- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 11-12-2017

(index / closing price / change items /% change)

Nikkei +127.65 22938.73 +0.56%

TOPIX +9.61 1813.34 +0.53%

Hang Seng +325.44 28965.29 +1.14%

CSI 300 +66.12 4069.50 +1.65%

Euro Stoxx 50 -9.24 3582.21 -0.26%

FTSE 100 +59.52 7453.48 +0.80%

DAX -30.05 13123.65 -0.23%

CAC 40 -12.26 5386.83 -0.23%

DJIA +56.87 24386.03 +0.23%

S&P 500 +8.49 2659.99 +0.32%

NASDAQ +35.00 6875.08 +0.51%

S&P/TSX +7.44 16103.51 +0.05%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1768 +0,04%

GBP/USD $1,3339 -0,37%

USD/CHF Chf0,99188 -0,10%

USD/JPY Y113,54 +0,07%

EUR/JPY Y133,63 +0,11%

GBP/JPY Y151,463 -0,30%

AUD/USD $0,7525 +0,29%

NZD/USD $0,6909 +1,00%

USD/CAD C$1,28547 -0,10%

00:30 Australia National Australia Bank's Business Confidence November 8

00:30 Australia House Price Index (QoQ) Quarter III 1.9% 0.6%

04:30 Japan Tertiary Industry Index October -0.2%

06:30 France Non-Farm Payrolls (Finally) Quarter III 0.4% 0.2%

09:30 United Kingdom Retail Price Index, m/m November 0.1% 0.3%

09:30 United Kingdom Producer Price Index - Input (MoM) November 1.0% 1.6%

09:30 United Kingdom Producer Price Index - Input (YoY) November 4.6% 6.8%

09:30 United Kingdom Producer Price Index - Output (YoY) November 2.8% 3.0%

09:30 United Kingdom Producer Price Index - Output (MoM) November 0.2% 0.2%

09:30 United Kingdom HICP ex EFAT, Y/Y November 2.7% 2.7%

09:30 United Kingdom Retail prices, Y/Y November 4.0% 4.1%

09:30 United Kingdom HICP, m/m November 0.1% 0.2%

09:30 United Kingdom HICP, Y/Y November 3.0% 3.0%

10:00 Eurozone ZEW Economic Sentiment December 30.9 30.2

10:00 Germany ZEW Survey - Economic Sentiment December 18.7 17.9

13:30 U.S. PPI excluding food and energy, m/m November 0.4% 0.2%

13:30 U.S. PPI excluding food and energy, Y/Y November 2.4% 2.4%

13:30 U.S. PPI, y/y November 2.8% 2.9%

13:30 U.S. PPI, m/m November 0.4% 0.4%

19:00 Eurozone ECB President Mario Draghi Speaks

19:00 U.S. Federal budget November -63.0 -135.2

21:45 New Zealand Food Prices Index, y/y November 2.7%

22:15 Australia RBA's Governor Philip Lowe Speaks

23:30 Australia Westpac Consumer Confidence December 99.7

23:50 Japan Core Machinery Orders October -8.1% -1.8%

23:50 Japan Core Machinery Orders, y/y October -3.5% -2.8%

Major US stock indices grew moderately on Monday, while DJIA and S & P finished the session at record highs, helped by the appreciation of shares in the technology and energy sectors.

The focus was also on the United States. As the survey of vacancies and labor turnover (JOLTS), published by the Bureau of Labor Statistics showed, in October the number of vacancies dropped to 5.996 million. Meanwhile, the indicator for September was revised upwards to 6.177 million from 6.093 million. Analysts had expected that the number of vacancies will decrease to 6,030 million. The vacancy level was 3,9%, decreasing by 0,1% relative to September. The number of vacancies declined in the private sector, and little has changed in the government segment. In October, hiring amounted to 5.552 million against 5.32 million in September. The level of hiring in October increased by 0.2%, and amounted to 3.8%.

Oil prices rose after the explosion in New York reoriented the market to geopolitical risk. On Monday morning, an explosion occurred near the Port Authority of New York and New Jersey, one of the city's busiest suburban hubs. "The explosion caused an increase in oil quotations," said Olivier Jacob, Managing Director of PetroMatrix, "However, prices are still within the recent range."

Most components of the DOW index finished trading in positive territory (19 out of 30). The leader of growth was the shares of The Walt Disney Company (DIS, + 2.37%). Outsider were shares of The Boeing Company (BA, -1.05%).

Most sectors of the S & P index recorded an increase. The raw materials sector grew most (+ 0.8%). The sector of industrial goods showed the greatest decrease (-0.4%).

At closing:

DJIA + 0.23% 24,386.03 +56.87

Nasdaq + 0.51% 6,875.08 +35.00

S & P + 0.32% 2,659.99 +8.49

The number of job openings was little changed at 6.0 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Over the month, hires increased to 5.6 million and separations were little changed at 5.2 million. Within separations, the quits rate and the layoffs and

discharges rate were little changed at 2.2 percent and 1.1 percent, respectively. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions.

U.S. stock-index futures were marginally higher on Wednesday, weighed down by reports of an explosion in New York's busy Port Authority commuter hub.

Global Stocks:

Nikkei 22,938.73 +127.65 +0.56%

Hang Seng 28,965.29 +325.44 +1.14%

Shanghai 3,322.24 +32.25 +0.98%

S&P/ASX 5,998.30 +3.90+0.07%

FTSE 7,429.00 +35.04 +0.47%

CAC 5,396.21 -2.88 -0.05%

DAX 13,154.94 +1.24 +0.01%

Crude $57.46 (+0.17%)

Gold $1,249.10 (+0.06%)

-

A few injuries reported in incident at New York's port authority - WABC news citing police sources

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 238.83 | 0.70(0.29%) | 130 |

| ALTRIA GROUP INC. | MO | 71.64 | 0.10(0.14%) | 654 |

| Amazon.com Inc., NASDAQ | AMZN | 1,164.88 | 2.88(0.25%) | 14549 |

| Apple Inc. | AAPL | 169.55 | 0.18(0.11%) | 58837 |

| AT&T Inc | T | 36.7 | -0.03(-0.08%) | 4431 |

| Barrick Gold Corporation, NYSE | ABX | 13.67 | 0.02(0.15%) | 7700 |

| Boeing Co | BA | 286.99 | 1.09(0.38%) | 5158 |

| Caterpillar Inc | CAT | 144.1 | 0.24(0.17%) | 1867 |

| Cisco Systems Inc | CSCO | 37.5 | -0.11(-0.29%) | 11107 |

| Exxon Mobil Corp | XOM | 82.6 | -0.06(-0.07%) | 1827 |

| Facebook, Inc. | FB | 179.35 | 0.35(0.20%) | 33901 |

| Ford Motor Co. | F | 12.62 | 0.01(0.08%) | 2952 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.03 | 0.06(0.40%) | 19257 |

| General Electric Co | GE | 17.74 | 0.03(0.17%) | 46718 |

| General Motors Company, NYSE | GM | 42.13 | 0.11(0.26%) | 2756 |

| Goldman Sachs | GS | 250.03 | -0.32(-0.13%) | 3085 |

| Google Inc. | GOOG | 1,038.37 | 1.32(0.13%) | 1510 |

| Hewlett-Packard Co. | HPQ | 20.95 | -0.12(-0.57%) | 1202 |

| Intel Corp | INTC | 43.41 | 0.06(0.14%) | 7460 |

| International Business Machines Co... | IBM | 155.5 | 0.69(0.45%) | 1038 |

| JPMorgan Chase and Co | JPM | 105.8 | -0.13(-0.12%) | 10836 |

| Merck & Co Inc | MRK | 55.6 | 0.03(0.05%) | 1257 |

| Microsoft Corp | MSFT | 84.3 | 0.14(0.17%) | 53245 |

| Pfizer Inc | PFE | 35.68 | -0.06(-0.17%) | 77544 |

| Starbucks Corporation, NASDAQ | SBUX | 58.46 | -0.15(-0.26%) | 1323 |

| Tesla Motors, Inc., NASDAQ | TSLA | 313.81 | -1.32(-0.42%) | 17495 |

| The Coca-Cola Co | KO | 45.3 | -0.01(-0.02%) | 86940 |

| Visa | V | 112.99 | 0.39(0.35%) | 1093 |

| Wal-Mart Stores Inc | WMT | 96.65 | 0.10(0.10%) | 31062 |

| Walt Disney Co | DIS | 104.6 | 0.37(0.36%) | 29840 |

| Yandex N.V., NASDAQ | YNDX | 33.25 | 0.36(1.09%) | 8000 |

Freeport-McMoRan (FCX) target raised to $16 at B. Riley FBR

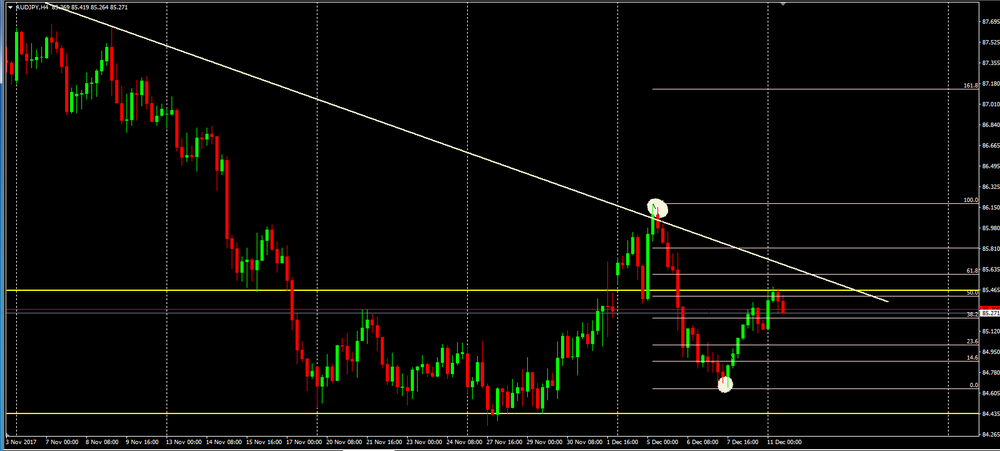

AUD/JPY 4-hour time frame chart

As we can see on 4-hour time frame chart, the price has been falling and respecting a downside trend line.

However, the price has been correcting its last bearish movement and now it seems that there is a potential new bearish movement soon.

We can see that the price is rejecting the resistance level and the fibonacci's levels, therefore, we can expect a further downside movement, at least to the previous low.

-

A rising share of new housing loans to households shows relatively high loan-to-value, debt service-to-income and debt-to-income ratios

-

Russia, India, China do not want tensions on Korean peninsula to be further escalated

EUR/USD: 1.1640(518 m), 1.1700(980 m), 1.1800(1.02 b), 1.1900(606 m), 1.1950(372 m), 1.200(505 m)

USD/JPY: 111.95-112.00(881 m), 113.00-10(1.06 b), 113.20(371 m), 113.40(345 m)

USD/CHF: 0.9900(465 m), 0.9940(275 m), 1.0200(540 m)

AUD/USD: 0.7550(214 m), 0.7610-15(340 m), 0.7790(295 m)

NZD/USD: 0.6790(300 m), 0.6915(208 m), 0.6950-51(328 m)

USD/CAD: 1.2900(580 m)

EUR/JPY: 133.25(660 m)

EUR/GBP: 0.8820(280 млн)

AUD/NZD: 1.1000(252 млн)

In October 2017, the retail trade decreased by 2.1% compared with October 2016, all store types showed decline as food retailing was down 1.7% and non-food retailing was down 2.4%.

Estimates of the value of retail sales fell month-on-month also: -1.0% compared with September 2017.

The underlying pattern, as measured by the 3 month on 3 month estimate, showed a contraction in October 2017, where the value of sales decreased by 0.1% and the volume of sales was down 0.2%.

The volume of retail trade dropped by 2.9% compared with October 2016 and decreased by 1.1% compared with September 2017.

-

Believes in Israel's interest to find sustainable mideast solution

-

Expresses full support to king of Jordan in peace process

-

Condemns all attacks on jews, including in Europe and on Israel

-

Says implementation of NPL addendum to be delayed by a "few months":

-

New Zealand government says Orr will take up role on march 27

European stocks rose Friday, scoring their highest close in a month, after the U.K. and the European Union came to terms on a Brexit divorce deal, opening the way to a key phase of talks. Bank stocks were in rally mode after news of the Brexit breakthrough and after global financial officials finally signed a deal Thursday to harmonize banking rules.

Stocks ended the week on an positive note Friday, with the S&P 500 and Dow Jones Industrial Average logging record closes, while the Nasdaq Composite also advanced. A stronger-than-expected November jobs report helped buoy stocks in early action.

Asia stocks were trading narrowly mixed in early Monday session, following an upbeat Wall Street last Friday after the release of a stronger-than-expected jobs report.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1902 (2100)

$1.1884 (1029)

$1.1856 (208)

Price at time of writing this review: $1.1779

Support levels (open interest**, contracts):

$1.1713 (3199)

$1.1675 (3854)

$1.1634 (3017)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 87829 contracts (according to data from December, 8) with the maximum number of contracts with strike price $1,1800 (4810);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3595 (3607)

$1.3546 (1844)

$1.3510 (1430)

Price at time of writing this review: $1.3397

Support levels (open interest**, contracts):

$1.3302 (1563)

$1.3238 (1971)

$1.3161 (1827)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 27820 contracts, with the maximum number of contracts with strike price $1,3500 (3607);

- Overall open interest on the PUT options with the expiration date January, 5 is 27653 contracts, with the maximum number of contracts with strike price $1,2900 (2426);

- The ratio of PUT/CALL was 0.99 versus 0.88 from the previous trading day according to data from December, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.