- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-02-2018

(raw materials / closing price /% change)

Oil 59.38+0.30%

Gold 1,325.10+0.71%

(index / closing price / change items /% change)

Hang Seng -47.79 29459.63 -0.16%

CSI 300 +49.45 3890.10 +1.29%

Euro Stoxx 50 +42.26 3368.25 +1.27%

FTSE 100 +84.63 7177.06 +1.19%

DAX +175.29 12282.77 +1.45%

CAC 40 +60.85 5140.06 +1.20%

DJIA +410.37 24601.27 +1.70%

S&P 500 +36.45 2656.00 +1.39%

NASDAQ +107.47 6981.97 +1.56%

S&P/TSX +207.35 15241.88 +1.38%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2291 +0,45%

GBP/USD $1,3837 +0,14%

USD/CHF Chf0,93919 -0,09%

USD/JPY Y108,65 -0,09%

EUR/JPY Y133,54 +0,35%

GBP/JPY Y150,339 +0,04%

AUD/USD $0,7861 +0,78%

NZD/USD $0,7262 +0,25%

USD/CAD C$1,25798 -0,12%

00:30 Australia National Australia Bank's Business Confidence January 11 10

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV 0.2% 0.2%

08:15 Switzerland Producer & Import Prices, y/y January 1.8% 0.9%

09:30 United Kingdom Producer Price Index - Input (MoM) January 0.1% 0.7%

09:30 United Kingdom Retail Price Index, m/m January 0.8% -0.7%

09:30 United Kingdom Producer Price Index - Input (YoY) January 4.9% 4.3%

09:30 United Kingdom Producer Price Index - Output (YoY) January 3.3% 3%

09:30 United Kingdom Producer Price Index - Output (MoM) January 0.4% 0.2%

09:30 United Kingdom Retail prices, Y/Y January 4.1% 4.1%

09:30 United Kingdom HICP ex EFAT, Y/Y January 2.5% 2.6%

09:30 United Kingdom HICP, m/m January 0.4% -0.6%

09:30 United Kingdom HICP, Y/Y January 3% 2.9%

13:00 U.S. FOMC Member Mester Speaks

21:45 New Zealand Food Prices Index, y/y January 2.3%

23:30 Australia Westpac Consumer Confidence February 105.1

23:50 Japan GDP, q/q (Preliminary) Quarter IV 0.6% 0.2%

23:50 Japan GDP, y/y (Preliminary) Quarter IV 2.5% 0.9%

Major US stock indices increased significantly on Monday, and recorded a second sessional increase in a row, mainly due to the growth in shares of the basic resources sector and the consumer goods sector.

Important statistical data that could have an impact on the mood of market participants, was not published. Investors are looking forward to the statistics on the consumer price index and retail sales, which will be released on Wednesday, as well as data on producer prices, which will come out on Thursday, and may affect the yield of bonds and movements in the stock market.

Oil prices rose slightly, as the weaker dollar prompted investors to buy oil futures, making them relatively cheap for holders of other currencies. The US dollar index, which shows the ratio of the dollar to the basket of 6 major currencies, is traded with a decrease of 0.32%, to 90.15.

Almost all components of the DOW index recorded a rise (28 out of 30). The leader of growth was the shares of Apple Inc. (AAPL, + 3.98%). Outsider were shares of General Electric Company (GE, -0.87%).

All sectors of S & P completed the auction in positive territory. The sector of basic materials grew most (+ 1.8%).

At closing:

Dow + 1.70% 24.601.27 +410.37

Nasdaq + 1.56% 6,981.96 +107.47

S & P + 1.39% 2,656.00 +36.45

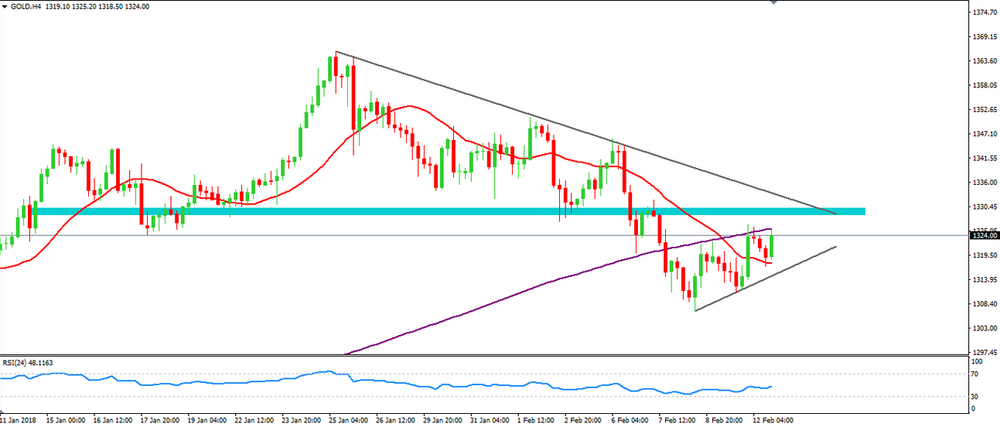

On 4-hour time frame chart we can see that the gold has been depreciation for several days.

At this moment, the price is correcting its last movements, however, it may be interesting to follow the next movements by the price and to see how it reacts near to the downside trend line and near to the resistance level.

Therefore, we can expect a further bearish movement on GOLD (XAU/USD).

U.S. stock-index futures rose by more than 1%, attempting to bounce back from Wall Street's worst week in two years, while volatility remained relatively elevated and U.S. bond yields hit new four-year highs.

Global Stocks:

Nikkei -

Hang Seng 29,459.63 -47.79 -0.16%

Shanghai 3,153.56 +23.71 +0.76%

S&P/ASX 5,820.70 -17.30 -0.30%

FTSE 7,183.53 +91.10 +1.28%

CAC 5,151.57 +72.36 +1.42%

DAX 12,318.29 +210.81 +1.74%

Crude $59.85 (+1.10%)

Gold $1,322.00 (+0.48%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 64.5 | 0.47(0.73%) | 3544 |

| Amazon.com Inc., NASDAQ | AMZN | 1,363.10 | 23.50(1.75%) | 89960 |

| American Express Co | AXP | 93.99 | 2.27(2.47%) | 1488 |

| AMERICAN INTERNATIONAL GROUP | AIG | 60.55 | 0.33(0.55%) | 92293 |

| Apple Inc. | AAPL | 158.8 | 2.39(1.53%) | 271624 |

| AT&T Inc | T | 36.41 | 0.36(1.00%) | 35116 |

| Barrick Gold Corporation, NYSE | ABX | 13.14 | 0.08(0.61%) | 9045 |

| Boeing Co | BA | 336.98 | 4.15(1.25%) | 49788 |

| Caterpillar Inc | CAT | 151.7 | 2.49(1.67%) | 25233 |

| Cisco Systems Inc | CSCO | 40.53 | 1.00(2.53%) | 61689 |

| Citigroup Inc., NYSE | C | 74.7 | 1.02(1.38%) | 18603 |

| Deere & Company, NYSE | DE | 157.75 | 2.82(1.82%) | 5014 |

| Exxon Mobil Corp | XOM | 77.35 | 1.57(2.07%) | 70390 |

| Facebook, Inc. | FB | 177.99 | 1.88(1.07%) | 202869 |

| FedEx Corporation, NYSE | FDX | 236.43 | 1.11(0.47%) | 4079 |

| Ford Motor Co. | F | 10.72 | 0.19(1.80%) | 80277 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.9 | 0.33(1.88%) | 24000 |

| General Electric Co | GE | 15 | 0.06(0.40%) | 345112 |

| General Motors Company, NYSE | GM | 42.38 | 0.92(2.22%) | 9685 |

| Goldman Sachs | GS | 252 | 2.70(1.08%) | 10867 |

| Google Inc. | GOOG | 1,048.86 | 11.08(1.07%) | 8453 |

| Home Depot Inc | HD | 186.9 | 2.78(1.51%) | 5663 |

| HONEYWELL INTERNATIONAL INC. | HON | 149.49 | 1.59(1.08%) | 425 |

| Intel Corp | INTC | 44.35 | 0.40(0.91%) | 100795 |

| International Business Machines Co... | IBM | 151.2 | 1.69(1.13%) | 12194 |

| International Paper Company | IP | 58.41 | 1.21(2.12%) | 2000 |

| JPMorgan Chase and Co | JPM | 111.14 | 1.10(1.00%) | 15140 |

| McDonald's Corp | MCD | 162.49 | 1.69(1.05%) | 5328 |

| Merck & Co Inc | MRK | 55.32 | 0.45(0.82%) | 10902 |

| Microsoft Corp | MSFT | 89.04 | 0.86(0.98%) | 135077 |

| Nike | NKE | 66.19 | 0.70(1.07%) | 1892 |

| Pfizer Inc | PFE | 34.62 | 0.46(1.35%) | 38275 |

| Procter & Gamble Co | PG | 80.5 | 0.58(0.73%) | 40734 |

| Starbucks Corporation, NASDAQ | SBUX | 54.91 | 0.33(0.60%) | 8609 |

| Tesla Motors, Inc., NASDAQ | TSLA | 317.53 | 7.11(2.29%) | 71006 |

| The Coca-Cola Co | KO | 43.57 | 0.44(1.02%) | 7502 |

| Twitter, Inc., NYSE | TWTR | 31.94 | 0.43(1.36%) | 399590 |

| United Technologies Corp | UTX | 124 | -1.03(-0.82%) | 13960 |

| UnitedHealth Group Inc | UNH | 224.37 | 3.41(1.54%) | 3115 |

| Verizon Communications Inc | VZ | 50.3 | 0.42(0.84%) | 15008 |

| Visa | V | 118.1 | 1.78(1.53%) | 18725 |

| Wal-Mart Stores Inc | WMT | 100.3 | 0.93(0.94%) | 19839 |

| Walt Disney Co | DIS | 104.45 | 1.36(1.32%) | 6232 |

| Yandex N.V., NASDAQ | YNDX | 36.55 | 0.66(1.84%) | 3067 |

-

Says oil market is only expected to balance towards the end of this year

-

Citing secondary sources,says its january oil output fell 8,000 bpd m/m to 32.302 mbpd

-

Opec's 11 members with supply targets pumped 29.371 mln bpd in january amounting to 137 pct compliance with supply cut pact (up from dec) - Reuters

-

Global oil demand to rise 1.59 million bpd this year (prev. Forecast 1.53 mbpd)

American Express (AXP) upgraded to Buy at Nomura

Cisco Systems (CSCO) upgraded to Buy from Neutral at Nomura

-

Deposits of domestic banks at 466.418 bln chf in week ending february 9 versus 465.385 bln chf a week earlier

-

Says Washington also supports credible elections in Libya

-

Washington supports credible, transparent elections in Egypt

-

Says if less credit headwind to UK economy, then may be ready for higher rates

-

There is increased evidence that tight labour markets are beginning to have upward effect on wages

-

If households are leveraging up when not much slack in economy, MPC should take an interest

The consumer price index (CPI) fell by 0.1% in January 2018 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was 0.7% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The decrease of 0.1% compared with the previous month is due in particular to the decrease in prices for outpatient hospital medical services. Prices for air transport also declined, along with prices for clothing and footwear, in particular because of sales. In contrast, prices for overnight stays in hotels, heating oil and electricity increased.

-

Says does not expect any period of political uncertainty to significantly dent economic confidence

-

'AAA' ratings reflect Germany's diversified, high value-added economy, strong institutions and history of sound public debt management

European stocks trimmed sharp losses in choppy Friday trade, after Wall Street surged at the open, partly rebounding after a plunge on Thursday that yanked both the S&P 500 index and Dow into correction territory. Stocks in Europe, however, were still on track for their worst week in two years.

After last week's roller-coaster ride on Wall Street, U.S. stock futures indicated gains in Monday trading. At 10 p.m. Eastern, Dow Jones Industrial Average futures YMH8, +0.58% were up 156 points, or 0.65%, in early Monday trading in Asia. S&P 500 futures ESH8, +0.58% were up 15.50, or 0.59%, and Nasdaq-100 futures NQH8, +0.41% were up 27, or 0.42%.

Asian stocks began the week on a calm note after a late rally Friday on Wall Street and the worst week in years for many global stock benchmarks. Markets in China SHCOMP, +0.80% , South Korea SEU, +1.17% and Taiwan Y9999, +0.77% were all at least 0.5% higher.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2382 (2637)

$1.2342 (1190)

$1.2313 (658)

Price at time of writing this review: $1.2278

Support levels (open interest**, contracts):

$1.2192 (5179)

$1.2174 (2070)

$1.2152 (4545)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 9 is 121851 contracts (according to data from February, 9) with the maximum number of contracts with strike price $1,2400 (5179);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4021 (3048)

$1.3969 (1287)

$1.3912 (639)

Price at time of writing this review: $1.3862

Support levels (open interest**, contracts):

$1.3742 (1778)

$1.3704 (2092)

$1.3656 (1854)

Comments:

- Overall open interest on the CALL options with the expiration date March, 9 is 42567 contracts, with the maximum number of contracts with strike price $1,3900 (3048);

- Overall open interest on the PUT options with the expiration date March, 9 is 41971 contracts, with the maximum number of contracts with strike price $1,3850 (2206);

- The ratio of PUT/CALL was 0.99 versus 0.94 from the previous trading day according to data from February, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.