- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-01-2020

The U.S. Energy Information Administration (EIA) revealed on Friday that crude inventories tumbled by 11.463 million barrels in the week ended December 27. Economists had forecast a drop of 3.288 million barrels.

At the same time, gasoline stocks surged by 3.212 million barrels, while analysts had expected an increase of 2.062 million barrels. Distillate stocks jumped by 8.776 million barrels, while analysts had forecast an advance of only 0.500 million barrels.

Analysts at Danske Bank think that following significant headwinds over the summer, the global economy is showing tentative signs of stabilization.

- "This stabilisation comes on the back of sizeable monetary policy stimulus in both advanced and emerging markets in addition to an expansionary fiscal policy in China.

- Despite the stabilisation and expectations of a modest recovery in the global manufacturing sector in early 2020, we have revised down our outlook for the global economy amid continued trade uncertainty and waning stimulus measures.

- However, the risk of a global recession over the next year or so has declined to 25% (from 30%) on the back of an improving chance of a trade deal and the receding risk of a no-deal Brexit, on the back of the UK election.

- The outcome of the US-China trade talks is a key risk to the global economy in 2020. The discussions could go in either direction, prompting considerable uncertainty for our global forecasts."

The Commerce Department announced on Friday that construction spending rose 0.6 percent m-o-m in November after a revised 0.1 percent m-o-m gain in October (originally a 0.8 percent m-o-m drop).

Economists had forecast construction spending increasing 0.3 percent m-o-m in November.

According to the report, spending on private construction increased 0.4 percent m-o-m, while investment in public construction climbed 0.9 percent m-o-m.

On a y-o-y basis, construction spending surged 4.1 percent in November.

A report from the Institute for Supply Management (ISM) showed on Friday the U.S. manufacturing sector's activity contracted further in December.

The ISM's index of manufacturing activity came in at 47.2 percent last month, down 0.9 percentage point from the November reading of 48.1 percent. That was the lowest reading since June 2009 and missed economists' forecast for a 49.0 percent reading.

A reading above 50 percent indicates expansion, while a reading below 50 percent indicates contraction.

According to the report, the New Orders Index stood at 46.8 percent, a fall of 0.4 percentage point from the November reading, while the Production Index registered 43.2 percent, down 5.9 percentage points compared to the November reading, and the Employment Index recorded 45.1 percent, a 1.5-percentage point drop from the November reading. At the same time, the Backlog of Orders Index posted 43.3 percent, up 0.3 percentage point compared to the November reading, the Supplier Deliveries Index registered 54.6 percent, a 2.6-percentage point increase from the November reading and the Inventories Index recorded 46.5 percent, an advance of 1 percentage point from the November reading. The Prices Index showed a 5-percentage point climb to 51.7 percent in December.

Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee said, "The past relationship between the PMI and the overall economy indicates that the PMI for December (47.2 percent) corresponds to a 1.3-percent increase in real gross domestic product (GDP) on an annualized basis."

Analysts at Nordea Markets suggest that next week we will get a fresh test of whether uncertainty in survey measures will abate now that trade and Brexit risks have faded.

- "The conference board CEO survey is published on Tuesday. This survey has never been at levels as bad as in Q3 2019 without a subsequent recession. Let's see whether this was a geopolitically-driven false flag. One should expect a BIG rebound in this survey, if geopolitical uncertainty was the key driver behind the weak survey. We suspect that tight financial conditions during 2018 are also part of the reason.

- Measures like NFIP job openings, employment legs of PMIs and overtime hours worked have warned of weaker non-farm-payrolls (Friday) a couple of months in a row. This is do or die time for the slowdown 2.0 narrative. The labour market should show some tentative weak signs during Q1 2020, if the usual lead/lag patterns are to be trusted. We still lean this way.

- We will also continue to watch out for signals of increasing inflation pressures next week in prices paid in PMI surveys and from the Euro area (risks are on the upside given data released today) on Tuesday. Gold prices have started to trade as if a small wave of inflation will flood markets during H1 2020. The otherwise strong correlation between gold prices and the amount of negative-yielding debt has broken down. Is this a sign that markets expect late-cyclical inflation pressures?

- Inflationary pressures will peak during H1 2020 judging from the simple relationship between PMI levels and core inflation. ISM leads US core inflation by roughly 1.5 years.

- The calendar in Scandinavia is relatively light next week, but it is worthwhile keeping an eye on the weak Swedish service PMI on Tuesday as well as the Riksbank minutes on Wednesday. On Friday, we will get the monthly inflation print from Norway."

U.S. stock-index futures fell on Friday after U.S. President Donald Trump ordered a drone strike in Iraq that killed Iranian General Suleimani, sharply escalating geopolitical tensions in the Middle East and denting risk appetite.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | - | - | - |

| Hang Seng | 28,451.50 | -92.02 | -0.32% |

| Shanghai | 3,083.79 | -1.41 | -0.05% |

| S&P/ASX | 6,733.50 | +42.90 | +0.64% |

| FTSE | 7,595.87 | -8.43 | -0.11% |

| CAC | 6,027.89 | -13.61 | -0.23% |

| DAX | 13,200.83 | -185.10 | -1.38% |

| Crude oil | $63.32 | | +3.47% |

| Gold | $1,548.50 | | +1.33% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 177.03 | -2.97(-1.65%) | 4011 |

| ALCOA INC. | AA | 21.23 | -0.19(-0.89%) | 22669 |

| ALTRIA GROUP INC. | MO | 49.09 | -0.16(-0.32%) | 21587 |

| Amazon.com Inc., NASDAQ | AMZN | 1,871.00 | -27.01(-1.42%) | 102896 |

| American Express Co | AXP | 124.8 | -1.05(-0.83%) | 4989 |

| AMERICAN INTERNATIONAL GROUP | AIG | 51 | -0.76(-1.47%) | 1101 |

| Apple Inc. | AAPL | 297.42 | -2.93(-0.98%) | 1259308 |

| AT&T Inc | T | 38.75 | -0.11(-0.28%) | 48754 |

| Boeing Co | BA | 331.33 | -1.99(-0.60%) | 46161 |

| Caterpillar Inc | CAT | 148.4 | -2.13(-1.42%) | 3216 |

| Chevron Corp | CVX | 122.11 | 0.68(0.56%) | 26028 |

| Cisco Systems Inc | CSCO | 47.9 | -0.52(-1.07%) | 49179 |

| Citigroup Inc., NYSE | C | 79.92 | -1.31(-1.61%) | 89208 |

| Deere & Company, NYSE | DE | 175 | -1.86(-1.05%) | 132 |

| E. I. du Pont de Nemours and Co | DD | 63.04 | -0.46(-0.72%) | 2693 |

| Exxon Mobil Corp | XOM | 71.18 | 0.28(0.39%) | 148846 |

| Facebook, Inc. | FB | 207.8 | -1.98(-0.94%) | 198185 |

| FedEx Corporation, NYSE | FDX | 153.2 | -1.90(-1.23%) | 8931 |

| Ford Motor Co. | F | 9.31 | -0.11(-1.17%) | 97669 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.01 | -0.19(-1.44%) | 128724 |

| General Electric Co | GE | 11.79 | -0.14(-1.17%) | 491751 |

| General Motors Company, NYSE | GM | 36.9 | -0.48(-1.28%) | 9797 |

| Goldman Sachs | GS | 231.5 | -2.82(-1.20%) | 48463 |

| Google Inc. | GOOG | 1,353.10 | -14.27(-1.04%) | 8422 |

| Hewlett-Packard Co. | HPQ | 20.56 | -0.23(-1.11%) | 1329 |

| Home Depot Inc | HD | 217.58 | -2.08(-0.95%) | 7035 |

| HONEYWELL INTERNATIONAL INC. | HON | 179.24 | -1.55(-0.86%) | 1393 |

| Intel Corp | INTC | 60.15 | -0.69(-1.13%) | 36465 |

| International Business Machines Co... | IBM | 134.22 | -1.20(-0.89%) | 21291 |

| International Paper Company | IP | 45.6 | 0.08(0.18%) | 2860 |

| Johnson & Johnson | JNJ | 144.79 | -1.18(-0.81%) | 9321 |

| JPMorgan Chase and Co | JPM | 138.6 | -1.59(-1.13%) | 55812 |

| McDonald's Corp | MCD | 199.32 | -1.47(-0.73%) | 12569 |

| Merck & Co Inc | MRK | 91.36 | -0.68(-0.74%) | 8166 |

| Microsoft Corp | MSFT | 158.9 | -1.72(-1.07%) | 239616 |

| Nike | NKE | 101.06 | -1.14(-1.12%) | 8193 |

| Pfizer Inc | PFE | 38.92 | -0.22(-0.56%) | 10400 |

| Procter & Gamble Co | PG | 122.97 | -0.44(-0.36%) | 6236 |

| Starbucks Corporation, NASDAQ | SBUX | 88.61 | -0.74(-0.83%) | 8023 |

| Tesla Motors, Inc., NASDAQ | TSLA | 437.46 | 7.20(1.67%) | 763954 |

| The Coca-Cola Co | KO | 54.8 | -0.19(-0.35%) | 7194 |

| Travelers Companies Inc | TRV | 136.3 | -1.21(-0.88%) | 202 |

| Twitter, Inc., NYSE | TWTR | 31.87 | -0.43(-1.33%) | 108403 |

| United Technologies Corp | UTX | 154 | 0.86(0.56%) | 12507 |

| UnitedHealth Group Inc | UNH | 289 | -3.50(-1.20%) | 826 |

| Verizon Communications Inc | VZ | 60.89 | -0.16(-0.26%) | 11458 |

| Visa | V | 188.81 | -2.31(-1.21%) | 17222 |

| Wal-Mart Stores Inc | WMT | 118.26 | -0.68(-0.57%) | 10387 |

| Walt Disney Co | DIS | 146.55 | -1.65(-1.11%) | 65146 |

| Yandex N.V., NASDAQ | YNDX | 43.5 | -0.58(-1.32%) | 3565 |

Apple (AAPL) target raised to $330 from $290 at BofA/Merrill

Steven Trypsteen, an economist at ING, notes the PSOE and Podemos together have 155 seats in parliament, 21 short of a majority. So in order to get this government running, they need to convince others to support them or to abstain and it now looks like they've succeeded in this.

- "In a first vote to be held this Sunday an absolute majority is required, but in a second vote planned on Tuesday, the coalition just needs more votes in favour than against. As the ERC (13 seats), and Bildu (4 seats), the far-left Basque secessionist party, said they will abstain, it looks now likely the government will get the green light.

- The ERC decided to abstain as Pedro Sánchez, the leader of the PSOE, agreed to start talks between the government and the Catalans. A new Catalan referendum, however, is out of the question for Sánchez.

- In the meantime, the judicial process concerning the 2017 referendum is continuing, which will make the negotiations more difficult. A sensitive decision by Spanish electoral authorities concerning the disbarring of Quim Torra, the current Catalan president, for example, is imminent.

- Last week, the PSOE and Podemos communicated their programme, and the policies they advocate are not surprising. They want to raise taxes on corporates and the rich and also want to raise the minimum wage. They also pledged to abolish some of the most controversial issues of the 2012 labour reform, such as the ability to fire workers during sick leave. The government will not be able to increase spending a lot. As the Spanish government debt level is still about 97% of GDP and the government deficit about 2.2%, there is little leeway.

- Bond markets did not react much to this news. Spanish government bond spreads were little changed. Admittedly, this development eases the political gridlock and uncertainty as there is now a clear path to a new government. But the political landscape remains tricky nonetheless. The new government would be a minority government, the Catalan tensions could flare up again as the judicial process continues, and the fiscal situation makes it difficult to increase spending a lot."

Germany's Federal Statistical Office reported on Friday the country's consumer price index (CPI) is expected to increase 0.5 m-o-m in December after dropping 0.8 percent m-o-m in the previous month.

On the y-o-y basis, Germany's inflation rate is seen to rise 1.5 percent this month, following a 1.1 percent gain in November. That would be the highest reading since July 2019.

On an annual average, the inflation rate is expected to stand at 1.4 percent in 2019.

Economists had predicted inflation would increase 0.4 percent m-o-m and 1.4 percent y-o-y in December.

According to the report, food price growth accelerated to 2.1 percent y-o-y in December from 1.8 percent y-o-y in November, while energy prices edged down 0.1 percent y-o-y, following a drop of 3.7 percent y-o-y in the previous month. Services costs rose 1.8 percent y-o-y in December, the same pace as in November.

Meanwhile, the harmonized index of consumer prices for Germany (HICP), which is calculated for European purposes, is expected to increase 0.6 percent m-o-m and 1.5 percent y-o-y in December, and 1.4 percent on an annual average in 2019 compared with 2018.

Analysts at Standard Chartered note that China's latest available data indicates improved growth in Q4-2019, and their model suggests 6.0% YoY growth in October-November, flat versus Q3-2019.

- "December indicators, including the official and Caixin PMIs and our SME index (SMEI), point to better sentiment and continued expansion in activity toward the end of 2019. Q4 growth may have edged up to 6.1% y/y, resulting in annual growth of 6.2%.

- Monetary policy is becoming more supportive of fiscal expansion. The 50bps reserve requirement ratio (RRR) cut, effective on 6 January, will unlock over CNY 800bn of long-term liquidity and reduce banks' funding costs by about CNY 15bn annually, according to the People's Bank of China (PBoC).

- Injecting adequate liquidity is critical to containing the government's debt cost and preventing a crowding out of the private sector. To lower SMEs' financing costs by 50bps in 2020 (as required by the State Council), we see another two RRR cuts this year of 50bps each in Q2 and Q3, in addition to a total 20bps cut in the medium-term lending (MLF) rate in H1.

- The January RRR cut paves the way for a 5bps reduction in the 1-year and 5-year loan prime rate (LPR) - the new references for pricing loans - on 20 January. The next MLF rate cut (5bps) may, therefore, come in February, with pass-through to the LPR."

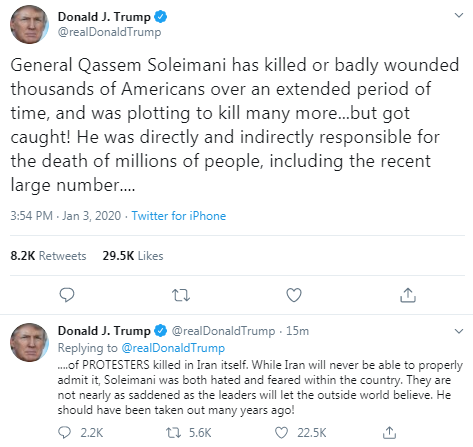

- U.S. needed to take action to restore deterrence

- Iranian leadership understands that Trump will take action

- U.S. has watched escalation take place

- U.S. has been planning for this

- U.S. government, President Trump are prepared to respond appropriately

Analysts at Rabobank believe the U.S. ISM survey will give us an update on the state of affairs in the U.S. manufacturing sector.

- "The market is looking for a modest uptick in the survey (from 48.1 to 49) but such an outcome by no means would be evidence that the slowdown in activity is over.

- The global picture - looking at similar surveys such as from Markit - is still very mixed. In some Asian economies, such as Thailand, Korea, India, and Malaysia, we have seen some pickup in the manufacturing survey whereas in the Americas (Canada, Brazil, Mexico) activity appears to have weakened. The Markit survey for the US - which serves as some gauge - actually declined 0.2 points in December."

Analysts at TD Securities think the U.S. data highlight will be the manufacturing ISM index for December, which is expected to rise slightly, to a still-low 49.5 from 48.1. The consensus is 49.0.

- "A slight rise would be consistent with the regional surveys that have been released. The cut-off point for the regional surveys is generally earlier in the month than for the ISM survey, but there is no sign thus far of the U.S.-China trade deal announcement leading to a major change in tone.

- Minutes to the December FOMC meeting will also be released; Fed officials have consistently been signaling that a policy change will require a "material reassessment" of the outlook, but "policy is not on a preset course."

Rabobank analysts suggest that today's release of the FOMC minutes will be watched closely for clues on the Fed's rate path and the recent stress in the repo markets.

"Turning to rates first, the latest dot plot showed that 13 out of 17 FOMC members sees policy on hold for the whole of 2020, with the other four forecasting a single rate hike(!). And Powell stressed that the Fed is not in a hurry to change its policy stance after the three insurance cuts of 2019: it would take "a material reassessment" for the Committee to alter its stance. That said, the previous dot plot, made in September, failed to signal the 25bp cut that materialised only one month later. We are sceptical about this new dot plot too: Cracks are starting to appear in the US economy and a mild recession appears to be in the making. Philip therefore expects a series of rate cuts this year. The big question is what economic data constitutes this 'material reassessment' that the Fed requires to conform to this view. The turn of the year went by pretty smoothly in the repo market, and we witnessed no new spikes in the general collateral rates. However, this was only thanks to the FOMC's repo interventions. On December 31, the market sought USD 25.6bn in overnight funding from the New York Fed, in addition to the USD 230bn that had already been provided through longer-term operations. The decision to purchase T-bills to increase liquidity should help to further alleviate the recent tensions, but that's not a structural solution. Today's minutes may reveal how the various FOMC members feel about a standing repo facility as a more permanent fix."

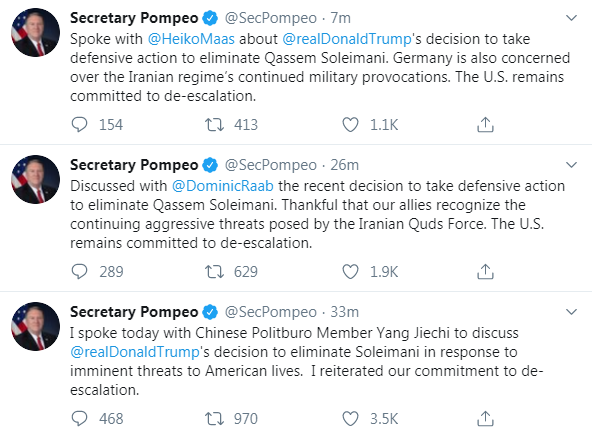

The United States was reacting to a series of provocations by Iran, a spokesperson for the German government said on Friday when commenting on the killing of Qassem Soleimani, a top Iranian general.

"We want to see a diplomatic solution to this crisis," the spokesperson added.

Germany's new appointee to the European Central Bank's board, Isabel Schnabel, has been given responsibility over the ECB's market operations, which includes running its vast money-printing programme, it said.

Under the same portfolio reshuffle published on the ECB's website, its other new board member, Italy's Fabio Panetta, will represent the central bank at international forums.

Bert Colijn, senior economist at ING, explains that Eurozone's data today shows that monetary conditions are probably too accommodative for a recession in the broader economy to happen but still signal nothing more than a shallow growth recovery in the course of 2020.

"Growth in broad money M3 and the narrower aggregate M1 both ticked down slightly in November. With inflation trending somewhat higher, this means that real M1, an important leading indicator, fell from 7.7 to 7.4%. This corresponds to a decent expansion, but the tick down indicates that any hopes of a faster growth recovery over the course of 2020 seem somewhat premature. Lending growth rates in November paint a similar picture. Even though financing conditions remain favourable, annual growth in lending to non-financial corporates shows that the industrial recession and running down of inventories are having a negative impact on investment appetite. Lending growth has been trending down since August and fell from 3.8% to 3.4% year-on-year from October to November. That is an important signal that a growth revival may not be around the corner just yet."

British consumers increased their borrowing in November at the slowest rate in more than five years, according to Bank of England data that added to signs the economy stalled late last year.

The growth rate in unsecured consumer lending slowed to 5.7% in the 12 months to November from 6.1% in October, marking the smallest increase since June 2014. The figures also showed credit card repayments exceeded borrowing for the first time since July 2013.

Household spending has helped to drive Britain's economy over the last few years, helped by record levels of employment and a recovery in wage growth.

In cash terms, consumer credit rose by 563 million pounds in November after a 1.339 billion-pound rise in October, the smallest increase since November 2013. The data also showed the number of mortgages approved for house purchase edged up to 64,994 in November from 64,662 in October, compared with the forecast of 64,450.

December data from IHS Markit/CIPS pointed to another sharp reduction in construction output, with a downturn persisting across all three broad categories of activity. Survey respondents attributed the latest drop in their workloads to political uncertainty and subdued client demand ahead of the general election.

At 44.4 in December, down from 45.3 in November, the headline seasonally adjusted UK Construction Total Activity Index registered below the crucial 50.0 no-change value for the eighth consecutive month. The current period of falling business activity across the construction sector is the longest recorded by the survey for almost a decade. Economists had expected an increase to 45.9.

Civil engineering was by far the worst-performing category of construction in December, with activity falling at the fastest pace since March 2009. Anecdotal evidence suggested that political indecision and delays with contract awards for new projects had led to falling business activity. Latest data also revealed a sharp drop in commercial work, which was partly attributed to clients opting to postpone spending decisions ahead of the general election. Meanwhile, house building dropped for the seventh month running in December, but the rate of decline was only modest.

In contrast to the subdued output trends reported during December, construction companies indicated that their optimism towards the year-ahead business outlook rebounded to a nine-month high. A number of firms suggested that greater clarity in relation to Brexit had the potential to boost order books in 2020.

Data from the Federal Labour Office showed that German unemployment rose more than expected in December, adding to signs that weakness in the manufacturing sector is hurting the labor market in Europe's biggest economy.

According to the report the number of people out of work rose by 8,000 to 2.279 million in seasonally adjusted terms. Economists had expected a rise of 2,000.

The jobless rate held steady at 5.0% - slightly above the record low of 4.9% reached earlier this year.

Thanks to the good development on the labour market until the first third of 2019, unemployment and underemployment continued to decline on average for the year. In the further course of the year, the weaker economic situation and a special effect due to testing activities of the unemployment status counteracted a further positive development.

On average in 2019, 2,267,000 people were registered as unemployed in Germany. This reduced the number by 73,000 compared to the previous year.

Underemployment, which also includes persons in labour market policy measures and in short-term incapacity for work, amounted to an average of 3,200,000 persons in 2019. This was 85,000 less than in the previous year.

"The labour market continued to be robust in 2019. Despite a weaker economy, unemployment and underemployment declined on average in 2019; employment rose again.", said Detlef Scheele, CEO of the federal employment agency (BA), today at the monthly press conference in Nuremberg.

The question of how much crude U.S. producers may be able to add this year could be pivotal for oil prices in 2020, analysts told CNBC, while warning of the potential for "vicious corrections" in the coming months.

Chris Weafer, a senior partner at Macro-Advisory, suggested three "critical factors" were set to have the greatest influence over crude futures this year. The first two factors were identified as oil demand growth and the current deal between OPEC and its allied partners.

"The big uncertainty this year - and it is already beginning to be talked about - is: Can or will U.S. producers be able to continue to add as much extra volume as they have been for the last seven or eight years?" "This is a huge question," Weafer said.

The International Energy Agency projected last month that total U.S. oil production growth will slow to 1.1 million b/d in 2020, down from 1.6 million b/d in 2019.

In such a scenario, Weafer said that, assuming the OPEC+ deal remains in place, oil prices should trade in the $60 to $70 price range.

Nonetheless, he warned many were becoming concerned that U.S. production growth might have passed its peak, amid speculation the industry will not be able to increase production at the same rate in 2020 as it has done in previous years.

Danske Bank analysts suggest that focus today will be on the market reaction to the US killing of a leading Iranian commander, which has sent oil prices higher.

"In an airstrike at Bagdad airport in Iraq, the US took out the Iranian head of the elite Quds force and spearhead of Iran's rising military influence in the Middle East. The price of Brent oil has jumped USD2.5, as the attack could risk escalating the US-Iran conflict and proxy war activities in Iraq. On the data front, the US ISM manufacturing index for December will be today's highlight. The ISM index has fallen to lower levels than other US surveys and has not yet shown the signs of a recovery that we see in business surveys globally. Hence, we see some upside risk to today's number where consensus looks for a rise from 48.1 to 49.9. Tonight, the minutes from the December FOMC meeting will be released. At the meeting, the Fed sent a signal of being firmly on hold with 13 out of 17 members expecting no rate changes in 2020 while three members projected one hike."

According to the report from INSEE, over a year, the Consumer Price Index (CPI) should accelerate to +1.4% in December 2019, after +1.0% in the previous month, according to the provisional estimate made at the beginning of January 2020. This sharp rise in inflation should result essentially from a marked rebound in energy prices, in the wake of petroleum product prices. The lesser drop in manufactured goods prices and the slight acceleration in services prices should contribute also. The prices of food and tobacco should rise at the same pace as in the previous month.

Over one month, consumer prices should increase by 0.4%, after +0.1% in November. The prices of energy and food should be more dynamic than in the previous month. Those of services should rebound seasonally. Finally, manufactured goods prices should rise slightly after a little fall in the previous month. Tobacco prices should be stable after a sharp increase in November.

Year on year, the Harmonised Index of Consumer Prices should gather pace to +1.6% after +1.2% in November. Over one month, it should rise by 0.5%, after +0.1% in the previous month.

According to Karen Jones, analyst at Commerzbank, USD/CHF's outlook is overall negative, but near term having held the .9659 August 2019 low on a closing basis and they suggest that they would allow for a small bounce higher to the .9765 accelerated downtrend.

"Below .9647 targets the September 2018 low at .9543. We have the .9623 23.6% retracement from the 2015 low also found here. Slightly longer term we look for a fall back to the 2018 low at .9188, this is also the 38.2% retracement of the same move. While rallies are capped by the lows seen in September and October 2019 at .9841/44 the market will remain immediately offered. A rise above the .9844 resistance would suggest recovery to the .9707/22 band of resistance, which if seen we would again look to cap."

According to the report from Nationwide Building Society, house prices in the UK rose by 1.4% y/y in December after increasing by 0.8% in November. On a monthly basis, house prices rose 0.1%, compared with a 0.5% increase in November and a forecast of 0.0%.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: "Annual UK house price growth edged up as 2019 drew to a close, with prices 1.4% higher than December 2018, the first time it been above 1% for 12 months. Indicators of UK economic activity were fairly volatile for much of 2019, but the underlying pace of growth appeared to slow through the year as a result of weaker global growth and an intensification of Brexit uncertainty. The underlying pace of housing market activity remained broadly stable, with the number of mortgages approved for house purchase continuing within the fairly narrow range prevailing over the past two years. Healthy labour market conditions and low borrowing costs appear to have offset the drag from the uncertain economic outlook. Looking ahead, economic developments will remain the key driver of housing market trends and house prices. Much will continue to depend on how quickly uncertainty about the UK's future trading relationships lifts as well as the outlook for global growth. Overall, we expect the economy to continue to expand at a modest pace in 2020, with house prices remaining broadly flat over the next twelve months".

EUR/USD

Resistance levels (open interest**, contracts)

$1.1300 (3839)

$1.1252 (3101)

$1.1221 (5397)

Price at time of writing this review: $1.1167

Support levels (open interest**, contracts):

$1.1100 (4776)

$1.1050 (3494)

$1.1000 (2693)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 3 is 60065 contracts (according to data from January, 2) with the maximum number of contracts with strike price $1,1200 (5397);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3213 (3603)

$1.3183 (876)

$1.3166 (1391)

Price at time of writing this review: $1.3119

Support levels (open interest**, contracts):

$1.3047 (969)

$1.2999 (1951)

$1.2950 (685)

Comments:

- Overall open interest on the CALL options with the expiration date January, 3 is 25900 contracts, with the maximum number of contracts with strike price $1,3400 (3608);

- Overall open interest on the PUT options with the expiration date January, 3 is 29688 contracts, with the maximum number of contracts with strike price $1,2500 (2270);

- The ratio of PUT/CALL was 0.87 versus 1.07 from the previous trading day according to data from January, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 66.68 | 0.12 |

| WTI | 61.09 | -0.11 |

| Silver | 17.99 | 0.78 |

| Gold | 1528.624 | 0.69 |

| Palladium | 1958.17 | 0.89 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| Hang Seng | 353.77 | 28543.52 | 1.25 |

| KOSPI | -22.5 | 2175.17 | -1.02 |

| ASX 200 | 6.5 | 6690.6 | 0.1 |

| FTSE 100 | 61.86 | 7604.3 | 0.82 |

| DAX | 136.92 | 13385.93 | 1.03 |

| Dow Jones | 330.36 | 28868.8 | 1.16 |

| S&P 500 | 27.07 | 3257.85 | 0.84 |

| NASDAQ Composite | 119.59 | 9092.19 | 1.33 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69887 | -0.33 |

| EURJPY | 121.28 | -0.51 |

| EURUSD | 1.11718 | -0.38 |

| GBPJPY | 142.583 | -0.9 |

| GBPUSD | 1.31347 | -0.78 |

| NZDUSD | 0.66973 | -0.46 |

| USDCAD | 1.29857 | 0.01 |

| USDCHF | 0.9711 | 0.3 |

| USDJPY | 108.547 | -0.11 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.