- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-03-2018

(raw materials / closing price /% change)

Oil 62.61 +2.22%

Gold 1,320.90 -0.19%

(index / closing price / change items /% change)

Nikkei -139.55 21042.09 -0.66%

TOPIX -13.55 1694.79 -0.79%

Hang Seng -697.06 29886.39 -2.28%

CSI 300 +1.64 4018.10 +0.04%

Euro Stoxx 50 +30.57 3355.32 +0.92%

FTSE 100 +46.08 7115.98 +0.65%

DAX +177.16 12090.87 +1.49%

CAC 40 +30.65 5167.23 +0.60%

DJIA +336.70 24874.76 +1.37%

S&P 500 +29.69 2720.94 +1.10%

NASDAQ +72.84 7330.70 +1.00%

S&P/TSX +156.69 15541.28 +1.02%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2335 +0,03%

GBP/USD $1,3847 +0,40%

USD/CHF Chf0,93976 +0,28%

USD/JPY Y106,19 +0,46%

EUR/JPY Y130,99 +0,48%

GBP/JPY Y147,053 +0,86%

AUD/USD $0,7765 +0,07%

NZD/USD $0,7225 -0,16%

USD/CAD C$1,29638 +0,60%

00:30 Australia Current Account, bln Quarter IV -9.1 -12.6

00:30 Australia Retail Sales, M/M January -0.5% 0.4%

03:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.5%

03:30 Australia RBA Rate Statement

08:15 Switzerland Consumer Price Index (MoM) February -0.1% 0.2%

08:15 Switzerland Consumer Price Index (YoY) February 0.7% 0.5%

12:30 U.S. FOMC Member Dudley Speak

15:00 Canada Ivey Purchasing Managers Index February 55.2 56.3

15:00 U.S. Factory Orders January 1.7% -1.3%

18:15 United Kingdom MPC Member Andy Haldane Speaks

21:35 Australia RBA's Governor Philip Lowe Speaks

22:30 Australia AiG Performance of Construction Index February 54.3

The main US stock indices grew strongly, which was facilitated by the fading fears that the threat of President Donald Trump to impose high tariffs on imports of steel and aluminum would cause a global trade war.

In addition, the focus was on statistics for the United States. As it became known, business activity in the US services sector expanded sharply in February, according to the latest PMI data. The increase in production volume accelerated to a maximum since August 2017. In addition, customer demand has led to a sharp increase in new orders, which have grown as much as almost three years. The pressure of capacity has increased due to the growth in demand, while the unfinished production has grown to the maximum extent since March 2015. Meanwhile, the inflation of both procurement and holiday prices has accelerated, and the fastest pace since June 2015. The seasonally adjusted final US business activity index from IHS Markit rose to 55.9 in February, up from 53.3 in January. After falling to a nine-month low in the previous survey period, the pace of expansion of business activity was the fastest since August 2017.

At the same time, the index of business activity in the US services sector, calculated by the Institute for Supply Management (ISM), fell to 59.5 points in February, compared with 59.9 points in January. Analysts predicted that the figure will drop to 59.0 points. Recall, the indicator is the result of a survey of about 400 firms from 60 sectors across the US. A value greater than 50 is usually considered an indicator of the growth of production activity.

Almost all components of the DOW index finished trading in positive territory (29 out of 30). Caterpillar Inc. was the growth leader. (CAT, + 3.37%). Outsider were the shares of NIKE, Inc. (NKE, -1.06%).

All sectors of S & P recorded a rise. The conglomerate sector grew most (+ 2.8%).

At closing:

Dow + 1.37% 24.874.76 +336.70

Nasdaq + 1.00% 7.330.70 +72.84

S & P + 1.10% 2,720.94 +29.69

The report was issued today by Anthony Nieves, Chair of the Institute for Supply Management:

"The NMI registered 59.5 percent, which is 0.4 percentage point lower than the January reading of 59.9 percent. This represents continued growth in the non-manufacturing sector at a slightly slower rate. The Non-Manufacturing Business Activity Index increased to 62.8 percent, 3 percentage points higher than the January reading of 59.8 percent, reflecting growth for the 103rd consecutive month, at a faster rate in February. The New Orders Index registered 64.8 percent, 2.1 percentage points higher than the reading of 62.7 percent in January".

U.S. stock-index futures tumbled on Friday, as investors continued fretting about the potential for a trade war, following the U.S. President Trump's decision to impose tariffs on steel and aluminum imports, which was announced on Thursday.

Global Stocks:

Nikkei 21,042.09 -139.55 -0.66%

Hang Seng 29,886.39 -697.06 -2.28%

Shanghai 3,257.53 +3.00 +0.09%

S&P/ASX 5,895.00 -33.90 -0.57%

FTSE 7,085.84 +15.94 +0.23%

CAC 5,147.69 +11.11 +0.22%

DAX 12,004.68 +90.97 +0.76%

Crude $61.30 (+0.08%)

Gold $1,323.00 (-0.03%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 230 | -0.37(-0.16%) | 960 |

| ALTRIA GROUP INC. | MO | 62.79 | 0.24(0.38%) | 1463 |

| Amazon.com Inc., NASDAQ | AMZN | 1,500.00 | -0.25(-0.02%) | 68923 |

| AMERICAN INTERNATIONAL GROUP | AIG | 56.52 | 0.01(0.02%) | 260 |

| Apple Inc. | AAPL | 175.8 | -0.41(-0.23%) | 182725 |

| AT&T Inc | T | 36.31 | -0.04(-0.11%) | 6173 |

| Barrick Gold Corporation, NYSE | ABX | 11.61 | 0.07(0.61%) | 5112 |

| Boeing Co | BA | 341.36 | -3.31(-0.96%) | 24802 |

| Caterpillar Inc | CAT | 145.76 | -0.62(-0.42%) | 9627 |

| Chevron Corp | CVX | 110.88 | -0.76(-0.68%) | 541 |

| Cisco Systems Inc | CSCO | 43.99 | -0.07(-0.16%) | 15063 |

| Citigroup Inc., NYSE | C | 73.4 | -0.28(-0.38%) | 1075 |

| Exxon Mobil Corp | XOM | 75.6 | 0.05(0.07%) | 4332 |

| Facebook, Inc. | FB | 176.73 | 0.11(0.06%) | 63626 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.35 | 0.03(0.16%) | 5687 |

| General Electric Co | GE | 14.2 | 0.08(0.57%) | 149670 |

| General Motors Company, NYSE | GM | 37.68 | 0.25(0.67%) | 9257 |

| Goldman Sachs | GS | 256.98 | -1.14(-0.44%) | 2637 |

| Google Inc. | GOOG | 1,078.00 | -0.92(-0.09%) | 7459 |

| Home Depot Inc | HD | 177.86 | -0.60(-0.34%) | 4951 |

| HONEYWELL INTERNATIONAL INC. | HON | 148.09 | -0.05(-0.03%) | 631 |

| Intel Corp | INTC | 48.95 | -0.03(-0.06%) | 18338 |

| JPMorgan Chase and Co | JPM | 112.75 | -0.57(-0.50%) | 5844 |

| McDonald's Corp | MCD | 148.25 | -0.02(-0.01%) | 6658 |

| Microsoft Corp | MSFT | 92.92 | -0.13(-0.14%) | 59527 |

| Nike | NKE | 65.74 | -0.15(-0.23%) | 4013 |

| Procter & Gamble Co | PG | 79.57 | 0.07(0.09%) | 681 |

| Tesla Motors, Inc., NASDAQ | TSLA | 334.82 | -0.30(-0.09%) | 20205 |

| The Coca-Cola Co | KO | 43.8 | 0.08(0.18%) | 254 |

| Twitter, Inc., NYSE | TWTR | 32.88 | -0.12(-0.36%) | 38592 |

| United Technologies Corp | UTX | 129.87 | -0.07(-0.05%) | 746 |

| UnitedHealth Group Inc | UNH | 224.6 | -0.59(-0.26%) | 257 |

| Verizon Communications Inc | VZ | 48.15 | -0.11(-0.23%) | 1242 |

| Visa | V | 120.76 | -0.01(-0.01%) | 3917 |

| Wal-Mart Stores Inc | WMT | 88.57 | -0.20(-0.23%) | 10619 |

| Walt Disney Co | DIS | 102.9 | -0.09(-0.09%) | 2547 |

| Yandex N.V., NASDAQ | YNDX | 41.35 | 0.09(0.22%) | 2665 |

In January 2018 compared with December 2017, the seasonally adjusted volume of retail trade decreased by 0.1% in both the euro area (EA19) and in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In December 2017, the retail trade volume fell by 1.0% in the euro area and by 0.9% in the EU28. In January 2018 compared with January 2017, the calendar adjusted retail sales index increased by 2.3% in the euro area and by 2.7% in the EU28.

U. S. President Donald Trump's comments that he wants to impose fines on certain products did not only alarm the EU Commission. Investors surveyed by sentix also react clearly. Economic expectations for all regions of the world are declining significantly. Expectations in the eurozone are losing more than 11 points. In Germany, which is already experiencing a weakening of the economy, we are even recording a negative expectation for the first time since February 2016. However, the expectation value for the USA is also falling by more than 10 points. A wake-up call for the US president to reconsider the matter of protectionism.

UK service providers experienced a modest rebound in business activity growth during February, supported by the fastest rise in new work since May 2017. The latest survey also pointed to stronger job creation across the service economy, with payroll numbers rising to the greatest extent for five months as firms sought to boost operating capacity in response to improved order books.

The seasonally adjusted IHS Markit/CIPS UK Services PMI Business Activity Index registered 54.5 in February, up from 53.0 in January, to signal the strongest rate of service sector output growth for four months. Higher levels of business activity were attributed to the resilient economic backdrop and an associated upturn in new work.

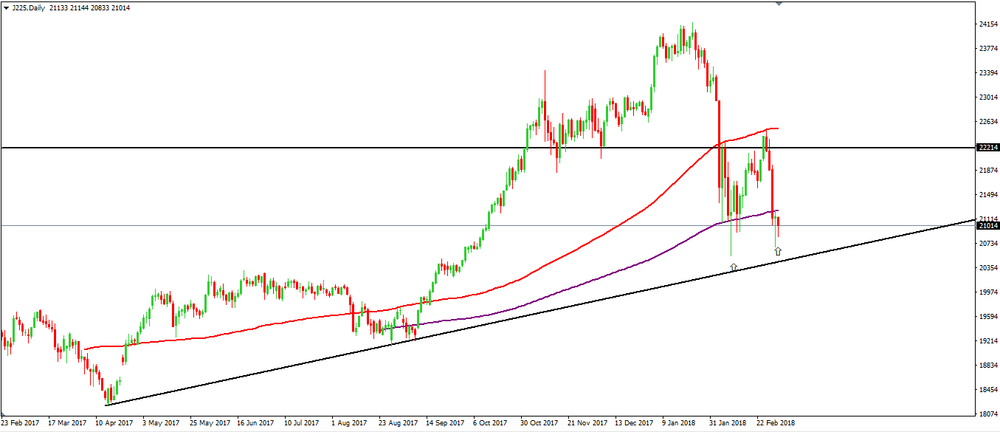

Nikkei 225 on daily time frame chart we can see that the price is showing some rejections of more downside movements, and simultaneously reject above the upside trend line.

Therefore, it may be interesting to enter long in this index once the price remains above the trend line.

Our suggestions is to put the stop-loss below the trend line and the take profit close to the previous highs or for the more conservative people, near the support line at which the price has had some difficulty going through.

Although pulling back from January's near 12-year high to a four-month low in February, the rate of output growth in the euro area remained robust. Manufacturers and service providers saw continued strong inflows of new business, while job creation and price pressures also remained elevated.

The final IHS Markit Eurozone PMI Composite Output Index posted 57.1 in February, down from January's near 12-year high of 58.8, but well above the series average of 53.0. The headline index has signalled expansion in each of the past 56 months, although the latest reading was slightly below the flash estimate of 57.5.

The seasonally adjusted final IHS Markit Germany Services PMI Business Activity Index dipped to a three-month low of 55.3 in February, down from January's 57.3. Despite easing, the rate of business activity growth remained robust in the context of the historical trend. Hotels & Restaurants and Post & Telecommunications were the two strongest performing areas, while Other Services - which includes health, education and leisure activities - was the only sector in which output fell. Manufacturing output growth also eased in February, down to the lowest for four months, resulting in a fall in the final IHS Markit Germany Composite Output Index to 57.6, from an 81- month high of 59.0 in January.

The headline index Business Activity Index - which is based on a single question asking respondents to report on the actual change in business activity at their companies compared to one month ago - came in at 55.0 during February. That was down from January's ten-and-a-half year record of 57.7, but nonetheless was indicative of marked growth that remained amongst the highest of the past decade.

Business activity continued to grow at a marked pace midway through the first quarter, albeit to a weaker extent than January amid a softer rise in new orders. In spite of the slowdown, business confidence improved to its highest level since September, which in turn encouraged firms to take on additional staff at an accelerated pace. Nonetheless, backlogs of work continued to accumulate at a marked pace. On the price front, input price inflation remained sharp, and led to a further rise in average charges.

The headline seasonally adjusted Business Activity Index posted 57.4 in February. Down from January's reading of 59.2, the latest index reading highlighted the weakest rate of growth in four months, but one that remained markedly higher than the long-run series average.

The ANZ Commodity Price Index rose 2.8% m/m in February, kicking on from the 0.7% gain in January. The lift was fairly broad-based, although the dairy group provided the major thrust, with a 6% gain. Despite some intramonth volatility, the NZD was broadly steady against major trading partners in the month (NZD TWI up 0.3% m/m), which saw the NZD commodity price index lift 2.4%. This is the first lift in NZD prices since November.

The Caixin China Composite PMI data (which covers both manufacturing and services) signalled a further strong rise in overall Chinese business activity in February, despite the pace of expansion softening since January. At 53.3 in February, the Composite Output Index fell only slightly from a seven-year record of 53.7 at the start of the year.

Activity continued to expand across both the manufacturing and service sectors in China during February, albeit at weaker rates than recorded at the beginning of the year. Nonetheless, growth in services activity held close to January's 68-month record and remained solid overall, as shown by the seasonally adjusted Caixin China General Services Business Activity Index declining only slightly from 54.7 to 54.2 in February. Meanwhile, manufacturing output increased at a pace that, though modest, was the second-fastest seen in the past year.

-

Centre-right on 248-268 seats, centre-left 107-127 seats

EUR/USD

Resistance levels (open interest**, contracts)

$1.2443 (4112)

$1.2416 (3008)

$1.2378 (3064)

Price at time of writing this review: $1.2316

Support levels (open interest**, contracts):

$1.2275 (2043)

$1.2247 (5596)

$1.2213 (3654)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 9 is 134405 contracts (according to data from March, 2) with the maximum number of contracts with strike price $1,2400 (6690);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3928 (3758)

$1.3893 (1857)

$1.3842 (1207)

Price at time of writing this review: $1.3787

Support levels (open interest**, contracts):

$1.3731 (1913)

$1.3703 (1596)

$1.3669 (1515)

Comments:

- Overall open interest on the CALL options with the expiration date March, 9 is 48277 contracts, with the maximum number of contracts with strike price $1,3900 (3758);

- Overall open interest on the PUT options with the expiration date March, 9 is 45531 contracts, with the maximum number of contracts with strike price $1,3900 (2379);

- The ratio of PUT/CALL was 0.94 versus 0.93 from the previous trading day according to data from March, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.