- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-08-2017

(raw materials / closing price /% change)

Oil 49.70 +0.28%

Gold 1,283.20 +0.30%

(index / closing price / change items /% change)

Nikkei -257.30 19738.71 -1.29%

TOPIX -17.42 1617.90 -1.07%

Hang Seng -97.82 27757.09 -0.35%

CSI 300 -1.17 3731.04 -0.03%

Euro Stoxx 50 -47.18 3468.45 -1.34%

FTSE 100 -44.67 7498.06 -0.59%

DAX -138.05 12154.00 -1.12%

CAC 40 -73.19 5145.70 -1.40%

DJIA -36.64 22048.70 -0.17%

S&P 500 -0.90 2474.02 -0.04%

NASDAQ -18.13 6352.33 -0.28%

S&P/TSX -39.02 15217.33 -0.26%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1759 +0,08%

GBP/USD $1,3006 +0,13%

USD/CHF Chf0,96343 -1,02%

USD/JPY Y109,91 -0,36%

EUR/JPY Y129,25 -0,29%

GBP/JPY Y142,95 -0,23%

AUD/USD $0,7885 -0,33%

NZD/USD $0,7352 +0,33%

USD/CAD C$1,26948 +0,23%

01:00 Australia Consumer Inflation Expectation August 4.4%

04:30 Japan Tertiary Industry Index June -0.1%

06:45 France Industrial Production, m/m June 1.9% -0.4%

08:30 United Kingdom Total Trade Balance June -3.07

08:30 United Kingdom Industrial Production (MoM) June -0.1% 0.1%

08:30 United Kingdom Industrial Production (YoY) June -0.2% -0.2%

08:30 United Kingdom Manufacturing Production (YoY) June 0.4% 0.7%

08:30 United Kingdom Manufacturing Production (MoM) June -0.2%

12:00 United Kingdom NIESR GDP Estimate July 0.3%

12:30 Canada New Housing Price Index, MoM June 0.7%

12:30 Canada New Housing Price Index, YoY June 3.8%

12:30 U.S. Continuing Jobless Claims 1968 1960

12:30 U.S. PPI excluding food and energy, m/m July 0.1% 0.2%

12:30 U.S. PPI excluding food and energy, Y/Y July 1.9% 2.1%

12:30 U.S. PPI, y/y July 2% 2.2%

12:30 U.S. PPI, m/m July 0.1% 0.1%

12:30 U.S. Initial Jobless Claims 240 240

14:00 U.S. FOMC Member Dudley Speak

18:00 U.S. Federal budget July -90 -73

22:30 New Zealand Business NZ PMI July 56.2

22:45 New Zealand Food Prices Index, y/y July 3.0%

Major US stock indexes finished trading in negative territory as investors switched to safe assets after US President Donald Trump's warning against North Korea exacerbated tensions with the nuclear power.

Today, officials of the DPRK declared their readiness to strike a missile strike at the US Air Force base on the island of Guam, located in the Pacific Ocean, if such a decision is made by the head of state. These comments are a reaction of North Korea to the statements of US President Donald Trump, who demanded that North Korea stop "further threats" and warned that the US would respond with "the fire and fury that the world has never seen."

In addition, the focus was on statistics on the United States. As it became known, the productivity of workers in the US grew in the second quarter, but remained alarmingly sluggish during the current period of economic expansion. Labor productivity in the non-agricultural sector of the economy increased by 0.9% in seasonally adjusted terms, compared with an increase of 0.1% in the first three months of 2017. Economists had expected growth of 0.7% in the last quarter.

Meanwhile, wholesale inventories in the US increased more in June than previously reported, recording their biggest increase in six months, as car inventories grew even more as sales fell. The Ministry of Trade reported that wholesale stocks rose by 0.7% after an increase of 0.6% in May.

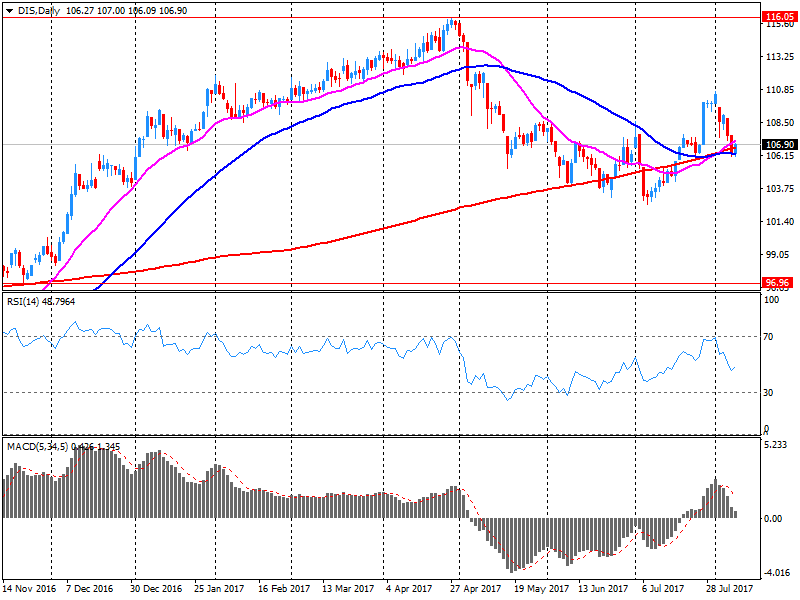

Components of the DOW index finished the trades mixed (16 in the red, 14 in the black). Outsider were the shares of The Walt Disney Company (DIS, -4.54%). The growth leader was the shares of The Home Depot, Inc. (HD, + 1.30%).

All sectors of the S & P index recorded a decline. The largest decline was observed in the sector of conglomerates (-0.9%).

At closing:

DJIA -0.18% 22.046.65 -38.69

Nasdaq -0.28% 6.352.33 -18.13

S & P -0.04% 2,473.92 -1.00

The U.S. Energy Information Administration (EIA) reported Wednesday that crude inventories fell by 6.451 million barrels to 475.4 million barrels in the week ended August 4. Economists had forecast a decline of 2.8 million barrels.

At the same time, gasoline stocks rose by 3.424 million barrels to 231.1 million barrels, while analysts had expected a drop of 1.5 million barrels.

Distillate stocks reduced by 1.729 million barrels to 147.7 million barrels last week, while analysts had forecast a fall of 131,000 barrels.

Meanwhile, oil production in the U.S. reduced to 9.423 million barrels per day versus 9.430 million barrels per day in the previous week.

U.S. crude oil imports averaged about 7.8 million barrels per day last week, down by 491,000 barrels per day from the previous week.

The Commerce Department revealed on Wednesday that wholesale inventories rose 0.7 percent m-o-m in June after growing 0.6 percent m-o-m in May (revised from an originally reported 0.4 percent m-o-m gain). That was the biggest gain since last December and exceeded economists' forecast for a 0.6 percent m-o-m increase.

The June increase in wholesale inventories came as auto inventories climbed 1.4 percent m-o-m after advancing 0.6 percent m-o-m in May. Meanwhile, wholesale stocks excluding autos, which goes into the calculation of GDP, rose 0.6 percent m-o-m in June.

Statistics Canada reported Wednesday that the value of building permits issued by the Canadian municipalities rose 2.5 percent m-o-m in June, following a 10.7 percent m-o-m surge in May (revised from an originally reported 8.9 percent m-o-m increase). Economists had forecast a 2 percent drop in June from May.

According to the report, residential building permits fell 0.9 percent m-o-m, as a tumble in the permits for single-family dwellings (-12.5 percent m-o-m) offset a surge in permits for multi-family buildings (+12.5 percent m-o-m).

Meanwhile, non-residential permits rose 8.8 percent m-o-m in June, as all building components, namely commercial (+13.0 percent m-o-m), industrial (+6.3 percent m-o-m) and institutional (+2.1 percent m-o-m), recorded higher construction intentions.

In June, building permits rose in six provinces, led by Quebec (+12.3 percent m-o-m) and Manitoba (+40.4 percent m-o-m).

Building permits demonstrated a 10.4 y-o-y surge in the second quarter, with all building components gaining except for institutional structures.

EURUSD: 1.1700 (EUR 570m) 1.1725 (725m) 1.1850 (515m)

USDJPY: 109.75 (USD 500m) 110.00 (850m) 110.50 (440m)

U.S. stock-index futures fell, as investors moved away from risky assets in response to heightened North Korea-U.S. tensions.

Global Stocks:

Nikkei 19,738.71 -257.30 -1.29%

Hang Seng 27,757.09 -97.82 -0.35%

Shanghai 3,275.57 -6.30 -0.19%

S&P/ASX 5,765.66 +21.91 +0.38%

FTSE 7,486.06 -56.67 -0.75%

CAC 5,129.95 -88.94 -1.70%

DAX 12,122.78 -169.27 -1.38%

Crude $49.53 (+0.73%)

Crude $1,280.90 (+1.45%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 206.58 | 0.15(0.07%) | 3888 |

| ALCOA INC. | AA | 39.45 | -0.13(-0.33%) | 1766 |

| ALTRIA GROUP INC. | MO | 65.29 | -0.09(-0.14%) | 2692 |

| Amazon.com Inc., NASDAQ | AMZN | 985 | -4.84(-0.49%) | 20416 |

| American Express Co | AXP | 85.79 | -0.15(-0.17%) | 4059 |

| AMERICAN INTERNATIONAL GROUP | AIG | 63.79 | -0.78(-1.21%) | 3228 |

| Apple Inc. | AAPL | 159.28 | -0.80(-0.50%) | 199615 |

| AT&T Inc | T | 38.25 | -0.11(-0.29%) | 24743 |

| Barrick Gold Corporation, NYSE | ABX | 16.83 | 0.33(2.00%) | 256510 |

| Boeing Co | BA | 237.83 | -0.25(-0.11%) | 10464 |

| Caterpillar Inc | CAT | 114.2 | -0.21(-0.18%) | 4357 |

| Chevron Corp | CVX | 110.5 | 0.15(0.14%) | 2733 |

| Cisco Systems Inc | CSCO | 31.69 | 0.02(0.06%) | 8479 |

| Citigroup Inc., NYSE | C | 68.1 | -0.78(-1.13%) | 69760 |

| E. I. du Pont de Nemours and Co | DD | 81.94 | 0.82(1.01%) | 3095 |

| Exxon Mobil Corp | XOM | 80.12 | 0.16(0.20%) | 6362 |

| Facebook, Inc. | FB | 170.05 | -1.18(-0.69%) | 92980 |

| FedEx Corporation, NYSE | FDX | 206.33 | -0.67(-0.32%) | 100 |

| Ford Motor Co. | F | 10.87 | -0.02(-0.18%) | 13732 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.39 | -0.08(-0.55%) | 14535 |

| General Electric Co | GE | 25.49 | -0.07(-0.27%) | 33815 |

| General Motors Company, NYSE | GM | 35.11 | -0.28(-0.79%) | 1115 |

| Goldman Sachs | GS | 230.25 | -1.80(-0.78%) | 12060 |

| Google Inc. | GOOG | 920.58 | -6.21(-0.67%) | 2092 |

| Home Depot Inc | HD | 152.85 | -0.50(-0.33%) | 2806 |

| Intel Corp | INTC | 36.3 | -0.11(-0.30%) | 8361 |

| International Business Machines Co... | IBM | 141 | -1.11(-0.78%) | 11773 |

| Johnson & Johnson | JNJ | 132.6 | 0.33(0.25%) | 6887 |

| JPMorgan Chase and Co | JPM | 92.75 | -0.93(-0.99%) | 58486 |

| McDonald's Corp | MCD | 154.86 | -0.06(-0.04%) | 3538 |

| Merck & Co Inc | MRK | 62.44 | 0.12(0.19%) | 6085 |

| Microsoft Corp | MSFT | 72.2 | -0.59(-0.81%) | 33563 |

| Nike | NKE | 59.25 | -0.21(-0.35%) | 754 |

| Pfizer Inc | PFE | 33.23 | -0.05(-0.15%) | 7129 |

| Procter & Gamble Co | PG | 91.5 | -0.08(-0.09%) | 14717 |

| Starbucks Corporation, NASDAQ | SBUX | 53.95 | -0.57(-1.05%) | 14044 |

| Tesla Motors, Inc., NASDAQ | TSLA | 361.5 | -3.72(-1.02%) | 79319 |

| Travelers Companies Inc | TRV | 128 | -0.55(-0.43%) | 100 |

| Twitter, Inc., NYSE | TWTR | 16 | -0.15(-0.93%) | 50217 |

| United Technologies Corp | UTX | 118.05 | -0.14(-0.12%) | 1300 |

| UnitedHealth Group Inc | UNH | 194.75 | -0.15(-0.08%) | 2233 |

| Verizon Communications Inc | VZ | 48.5 | -0.10(-0.21%) | 14438 |

| Visa | V | 100.6 | -0.68(-0.67%) | 5578 |

| Wal-Mart Stores Inc | WMT | 80.9 | -0.18(-0.22%) | 4185 |

| Walt Disney Co | DIS | 101.25 | -5.73(-5.36%) | 364610 |

| Yandex N.V., NASDAQ | YNDX | 30.8 | 0.96(3.22%) | 84190 |

Starbucks (SBUX) downgraded to Market Perform from Outperform at BMO Capital Markets

The preliminary data from the U.S. Labour Department showed Wednesday that labour productivity in the United States rose 0.9 percent q-o-q in the second quarter, as output boosted 3.4 percent q-o-q and hours worked increased 2.5 percent q-o-q (seasonally adjusted). That exceeded economists' forecast for a 0.7 percent q-o-q gain after initially reported flat performance in the first quarter. The first quarter reading was revised to +0.1 percent. In y-o-y terms, the labor productivity rose 1.2 percent in the second quarter, reflecting a 2.7-percent surge in output and a 1.5-percent increase in hours worked.

Meanwhile, unit labor costs in the nonfarm business sector in the second quarter rose 0.6 percent compared to a 5.4 percent q-o-q growth in the prior quarter (revised from +2.2 percent). Economists had forecast a 1.2 percent gain in second-quarter unit labor costs. Unit labor costs quarterly growth reflected a 1.6-percent q-o-q increase in hourly compensation and a 0.9-percent q-o-q gain in productivity. Compared to the corresponding period of 2016, unit labor costs fell 0.2 percent.

The Canada Mortgage And Housing Corp. (CMHC) announced the Canadian housing starts rose to a seasonally adjusted rate of 222,324 units in July from an upwardly revised 212,948 units in June (originally 212,695). Economists had forecast housing starts falling to 205,000.

According to the report, urban starts increased by 5 percent m-o-m last month to 206,122, as multiple urban starts surged by 10.4 percent m-o-m to 141,950, while single-detached urban starts declined by 3.9 percent m-o-m to 64,172 units. At the same time, rural starts were estimated at a seasonally adjusted annual rate of 16,202 units (-8.3 percent m-o-m).

Disney (DIS) reported Q3 FY 2017 earnings of $1.58 per share (versus $1.62 in Q3 FY 2016), beating analysts' consensus estimate of $1.55.

The company's quarterly revenues amounted to $14.238 bln (-0.3% y/y), missing analysts' consensus estimate of $14.439 bln.

Disney (DIS) also announced plans to end its partnership with Netflix in 2019 and to acquire a majority stake in BAMTech, a streaming technology provider, as it intends to launch its own streaming services.

DIS fell to $102.65 (-4.05%) in pre-market trading.

Japan Machine Tool Builders' Association (JMTBA) reported its preliminary estimates showed that the country's machine tool orders rose 26.3 percent y-o-y in July, following a 31.1 percent y-o-y increase in June.

JMTBA's data on machine tool orders are released nearly a month ahead of the Japanese machine orders data set from the Cabinet Office's think tank, the Economic and Social Research Institute. These data are a leading indicator of the Japanese production.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1901 (2681)

$1.1875 (1615)

$1.1836 (1719)

Price at time of writing this review: $1.1740

Support levels (open interest**, contracts):

$1.1677 (2296)

$1.1652 (2980)

$1.1624 (3279)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 8 is 118868 contracts (according to data from August, 8) with the maximum number of contracts with strike price $1,2000 (5179);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3166 (1740)

$1.3110 (3110)

$1.3070 (913)

Price at time of writing this review: $1.3014

Support levels (open interest**, contracts):

$1.2956 (928)

$1.2919 (1058)

$1.2867 (1977)

Comments:

- Overall open interest on the CALL options with the expiration date September, 8 is 28477 contracts, with the maximum number of contracts with strike price $1,3000 (3110);

- Overall open interest on the PUT options with the expiration date September, 8 is 24486 contracts, with the maximum number of contracts with strike price $1,2850 (2606);

- The ratio of PUT/CALL was 0.86 versus 0.87 from the previous trading day according to data from August, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The National Bureau of Statistics (NBS) reported Wednesday that China's producer price index (PPI) rose 5.5 percent y-o-y in July, in-line with the pace in June and economists' forecast.

The producer price inflation steadied on growing commodity prices, as demand stayed resilient and the government's drive to reduce industrial capacity takes hold.

The PPI rose 0.2 percent m-o-m in July, marking the first increase in four months.

Meanwhile, the consumer price index (CPI) increased 1.4 percent y-o-y in July, decelerating from June's 1.5 percent y-o-y increase. That was the lowest inflation rate since April and below economists' forecast for 1.5 y-o-y gain.

The NBS attributed weaker July inflation to slowed growth of non-food prices (+2 percent y-o-y, compared with a 2.2 percent y-o-y increase in June) and continued declines in food prices fell (-1.1 percent y-o-y, compared with a 1.2 percent y-o-y drop in June).

In m-o-m terms, the CPI edged up 0.1 percent in July, following a 0.2 percent fall in the previous month.

The Australian Bureau of Statistics (ABS) announced Wednesday that the Australian home loans rose 0.5 percent m-o-m in June, following a revised 1.1 percent m-o-m gain in May (initially 1 percent). Economists had expected a 1.5 percent m-o-m increase. According to the report, the lending to owner occupiers rose 0.3 percent m-o-m in June compared to a 2.9 percent gain in May. Meanwhile, loans to investors increased 1.6 percent m-o-m, snapping two months of declines. Number of loan approvals to build new dwellings went up 3.6 percent m-o-m in June, while approvals to buy new dwellings rose 3.5 percent m-o-m. In the meantime, lending for the purchase of established homes edged down 0.1 percent m-o-m.

Westpac Bank revealed its gauge for consumer sentiment in Australia fell 1.2 percent to 95.5 in August. The latest reading marks the fourth consecutive month when the index has been below the 100 level, which separates optimism from pessimism.

Westpac's chief economist, Bill Evans noted, "Much of the weakness is likely to reflect a mix of weak growth in wages, increases in key costs such as electricity and emerging concerns about rising interest rates." "The survey detail suggests increased pressures on family finances; concerns around interest rates; and housing affordability in NSW and Victoria are more than outweighing increased confidence around jobs," he added.

European stocks finished Tuesday's session at a roughly two-week high, as a drop in the euro helped regional equities push past disappointing trade data from Germany and China that cast doubt on the prospects for those powerhouse economies. Meanwhile, Danish jeweler Pandora A/S was among the companies whose shares were yanked down after earnings reports.

U.S. stocks finished near lows of the session Tuesday, reversing earlier gains as an early rally in financial, tech and energy stocks fizzled amid tough talk from President Donald Trump on North Korea.

Asian stock markets slid Wednesday following Wall Street's decline as President Donald Trump and North Korea traded threats over the North's nuclear program.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.