- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 21-02-2020.

On Monday, at 09:00 GMT Germany will publish the IFO business environment indicator, the IFO current situation assessment indicator, and the IFO economic expectations indicator for February. At 09:30 GMT the UK will report a change in the number of approved mortgage applications for January. At 13:30 GMT Canada will announce a change in wholesale trade for December, and the United States will release an economic activity index from the Federal Reserve Bank of Chicago for January.

On Tuesday, at 07:00 GMT Germany will report a change in GDP for the 4th quarter. At 11:00 GMT, UK will release a retail sales index according to the Confederation of British Industrialists for February. At 14:00 GMT the United States will present the S & P / Case-Shiller housing price index for December, and at 15:00 GMT - the consumer confidence indicator and Richmond Fed manufacturing index for February.

On Wednesday, at 00:30 GMT Australia will report a change in construction work done for the 4th quarter. At 07:45 GMT France will publish consumer confidence index for February. At 15:00 GMT the United States will announce a change in new home sales for January. At 15:30 GMT, the US will release a report on changes in oil reserves from the Department of Energy. At 21:45 GMT, New Zealand will announce a change in the trade balance for January.

On Thursday, at 00:00 GMT, New Zealand will publish the ANZ business confidence indicator for February. At 00:30 GMT Australia will report a change in the volume of capital expenditures in the private sector for the 4th quarter. At 09:00 GMT, the eurozone will announce a change in the M3 aggregate of the money supply and the volume of lending to the private sector for January. At 10:00 GMT, the eurozone will present an index of consumer confidence, an index of sentiment in the economy, an index of business optimism in industry and an index of sentiment in business circles for February. At 13:30 GMT Canada will report a change in the balance of payments for the 4th quarter. Also at this time, the United States will announce a change in GDP for the 4th quarter, the volume of orders for durable goods for January and the number of initial applications for unemployment benefits. At 15:00 GMT the United States will report a change in the volume of pending home sales for January. At 23:30 GMT Japan will release the consumer price index in the Tokyo region for February and announce the change in unemployment for January. At 23:50 GMT, Japan will announce a change in industrial production and retail sales for January.

Oon Friday, at 00:01 GMT, UK will present an indicator of consumer confidence from GfK for February. At 00:30 GMT Australia will announce a change in lending to the private sector for January. At 05:00 GMT, Japan will report a change in housing starts for January. At 07:30 GMT Switzerland will announce a change in retail sales for January. At 07:45 GMT France will announce a change in consumer spending for January and GDP for the 4th quarter, and will release a consumer price index for February. At 08:00 GMT Switzerland will release the index of leading economic indicators from KOF for February. At 08:55 GMT Germany will report a change in unemployment and the number of unemployed for February. At 10:00 GMT, the eurozone will release consumer price index for February. At 13:00 GMT Germany will release a consumer price index for February. At 13:30 GMT Canada will report a change in GDP for December and present a producer price index for January. Also at 13:30 GMT the United States will publish the basic index of personal consumption expenditures for January and announce a change in personal income and expenses for January. At 14:45 GMT, the United States will present the Chicago Purchasing Managers Index for February, and at 15:00 GMT the Reuters / Michigan Consumer Sentiment Index for February. At 18:00 GMT, in the US, Baker Hughes will release an oil rig count report.

On Saturday, at 01:00 GMT, China will present the PMI for manufacturing and the non-manufacturing activity index for February.

On Sunday, at 21:30 GMT, Australia will release AiG manufacturing activity index for February. At 23:50 GMT Japan will announce a change in the volume of capital expenditures for the 4th quarter.

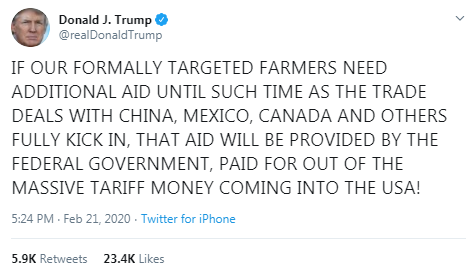

FXStreet notes that the U.S. presidential election takes place on 3 November, and the race to determine who will face president Trump – the Democratic primaries – has officially kicked off. Bill Diviney, Senior economist at ABN Amro, analyzes the chances of the candidates in the primary contests.

“Primary contests take place in all 50 states, plus US overseas territories, to choose a presidential candidate. With 6 viable candidates and a relatively even split in support, the chances are relatively high that the contest does not produce a clear winner with more than 50% of the delegates.”

“All candidates support a $15 hourly minimum wage, higher corporation taxes, significant investment to combat climate change (a ‘green new deal’), and rejoining the Paris Climate and Iran Nuclear accords.”

“The frontrunner in both polls and betting markets is left-wing candidate Bernie Sanders. His radical policies include abolishing private health insurance and replacing it with a public ‘single payer’ system. He also proposes a wealth tax and significant rises in other taxes.”

“Centrist billionaire Michael Bloomberg has significant polling momentum, and his unorthodox strategy of focusing on the Super Tuesday contests could yet win him the nomination.”

“Opinion polls suggest all candidates – by varying margins – would beat Trump in a head-to-head, but it is historically rare for a presidential incumbent not to win a second term in the absence of a recession.”

- There is "a lot of mood swings" in market, which do not reflect fundamentals

- Low bond yields are a "flight to safety" over coronavirus concerns

- Economy is "fundamentally very sound"

- Says there is a risk inflation expectations have slipped

- Countercyclical capital buffer good for imbalances

- Proposes yield tools if rates at lower bound

- Says nonmonetary tools needed to temper financial cycle

- Lower bound may constrain policy rate more frequently

- Robust countercyclical fiscal policy is vital

- Rate caps would transmit additional accommodation

- Yield curve caps would augment credibility

- Prefers flexible inflation averaging to achieve Fed's 2% inflation goal

The National Association of Realtors (NAR) announced on Friday that the U.S. existing home sales fell 1.3 percent m-o-m to a seasonally adjusted rate of 5.46 million in January 2020 from a revised 5.53 million in December 2019 (originally 5.54 million).

Economists had forecast home resales decreasing to a 5.43 million-unit pace last month.

In y-o-y terms, existing-home sales climbed 9.6 percent in January.

According to the report, single-family home sales stood at 4.85 million in January, down from 4.91 million in December, and up 9.7 percent from a year ago. The median existing single-family home price was $268,600 in January 2020, up 6.9 percent from January 2019. Meanwhile, existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 610,000 units in December, down 1.6 percent from December but 8.9 percent higher than a year ago. The median existing condo price was $248,100 in January, an advance of 5.7 percent from a year ago.

Lawrence Yun, NAR's chief economist, found the outlook for 2020 home sales promising despite the drop in January. "Existing-home sales are off to a strong start at 5.46 million." Yun said. "The trend line for housing starts is increasing and showing steady improvement, which should ultimately lead to more home sales."

Preliminary data released by IHS Markit on Friday pointed to a contraction in business activity in February, which was driven by a significant worsening of the service sector performance, where output decreased for the first time in four years.

According to the report, the Markit flash manufacturing purchasing manager's index (PMI) came in at 50.8 in February, down from 51.9 in January. That was the lowest value since last August. Economists had expected the reading to decrease to 51.5. A reading above 50 signals an expansion in activity, while a reading below this level signals a contraction. According to the report, the lower headline index reading was partially driven by slower expansions in production and new orders.

Meanwhile, the Markit flash services purchasing manager's index (PMI) fell to 49.4 this month, from 53.4 in the prior month. The latest reading signaled the first decline in sector's business activity since February 2016. Economists had expected the reading to drop to 53.0. According to the report, the contraction in the output was in part driven by a renewed decrease in new business across the service sector (the rate of the drop was the strongest since the series began in October 2009).

Overall, IHS Markit Flash U.S. Composite PMI Output Index came in at 49.6 in February, down from 53.3 in January, pointing to the first month of contraction in the private sector since October 2013.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at HIS Markit, noted: "With the exception of the government-shutdown of 2013, US business activity contracted for the first time since the global financial crisis in February. Weakness was primarily seen in the service sector, where the first drop in activity for four years was reported, but manufacturing production also ground almost to a halt due to a near-stalling of orders."

FXStreet reports that Nathan Janzen from RBC Economics notes that Canada has just released retail sales data with no changes.

“Canadian retail sales ended 2019 about where they ended 2018. Excluding price increases, sale volumes in December were up just 0.1% from a year prior.”

“Sales on a month-over-month basis were unchanged from November, both including and excluding prices, leaving overall consumer spending on track to post another lackluster increase in Q4 of last year - and in line with our expectation that overall GDP increased little if at all in the quarter.”

“E-commerce sales were up a whopping 31.5% from a year ago in December.”

“We think the Bank of Canada will ultimately look through most of those transitory disruptions, but underlying growth trends have also been softer, and we continue to pencil in a rate cut from the central bank in April.”

- Says he is open to moving rates if he sees weakness in the future, but that is not his expectation at this time

- The economy is strong and can stand on its own feet and we should let it do that

- Labor market remains strong

- Bond market moves are reflecting low neutral rate of interest, with a flight to safety

- Businesses tell him coronavirus to be short-term disruption

- Models expect short-term hit from coronavirus but recovery after

- Does not believe balance sheet actions are pumping up stock prices

Statistics Canada reported on Friday that the Canadian retail sales were virtually unchanged m-o-m at CAD51.65 billion in December, following a revised 1.1 percent m-o-m climb in November (originally a 0.9 percent m-o-m advance).

Economists had forecast a 0.1 percent m-o-m increase for December.

According to the report, the gains in sales at building material and garden equipment and supplies dealers (+3.8 percent m-o-m), as well as food and beverage stores (+0.5 percent m-o-m), were offset by declines in sales at motor vehicle and parts dealers (-1.3 percent m-o-m) and gasoline stations (-2.3 percent m-o-m).

Excluding motor vehicle and parts dealers, retail sales rose 0.5 percent m-o-m in December compared to a revised 0.5 percent m-o-m increase in November (originally a 0.2 percent m-o-m gain) and economists' forecast for a 0.4 percent m-o-m advance. Excluding motor vehicle and parts dealers and gasoline stations, retail sales surged 1.0 percent m-o-m in December.

In y-o-y terms, Canadian retail sales climbed 2.4 percent in December, following a revised 2.2 percent climb in November (originally 1.9 percent).

In 2019, Canadian retail sales rose 1.6 percent compared to 2018, the smallest increase since 2009.

- Base case for coronavirus impact on economy is V-shaped

- Coronavirus uncertainty reigniting downside risk

- Euro economy is growing as domestic demand increases

- ECB sees wage growth, inflation gradually improving

- PMI data largely in line with the latest ECB forecasts

- Monetary policy will be slower without fiscal support

- The only way to ensure ECB credibility is revived inflation

- ECB is super clear that it stands ready to cut rates if needed

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:15 | France | Manufacturing PMI | February | 51.1 | 50.7 | 49.7 |

| 08:15 | France | Services PMI | February | 51 | 51.3 | 52.6 |

| 08:30 | Germany | Services PMI | February | 54.2 | 53.8 | 53.3 |

| 08:30 | Germany | Manufacturing PMI | February | 45.3 | 44.8 | 47.8 |

| 09:00 | Eurozone | Manufacturing PMI | February | 47.9 | 47.5 | 49.1 |

| 09:00 | Eurozone | Services PMI | February | 52.5 | 52.2 | 52.8 |

| 09:30 | United Kingdom | PSNB, bln | January | -3.5 | 12.1 | 10.5 |

| 09:30 | United Kingdom | Purchasing Manager Index Manufacturing | February | 50 | 49.7 | 51.9 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | February | 53.9 | 53.4 | 53.3 |

| 10:00 | Eurozone | Harmonized CPI | January | 0.3% | -1% | -1% |

| 10:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | January | 1.3% | 1.1% | 1.1% |

| 10:00 | Eurozone | Harmonized CPI, Y/Y | January | 1.3% | 1.4% | 1.4% |

EUR traded mixed in the European session on Friday, following the release of IHS Markit's flash purchasing managers'indexes (PMIs), which indicated that business activity in the Eurozone accelerated more than expected this month. While EUR fell against GBP, it appreciated against the rest of major rivals.

Markit's flash estimates showed that manufacturing PMI for the Eurozone climbed to a 12-month high of 49.1 in February from 47.9 in the previous month, beating economists' forecast for 47.5. Meanwhile, the flash Eurozone services PMI rose to a 2-month high of 52.8 from 52.5 in January, also above economists' projection of 52.2. As a result, flash Eurozone Composite PMI, tracking the combined change in activity across the manufacturing and service sectors, increased to 51.6 from 51.3 in January, indicating the largest monthly expansion in business activity since August 2019. Economists had forecast the indicator to decline to 51.

A separate survey from Markit revealed that Germany's manufacturing sector's activity expanded in February to the highest since January 2019. The flash Germany manufacturing PMI surged from January’s 45.3 to a 13-month high of 47.8, beating economists' forecasts of 44.8. However, the flash composite output index was at to 51.1, down slightly from January’s five-month high of 51.2, impacted by a softer pace of growth in service sector activity - flash Germany Services PMI fell to a 2-month low of 53.3 in February from 54.2 in the previous month.

GBP rose against its major counterparts, supported by Markit/CIPS survey, which revealed that the flash UK manufacturing PMI jumped to 51.9 in February from 50.0 in January, signaling the strongest improvement in overall business conditions since April 2019. The strong performance helped to offset a slight loss of momentum in the service economy - flash UK Services PMI dropped to 53.3 in February from 53.9 in January but remained well above the crucial 50.0 no-change value. Flash UK composite output index was unchanged at 53.3 in February, pointing to the joint-fastest expansion of private-sector output since September 2018.

FXStreet notes that the coronavirus (COVID-19) epidemic is changing supply and demand in the global economy. The shutting down of Chinese factories clearly hits global supply chains. Commodity prices have fallen as Chinese demand has weakened. Paul Donovan, the Chief Economist of UBS Global Wealth Management, analyzes the implications for global inflation.

“Economic theory says that if supply goes down, prices should go up. But firms may choose to keep prices stable. Instead, firms delay sending goods to their customers.”

“China is a more efficient producer of goods. China is a less efficient consumer of commodities. Past outsourcing to China lowered goods inflation but raised commodity inflation. The net effect was to (mildly) raise global inflation.”

“China's lower commodity demand is likely to be more important than delays in goods supply. If there is any impact at all, the coronavirus should be a very small negative for global inflation rates. However, in advanced economies the most important drive of local consumer prices remains local labor costs.”

- High probability that coronavirus outbreak will "blow over"

- Low probability that virus outbreak will get much worse

- There is good chance the outbreak will be temporary shock

- Market expectations likely to return to "on-hold outlook"

- Have been concerned by yield curve issues

- There will be little impact on the Fed from the election cycle

- Fed purchases in repo market are not QE

FXStreet notes that the preliminary Markit PMIs for February will lead the US data calendar on Friday, as market participants continue to look for any signs of concern related to the novel coronavirus. JPY has strengthened across the board (+0.25% vs USD), analysts at TD Securities inform.

“The surveys released so far related to Markit PMIs for Feb have not only failed to flag any issues but have also surprised to the upside.”

“We look for existing home sales to decline 2.3% m/m in Jan following the firm 3.6% rise registered in Dec.”

“Lastly, a number of Fed officials will be participating in the Chicago Booth's US Monetary Policy Forum that is scheduled to start at 10:15am ET. Key participants include Fed voters Clarida, Brainard and Mester, and the ECB's Philip Lane.”

“JPYUSD is trading ~3.5% rich on our tactical model, suggesting the ominous rally sits on thin ice especially as major global equity benchmarks look overbought.”

- Hasn't seen turning point of virus outbreak yet

- Coronavirus outbreak has an obvious impact on China's economy, but long-term improving momentum of the economy will not change

- Will fend off systemic financial risks

- Fiscal policy will be more proactive and effective

- Prudent monetary policy will be more flexible

- "Frugal Four" group is sticking to its position hard [the group made up of Austria, Denmark, Sweden and the Netherlands, requires EU budget to be capped at 1 percent of EU gross national income]

- Ireland cannot accept a cut in common agriculture policy funding

FXStreet notes that the AUD has fallen to a multi-year low, as growth differentials and concerns over the global growth outlook weigh. Analysts at ANZ Research share their outlook for the AUD/USD pair which is currently trading at 0.6595.

“While easing geopolitical risks and accommodative global policy have been supportive, only a globally synchronous rise in growth would lift the AUD much above current levels.”

“While RBA easing is likely to have been pushed out by improving labour market momentum, lack of carry from low domestic yields will hamper the AUD in the medium term.”

FXStreet reports that China will release manufacturing PMI numbers on 29 February. A big drop is expected by economists at Standard Chartered Bank. USD/CNY is being exchanged at 7.031.

"We expect the official manufacturing PMI to plunge to 36 in February from 50 last month, reflecting the impact of the coronavirus outbreak."

"While newly confirmed cases have shown a downtrend since the beginning of February and restrictions on transport have been eased in some cities, we think disruption to production activity within the survey period will result in the official index reaching a historical low."

"We expect the non-manufacturing PMI to drop to 44 in February from 54.1 prior, entering contractionary territory for the first time on record, as the retail, catering and accommodation, transportation and real-estate sectors have been hit hard by the outbreak."

FXStreet reports that analysts at Nordea have changed their forecast. They still expect the Fed to cut, but in June, as March is probably too early given the lack of FOMC speak on the subject and the generally positive key figure surprises during the first week of February.

"Growth is likely to slow below its potential in the first half of the year. So far, the labour market has held up despite the slowing economy, but we believe it will be a matter of time before the labour market weakens to reflect the slowdown."

"Tapering of the short-term liquidity provisions is planned for the coming months and, in turn, the balance-sheet expansion will be much more moderate."

"Market expectations have moved in favour of rate cuts. Minutes from the January FOMC meeting showed that the Fed attributed the 30bp implied drop in policy rates by year-end at that time as a combination of market participants expecting unchanged rates and seeing risks tilted heavily towards cuts rather than hikes."

"While not in itself an argument for a rate cut, we do believe the market consensus is wrong to believe monetary policy inaction during an election year. The Fed changes policy when policy changes are necessary."

eFXdata reports that Citi discusses Gold prices and notes a setup in options markets reminiscent to 2010/2011 when Gold last traded to $1,800-1,900/oz before declining through 2015.

"Cit analysts point to the set-up in Gold options markets and call skew as being reminiscent of 2010/2011, when Gold last traded to $1,800-1,900/oz. Meanwhile, gold net long positioning-when normalized for the expanded asset base-is at only half the levels of the 2011 peak. Slowing physical demand in Asia, especially jewelry sales, which still take down ~45% of annual world supply, is a bearish risk for bullion," Citi notes.

"But investor inflows and central bank gold buying are significant buffers for gold consumption and more importantly, the gains in Gold come even as the USD continues to strengthen (breaking the inverse correlation between Gold and USD)," Citi adds.

Eurostat, the statistical office of the European Union, said, the euro area annual inflation rate was 1.4% in January 2020, up from 1.3% in December. A year earlier, the rate was 1.4%. European Union annual inflation was 1.7% in January 2020, up from 1.6% in December. A year earlier, the rate was 1.5%. Core CPI, which strips volatile food and energy prices, remained steady at -1.7% and 1.1% on a monthly and yearly basis, respectively.

.The lowest annual rates were registered in Italy (0.4%), Cyprus (0.7%), Denmark and Portugal (both 0.8%). The highest annual rates were recorded in Hungary (4.7%), Romania (3.9%), Czechia and Poland (both 3.8%).

Compared with December, annual inflation fell in five Member States, remained stable in five and rose in eighteen.

In January, the highest contribution to the annual euro area inflation rate came from services (+0.68 percentage points, pp), followed by food, alcohol & tobacco (+0.40 pp), energy (+0.19 pp) and non-energy industrial goods (+0.08 pp).

According to the report from IHS Markit / CIPS, manufacturing production growth accelerated to its strongest for 10 months in February, helping to offset a slight loss of momentum in the service economy.

The seasonally adjusted IHS Markit / CIPS Flash UK Composite Output Index - which is based on approximately 85% of usual monthly replies - was unchanged at 53.3 in February and comfortably above the 50.0 threshold that separates expansion from contraction. Moreover, the latest reading pointed to the joint-fastest expansion of private sector output since September 2018 (equalling that recorded in January). Survey respondents noted that receding political uncertainty since the general election continued to translate into higher business activity and greater willingness to spend among clients. That said, the overall rate of new order growth eased from the 19-month peak seen in January amid a weaker expansion across the service economy.

There were a number of reports from service providers that the COVID-19 outbreak had weighed on overseas bookings and resulted in the cancellation of some orders from clients in Asia, particularly those based in mainland China. Manufactures also commented on a headwind from extended shutdowns in China, with stocks of inputs falling at the fastest pace for over seven years and vendor lead times lengthening to the greatest extent since March 2019. Moreover, the sevenpoint drop in the suppliers' delivery times index since January signalled the largest month-on-month slide in supply chain performance since the survey began in 1992, exceeding the previous record seen during the UK fuel protests in September 2000.

According to the report from IHS Markit, the eurozone economy grew at its fastest rate in six months during February. Although remaining weak, the rate of expansion accelerated for a third straight month despite signs of demand being dampened and production being stymied by the coronavirus outbreak.

At 51.6 in February, the 'flash' IHS Markit Eurozone Composite PMI rose from 51.3 in January to indicate the largest monthly increase in business activity since last August. Growth was centered on the services sector, where business grew at the joint-fastest rate seen over the past six months. Manufacturing meanwhile remained in decline, although the rate of contraction in output eased to the mildest seen over the past eight months. The overall rate of expansion remained only modest, however, largely due to subdued new business growth. New orders rose at a rate equal to January's seven-month high, yet the rise was insufficient to prevent backlogs of work continuing to decline slightly, hinting at persistent excess capacity. Inflows of new business into the service sector grew at a fractionally weaker rate than seen in the prior two months, the slowdown in part linked to travel, tourism and some areas of business reportedly being disrupted by the coronavirus outbreak. New orders placed at manufacturers meanwhile fell for a seventeenth successive month. More encouragingly, the overall drop in factory orders was the smallest for 15 months as firming demand from domestic customers helped offset a stronger decline in export orders.

The flash February PMI data also showed inflationary pressures cooling slightly. Finally, expectations of output growth over the coming year dipped from January's 16-month high, though remained well above the average seen in 2019 and up markedly from the low plumbed last August. Sentiment softened in both services and manufacturing.

Data from IHS Markit indicated a modest expansion of German private sector business activity in February, with the rate of growth little-changed from that recorded at the start of the year. Notably, the manufacturing sector moved closer to stabilisation, with survey data indicating slower falls in output, new orders and employment. This was despite reports from goods producers of a slump in both exports and sentiment, linked to the impact of the coronavirus on activity in China and the wider region.

The Flash Germany Composite Output Index - which tracks the combined change in activity across the country's manufacturing and service sectors, and is based on approximately 85% of usual monthly replies - registered 51.1, down only slightly from January's five-month high of 51.2. Growth of output was driven by the service sector, where business activity continue to rise at solid pace, albeit one that was slower than January's five-month high. The rate of decline in manufacturing production meanwhile eased for the fourth time in the past five months to the weakest since May last year. There were some reports from surveyed firms of a lack of availability of inputs weighing on output levels.

February saw the headline Flash Germany Manufacturing PMI climb from January's 45.3 to a 13-month high of 47.8. Economists had expected a decrease to 44.8. Almost half of the index's month-on month gain was attributable to a deterioration in supplier delivery times*, which panellists predominantly linked to coronavirus related disruption in China. That said, there were also slight positive influences on the headline manufacturing PMI from the output, new orders, employment and stocks of purchases components, which all exhibited slower rates of decline.

FXStreet reports that in opinion of FX Strategists at UOB Group, Cable could extend the leg lower to the 1.2800 zone if 1.2840 is cleared.

24-hour view: "We highlighted yesterday the weakness in GBP 'is likely aiming for the month-to-date low of 1.2873' but held the view that the 'next support at 1.2840 is unlikely to come into the picture'. Our expectation was not wrong as GBP dropped to an overnight low of 1.2849 before staging a mild recovery to end the day at 1.2879. While downward momentum has eased somewhat, there is room for GBP to test 1.2840 before a more sustained recovery can be expected (next support at 1.2800 is not likely to come into the picture). On the upside, a break of 1.2925 would indicate the current downward pressure has eased (minor resistance is at 1.2905)."

Next 1-3 weeks: "As highlighted, GBP is under mild downward pressure and could edge lower to 1.2840. GBP subsequently dropped to a low of 1.2849. The pace of the decline is faster than anticipated and from here, a break of 1.2840 would lead to further weakness to 1.2800 (we held the view yesterday that 1.2800 is likely out of reach). All in, GBP is expected to trade on the back foot unless it can move above 1.2960 ('strong resistance' level was at 1.3020 yesterday)."

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Japan | Manufacturing PMI | February | 48.8 | 47.6 | |

| 04:30 | Japan | All Industry Activity Index, m/m | December | 0.9% | 0% |

During today's Asian trading, the US dollar declined after a significant increase in recent days.

The ICE Dollar index, which shows the value of the dollar against six major world currencies, fell by 0.07% compared to the previous day. On Thursday, it rose for the third consecutive session and reached its highest in three years.

Concerns about the negative impact on the economy of China and other Asian countries from the spread of a new type of coronavirus caused a significant decline in a number of currencies in the region against the US dollar. Thus, the Thai baht fell to the lowest level since June, the Korean won - since October, the Singapore dollar-almost three years, analysts say National Australia Bank.

Meanwhile, statistics released on Friday indicated that inflation in Japan accelerated for the fourth month in a row in January.

FXStreet reports that according to FX Strategists at UOB Group, there is still scope for EUR/USD to grind lower to the 1.0770 region ahead of 1.0740.

24-hour view: "EUR edged below the bottom of our expected sideway-trading range of 1.0785/1.0830 (low of 1.0775) before settling at 1.0783 (- 0.19%). While it is too early to expect a bottom, the combination of waning momentum and oversold conditions suggest EUR is likely to struggle to extend its decline. From here, there is chance for EUR to dip below the major 1.0770 support but a sustained drop below this level is not expected (next support is at 1.0740). Resistance is at 1.0805 followed by 1.0820."

Next 1-3 weeks: "EUR registered the thirteen straight days of 'lower low' yesterday (albeit marginally) as it touched 1.0775. Our latest narrative from Wednesday (19 Feb, spot at 1.0795) still stands. As highlighted, the weak phase that started earlier this month has not stabilized. That said, downward momentum appears to be struggling and EUR has to break the major 1.0770 support before a move to 1.0740 can be expected. On the upside, the 'strong resistance' level has moved lower to 1.0845 from 1.0860. A breach of the 'strong resistance' would indicate the current weakness in EUR has run its course."

eFXdata reports that CIBC Research discusses CAD outlook and now expects USD/CAD to trade around 1.32 by end of Q1 before moving towards 1.34 by end of Q2.

"If fears abate and sentiment eventually improves in the next few months, oil prices should rebound and the loonie will likely be dragged along for the ride. As such, the C$ should end Q1 slightly stronger than its current level, seeing USDCAD hover around 1.32. However, that rebound will likely be short-lived, as softness in GDP growth continues and strength in the labour market wanes accordingly," CIBC notes.

"Moreover, that will likely be compounded by the repercussions of the coronavirus on global supply chains and production, and potentially current rail disruptions. That could be enough reason to see the Bank of Canada cut interest rates by 25 bps in April. Given that such a move is not currently priced into markets, that surprise would take a bite out of short term rates and send the currency weaker, with USDCAD reaching 1.34 by the end of Q2," CIBC adds.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0914 (1919)

$1.0877 (3687)

$1.0848 (628)

Price at time of writing this review: $1.0790

Support levels (open interest**, contracts):

$1.0756 (2886)

$1.0725 (3242)

$1.0686 (1335)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 6 is 111338 contracts (according to data from February, 20) with the maximum number of contracts with strike price $1,1200 (6385);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3025 (2157)

$1.2990 (1022)

$1.2959 (366)

Price at time of writing this review: $1.2892

Support levels (open interest**, contracts):

$1.2864 (1625)

$1.2850 (2495)

$1.2830 (3472)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 28591 contracts, with the maximum number of contracts with strike price $1,3050 (4042);

- Overall open interest on the PUT options with the expiration date March, 6 is 30508 contracts, with the maximum number of contracts with strike price $1,2800 (3709);

- The ratio of PUT/CALL was 1.07 versus 1.07 from the previous trading day according to data from February, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.66119 | -0.96 |

| EURJPY | 120.884 | 0.47 |

| EURUSD | 1.07828 | -0.22 |

| GBPJPY | 144.373 | 0.35 |

| GBPUSD | 1.28786 | -0.33 |

| NZDUSD | 0.6331 | -0.81 |

| USDCAD | 1.32577 | 0.29 |

| USDCHF | 0.98417 | 0.05 |

| USDJPY | 112.097 | 0.68 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.