- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-11-2017

(raw materials / closing price /% change)

Oil 54.94 +1.18%

Gold 1,278.00 +0.05%

(index / closing price / change items /% change)

Nikkei +119.04 22539.12 +0.53%

TOPIX +7.37 1794.08 +0.41%

Hang Seng -75.42 28518.64 -0.26%

CSI 300 +0.51 3997.13 +0.01%

Euro Stoxx 50 -8.60 3688.80 -0.23%

FTSE 100 +67.36 7555.32 +0.90%

DAX -24.58 13440.93 -0.18%

CAC 40 -3.79 5510.50 -0.07%

DJIA +81.25 23516.26 +0.35%

S&P 500 +0.49 2579.85 +0.02%

NASDAQ -1.56714.94 -0.02%

S&P/TSX -14.34 16014.99 -0.09%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1656 +0,29%

GBP/USD $1,3057 -1,47%

USD/CHF Chf0,99921 -0,35%

USD/JPY Y114,07 -0,04%

EUR/JPY Y132,96 +0,24%

GBP/JPY Y148,947 -1,51%

AUD/USD $0,7713 +0,49%

NZD/USD $0,6912 +0,34%

USD/CAD C$1,28108 -0,39%

01:30 Australia AIG Services Index October 52.1 51.4

03:00 Japan Bank holiday

03:30 Australia Retail Sales, M/M September -0.6% 0.4%

04:45 China Markit/Caixin Services PMI October 50.6 50.8

12:30 United Kingdom Purchasing Manager Index Services October 53.6 53.3

15:30 Canada Trade balance, billions September -3.41 -3

15:30 Canada Unemployment rate October 6.2% 6.2%

15:30 Canada Employment October 10 15

15:30 U.S. Manufacturing Payrolls October -1 15.0

15:30 U.S. Government Payrolls October 7

15:30 U.S. Average workweek October 34.4 34.4

15:30 U.S. Private Nonfarm Payrolls October -40 303

15:30 U.S. Average hourly earnings October 0.5% 0.2%

15:30 U.S. Labor Force Participation Rate October 63.1%

15:30 U.S. International Trade, bln September -42.4 -43.2

15:30 U.S. Nonfarm Payrolls October -33 310

15:30 U.S. Unemployment Rate October 4.2% 4.2%

16:45 U.S. Services PMI (Finally) October 55.3 55.9

17:00 U.S. ISM Non-Manufacturing October 59.8 58.5

17:00 U.S. Factory Orders September 1.2% 1.3%

19:15 U.S. FOMC Member Kashkari Speaks

20:00 U.S. Baker Hughes Oil Rig Count November 737

23:15 Eurozone ECB's Benoit Coeure Speaks

Major US stock indexes finished the session mostly in positive territory, while the DJIA index updated a record high. Investors evaluated the long-awaited proposals to reduce taxes, promulgated by the Republicans, which caused deep skepticism about the adoption of the bill. In addition, traders were waiting for news about who will become the next head of the Fed.

President of the United States Donald Trump nominated Jerome Powell as chairman of the Fed, which, in the case of Senate Powell's approval in February, will be replaced by Janet Yellen. The White House expects that the candidature of Powell will be approved by the senators. It is worth emphasizing that the US president did not renew the powers of the current chairman of the Fed for the first time in 40 years. After the decision of Trump, the head of the Fed, Yellen congratulated Powell on his nomination, and expressed confidence that Powell is committed to the mission of the Fed.

The focus was also on the US data. The Ministry of Labor reported that the number of Americans applying for new unemployment benefits fell last week, despite the fact that Puerto Rico, devastated by hurricanes, has just begun processing the lagging applications. Initial applications for unemployment benefits, an indicator of layoffs across all US states, fell by 5,000 to 229,000, seasonally adjusted for the week ending October 28. Economists had expected 235,000 initial hits last week.

A separate report from the Ministry of Labor showed that productivity in the non-agricultural sector, measured as goods and services produced per hour, increased by 3.0%, seasonally adjusted in the third quarter, compared to a growth rate of 1.5% in the second quarter of 2017. Economists had expected growth of 2.4% in the last quarter. The output increased by 3.8% compared to the second quarter, while the hours worked - by 0.8%.

Meanwhile, the index of business activity in New York improved moderately last month, but was below forecasts. According to the data, the index, assessing the economic conditions in the manufacturing and services sectors for companies registered in New York, rose in October to 51.6 points from 49.7 points in September. Economists predicted that the index will rise to 56.8 points. At the same time, the index reflecting economic conditions in 6 months, has improved to 62.6 points against 58.4 points in September.

Components of the DOW index finished trading mixed (13 in negative, 17 in positive territory). The leader of growth was the shares of The Boeing Company (BA, + 1.72%). Outsider was the shares of The Home Depot, Inc. (HD, -1.72%).

Most sectors of the S & P index recorded a decline. The largest decrease was shown by the sector of conglomerates (-1.9%). The financial sector grew most (+ 0.6%).

At closing:

DJIA + 0.35% 23.516.06 +81.05

Nasdaq -0.02% 6,714.94 -1.59

S & P + 0.02% 2.579.85 + 0.49

EURUSD: 1.1580 (EUR 820m) 1.1600 (1.32bln) 1.1605-10 (1.03bln) 1.1650 (1.52bln) 1.1670 (780m) 1.1700-05 (1.3bln) 1.1850 (560m)

USDJPY: 112.50 (USD 450m) 113.00 (735m) 114.00 (1.4bln)

GBPUSD: 1.3055-60 (GBP 430m)

AUDUSD: 0.7700(AUD 1,5bln) 0.7725 (520m)

U.S. stock-index futures were flat on Thursday as investors waited for the unveiling of a long-awaited tax bill and President Donald Trump's decision on the next Federal Reserve chair.

Global Stocks:

Nikkei 22,539.12 +119.04 +0.53%

Hang Seng 28,518.64 -75.42 -0.26%

Shanghai 3,383.14 -12.77 -0.38%

S&P/ASX 5,931.71 -6.06 -0.10%

FTSE 7,549.55 +61.59 +0.82%

CAC 5,506.15 -8.14 -0.15%

DAX 13,451.46 -14.05 -0.10%

Crude $54.21 (-0.17%)

Gold $1,277.10 (-0.02%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 64.6 | -0.10(-0.15%) | 11217 |

| Amazon.com Inc., NASDAQ | AMZN | 1,100.06 | -3.62(-0.33%) | 10924 |

| Apple Inc. | AAPL | 167.44 | 0.55(0.33%) | 319218 |

| AT&T Inc | T | 33.51 | -0.04(-0.12%) | 9070 |

| Barrick Gold Corporation, NYSE | ABX | 14.21 | -0.01(-0.07%) | 22097 |

| Chevron Corp | CVX | 116 | 0.10(0.09%) | 308 |

| Cisco Systems Inc | CSCO | 34.52 | -0.10(-0.29%) | 2781 |

| Citigroup Inc., NYSE | C | 74.1 | 0.07(0.09%) | 23013 |

| Deere & Company, NYSE | DE | 133.77 | -0.50(-0.37%) | 575 |

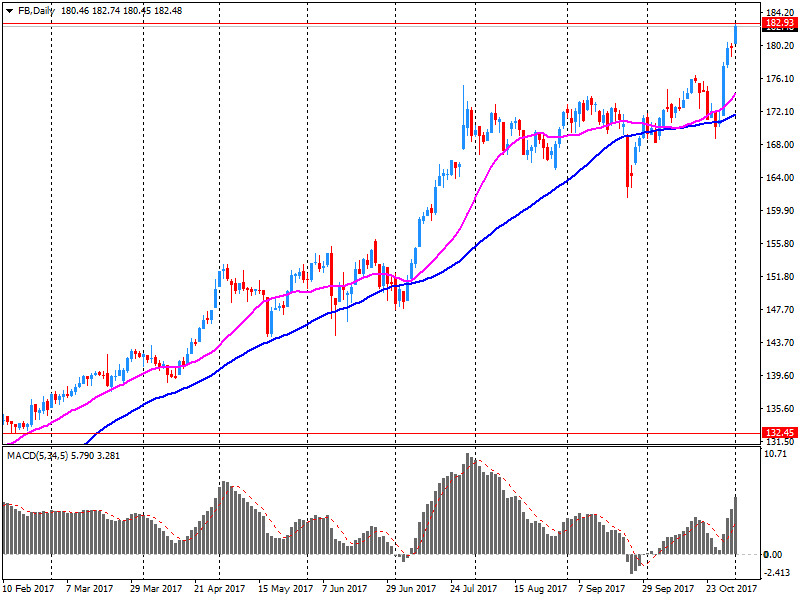

| Facebook, Inc. | FB | 181.3 | -1.36(-0.74%) | 1544970 |

| Ford Motor Co. | F | 12.34 | -0.01(-0.08%) | 8140 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.39 | 0.01(0.07%) | 2601 |

| General Electric Co | GE | 20.05 | 0.03(0.15%) | 74130 |

| General Motors Company, NYSE | GM | 43.2 | 0.07(0.16%) | 22905 |

| Google Inc. | GOOG | 1,022.98 | -2.52(-0.25%) | 1461 |

| Home Depot Inc | HD | 165 | -0.38(-0.23%) | 1141 |

| Intel Corp | INTC | 46.6 | -0.11(-0.24%) | 1096867 |

| JPMorgan Chase and Co | JPM | 101 | 0.08(0.08%) | 2863 |

| Merck & Co Inc | MRK | 55.45 | 0.11(0.20%) | 916 |

| Microsoft Corp | MSFT | 83.05 | -0.13(-0.16%) | 3401 |

| Nike | NKE | 54.79 | -0.28(-0.51%) | 1150 |

| Pfizer Inc | PFE | 35.3 | 0.04(0.11%) | 2485 |

| Starbucks Corporation, NASDAQ | SBUX | 54.88 | -0.25(-0.45%) | 2875 |

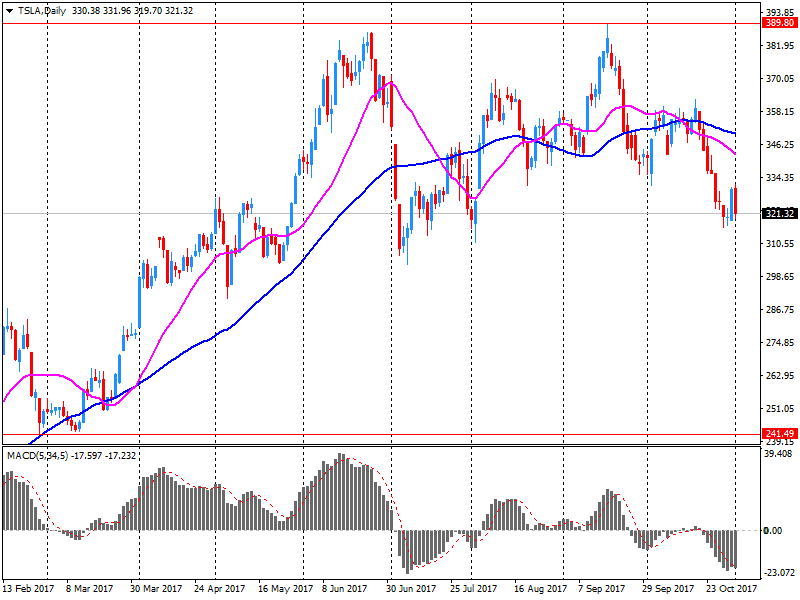

| Tesla Motors, Inc., NASDAQ | TSLA | 302 | -19.08(-5.94%) | 415176 |

| The Coca-Cola Co | KO | 45.75 | -0.05(-0.11%) | 278 |

| Twitter, Inc., NYSE | TWTR | 20.56 | -0.05(-0.24%) | 18033 |

| Verizon Communications Inc | VZ | 48 | 0.17(0.36%) | 548 |

| Visa | V | 111.2 | 0.13(0.12%) | 127 |

| Wal-Mart Stores Inc | WMT | 88.07 | 0.13(0.15%) | 1544 |

| Yandex N.V., NASDAQ | YNDX | 33.58 | -0.45(-1.32%) | 4070 |

Facebook (FB) target raised to $215 from $185 at Needham

Facebook (FB) target raised to $195 from $200 at Stifel

Facebook (FB) target raised to $230 from $195 at RBC Capital Mkts

Tesla (TSLA) target lowered to $340 at RBC Capital Mkts

Yandex N.V. (YNDX) downgraded to Hold from Buy at VTB Capital

In the week ending October 28, the advance figure for seasonally adjusted initial claims was 229,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 233,000 to 234,000. The 4-week moving average was 232,500, a decrease of 7,250 from the previous week's revised average. This is the lowest level for this average since April 7, 1973 when it was 232,250. The previous week's average was revised up by 250 from 239,500 to 239,750.

-

It isn't where inflation is now, but where it's going that concerns us

-

Time has come to ease our foot off the accelerator

-

Domestic inflationary pressures are likely to build

-

Interest rate are one of many influences on exchange rate and other asset prices

-

Households are generally well positioned for a rate rise

-

Sheer novelty of first increase in bank rate creates some uncertainty about impact, but no reason to expect it to be larger than normal

DowDuPont (DWDP) reported Q3 FY 2017 earnings of $0.55 per share (versus $0.91 in Q3 FY 2016), beating analysts' consensus estimate of $0.45.

The company's quarterly revenues amounted to $18.285 bln (+7.6% y/y), generally in-line with analysts' consensus estimate of $18.243 bln.

DWDP rose to $74.32 (+1.36%) in pre-market trading.

Tesla (TSLA) reported Q3 FY 2017 losses of $2.92 per share (versus $0.71 in Q3 FY 2016), missing analysts' consensus estimate of -$2.29.

The company's quarterly revenues amounted to $2.985 bln (+29.9% y/y), beating analysts' consensus estimate of $2.939 bln.

The company also announced about delaying Model 3 production targets. It currently expects to achieve a production rate of 5,000 Model 3 vehicles per week by late Q1 2018 (from end of 2017 previously).

TSLA fell to $306.06 (-4.68%) in pre-market trading.

-

Market interest rate assumption based on bank rate at 0.7 pct in q3 2018, 0.9 pct in q4 2019, 1.0 pct in q3 2020

-

Economic outlook "Broadly similar" to august, "considerable risks" remain, including around brexit

-

Boe forecast shows inflation in two years' time at 2.21 pct (aug forecast 2.19 pct), based on market interest rates

-

Shows inflation in one year's time at 2.37 pct (aug forecast 2.58 pct), based on market interest rates

-

Unemployment rate at 4.2 pct in two years' time (aug 4.5 pct), based on market rates

The Bank of England's Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 1 November 2017, the MPC voted by a majority of 7-2 to increase Bank Rate by 0.25 percentage points, to 0.5%. The Committee voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £10 billion. The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion.

Facebook (FB) reported Q3 FY 2017 earnings of $1.59 per share (versus $1.09 in Q3 FY 2016), beating analysts' consensus estimate of $1.28.

The company's quarterly revenues amounted to $10.328 bln (+47.3% y/y), beating analysts' consensus estimate of $9.844 bln.

The company also reported the daily active users (DAUs) were 1.37 billion on average for September 2017 (+16% y/y), and monthly active users (MAUs) were 2.07 billion as of September 30, 2017(+16% y/y).

FB fell to $180.50 (-1.18%) in pre-market trading.

UK construction companies signalled that business conditions remained subdued during October. Output growth was largely confined to house building, which partly offset lower volumes of civil engineering and commercial activity. Moreover, the balance of construction firms expecting an increase in business activity over the next 12 months eased to its weakest since December 2012. Caution in terms of the outlook for construction workloads meant that employment numbers increased at one of the slowest rates seen over the past four years.

At 50.8 in October, up from 48.1 in September, the seasonally adjusted IHS Markit/CIPS UK Construction Purchasing Managers' Index moved back above the 50.0 no-change mark. However, the latest reading was weaker than the post-crisis trend (54.7) and signalled only a marginal rise in overall construction output.

The eurozone manufacturing sector started the final quarter on a strong footing. Growth of both output and new orders remained elevated, while the pace of job creation accelerated to a survey-record high.

The final IHS Markit Eurozone Manufacturing PMI rose to an 80-month high of 58.5 in October, up from 58.1 in September and slightly below the earlier flash estimate of 58.6. The headline PMI has signalled expansion in each month since July 2013.

Germany's manufacturing sector continued to grow strongly at the start of the fourth quarter, according to the latest PMI survey data from IHS Markit and BME. Production and new orders rose sharply in October, and goods producers upped the rate of job creation to the fastest since April 2011 in order to support the higher level of activity. Supply chain pressures further intensified, however, with the incidence of delivery delays among the most widespread on record and manufacturers facing sharply rising purchase prices.

October's PMI reading was 60.6, unchanged on September's 77-month high. The intermediate and investment goods sectors were again the best performers, with the consumer goods category continuing to lag behind.

The Spanish manufacturing sector gained further growth momentum during October, with sharp and accelerated rises in output, new orders and employment recorded. Firms responded to higher workloads by increasing purchasing activity, in turn leading to one of the fastest rises in input stocks in the survey's history. Meanwhile, inflationary pressures gathered pace amid reports of raw material shortages. This also contributed to longer suppliers' delivery times.

The PMI increased to 55.8 in October, up from 54.3 in September and the highest reading since May 2015. In fact, the rate of improvement in the health of the sector was the joint-fastest since the financial crisis.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1801 (3905)

$1.1754 (2441)

$1.1712 (2739)

Price at time of writing this review: $1.1652

Support levels (open interest**, contracts):

$1.1587 (5991)

$1.1545 (3729)

$1.1498 (3817)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 120174 contracts (according to data from November, 1) with the maximum number of contracts with strike price $1,2000 (10004);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3338 (3442)

$1.3313 (1022)

$1.3294 (4287)

Price at time of writing this review: $1.3261

Support levels (open interest**, contracts):

$1.3228 (2173)

$1.3203 (975)

$1.3172 (2744)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 45723 contracts, with the maximum number of contracts with strike price $1,3200 (4287);

- Overall open interest on the PUT options with the expiration date November, 3 is 39578 contracts, with the maximum number of contracts with strike price $1,3100 (3228);

- The ratio of PUT/CALL was 0.87 versus 0.84 from the previous trading day according to data from November, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

At -2 points, the overall index is virtually unchanged in October compared to the previous quarter (-3 points). Continued optimism regarding economic development and unemployment are supporting the positive outlook in particular, while expectations regarding the financial situation of households remain below average. This indicates that consumers' perceptions have barely changed since the July survey, although there has been a significant increase in anticipated price trends.

Total dwelling units:

-

The trend estimate for total dwellings approved rose 1.8% in september and has risen for eight months.

-

The seasonally adjusted estimate for total dwellings approved rose 1.5% in september and has risen for two months.

Value of building approved:

-

The trend estimate of the value of total building approved rose 1.3% in september and has risen for nine months. The value of residential building rose 1.5% and has risen for five months. The value of non-residential building rose 1.0% and has risen for eight months.

-

The seasonally adjusted estimate of the value of total building approved rose 8.3% in september after falling for two months. The value of residential building rose 0.1% and has risen for two months. The value of non-residential building rose 22.4% following a fall of 10.9% in the previous month.

Balance on goods and services:

-

In trend terms, the balance on goods and services was a surplus of $1,061m in september 2017, an increase of $6m on the surplus in august 2017.

-

In seasonally adjusted terms, the balance on goods and services was a surplus of $1,745m in september 2017, an increase of $872m on the surplus in august 2017.

Credits (exports of goods and services):

-

In seasonally adjusted terms, goods and services credits rose $924m (3%) to $32,961m. Non-rural goods rose $599m (3%), non-monetary gold rose $217m (17%), rural goods rose $5m and net exports of goods under merchanting rose $1m (2%). Services credits rose $102m (1%).

Stocks inched higher in Asia on Thursday, tracking muted gains on Wall Street overnight even as the Federal Reserve signaled an optimistic view of the U.S. economy. Many investors retreated to the sidelines ahead of President Donald Trump's nomination for the Federal Reserve's next leader. Trump is likely to tap Fed governor Jerome Powell as the next chairman of the central bank, according to a person familiar with the matter.

European stocks posted their highest close in more than two years Wednesday, boosted by resource stocks after solid Chinese manufacturing data and car makers following strong U.S. sales figures. The Stoxx Europe 600 index SXXP, +0.39% climbed 0.4% to 396.77, for its highest close since August 2015, according to FactSet data.

U.S. stocks mostly closed higher Wednesday, with the Dow and the S&P 500 ending near record levels after the Federal Reserve stood pat on interest rates but referred to the U.S. economy in positive terms. The central bank, in its statement following a two-day meeting, said economic activity has been picking up at a "solid rate," versus the "moderate" rate that it had referenced in September.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.