- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 18-10-2017.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1791 +0,22%

GBP/USD $1,3202 +0,11%

USD/CHF Chf0,98069 +0,26%

USD/JPY Y112,95 +0,67%

EUR/JPY Y133,20 +0,90%

GBP/JPY Y149,126 +0,78%

AUD/USD $0,7847 +0,04%

NZD/USD $0,7157 -0,19%

USD/CAD C$1,24608 -0,49%

02:50 Japan Trade Balance Total, bln September 113.6 560

03:30 Australia Unemployment rate September 5.6% 5.6%

03:30 Australia Changing the number of employed September 54.2 15

05:00 China Industrial Production y/y September 6.0% 6.2%

05:00 China Retail Sales y/y September 10.1% 10.2%

05:00 China Fixed Asset Investment September 7.8% 7.7%

05:00 China NBS Press Conference

05:00 China GDP y/y Quarter III 6.9% 6.8%

07:30 Japan All Industry Activity Index, m/m August -0.1% 0.2%

09:00 Switzerland Trade Balance September 2.17 2.470

11:30 United Kingdom Retail Sales (YoY) September 2.4% 2.1%

11:30 United Kingdom Retail Sales (MoM) September 1% -0.1%

15:30 U.S. Continuing Jobless Claims 1889 1900

15:30 U.S. Philadelphia Fed Manufacturing Survey October 23.8 22

15:30 U.S. Initial Jobless Claims 243 240

16:30 U.S. Fed's George Speaks

17:00 U.S. Leading Indicators September 0.4% 0.1%

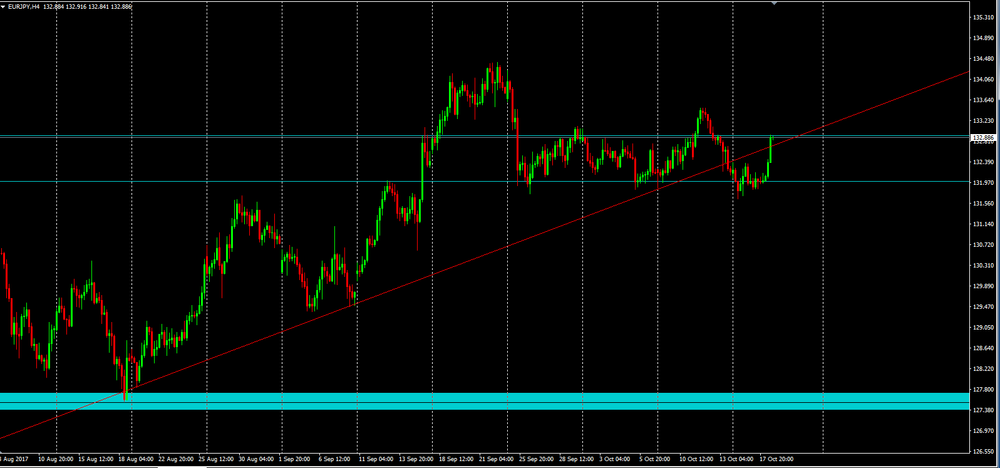

As we can see on 4h time frame chart on EUR/JPY, as soon as the price hit new highs there was a correction of the previous movement and that correction become the price indecisive (it has been consolidating).

We also can see that even with the fake breakout from a relatively large trend line which may indicate that once the price breaks the consolidation zone above, we can expect the formation of a new maximum.

Our suggestion is to wait for the breakout above consolidation line at 132.91 and put stops below consolidation in order to give margin for price moves and take profit slightly above the previous high or for the more conservative, at the same level as the previous high price.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.7 million barrels from the previous week. At 456.5 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories increased 0.9 million barrels last week, and are in the upper half of the average range. Finished gasoline inventories increased last week, but blending components inventories decreased last week.

Distillate fuel inventories increased by 0.5 million barrels last week and are in the lower half of the average range for this time of year. Propane/propylene inventories decreased by 0.1 million barrels last week and are in the lower half of the average range. Total commercial petroleum inventories decreased by 8.7 million barrels last week.

EURUSD: 1.1685 (EUR 870m) 1.1825-30 (420m) 1.1930 (1.32bln)

USDJPY: 111.20 (USD (520m) 112.25 (310m) 112.30 (1.16bln) 112.50 (500m) 113.25 (500m)

GBPUSD: 1.3055 (GBP 1.16bln) 1.3530-35 (1.8bln)

EURGBP: 0.8940 (EUR 1.1bln) 0.8960 (530m)*

AUDUSD: 0.7700 (AUD 670m) 0.7790 (760m)

The gain was mainly attributable to higher sales in the transportation equipment, and petroleum and coal product industries.

Sales were up in 8 of the 21 industries, representing 66% of the Canadian manufacturing sector.

Once price changes are taken into account, sales volume in the manufacturing sector rose 1.2% in August.

Sales in the transportation equipment industry rose 8.2% to $10.4 billion, after falling 13.6% in July. This growth was the result of gains in the motor vehicle (+12.9%) and motor vehicle parts (+5.7%) industries, primarily reflecting higher volumes generated by increased production after the longer-than-usual shutdowns of motor vehicle assembly plants in July. In constant dollars, sales volumes rose 13.3% in the motor vehicle and 5.8% in the motor vehicle parts industries in August.

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,215,000. This is 4.5 percent below the revised August rate of 1,272,000 and is 4.3 percent below the September 2016 rate of 1,270,000. Single-family authorizations in September were at a rate of 819,000; this is 2.4 percent above the revised August figure of 800,000. Authorizations of units in buildings with five units or more were at a rate of 360,000 in September.

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,127,000. This is 4.7 percent below the revised August estimate of 1,183,000, but is 6.1 percent above the September 2016 rate of 1,062,000. Single-family housing starts in September were at a rate of 829,000; this is 4.6 percent below the revised August figure of 869,000. The September rate for units in buildings with five units or more was 286,000.

-

Have genuine concerns about UK economic performance over next few years

-

ECB research finds no convincing evidence that high interest rates lead to more reforms

Latest estimates show that average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.2% including bonuses, and by 2.1% excluding bonuses, compared with a year earlier.

Average weekly earnings for employees in Great Britain in real terms (that is, adjusted for price inflation) fell by 0.3% including bonuses, and fell by 0.4% excluding bonuses, compared with a year earlier.

Estimates from the Labour Force Survey show that, between March to May 2017 and June to August 2017, the number of people in work increased, the number of unemployed people fell, and the number of people aged from 16 to 64 not working and not seeking or available to work (economically inactive) also fell.

There were 32.10 million people in work, 94,000 more than for March to May 2017 and 317,000 more than for a year earlier.

The employment rate (the proportion of people aged from 16 to 64 who were in work) was 75.1%, up from 74.5% for a year earlier.

There were 1.44 million unemployed people (people not in work but seeking and available to work), 52,000 fewer than for March to May 2017 and 215,000 fewer than for a year earlier.

The unemployment rate (the proportion of those in work plus those unemployed, that were unemployed) was 4.3%, down from 5.0% for a year earlier and the joint lowest since 1975.

-

Says people are more optimistic about the economic situation so it's appropriate to think about small corrections to ECB's bond purchases

EUR/USD: 1.1900 (133 m), 1.1825/30 (410 m), 1.1600 (865 m)

USD/JPY: 113.25 (490 m), 112.50 (490 m), 112.30 (115 m), 112.25 (305 m), 111.20 (520 m)

AUD/USD: 0.7790 (755 m), 0.7700 (665 m)

EUR/USD

Resistance levels (open interest**, contracts)

$1.1943 (3609)

$1.1883 (3012)

$1.1831 (388)

Price at time of writing this review: $1.1768

Support levels (open interest**, contracts):

$1.1726 (3125)

$1.1699 (3027)

$1.1666 (4909)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 99427 contracts (according to data from October, 17) with the maximum number of contracts with strike price $1,2000 (6332);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3294 (1465)

$1.3261 (1366)

$1.3233 (1050)

Price at time of writing this review: $1.3172

Support levels (open interest**, contracts):

$1.3099 (1318)

$1.3070 (2167)

$1.3038 (1669)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 37560 contracts, with the maximum number of contracts with strike price $1,3300 (3440);

- Overall open interest on the PUT options with the expiration date November, 3 is 33067 contracts, with the maximum number of contracts with strike price $1,3000 (2133);

- The ratio of PUT/CALL was 0.88 versus 0.88 from the previous trading day according to data from October, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.