2017 earnings of $1.82 per share (versus $1.55 in Q2 FY 2016), beating analysts' consensus estimate of $1.59.

The company's quarterly revenues amounted to $25.500 bln (+4.6% y/y), beating analysts' consensus estimate of $24.360 bln.

The company also cut FY 2017 net interest income guidance slightly. Now it expects 2017 net interest income to be up $4 bln y/y (down from $4.5 bln).

JPM fell to $92.30 (-0.86%) in pre-market trading.

The first estimate for euro area (EA19) exports of goods to the rest of the world in May 2017 was €189.6 billion, an increase of 12.9% compared with May 2016 (€167.8 bn). Imports from the rest of the world stood at €168.1 bn, a rise of 16.4% compared with May 2016 (€144.4 bn).

As a result, the euro area recorded a €21.4 bn surplus in trade in goods with the rest of the world in May 2017, compared with +€23.4 bn in May 2016. Intra-euro area trade rose to €162.4 bn in May 2017, up by 15.3% compared with May 2016. These data are released by Eurostat, the statistical office of the European Union.

In June 2017, the Italian consumer price index for the whole nation (NIC) decreased by 0.1% on monthly basis and increased by 1.2% compared with June 2016, down from +1.4% in May 2017. The flash estimate was confirmed.

In June, the lower growth of the annual rate of change of All items index was mainly due to the prices of Unprocessed food (+1.4%, from +3.8% in May) and Non-regulated energy products (+2.9%, from +6.8% in the previous month), partly offset by the increase of the prices of Services related to transport (+4.1% from +3.2% in May).

Therefore, excluding energy and unprocessed food, core inflation increased by +0.9% (0.2 percentage points higher than in May), while inflation excluding energy was +0.9% (0.1 percentage points lower than in the previous month).

The annual rate of change of prices of Goods was +0.9% (down from +1.6% in May) and that one of prices of Services was +1.5% (up from +1.4%). As a consequence, the inflationary gap between Services and Goods was positive again (+0.6 percentage points).

EURUSD: 1.1300 (EUR 1.6bln) 1.1365-75 (1.0bln) 1.1400 (545m) 1.1425-35 (790m) 1.1450 (910m) 1.1500-10 (2.1bln) 1.1550 (560m)

USDJPY: 112.00 (USD 530m) 112.25 (415m) 112.50 (265m) 113.20-30 (1bln) 113.80 (425m) 113.90-00 (1.85bln) 114.40-50 (560m) 115.00 (500m)

EURGBP: 0.8660 (EUR 305m) 0.8800 (230m)

AUDUSD: 0.7595-05 (AUD 1.1bln) 0.7630-40 (610m) 0.7750 (250m)

USDCAD: 1.2765-75 (USD 180m) 1.2810-20 (415m)

NZDUSD: 0.7150 (NZD 335m) 0.7250 (250m)

EUR/USD

Resistance levels (open interest**, contracts)

$1.1520 (2704)

$1.1496 (1665)

$1.1464 (2331)

Price at time of writing this review: $1.1415

Support levels (open interest**, contracts):

$1.1348 (1803)

$1.1316 (2612)

$1.1279 (2513)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 4 is 63919 contracts (according to data from July, 13) with the maximum number of contracts with strike price $1,1500 (4158);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3078 (2318)

$1.3033 (1708)

$1.3005 (1161)

Price at time of writing this review: $1.2959

Support levels (open interest**, contracts):

$1.2893 (307)

$1.2868 (1209)

$1.2838 (2019)

Comments:

- Overall open interest on the CALL options with the expiration date August, 4 is 25505 contracts, with the maximum number of contracts with strike price $1,3100 (3088);

- Overall open interest on the PUT options with the expiration date August, 4 is 24146 contracts, with the maximum number of contracts with strike price $1,2800 (2977);

- The ratio of PUT/CALL was 0.95 versus 0.95 from the previous trading day according to data from July, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Japan's industrial production declined more than estimated in May, final data from the Ministry of Economy, Trade and Industry showed, cited by rttnews.

Industrial output fell 3.6 percent on a monthly basis instead of 3.3 percent decrease estimated previously. Year-on-year, production advanced 6.5 percent.

The monthly decline in shipments was revised to 2.9 percent from 2.8 percent. Stock remained stable, in contrast to the initially estimated 0.1 percent rise.

The inventory ratio came in at -1.9 percent, unchanged from the initial estimate.

The capacity utilization rate declined by adjusted 4.1 percent month-on-month in May, data showed.

New Zealand's manufacturing sector saw expansion continue to hover around expansion levels experienced over the last three months, according to the BNZ - BusinessNZ Performance of Manufacturing Index (PMI).

The seasonally adjusted PMI for June was 56.2 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 2.0 points lower than May, and similar to expansion levels seen in April. Overall, the sector has remained in expansion in all months since October 2012.

BusinessNZ's executive director for manufacturing Catherine Beard said that the last four months show the sector hovering around an expansion range between 56-58, which is still positive and healthy.

"Encouragingly new orders (58.7) continues to push forward with healthy expansion, followed by production (58.0). However, one noticeable dip was for employment (49.5), which went into minor contraction for the first time since November 2016.

"While expansion eased during June, the proportion of positive comments stood at 68.2%, compared 69.4% in May and 64.7% in April".

Fitch Ratings has affirmed China's Long-Term Foreign- and Local-Currency Issuer Default Ratings (IDRs) at 'A+' with a Stable Outlook. The Short-Term Foreign- and Local-Currency IDRs have been affirmed at 'F1+'. The issue ratings on China's senior unsecured bonds are also affirmed at 'A+' and 'F1+'. The Country Ceiling is affirmed at 'A+'.

The affirmation of the ratings and Outlook reflects the following key rating drivers:

China's ratings are underpinned by the strength of its external finances and macroeconomic track record. The country's near-term growth prospects remain favourable, and economic policies have been effective in responding to a variety of domestic and external pressures over the past year. However, a further increase in the economy's overall leverage in the context of continued adherence to ambitious GDP growth targets raises the potential for economic and financial shocks and, in Fitch's view, will constrain growth prospects over the medium-term.

Large and rising debt levels across China's non-financial sector, combined with the low stand-alone credit quality of Fitch-rated banks in its financial system (as indicated by their average viability rating of 'bb') remain the most significant risk factor for the sovereign rating. The agency expects official aggregate financing (excluding equity) will rise to 208% of GDP in 2017, from 201% in 2016 and 114% in 2008. Fitch's Financial Institutions team estimates that a broader credit measure, which incorporates activity not directly captured in the official series, will rise to around 270% at end-2017. Household debt remains moderate despite its rapid growth in recent years, but China's corporate sector has become the most highly indebted among major economies globally, based on figures from the Bank for International Settlements.

European stocks largely stepped higher Thursday, building on the prior day's sizable jump that was sparked by dovish comments from U.S. Federal Reserve chief Janet Yellen. The Stoxx Europe 600 SXXP, +0.32% rose 0.3% to close at 386.14, after the index on Wednesday notched its biggest one-day percentage advance since April 24, tacking on 1.5%. Global equity benchmarks have been given a midweek shot in the arm by Yellen saying interest rates don't have to rise all that much further.

The Dow on Thursday closed at a record for the 24th time in 2017, as gains in the financial sector helped the broader market book modest gains ahead of a roster of corporate results from the U.S.'s biggest banks.

Global stocks continued to move higher Friday, with most Asia-Pacific markets poised to end the week on a high note as investors maintained their risk for appetite. "Asia has done well in the past couple of days," despite commentary from Federal Reserve chief Janet Yellen and the latest worries regarding U.S. President Donald Trump, said Tai Hui, chief market strategist in Asia at J.P. Morgan Funds.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.