- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 01-02-2018

(raw materials / closing price /% change)

Oil 66.13 +2.16%

Gold 1,352.50 +0.70%

(index / closing price / change items /% change)

Nikkei +387.82 23486.11 +1.68%

TOPIX +33.73 1870.44 +1.84%

Hang Seng -245.18 32642.09 -0.75%

CSI 300 -30.00 4245.90 -0.70%

Euro Stoxx 50 -31.94 3577.35 -0.88%

FTSE 100 -43.16 7490.39 -0.57%

DAX -185.58 13003.90 -1.41%

CAC 40 -27.38 5454.55 -0.50%

DJIA +37.32 26186.71 +0.14%

S&P 500 -1.83 2821.98 -0.06%

NASDAQ -25.62 7385.86 -0.35%

S&P/TSX -90.75 15860.92 -0.57%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2505 +0,74%

GBP/USD $1,4262 +0,49%

USD/CHF Chf0,9262 -0,53%

USD/JPY Y109,40 +0,21%

EUR/JPY Y136,81 +0,94%

GBP/JPY Y156,03 +0,69%

AUD/USD $0,8078 +0,27%

NZD/USD $0,7394 +0,41%

USD/CAD C$1,2266 -0,39%

00:30 Australia Producer price index, q / q Quarter IV 0.2% 0.2%

00:30 Australia Producer price index, y/y Quarter IV 1.6% 1.2%

09:30 United Kingdom PMI Construction January 52.2 52.0

10:00 Eurozone Producer Price Index, MoM December 0.6% 0.1%

10:00 Eurozone Producer Price Index (YoY) December 2.8% 2.3%

13:30 U.S. Government Payrolls January 2

13:30 U.S. Manufacturing Payrolls January 25 20

13:30 U.S. Average workweek January 34.5 34.5

13:30 U.S. Private Nonfarm Payrolls January 146 180

13:30 U.S. Labor Force Participation Rate January 62.7% 62.8%

13:30 U.S. Average hourly earnings January 0.3% 0.3%

13:30 U.S. Unemployment Rate January 4.1% 4.1%

13:30 U.S. Nonfarm Payrolls January 148 180

15:00 U.S. Factory Orders December 1.3% 0.6%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index

(Finally) January 95.9 95

18:00 U.S. Baker Hughes Oil Rig Count February 759 758

Major US stock indexes mostly fell on Thursday, responding to a series of unconvincing quarterly reports and mixed economic data for the US.

As it became known, the number of Americans applying for new unemployment benefits fell last week, remaining near historically low levels. Initial applications for unemployment benefits, an indicator of layoffs in all US states, fell by 1,000 to 230,000 people for the week ending January 27, the Ministry of Labor said. Economists were expecting 238,000 new applications last week.

However, employee productivity in the US unexpectedly fell in the fourth quarter, the first decline since early 2016 and evidence that it will be difficult to increase annual economic growth to 3% on a sustainable basis. The Ministry of Labor reported on Thursday that labor productivity in the non-agricultural sector, which measures hourly output per employee, in October-December decreased by 0.1% year-on-year. This was the first drop and the weakest performance since the first quarter of 2016.

In addition, a report published by the Institute for Supply Management (ISM) showed: in January, activity in the US manufacturing sector weakened, but was better than economists' forecasts. The PMI index for the manufacturing sector in January was 59.1 points against 59.7 in December. Analysts had expected that the figure would drop to 58.8 points.

Components of the DOW index finished trading mixed (14 in positive territory, 16 in negative territory). Outsider shares were DowDuPont Inc. (DWDP, -2.60%). Exxon Mobil Corporation (XOM, + 2.18%) was the leader of growth.

Most S & P sectors recorded a decline. The utilities sector showed the greatest decrease (-1.4%). The base resources sector grew most (+ 0.3%).

At closing:

DJIA + 0.14% 26,186.71 +37.32

Nasdaq -0.35% 7.385.86 -25.62

S & P -0.06% 2,821.98 -1.83

EUR/USD is currently in a relatively important are close to 1.24.

On daily time frame chart, we can see that the price has been shown some indecision.

However, that below the price it has formed a upside trend line which the price has been respecting quite well.

Therefore, if the price keeps above the resistance level at 1.24 and the upside trend line, then we can expect a further bullish movement on eur/usd.

Economic activity in the manufacturing sector expanded in January, and the overall economy grew for the 105th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business.

The report was issued today by Timothy R. Fiore, Chair of the Institute for Supply Management: "The January PMI registered 59.1 percent, a decrease of 0.2 percentage point from the seasonally adjusted December reading of 59.3 percent. The New Orders Index registered 65.4 percent, a decrease of 2 percentage points from the seasonally adjusted December reading of 67.4 percent. The Production Index registered 64.5 percent, a 0.7 percentage point decrease compared to the seasonally adjusted December reading of 65.2 percent. The Employment Index registered 54.2 percent, a decrease of 3.9 percentage points from the seasonally adjusted December reading of 58.1 percent".

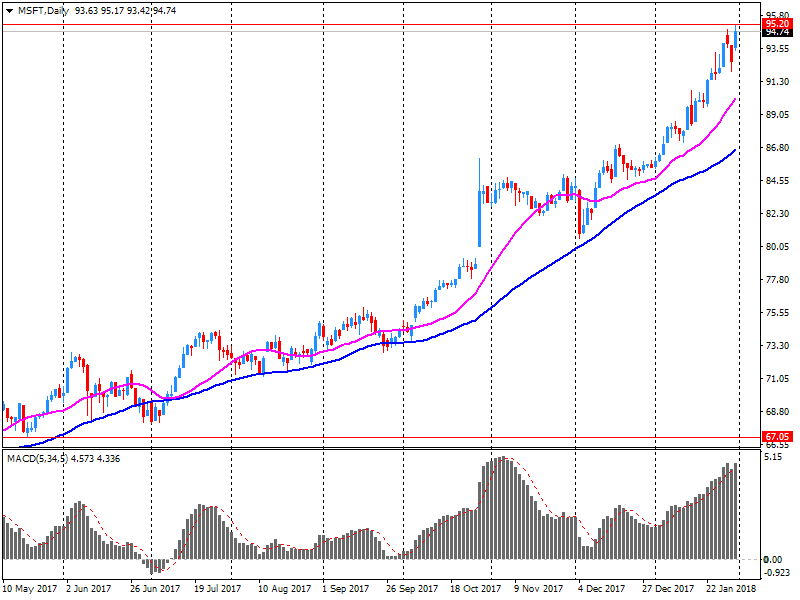

U.S. stock-index futures fell on Thursday after the Federal Reserve improved its inflation outlook and flagged "further gradual" interest rate hikes, and Microsoft (MSFT) shares dropped 0.8% despite its strong quarterly report.

Global Stocks:

Nikkei 23,486.11 +387.82 +1.68%

Hang Seng 32,642.09 -245.18 -0.75%

Shanghai 3,446.24 -34.59 -0.99%

S&P/ASX 6,090.10 +52.40 +0.87%

FTSE 7,506.06 -27.49 -0.36%

CAC 5,466.70 -15.23 -0.28%

DAX 13,049.38 -140.10 -1.06%

Crude $65.42 (+1.07%)

Gold $1,343.20 (+0.01%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 250.28 | -0.22(-0.09%) | 1007 |

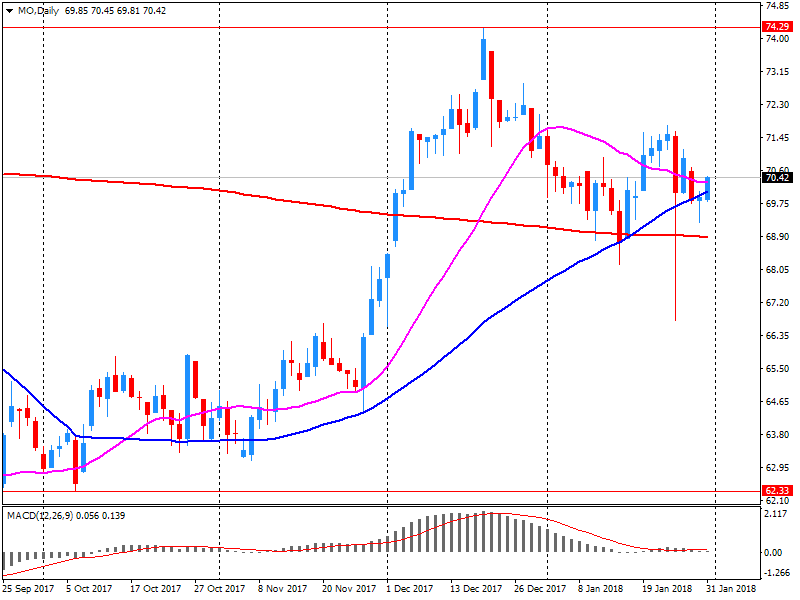

| ALTRIA GROUP INC. | MO | 70 | -0.34(-0.48%) | 3382 |

| Amazon.com Inc., NASDAQ | AMZN | 1,451.48 | 0.59(0.04%) | 83002 |

| Apple Inc. | AAPL | 166.87 | -0.56(-0.33%) | 266191 |

| AT&T Inc | T | 38.48 | 1.03(2.75%) | 846589 |

| Barrick Gold Corporation, NYSE | ABX | 14.3 | -0.08(-0.56%) | 2180 |

| Boeing Co | BA | 352.22 | -2.15(-0.61%) | 23268 |

| Caterpillar Inc | CAT | 162.51 | -0.27(-0.17%) | 8661 |

| Chevron Corp | CVX | 125.51 | 0.16(0.13%) | 2017 |

| Cisco Systems Inc | CSCO | 41.29 | -0.25(-0.60%) | 13018 |

| Citigroup Inc., NYSE | C | 78.25 | -0.23(-0.29%) | 12227 |

| Deere & Company, NYSE | DE | 166.29 | -0.13(-0.08%) | 1353 |

| Exxon Mobil Corp | XOM | 87.33 | 0.03(0.03%) | 6525 |

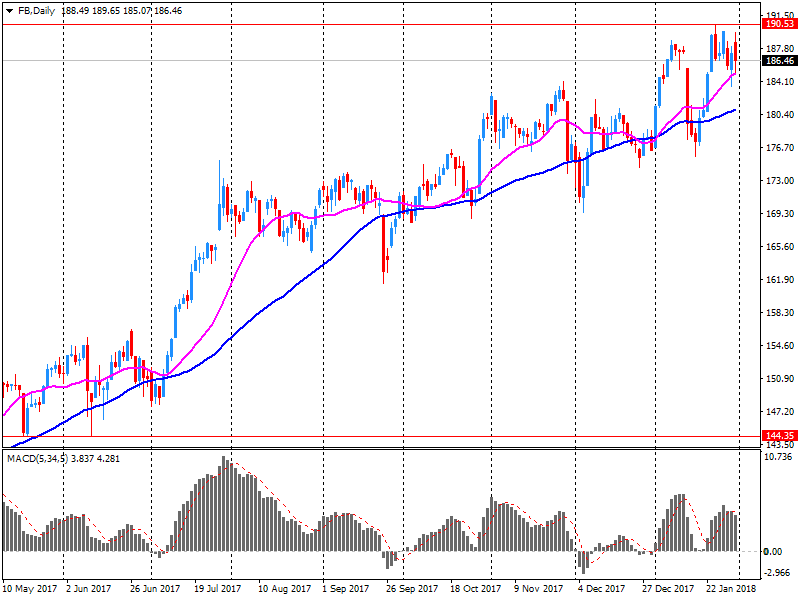

| Facebook, Inc. | FB | 189.1 | 2.21(1.18%) | 2162612 |

| FedEx Corporation, NYSE | FDX | 264 | 1.52(0.58%) | 1416 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.49 | -0.01(-0.05%) | 400 |

| General Electric Co | GE | 16.08 | -0.09(-0.56%) | 148717 |

| General Motors Company, NYSE | GM | 42.31 | -0.10(-0.24%) | 1480 |

| Goldman Sachs | GS | 266.5 | -1.39(-0.52%) | 1495 |

| Google Inc. | GOOG | 1,168.79 | -1.15(-0.10%) | 6972 |

| Home Depot Inc | HD | 200 | -0.90(-0.45%) | 2125 |

| Intel Corp | INTC | 47.65 | -0.49(-1.02%) | 55444 |

| International Business Machines Co... | IBM | 163.08 | -0.62(-0.38%) | 1788 |

| Johnson & Johnson | JNJ | 138.01 | -0.18(-0.13%) | 6448 |

| JPMorgan Chase and Co | JPM | 115.45 | -0.22(-0.19%) | 12433 |

| McDonald's Corp | MCD | 171.05 | -0.09(-0.05%) | 2673 |

| Microsoft Corp | MSFT | 93.65 | -1.36(-1.43%) | 423038 |

| Nike | NKE | 67.93 | -0.29(-0.43%) | 705 |

| Pfizer Inc | PFE | 36.66 | -0.04(-0.11%) | 32267 |

| Procter & Gamble Co | PG | 86.39 | 0.05(0.06%) | 9371 |

| Starbucks Corporation, NASDAQ | SBUX | 56.64 | -0.17(-0.30%) | 11783 |

| Tesla Motors, Inc., NASDAQ | TSLA | 351.5 | -2.81(-0.79%) | 21437 |

| The Coca-Cola Co | KO | 47.51 | -0.08(-0.17%) | 2344 |

| Twitter, Inc., NYSE | TWTR | 25.55 | -0.26(-1.01%) | 62079 |

| United Technologies Corp | UTX | 136.82 | -1.19(-0.86%) | 1313 |

| UnitedHealth Group Inc | UNH | 235.01 | -1.77(-0.75%) | 1772 |

| Verizon Communications Inc | VZ | 54.1 | 0.03(0.06%) | 22279 |

| Visa | V | 125.52 | 1.29(1.04%) | 70231 |

| Wal-Mart Stores Inc | WMT | 106.31 | -0.29(-0.27%) | 9309 |

| Walt Disney Co | DIS | 108.88 | 0.21(0.19%) | 8533 |

| Yandex N.V., NASDAQ | YNDX | 38.84 | 0.11(0.28%) | 518 |

Facebook (FB) reiterated with a Hold at Stifel; target $195

Facebook (FB) reiterated with a Buy at Needham; target $215

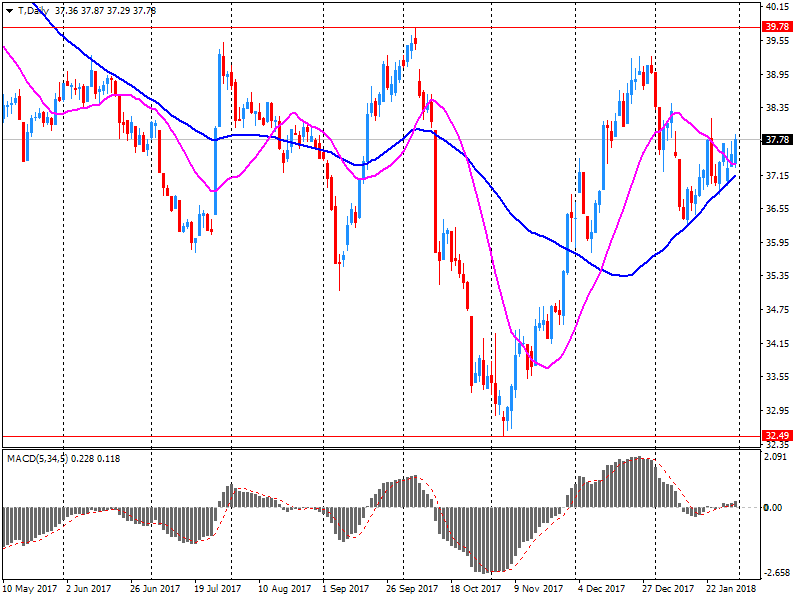

AT&T (T) reiterated with with a Perform at Oppenheimer

Nonfarm business sector labor productivity decreased 0.1 percent during the fourth quarter of 2017, the U.S. Bureau of Labor Statistics reported today, as

output increased 3.2 percent and hours worked increased 3.3 percent. (All quarterly percent changes in this release are seasonally adjusted annual rates.) From the fourth quarter of 2016 to the fourth quarter of 2017, productivity increased 1.1 percent, reflecting a 3.2-percent increase in output and a 2.1-percent increase in hours worked.

Annual average productivity increased 1.2 percent from 2016 to 2017.

Microsoft (MSFT) target raised to $107 from $100 at BMO Capital Markets

Microsoft (MSFT) target raised to $105 from $92 at Stifel

In the week ending January 27, the advance figure for seasonally adjusted initial claims was 230,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 233,000 to 231,000. The 4-week moving average was 234,500, a decrease of 5,000 from the previous week's revised average. The previous week's average was revised down by 500 from 240,000 to 239,500.

Altria (MO) reported Q4 FY 2017 earnings of $0.91 per share (versus $0.68 in Q4 FY 2016), beating analysts' consensus estimate of $0.80.

The company's quarterly revenues amounted to $4.714 bln (-0.4% y/y), missing analysts' consensus estimate of $4.803 bln.

MO fell to $70.01 (-0.47 %) in pre-market trading.

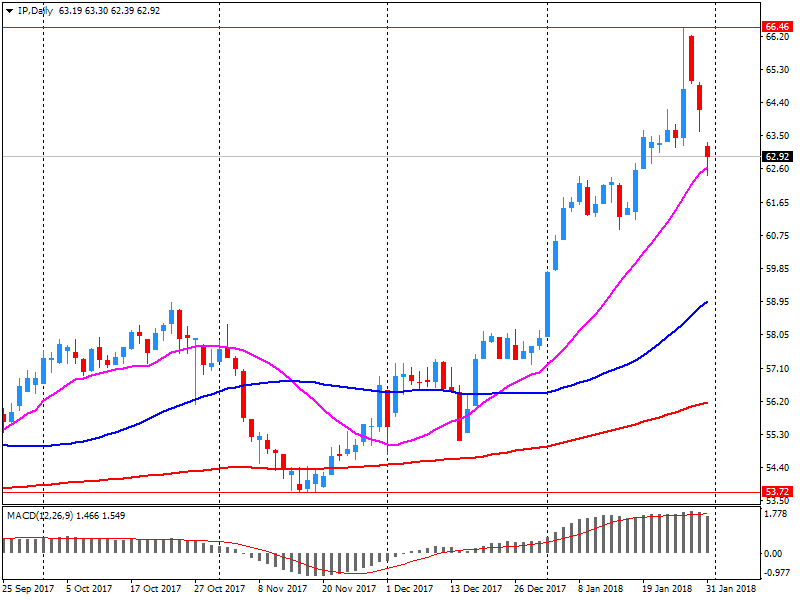

Int'l Paper (IP) reported Q4 FY 2017 earnings of $1.27 per share (versus $0.67 in Q4 FY 2016), beating analysts' consensus estimate of $1.19.

The company's quarterly revenues amounted to $5.711 bln (+14.2% y/y), missing analysts' consensus estimate of $6.006 bln.

IP closed Wednesday's trading session at $62.86 (-2.09%).

Microsoft (MSFT) reported Q4 FY 2017 earnings of $0.96 per share (versus $0.83 in Q4 FY 2016), beating analysts' consensus estimate of $0.87.

The company's quarterly revenues amounted to $28.918 bln (+11.9% y/y), beating analysts' consensus estimate of $28.420 bln.

MSFT fell to $94.32 (-0.73%) in pre-market trading.

Facebook (FB) reported Q4 FY 2017 earnings of $2.21 per share (versus $1.41 in Q4 FY 2016), beating analysts' consensus estimate of $1.97.

The company's quarterly revenues amounted to $12.972 bln (+47.3% y/y), beating analysts' consensus estimate of $12.547 bln.

FB rose to $190.47 (+1.92%) in pre-market trading.

AT&T (T) reported Q4 FY 2017 earnings of $0.78 per share (versus $0.66 in Q4 FY 2016), beating analysts' consensus estimate of $0.65.

The company's quarterly revenues amounted to $41.676 bln (-0.4% y/y), beating analysts' consensus estimate of $41.208 bln.

The company also issued upside guidance for FY2018, projecting EPS of $3.50 versus analysts' consensus estimate of $2.97.

T rose to $38.83 (+3.68%) in pre-market trading.

-

Revises 10-year U.S. treasury yield forecasts upwards, now expects 2.90 percent by end-2018 (pvs 2.70 pct)

The start of 2018 saw a further easing in the rate of expansion of the UK manufacturing sector. At 55.3 in January, the seasonally adjusted IHS Markit/CIPS Purchasing Managers' Index was down further from November's 51-month high and at its lowest level since June last year. That said, the PMI remained well above its long-run average of 51.7. The latest survey was conducted from 12-26 January.

Manufacturing output continued to rise at a solid pace, although the rate of expansion eased to a six-month low. Higher production reflected rising new order intakes, albeit the slowest in seven months, which increased through robust demand from both domestic and export clients.

The eurozone manufacturing sector made a strong start to 2018. Although January saw rates of growth in output and new orders ease from near-record highs at the end of last year, they remained among the best seen since the survey began in 1997.

The final IHS Markit Eurozone Manufacturing PMI posted a three-month low of 59.6 in January, down from December's record high of 60.6 and identical to the earlier flash estimate. The PMI has signalled expansion in each of the past 55 months.

The final IHS Markit/BME Germany Manufacturing PMI - a single-figure snapshot of the performance of the manufacturing economy - registered 61.1 in January, down from a surveyrecord high of 63.3 in December but still signalling one the greatest improvements in overall business conditions since the survey began in 1996.

Although easing to a three-month low in January, the rate of output growth at German factories remained strong and faster than at any other time since April 2011. Furthermore, there were sharp increases in overall production levels across each of the three main industry groupings covered by the survey: consumer, intermediate and investment.

Italy's manufacturing sector enjoyed a strong start to 2018, registering the highest growth in output since early 2011 and one of the greatest rises in new orders of the past 18 years. Jobs were created at a faster rate as capacity came under further strain, but inflationary pressures intensified in line with growing supply-side shortages.

The headline IHS Markit Italy Manufacturing Purchasing Managers' Index improved to a near seven-year high of 59.0 in January. That was up from December's 57.4 and represented a substantial improvement in operating conditions. The PMI has now continuously posted above the 50.0 no-change mark for 17 months.

Turnover in the retail sector rose by 1.5% in nominal terms in December 2017 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.8% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Real turnover in the retail sector also adjusted for sales days and holidays rose by 0.6% in December 2017 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered a decline of 0.7%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2493 (2391)

$1.2477 (1684)

$1.2453 (4007)

Price at time of writing this review: $1.2395

Support levels (open interest**, contracts):

$1.2354 (727)

$1.2321 (1823)

$1.2282 (2511)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 133747 contracts (according to data from January, 31) with the maximum number of contracts with strike price $1,1850 (7036);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4295 (1246)

$1.4271 (748)

$1.4238 (561)

Price at time of writing this review: $1.4175

Support levels (open interest**, contracts):

$1.4128 (149)

$1.4105 (191)

$1.4079 (406)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 45341 contracts, with the maximum number of contracts with strike price $1,3600 (3462);

- Overall open interest on the PUT options with the expiration date February, 9 is 43132 contracts, with the maximum number of contracts with strike price $1,3400 (3038);

- The ratio of PUT/CALL was 0.95 versus 0.94 from the previous trading day according to data from January, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: "The annual rate of house price growth picked up to 3.2% at the start of 2018, compared with 2.6% at the end of 2017. House prices increased by 0.6% over the month, after taking account of seasonal factors, the same increase as December.

The acceleration in annual house price growth is a little surprising, given signs of softening in the household sector in recent months. Retail sales were relatively soft over the Christmas period, as were key measures of consumer confidence, as the squeeze on household incomes continued to take its toll".

Output and new order growth rates accelerated, while businesses raised employment amid rising backlogs of work. Robust demand also encouraged firms to pass on part of the sharp rise in cost burdens to customers.

In line with stronger business confidence, firms increased input buying and were less cautious over inventory levels.

The headline Nikkei Japan Manufacturing Purchasing Managers' IndexTM - a composite single-figure indicator of manufacturing performance - increased to 54.8 in January, up from 54.0 in December. The headline PMI has risen for three successive months and the latest reading signalled the sharpest improvement in the health of the Japanese manufacturing sector since February 2014.

Looking ahead, companies were generally optimistic that output would rise over the next year. Moreover, the degree of confidence strengthened to a four-month high. The seasonally adjusted Purchasing Managers' Index - a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy - was unchanged from December's reading of 51.5 in January, to signal a further modest improvement in overall operating conditions. The health of the sector has now strengthened in each of the past eight months, while the pace of improvement was slightly stronger than the long-run trend.

-

Updated longer-run goals and strategies statement to incorporate december's median estimate for longer-run unemployment rate

-

Says gains in employment, household spending, business fixed investment have been solid

-

Fed says overall inflation and inflation excluding food and energy continued to run below 2 pct

-

Market-based measures of inflation compensation have increased in recent months but remain low

-

Inflation on a 12-month basis is expected to move up this year; drops language on expecting inflation to remain below 2 pct in near term

European stocks closed lower on Wednesday, but the region's benchmark still scored its best month since October. U.K. stocks, however, underperformed the wider market after a plunge of nearly 50% for shares of outsourcer Capita PLC rattled investors.

Some Asian stock markets rebounded after the broad pullback that started the week, but Chinese equities weakened again following another muted manufacturing reading, weighing on Hong Kong stocks. A gauge of manufacturing activity that some watch more closely than the official reading out Wednesday was flat for January and only modestly in expansion territory.

Stocks saw choppy trade Wednesday after the Federal Reserve did nothing to discourage expectations for a March rate rise, but ended the session with modest gains while booking the biggest monthly rise since March 2016. The Dow Jones Industrial Average DJIA, +0.28% rose 72.50 points, or 0.3%, to end at 26,149.39.

(raw materials / closing price /% change)

Oil 64.77 +0.42%

Gold 1,344.40 +0.67%

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.