- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 01-08-2017

(raw materials / closing price /% change)

Oil 48.79 -0.75%

Gold 1,274.80 -0.36%

(index / closing price / change items /% change)

Nikkei +60.61 19985.79 +0.30%

TOPIX +9.89 1628.50 +0.61%

Hang Seng +216.24 27540.23 +0.79%

CSI 300 +32.51 3770.38 +0.87%

Euro Stoxx 50 +28.03 3477.39 +0.81%

FTSE 100 +51.66 7423.66 +0.70%

DAX +133.04 12251.29 +1.10%

CAC 40 +33.26 5127.03 +0.65%

DJIA +72.80 21963.92 +0.33%

S&P 500 +6.05 2476.35 +0.24%

NASDAQ +14.82 6362.94 +0.23%

S&P/TSX +58.23 15202.10 +0.38%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1804 -0,25%

GBP/USD $1,3206 +0,00%

USD/CHF Chf0,96508 -0,16%

USD/JPY Y110,36 +0,11%

EUR/JPY Y130,29 -0,15%

GBP/JPY Y145,752 +0,11%

AUD/USD $0,7968 -0,40%

NZD/USD $0,7469 -0,53%

USD/CAD C$1,25375 +0,41%

01:30 Australia Building Permits, m/m June -5.6% 1.5%

05:00 Japan Consumer Confidence July 43.3

05:45 Switzerland SECO Consumer Climate Quarter III -8

07:15 Switzerland Retail Sales Y/Y June -0.3%

07:15 Switzerland Retail Sales (MoM) June 0.3%

07:30 Switzerland Manufacturing PMI July 60.1

08:30 United Kingdom PMI Construction July 54.8 54

09:00 Eurozone Producer Price Index (YoY) June 3.3% 2.4%

09:00 Eurozone Producer Price Index, MoM June -0.4% -0.1%

12:15 U.S. ADP Employment Report July 158 190

14:30 U.S. Crude Oil Inventories July -7.208

16:00 U.S. FOMC Member Mester Speaks

19:30 U.S. FOMC Member Williams Speaks

23:30 Australia AIG Services Index July 54.8

The main US stock indices grew moderately on the first trading day of the month, which was supported by the positive reporting of a number of companies. Meanwhile, the pressure on the market had a strong drop in oil quotations, ambiguous statistics on the US, as well as political uncertainty in Washington.

As it became known, Americans increased spending in June by the smallest amount in five months. Consumer spending rose 0.1% in June, which corresponds to the smallest increase in 2017. This was in line with the forecast of economists. Meanwhile, revenue growth and inflation remained unchanged.

At the same time, the July data showed a noticeable improvement in the conditions in the manufacturing sector of the United States. The seasonally adjusted final PMI index in the US industry from IHS Markit rose to 53.3 in July from 52.0 in June, and signaled further improvement in the sector. The growth was largely due to the expansion in the components of the release and new orders. Meanwhile, firms added jobs and increased purchasing activity at the fastest pace since February. Business confidence reached a six-month high, as firms have become more optimistic about the future release.

In addition, a report published by the Institute for Supply Management (ISM) showed that in July, activity in the US manufacturing sector deteriorated more than forecast. The PMI index for the manufacturing sector was 56.3 points versus 57.8 points in June. Analysts had expected the figure to drop to 56.5 points.

Most components of the DOW index recorded a rise (20 out of 30). The leader of growth was shares of Intel Corporation (INTC, + 2.33%). Outsider were shares of The Boeing Company (BA, -1.11%).

Most sectors of the S & P index finished trading in positive territory. The financial sector grew most (+ 0.7%). The greatest decrease was shown by the conglomerate sector (-0.4%).

At closing:

DJIA + 0.33% 21,963.03 +71.91

Nasdaq + 0.23% 6.362.94 +14.82

S & P + 0.24% 2.476.33 +6.03

A report from Institute for Supply Management (ISM) showed the U.S. manufacturing sector expanded in July, and the overall economy grew for the 98th consecutive month.

The ISM's index of manufacturing activity came in at 56.3 percent last month, down 1.5 percentage points from the June figure of 57.8 percent, missing economists' forecast for a 56.5 percent reading. A reading above 50 percent indicates expansion, while a reading below 50 percent indicates contraction.

According to the report, orders for new goods decreased to 60.4 percent last month from 63.5 percent in the prior month, production fell to 60.6 percent from 62.4 percent, and employment index dropped to 55.2 percent from 57.2 percent. At the same time, inventories rose to 50 percent in July from the June reading of 49 percent, while the prices index increased to 62 percent last month from 55 percent in the prior month.

Of the 18 manufacturing industries, 15 reported growth in July.

Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee said, "The past relationship between the PMI and the overall economy indicates that the average PMI for January through July (56.4 percent) corresponds to a 4.1 percent increase in real gross domestic product (GDP) on an annualized basis. In addition, if the PMI for July (56.3 percent) is annualized, it corresponds to a 4.1 percent increase in real GDP annually."

Final data released by IHS Markit showed that activity in the U.S. manufacturing sector in July improved further in July.

According to the report, the seasonally adjusted IHS Markit final U.S. Manufacturing Purchasing Managers' Index (PMI) came in at 53.3 last month, compared to a preliminary reading of 53.2 and a final reading of 52 in June. That was the highest reading in four months. Economists had expected the reading to stay at 53.2.

The July improvement in business conditions was largely driven by marked and accelerated expansions in both output and new orders, while inflationary pressures remained muted, despite a pickup in the rate of input cost inflation.

Chief Business Economist at HIS Markit Chris Williamson noted: "The second half of the year got off to a good start for US manufacturers, with the health of the sector improving at the fastest rate for four months. Output, new orders, employment and buying activity all grew at increased rates. The only real blot on the copybook was a decline in exports for the first time since last September."

EURUSD: 1.1500 (EUR 1.05bln ) 1.1550 (335m) 1.1600 (1.1bln) 1.1750 (635m) 1.1800 (975m)

USDJPY: 110.00 (USD 575m) 110.55-60 (560m)

AUDUSD: 0.7675 (AUD 280m)

AUDNZD: 1.0640 (AUD 480m) 1.0660 (270m)

USDCAD: 1.2500 (USD 245m) 1.2625 (470m)

EURJPY: 129.00 (EUR 280m)

U.S. stock-index futures rose as investors assessed a raft of quarterly earnings reports and ignored weaker-than-expected data on personal income .

Global Stocks:

Nikkei 19,985.79 +60.61 +0.30%

Hang Seng 27,540.23 +216.24 +0.79%

Shanghai 3,292.28 +19.26 +0.59%

S&P/ASX 5,772.37 +51.78 +0.91%

FTSE 7,433.40 +61.40 +0.83%

CAC 5,136.46 +42.69 +0.84%

DAX 12,216.89 +98.64 +0.81%

Crude $49.78 (-0.78%)

Gold $1,272.40 (-0.08%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 64.7 | -0.27(-0.42%) | 40557 |

| Amazon.com Inc., NASDAQ | AMZN | 994.6 | 6.82(0.69%) | 35499 |

| Apple Inc. | AAPL | 149.16 | 0.43(0.29%) | 149451 |

| Barrick Gold Corporation, NYSE | ABX | 16.83 | -0.08(-0.47%) | 33836 |

| Boeing Co | BA | 243.35 | 0.89(0.37%) | 9262 |

| Caterpillar Inc | CAT | 113.2 | -0.75(-0.66%) | 585 |

| Chevron Corp | CVX | 109.69 | 0.50(0.46%) | 1236 |

| Cisco Systems Inc | CSCO | 31.52 | 0.07(0.22%) | 5651 |

| Deere & Company, NYSE | DE | 127.2 | -1.08(-0.84%) | 2010 |

| E. I. du Pont de Nemours and Co | DD | 82.06 | -0.15(-0.18%) | 395 |

| Exxon Mobil Corp | XOM | 80.11 | 0.07(0.09%) | 4440 |

| Facebook, Inc. | FB | 169.9 | 0.65(0.38%) | 81477 |

| Ford Motor Co. | F | 11.23 | 0.01(0.09%) | 93086 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.75 | 0.13(0.89%) | 41503 |

| General Electric Co | GE | 25.7 | 0.09(0.35%) | 16145 |

| Goldman Sachs | GS | 226.1 | 0.77(0.34%) | 866 |

| Google Inc. | GOOG | 933 | 2.50(0.27%) | 1850 |

| HONEYWELL INTERNATIONAL INC. | HON | 136.15 | 0.03(0.02%) | 200 |

| Intel Corp | INTC | 35.62 | 0.15(0.42%) | 2713 |

| International Business Machines Co... | IBM | 144.8 | 0.13(0.09%) | 3480 |

| JPMorgan Chase and Co | JPM | 92.43 | 0.63(0.69%) | 4193 |

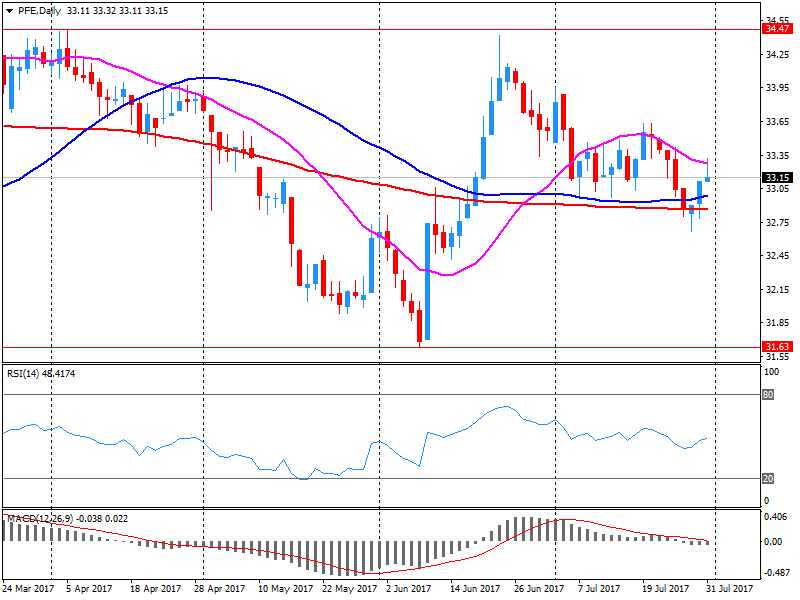

| Pfizer Inc | PFE | 33.1 | -0.06(-0.18%) | 78510 |

| Tesla Motors, Inc., NASDAQ | TSLA | 324.79 | 1.32(0.41%) | 40213 |

| Twitter, Inc., NYSE | TWTR | 16.14 | 0.05(0.31%) | 76584 |

| Yandex N.V., NASDAQ | YNDX | 29.28 | 0.30(1.04%) | 214 |

The Commerce Department reported that consumer spending in the U.S. rose 0.1 percent m-o-m in June, following an upwardly revised 0.2 percent m-o-m gain in May (originally a 0.1 percent increase). Economists had forecast the reading to show a 0.1 percent m-o-m increase.

Meanwhile, consumer income was unchanged in June, after rising revised 0.3 percent m-o-m in May (originally a 0.4 percent advance). Economists had expected the personal incomes to grow by 0.4 percent in June.

The June flat performance in personal income primarily reflected decreases in personal dividend income and personal interest income that were partially offset by an increase in compensation of employees.

The personal consumption expenditures (PCE) price index, excluding the volatile categories of food and energy, which is the Fed's preferred inflation measure, rose 0.1 percent m-o-m in June after an unrevised 0.1 increase in the prior month. Economists had projected the index would rise 0.1 percent. In the 12 months through June, the core PCE rose 1.5 percent, below the Fed's inflation target of 2 percent.

Pfizer (PFE) reported Q2 FY 2017 earnings of $0.67 per share (versus $0.64 in Q2 FY 2016), beating analysts' consensus estimate of $0.66.

The company's quarterly revenues amounted to $12.896 bln (-1.9% y/y), missing analysts' consensus estimate of $13.077 bln.

The company also raised its FY 2017 EPS forecast to $2.54-2.60 from $2.50-2.60 (versus analysts' consensus estimate of $2.55) and reaffirmed FY 2017 revenues guidance at $52-54 bln (versus analysts' consensus estimate of $52.78 bln).

PFE rose to $33.20 (+0.12%) in pre-market trading.

Eurostat, the statistical office of the European Union (EU) reported its preliminary estimates showed that the pace of growth in the Eurozone accelerated by 0.6 percent q-o-q in the second quarter from a 0.5 percent q-o-q in the first quarter (revised down from 0.6 percent q-o-q).

In y-o-y terms, economic growth leaped to 2.1 percent in the second quarter from 1.9 percent in the prior three-month period.

Both the quarterly and annual rates of the GDP growth matched economists' forecasts.

The report from IHS Markit and Chartered Institute of Procurement & Supply (CIPS) showed that activity in the manufacturing sector of the UK's economy expanded more-than-expected in July.

According to the report, the Markit/CIPS Purchasing Managers' Index (PMI) for the UK's manufacturing sector rose to 55.1 in July from a downwardly revised 54.2 in June (originally 54.3). Economists had forecast the indicator to increase to 54.4. The 50 mark divides contraction and expansion.

The July improvement in the PMI was boosted by stronger inflows of new work, higher levels of production, improved job creation, longer supplier delivery times and a slight increase in inventory holdings. Meanwhile, cost pressures eased. Input prices rose at the slowest pace in over a year.

The Federal Labor Agency reported that number of unemployed Germans reduced by 9,000 to 2.537 million in seasonally adjusted terms in June. Economists had forecast the jobless total to fall 5,000 after growing by 7,000 in May.

Meanwhile, the unemployment rate was unchanged at 5.7 percent, the lowest level since reunification in 1990 and in line with the economists' expectations.

The Reserve Bank of Australia (RBA) decided to leave the cash rate unchanged at 1.50 percent at its August monetary policy meeting. The move was widely expected by the markets.

In the statement accompanying the decision, the governor of the Australian regulator Philip Lowe noted that the regulator's forecasts for the domestic economy were largely changed. "Over the next couple of years, the central forecast is for the economy to grow at an annual rate of around 3 percent", he stated.

Mr. Lowe also said that the conditions in Australia's housing market vary considerably around the country, but noted that situation with briskly rising housing prices is "starting to ease."

Regarding the situation with inflation, he said that recent inflation data were broadly in-line with the RBA's expectations and reiterated his forecast the inflation pressure to pick up gradually.

The statement again reminded that the Australian dollar appreciation is expected "to contribute to subdued price pressures in the economy" as well as to "to result in a slower pick-up in economic activity and inflation than currently forecast."

EUR/USD

Resistance levels (open interest**, contracts)

$1.1902 (3379)

$1.1883 (4875)

$1.1866 (2454)

Price at time of writing this review: $1.1815

Support levels (open interest**, contracts):

$1.1777 (1155)

$1.1738 (1101)

$1.1694 (2554)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 4 is 99754 contracts (according to data from July, 31) with the maximum number of contracts with strike price $1,1800 (4875);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3287 (1781)

$1.3262 (2598)

$1.3233 (3056)

Price at time of writing this review: $1.3209

Support levels (open interest**, contracts):

$1.3155 (126)

$1.3123 (995)

$1.3084 (696)

Comments:

- Overall open interest on the CALL options with the expiration date August, 4 is 31516 contracts, with the maximum number of contracts with strike price $1,3100 (3056);

- Overall open interest on the PUT options with the expiration date August, 4 is 30713 contracts, with the maximum number of contracts with strike price $1,2800 (3027);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from July, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Markit/Caixin's survey revealed Tuesday that activity in China's manufacturing sector improved in July for the second successive month, supported by accelerated increases in both output and new orders.

The Caixin/Markit services purchasing managers' index (PMI) rose to 51.1 last month on a seasonally adjusted basis from 50.4 in June. That was the strongest improvement since March. Economists' had predicted the reading to stay at 50.4. The 50 mark divides contraction and expansion.

Dr. Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group, noted: "The Caixin China General Manufacturing PMI rose 0.7 points to 51.1 in July, the highest reading in four months. The sub-indices of output and new orders both rebounded further from May's recent lows. The sub-indices of input costs and output prices both continued to rise to hit four-month highs. Although the sub-index measuring stocks of finished goods remained in contraction territory and slid further, the sub-index showing quantity of purchases indicated the strongest rise in buying activity for five months, pointing to moderate growth in manufacturing production going forward. Operating conditions in the manufacturing sector improved further in July, suggesting the economy's growth momentum will be sustained. That said, it's unlikely that financial regulatory tightening will be relaxed."

European stocks turned lower Monday, as gains for mining stocks couldn't offset concerns about persistent strength in the euro as investors finished up trading for July. The Stoxx Europe 600 SXXP, -0.13% slipped 0.1% to close at 377.85, languishing at its lowest since April, according to FactSet data. Consumer-related, industrial and tech shares fell, but utility and health care stocks were among the advancers.

Equities continued to rise Tuesday, with Asian stocks starting August widely higher during what has been a strong earnings season so far. But there has been caution that further declines in the U.S. dollar, near its lowest levels in a year, could crimp results. A weaker dollar could make Asian exports less competitive over time.

The Dow industrials finished at an all-time high on Monday, but the broader market's gains were hobbled by losses in the technology sector. The Dow Jones Industrial Average DJIA, +0.28% gained 60.81 points, or 0.3%, to close at 21,891.12, pulling back from its best levels after hitting an intraday record earlier in the session at 21,929.80.

Final data released by IHS Markit showed activity in Japan's manufacturing sector expanded at a slower rate in July as growth in exports falters. The Nikkei Japan Manufacturing purchasing manager's index (PMI) came in at 52.1 last month, compared to a preliminary reading of 52.2 and a final reading of 52.4 in June. That was the lowest reading since November 2016. Economists had expected the reading to stay at 52.2. A reading above 50 signals an expansion in activity, while a reading below this level signals a contraction.

The growth of the Japanese manufacturing sector was sustained at a modest rate during July, supported by further improvement in output, new orders and employment, the report said. However, in each case, rates of expansion were lower than recorded in June, while export trade increased at the weakest pace in nearly a year.

Commenting on the Japanese Manufacturing PMI survey data, Paul Smith, senior economist at IHS Markit, which compiles the survey, said: "The expansion of the Japanese manufacturing sector was undermined somewhat during July by a slump in new export order growth, which led to the lowest rises in both output and new orders since the final few months of last year. However, sentiment reached its highest level in over five years of data collection and, combined with ongoing rises in staffing levels, provides some reassurance that growth should be sustained in the coming months."

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.