- Analytics

- News and Tools

- Market News

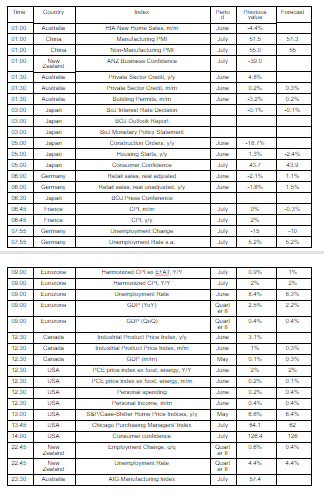

Analytics, News, and Forecasts for CFD Markets: currency news — 30-07-2018.

| Pare | Closed | % change |

| EUR/USD | $1,1704 | +0,41% |

| GBP/USD | $1,3130 | +0,21% |

| USD/CHF | Chf0,98819 | -0,67% |

| USD/JPY | Y111,04 | +0,04% |

| EUR/JPY | Y129,97 | +0,45% |

| GBP/JPY | Y145,807 | +0,25% |

| AUD/USD | $0,7407 | +0,02% |

| NZD/USD | $0,6822 | +0,37% |

| USD/CAD | C$1,30309 | -0,23% |

Pending home sales increased in all four major regions in June, but overall activity lagged year ago levels for the sixth straight month, according to the National Association of Realtors.

The Pending Home Sales Index,, a forward-looking indicator based on contract signings, rose 0.9 percent to 106.9 in June from 105.9 in May. Despite last month's increase, contract signings are still down 2.5 percent on an annual basis.

The inflation rate in Germany as measured by the consumer price index is expected to be 2.0% in July 2018. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.3% on June 2018.

In July 2018, the harmonised index of consumer prices for Germany, which is calculated for European purposes, is expected to increase by 2.1% year on year and 0.4% on June 2018.

-

N Rhine Westphalia Jul CPI +0.3% MM; +2.0% YY

-

Baden-Wuerttemberg Jul CPI +0.2% MM; +2.2% YY

-

Brandenburg Jul CPI +0.4% On Mo, +2.2% On Year

-

Hesse Jul CPI +0.4% On Mo; +1.8% On Year

-

The annual growth rates of consumer credit and mortgage lending were unchanged in June, at 8.8% and 3.2% respectively.

-

Net finance raised by UK businesses was £2.6 billion in June, above its average over the past year; this followed strength in May. Net bank lending was the largest component of businesses' borrowing.

-

The amount of money held by UK households increased by £3.7 billion in June, slightly above its recent average.

The estimated annual inflation in July 2018 is 2.2%, according to the advance indicator prepared by the INE. This indicator provides an advance of the CPI which, if confirmed, would imply decrease of one tenth in its annual rate, since in the month of June this variation was of 2.3%. In this behavior, the drop in the prices of food and beverages stands out. alcoholic For its part, the annual variation of the leading indicator of the HICP is placed in July in the 2.3%.

The KOF Economic Barometer only slightly moved in July. Compared to its June value, it decreased by 0.2 to 101.1 points. The current Barometer value still stands slightly above the long-term average of 100 points; it thus indicates a slightly above-average economic development in Switzerland in the coming months.

In July, the KOF Economic Barometer fell slightly to 101.1 points from 101.3 in June (101.7 in the initial publication in June). Negative indicators for manufacturing, the export industry and the accommodation and food service activities sector were mainly responsible for the slight decrease. Positive signals come from the banking and the construction sectors.

"I think that's way too high," the chief economic advisor at Allianz said." "If I looked only at the U.S., I would buy the 92 percent. But I think there are other things happening in the world."

El-Erian's probability of a rate hike was above 50 percent because of "headwinds from the rest of the world."

-

Fed Looks for Goldilocks Path as Jobless Rate Drops

-

Study Metro-Areas Data for Clues on Inflation When Unemployment Is Low

Japan retail sales recovered in June, data from the Ministry of Economy, according to rttnews.

Retail sales climbed 1.5 percent month-on-month in June, reversing a 1.7 percent fall in May. The rate came in line with expectations.

On a yearly basis, retail sales grew 1.8 percent in June, slightly faster than the 1.7 percent rise expected by economists.

The rebound in retail sales in June suggests that consumer spending picked up again in the second quarter, which supports the assessment that the economy returned to growth last quarter, Marcel Thieliant, an economist at Capital Economics, said.

"I would be willing to "shut down" government if the Democrats do not give us the votes for Border Security, which includes the Wall! Must get rid of Lottery, Catch & Release etc. and finally go to system of Immigration based on MERIT! We need great people coming into our Country!"

"The biggest and best results coming out of the good GDP report was that the quarterly Trade Deficit has been reduced by $52 Billion and, of course, the historically low unemployment numbers, especially for African Americans, Hispanics, Asians and Women"

EUR/USD

Resistance levels (open interest**, contracts)

$1.1772 (5085)

$1.1723 (807)

$1.1705 (154)

Price at time of writing this review: $1.1655

Support levels (open interest**, contracts):

$1.1626 (3667)

$1.1588 (4045)

$1.1544 (2695)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 13 is 90669 contracts (according to data from July, 27) with the maximum number of contracts with strike price $1,1850 (5301);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3266 (1045)

$1.3201 (584)

$1.3154 (285)

Price at time of writing this review: $1.3104

Support levels (open interest**, contracts):

$1.3060 (2206)

$1.3025 (2256)

$1.2985 (1556)

Comments:

- Overall open interest on the CALL options with the expiration date August, 13 is 24062 contracts, with the maximum number of contracts with strike price $1,3600 (3206);

- Overall open interest on the PUT options with the expiration date August, 13 is 28064 contracts, with the maximum number of contracts with strike price $1,2950 (2291);

- The ratio of PUT/CALL was 1.17 versus 1.16 from the previous trading day according to data from July, 27.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.