- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 12-12-2017.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1740 -0,24%

GBP/USD $1,3316 -0,17%

USD/CHF Chf0,99133 -0,06%

USD/JPY Y113,54 0,00%

EUR/JPY Y133,31 -0,24%

GBP/JPY Y151,198 -0,18%

AUD/USD $0,7557 +0,42%

NZD/USD $0,6932 +0,34%

USD/CAD C$1,28647 +0,08%

07:00 Germany CPI, m/m (Finally) November 0.0% 0.3%

07:00 Germany CPI, y/y (Finally) November 1.6% 1.8%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y October 2.2% 2.2

09:30 United Kingdom Average Earnings, 3m/y October 2.2% 2.5%

09:30 United Kingdom ILO Unemployment Rate October 4.3% 4.2%

09:30 United Kingdom Claimant count November 1.1 3.2

10:00 Eurozone Employment Change Quarter III 0.4% 0.4%

10:00 Eurozone Industrial Production (YoY) October 3.3% 3.5%

10:00 Eurozone Industrial production, (MoM) October -0.6% 0.0%

13:30 U.S. CPI, m/m November 0.1% 0.4%

13:30 U.S. CPI excluding food and energy, Y/Y November 1.8% 1.8%

13:30 U.S. CPI, Y/Y November 2% 2.2%

13:30 U.S. CPI excluding food and energy, m/m November 0.2% 0.2%

15:30 U.S. Crude Oil Inventories December -5.610 -3.78

19:00 U.S. FOMC Economic Projections

19:00 U.S. Fed Interest Rate Decision 1.25% 1.5%

19:30 U.S. Federal Reserve Press Conferenc

23:00 U.S. FOMC Member Brainard Speaks

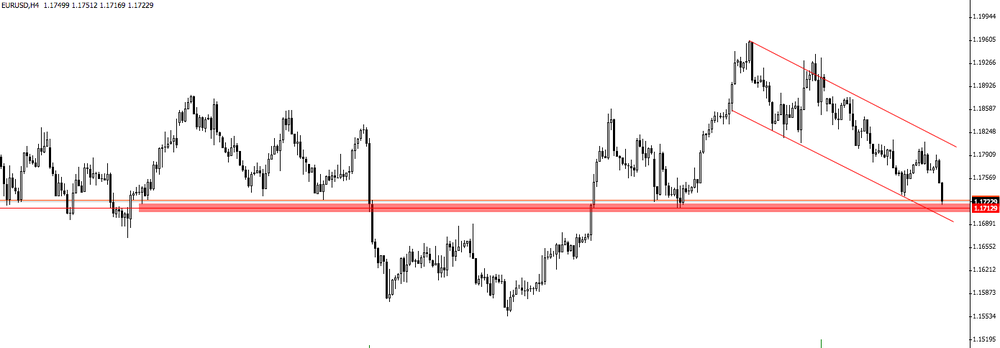

EUR/USD is now close to the bottom of the downside channel and close to the support zone.

It could be interesting to see how the price reacts on that area and if it starts rejecting the bottom of the channel and the support level then we can expect a bullish movement to the top of the channel.

The Producer Price Index for final demand increased 0.4 percent in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices also moved up 0.4 percent in both October and September. On an unadjusted basis, the final demand index rose 3.1 percent for the 12 months ended in November, the largest advance since a 3.1-percent increase for the 12 months ended January 2012.

In November, three-fourths of the rise in the final demand index is attributable to a 1.0-percent increase in prices for final demand goods. The index for final demand services climbed 0.2 percent.

The index for final demand less foods, energy, and trade services rose 0.4 percent in November, the largest advance since increasing 0.6 percent in April. For the 12 months ended in November, prices for final demand less foods, energy, and trade services moved up 2.4 percent.

-

Overheating in wider economy remains a risk as it approaches full employment

-

Large share of debt, including mortgage debt, vulnerable to a rise in interest rates

However, it could be interesting how the price reacts close to the resistance level (red zone) and if it starts rejecting then we can expect a new bearish movement on this pair.

However, it could be interesting how the price reacts close to the resistance level (red zone) and if it starts rejecting then we can expect a new bearish movement on this pair.

-

Uncertainty on future german government has not had any impact on assessment of economic outlook so far

-

Outlook for german economy in coming six months remains positive

UK house prices grew by 4.5% in the year to October 2017, experiencing a 0.3 percentage point decrease from the previous month.

In terms of housing demand the Royal Institution of Chartered Surveyors' (RICS) Residential Market Survey for October 2017 reported that the headline near term price expectations series slipped to -11%, from -8% in September, and has now been negative in each of the last three months. New buyer enquiries continue to signal a softening in demand, with the net national balance remaining at -20%.

The headline rate of inflation for goods leaving the factory gate (output prices) rose 3.0% on the year to November 2017, up from 2.8% in October 2017.

Prices for materials and fuels (input prices) rose 7.3% on the year to November 2017, up from 4.8% in October 2017.

All industries provided upward contributions to both input and output annual inflation; the largest contributors to the change in the annual rates were crude oil and petroleum products respectively.

Core input inflation was 4.6% on the year to November 2017, up from 3.4% in October 2017.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) 12-month inflation rate was 2.8% in November 2017, unchanged from October 2017.

The Consumer Prices Index (CPI) 12-month rate was 3.1% in November 2017, up from 3.0% in October 2017; it was last higher in March 2012.

The largest upward contribution to change in both the CPIH and CPI rates came from air fares which fell between October and November but by less than a year ago.

Rising prices for a range of recreational and cultural goods and services, most notably computer games, also had an upward effect.

Falling prices in the miscellaneous goods and services category (covering products such as travel goods and financial services) provided the largest offsetting downward contribution

Romania's consumer price inflation accelerated for the third straight month in November, figures from the National Institute of Statistics, cited by rttnews.

The consumer price index climbed 3.2 percent year-over-year in November, faster than the 2.6 percent increase in October. The measure has been rising since January.

Food prices grew 3.9 percent annually in November and non-food prices advanced by 4.1 percent. Costs for services registered a slight increase of 0.1 percent.

On a monthly basis, consumer prices went up 0.7 percent in November.

-

Sees further increase in german exports despite recent weakness

-

Sees strong economic growth in 2017

EUR/USD: 1.1700 (243m), 1.1750 (193m), 1.1820-30 (608m), 1.1850-60 (1.0b), 1.1900 (1.2b)

USD/JPY: 113.00 (147m), 113.15-20 (368m), 113.25-30 (254m), 113.45-50 (376m), 113.60 (175m), 114.17 (308m)

GBP/USD: 1.3350 (428m)

USD/CHF: 0.9900 (250m)

USD/CAD: 1.2775-80 (210m)

EUR/USD

Resistance levels (open interest**, contracts)

$1.1910 (2125)

$1.1894 (1026)

$1.1871 (208)

Price at time of writing this review: $1.1779

Support levels (open interest**, contracts):

$1.1720 (3360)

$1.1681 (3935)

$1.1638 (3399)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 89464 contracts (according to data from December, 11) with the maximum number of contracts with strike price $1,1800 (4707);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3505 (1999)

$1.3461 (1430)

$1.3432 (859)

Price at time of writing this review: $1.3343

Support levels (open interest**, contracts):

$1.3285 (1770)

$1.3258 (1615)

$1.3227 (2130)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 29272 contracts, with the maximum number of contracts with strike price $1,3500 (3805);

- Overall open interest on the PUT options with the expiration date January, 5 is 28426 contracts, with the maximum number of contracts with strike price $1,2900 (2426);

- The ratio of PUT/CALL was 0.97 versus 0.99 from the previous trading day according to data from December, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The Residential Property Price Index (RPPI) for Sydney fell 1.4 per cent in the September quarter 2017 following positive growth over the last five quarters, according to figures released today by the Australian Bureau of Statistics (ABS).

Sydney established house prices fell 1.3 per cent and attached dwellings prices fell 1.4 per cent in the September quarter 2017.

"The fall in Sydney property prices this quarter was consistent with market indicators," Chief Economist for the ABS, Bruce Hockman said.

Falls in the RPPI were also seen in Perth (-1.0 per cent), Darwin (-2.6 per cent) and Canberra (-0.2 per cent). These were offset by rises in Melbourne (+1.1 per cent), Brisbane (+0.7 per cent), Adelaide (+0.7 per cent) and Hobart (+3.4 per cent).

For the weighted average of the eight capital cities, the RPPI fell 0.2 per cent in the September quarter 2017. This was the first fall in the RPPI since the March quarter 2016.

In Q3 2017, net payroll job creation reached 44,500, that is an increase of +0.2% after an increase of +0.4% in the previous quarter. The payroll employment increased by 49,900 in the private sector while it decreased by 5,400 in the public sector. Year on year, it rose by 269,100 net jobs (that is +1.1%): 260,100 jobs were created in the private sector and 9,000 jobs in the public service.

In Q3 2017, payroll employment in industry continued to decrease slightly: −2,800 (that is −0.1%, as in the previous quarter). Year on year, industry lost 15,600 jobs (that is −0.5%).

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.