- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-07-2017

Major US stock indexes finished trading with a moderate increase, as the data surpassing the forecast on changes in the number of employed in non-agricultural sectors of the US economy increased expectations that the upward trend in the labor market could allow the Fed to go for the third increase in the interest rate this year, despite weak inflation .

The report of the Ministry of Labor showed that the number of jobs in the US increased more than expected in June and employers increased the number of working hours, which indicates the strength of the labor market. According to the report, the number of people employed in non-agricultural sectors jumped by 222,000 jobs last month, outpacing the expectations of growth economists by 179,000 jobs. Data for April and May were revised, and more was created for 47,000 new jobs than previously reported. At the same time, the unemployment rate rose to 4.4% from a 16-year low of 4.3%, which was caused by the fact that more people were looking for a job, which indicates a confidence in the labor market. The unemployment rate fell by four tenths of a percent this year and is close to the last median median forecast for 2017. The average work week increased to 34.5 hours from 34.4 hours in May. The average hourly earnings increased by four cents or 0.2% in June after rising 0.1% in May. This increased the annual wage growth to 2.5% from 2.4% in May.

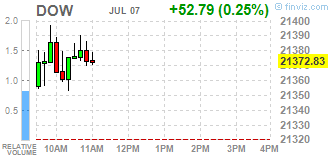

Most components of the DOW index recorded a rise (24 out of 30). The leader of growth were shares of McDonald's Corp. (MCD, + 2.16%). Outsider were shares of The Goldman Sachs Group, Inc. (GS, -0.67%).

All sectors of S & P finished the session in positive territory. The technological sector grew most (+ 1.1%).

At closing:

Dow + 0.44% 21.412.97 +92.93

Nasdaq + 1.04% 6,153.08 +63.62

S & P + 0.64% 2.425.18 +15.43

Major U.S. stock-indexes rose on Friday as better-than-expected nonfarm payrolls data for June increased expectations that the labor market strength could make the case for a third interest rate hike by the Fed this year despite weakened inflation.

Most of Dow stocks in positive area (19 of 30). Top gainer - McDonald's Corp. (MCD, +1.50%). Top loser - Chevron Corp. (CVX, -0.72%).

A majority of S&P sectors in positive area. Top gainer - Technology (+0.75%). Sole loser - Basic Materials (-0.80%).

At the moment:

Dow 21329.00 +49.00 +0.23%

S&P 500 2415.75 +7.25 +0.30%

Nasdaq 100 5641.25 +44.50 +0.80%

Crude Oil 44.26 -1.26 -2.77%

Gold 1213.20 -10.10 -0.83%

U.S. 10yr 2.38 +0.01

-

Trump does not answer shouted question from reporters about russian meddling in U.S. election

-

Trump says we look forward to a lot of positive things happening for Russia and US

EURUSD: 1.1300 (EUR 365m) 1.1325 (450m) 1.1400 (1.14bln) 1.1430 (630m) 1.1450 (215m) 1.1500 (485m)

USDJPY: 112.00 (USD 865m) 112.15 (360m0 112.50 (350m) 113.00 (310m) 113.25 (350m) 113.45 (420m) 113.75 (390m) 113.90-114.00 (1.2bln) 114.75 (255m) 115.00 (380m)

GBPUSD: 1.2725 (GBP 460m)

AUDUSD: 0.7500 (AUD 240m) 0.7565 (300m) 0.7600 (375m) 0.7650 (810m) 0.7720-30 (550m) 0.7750 (350m)

Employment rose by 45,000 in June, mostly in part-time work. The unemployment rate was 6.5%, down 0.1 percentage points from the previous month.

Compared with 12 months earlier, there were 351,000 (+1.9%) more people employed. Most of the growth was in full-time work (+248,000 or +1.7%), while part-time employment was also up (+103,000 or +3.0%). The total number of hours worked increased 1.4% over this period.

In the second quarter of 2017, overall employment grew by 103,000 (+0.6%), the fourth consecutive quarter of strong employment growth and the largest quarterly increase since 2010. In the first half of 2017, employment grew by 186,000 (+1.0%), compared with 64,000 (+0.4%) over the first half of 2016.

Total nonfarm payroll employment increased by 222,000 in June, and the unemployment rate was little changed at 4.4 percent, the U.S. Bureau of Labor Statistics reported today. Employment increased in health care, social assistance, financial activities, and mining.

In June, the unemployment rate, at 4.4 percent, and the number of unemployed persons, at 7.0 million, were little changed. Since January, the unemployment rate and the number of unemployed are down by 0.4 percentage point and 658,000, respectively.

The labor force participation rate, at 62.8 percent, changed little in June and has shown no clear trend over the past year. The employment-population ratio (60.1 percent) was also little changed in June and has held fairly steady thus far this year.

U.S. stock-index futures rose moderately amid better-than-expected nonfarm payrolls data and somewhat disappointing statistics on average hourly earnings for June.

Global Stocks:

Nikkei 19,929.09 64.97 -0.32%

Hang Seng 25,340.85 -124.37 -0.49%

Shanghai 3,217.61 +5.17 +0.16%

S&P/ASX 5,703.57 -55.20 -0.96%

FTSE 7,349.05 +11.77 +0.16%

CAC 5,142.11 -10.29 -0.20%

DAX 12,369.77 -11.48 -0.09%

Crude $44.54 (-2.15%)

Gold $1,221.40 (-0.16%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 208.51 | 0.49(0.24%) | 198 |

| Amazon.com Inc., NASDAQ | AMZN | 970 | 4.86(0.50%) | 17584 |

| American Express Co | AXP | 83.72 | -0.02(-0.02%) | 1086 |

| Apple Inc. | AAPL | 143.3 | 0.57(0.40%) | 71235 |

| Boeing Co | BA | 202.79 | 1.31(0.65%) | 2461 |

| Caterpillar Inc | CAT | 106.77 | 0.26(0.24%) | 946 |

| Chevron Corp | CVX | 103.58 | -0.24(-0.23%) | 971 |

| Cisco Systems Inc | CSCO | 30.89 | 0.17(0.55%) | 4027 |

| Citigroup Inc., NYSE | C | 67.86 | 0.23(0.34%) | 17735 |

| Exxon Mobil Corp | XOM | 80 | -0.12(-0.15%) | 18503 |

| Facebook, Inc. | FB | 149.5 | 0.68(0.46%) | 43348 |

| Ford Motor Co. | F | 11.22 | 0.04(0.36%) | 22815 |

| General Electric Co | GE | 26.33 | 0.02(0.08%) | 78721 |

| Goldman Sachs | GS | 227.7 | 1.01(0.45%) | 11945 |

| Intel Corp | INTC | 33.85 | 0.22(0.65%) | 5289 |

| JPMorgan Chase and Co | JPM | 93.76 | 0.38(0.41%) | 23615 |

| McDonald's Corp | MCD | 153.6 | 0.51(0.33%) | 779 |

| Microsoft Corp | MSFT | 68.83 | 0.26(0.38%) | 17355 |

| Pfizer Inc | PFE | 33.34 | 0.12(0.36%) | 538 |

| Starbucks Corporation, NASDAQ | SBUX | 57.9 | 0.30(0.52%) | 1511 |

| Tesla Motors, Inc., NASDAQ | TSLA | 315.2 | 6.37(2.06%) | 173074 |

| The Coca-Cola Co | KO | 44.5 | 0.10(0.23%) | 453 |

| Twitter, Inc., NYSE | TWTR | 18.08 | 0.16(0.89%) | 49817 |

| Verizon Communications Inc | VZ | 43.65 | 0.13(0.30%) | 9132 |

| Wal-Mart Stores Inc | WMT | 75.5 | 0.03(0.04%) | 1570 |

| Walt Disney Co | DIS | 104 | 0.65(0.63%) | 1315 |

Construction output fell in May 2017 by 1.2%, in both the month-on-month and 3 month on 3 month time series.

The 3 month on 3 month decrease represents the largest 3 month on 3 month fall in output since September 2012, driven by falls in both repair and maintenance, and all new work.

The main downward pressure on month-on-month growth came from all new work, most notably from infrastructure, which fell 4.0% following strong growth in April 2017.

Construction output also fell month-on-year, falling by 0.3% in May 2017, the first consecutive month-on-year decrease in output since May 2013.

Construction output for April 2017 has been revised up 0.5 percentage points from negative 1.6% to negative 1.1%.

Between the 3 months to February 2017 and the 3 months to May 2017, the total UK trade (goods and services) deficit widened from £6.9 billion to £8.9 billion.

The widening of the trade deficit in the 3 months to May 2017 reflects a higher rise in imports than the rise in exports of goods, in particular transport equipment (cars, aircraft and ships), oil and electrical machinery from non-EU countries; a decrease in exports of services also contributed.

Between the 3 months to February 2017 and the 3 months to May 2017, the total UK trade (goods and services) excluding erratics deficit widened from £8.6 billion to £9.3 billion.

The total UK trade (goods and services) deficit widened by £1.0 billion between April and May 2017 to £3.1 billion, following a narrowing in April 2017; this reflects an increase in imports of goods on the month following a decrease in April 2017.

Import prices increased by 0.5% in the 3 months to May 2017 whereas export prices remained flat; however, excluding the impact of falling oil prices, import and export prices grew by 1.0% and 0.5% respectively.

In the 3 months to May 2017 compared with the 3 months to February 2017, the Index of Production was estimated to have decreased by 1.2%, due mainly to falls of 1.1% in manufacturing and 3.5% in energy supply.

The largest contribution to the fall in manufacturing came from the highly volatile pharmaceutical industry along with a range of other industries while the fall in energy supply was due largely to warmer temperatures.

In the 3 months to May 2017 compared with the same 3 months a year ago, the Index of Production increased by 0.1%; this was due mainly to a rise of 0.9% in manufacturing where there were broad-based upwards contributions from most manufacturing industries.

In May 2017, total production was estimated to have decreased by 0.1% compared with April 2017, due to falls of 0.2% in manufacturing and 0.8% in energy supply; transport equipment provided the largest contribution to the manufacturing decrease, followed by food products, beverages and tobacco.

House prices in the three months to June were 2.6% higher than in the same period of 2016.

Prices in the three months to June were 0.1% lower than in the preceding quarter.

Martin Ellis, Halifax housing economist, said: "House prices have flattened over the past three months. Overall, prices in the three months to June were marginally lower than in the preceding three months. The annual rate of growth has fallen, to 2.6%; the lowest rate since May 2013. "Although employment levels continue to rise, household finances face increasing pressure as consumer prices grow faster than wages. This, combined the new stamp duty on buy to let and second homes in 2016, appears to have weakened housing demand in recent months. "A continued low mortgage rate environment, combined with an ongoing acute shortage of properties for sale should help continue to underpin house prices over the coming months."

In May 2017, output bounced back sharply in the manufacturing industry (+2.0% after −1.3% in April), as well as in the whole industry (+1.9% after −0.6%).

Manufacturing output grew sharply over the last three months in the manufacturing industry (+1.9%) as well as in the overall industry (+1.4%).

Output increased markedly in "other manufacturing" (+1.8%), in the manufacture of machinery and equipment goods (+3.0%), in the manufacture of transport equipment (+2.7%) and in the manufacture of food products and beverages (+1.2%). Conversely, it decreased sharply in mining and quarrying, energy, water supply (−2.0%) and in the manufacture of coke and refined petroleum products (−2.3%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1515 (3807)

$1.1486 (2940)

$1.1465 (2865)

Price at time of writing this review: $1.1408

Support levels (open interest**, contracts):

$1.1349 (2342)

$1.1300 (2788)

$1.1250 (2188)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date July, 7 is 79400 contracts (according to data from July, 6) with the maximum number of contracts with strike price $1,1100 (4791);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3059 (2199)

$1.3026 (2084)

$1.3009 (2240)

Price at time of writing this review: $1.2958

Support levels (open interest**, contracts):

$1.2897 (2695)

$1.2849 (1429)

$1.2799 (3691)

Comments:

- Overall open interest on the CALL options with the expiration date July, 7 is 35756 contracts, with the maximum number of contracts with strike price $1,2800 (2350);

- Overall open interest on the PUT options with the expiration date July, 7 is 36683 contracts, with the maximum number of contracts with strike price $1,2800 (3691);

- The ratio of PUT/CALL was 1.03 versus 1.01 from the previous trading day according to data from July, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

According to the State Secretariat of Economic Affairs (SECO) surveys, 133'603 unemployed persons were registered at the Regional Employment Centers (RAV) at the end of June 2017, 6'175 less than in the previous month.

The unemployment rate thus fell from 3.1% in May 2017 to 3.0% in the reporting month. Compared to the previous month, unemployment fell by 5'524 persons (-4.0%). Youth unemployment in June 2017 Youth unemployment (15 to 24 year olds) fell by 848 persons (-5.7%) to 14'108. Compared to the previous year, this corresponds to a decrease of 1'683 persons (-10.7%).

In May 2017, production in industry was up by 1.2% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In April 2017, the corrected figure shows an increase of 0.7% (primary +0.8%) from March 2017.

In May 2017, production in industry excluding energy and construction was up by 1.3%. Within industry, the production of capital goods increased by 2.6% and the production of consumer goods by 1.4%. The production of intermediate goods showed a decrease by 0.2%. Energy production was up by 2.9% in May 2017 and the production in construction decreased by 1.0%.

European stocks ended firmly lower on Thursday, with minutes from the European Central Bank and Federal Reserve fueling fears among traders that the era of ultraloose monetary policy is coming to an end. Among top performers on Thursday, Associated British Foods PLC ABF, +2.57% shares jumped 2.6% after the ingredient supplier and parent of fashion retailer Primark said its full-year outlook has improved.

U.S. stocks closed lower Thursday as investors continued to rotate out of battered technology names. A combination of geopolitical jitters and growing signs that global central banks are inching closer to unwinding policies that have helped to support both stocks and government bonds is also weighing on the broader market.

Equity markets across the Asia-Pacific region were lower Friday, tracking declines in the U.S. and Europe, as investors become more cautious about the prospects of global central bank tightening. Australia was leading the declines early in the session, as a slump in the country's bank stocks pressured the benchmark index. Mining stocks there also fell following a report that the Australian government is expecting iron ore to have an average price of $62.40 per metric ton this year, down from an earlier forecast of $65.20.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.