- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 09-10-2017.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1740 +0,06%

GBP/USD $1,3141 +0,58%

USD/CHF Chf0,9795 +0,21%

USD/JPY Y112,65 +0,03%

EUR/JPY Y132,27 +0,07%

GBP/JPY Y148,035 +0,58%

AUD/USD $0,7752 -0,30%

NZD/USD $0,7057 -0,44%

USD/CAD C$1,25499 +0,17%

02:50 Japan Current Account, bln August 2320 2.262

03:30 Australia National Australia Bank's Business Confidence September 5 6

06:20 Australia RBA Assist Gov Debelle Speaks

08:00 Japan Eco Watchers Survey: Current September 49.7 49.9

08:00 Japan Eco Watchers Survey: Outlook September 51.1

08:45 Switzerland Unemployment Rate (non s.a.) September 3% 3%

09:00 Germany Current Account August 19.4

09:00 Germany Trade Balance (non s.a.), bln August 19.5

09:45 France Industrial Production, m/m August 0.5% 0.4%

11:30 United Kingdom Industrial Production (MoM) August 0.2% 0.2%

11:30 United Kingdom Industrial Production (YoY) August 0.4% 0.8%

11:30 United Kingdom Manufacturing Production (YoY) August 1.9% 1.9%

11:30 United Kingdom Manufacturing Production (MoM) August 0.5% 0.3%

11:30 United Kingdom Total Trade Balance August -2.87 -3.60

15:00 United Kingdom NIESR GDP Estimate September 0.4%

15:15 Canada Housing Starts September 223.2 210.0

15:30 Canada Building Permits (MoM) August -3.5%

17:00 U.S. FOMC Member Kashkari Speaks

21:00 Canada Gov Council Member Wilkins Speaks

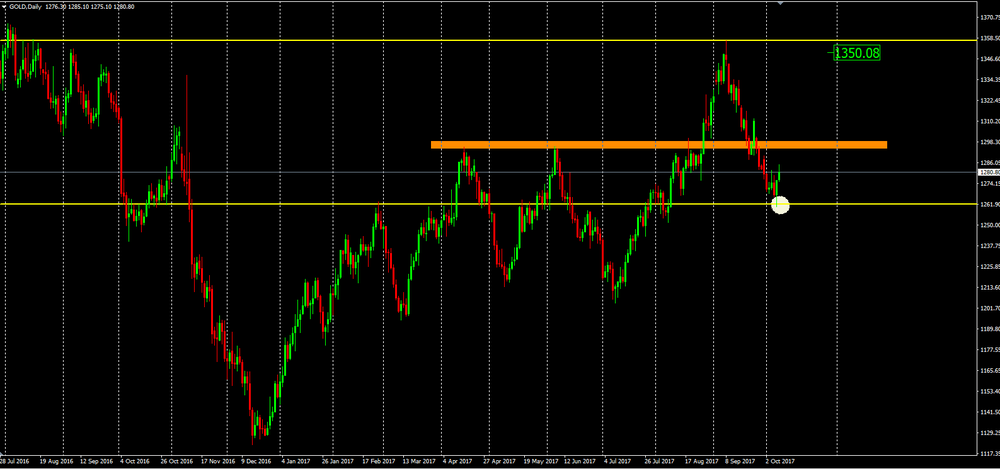

Gold has become very volatile and has sparked some interest from investors due to the instability experienced at the international level, with the main focus being the exchange of words between the United States and North Korea.

After successive weeks of devaluation of the value of gold, we can now expect a recovery of its value and perhaps until the formation of a new maximum relative to the previous one (values close to 1350.08).

-

Says that in august, overhang in OECD oil products stocks compared to 5-year average was a 'mere' 25 million barrels, 'almost converging with the 5-year average'

EUR/USD: 1.1795(305 млн), 1.1765(108 млн), 1.1700(156 млн),

USD/JPY: 113.00(555 млн), 112.50(330 млн)

AUD/USD: 0.7700(330 млн)

The economic momentum continues. The overall index for Euro area improves by 1.5 points and reaches a new 10-year high with 29.7 points. Current situation and expectations are improving to a similar extent. The first economic test after the Bundestag elections can be considered successful. The time series for German economy of the "first movers among the leading indicators" are clearly climbing and are promising an unbroken upturn - even under a changed government. The global economic engine continues to gain strength. For the US investors are shaking their intermittent worries and the region of Asia is also creating strong economic optimism. The sentix Global Aggregate also rises to a 10-year high.

EUR/USD: 1.1795(305 m), 1.1765(108 m), 1.1700(156 m),

USD/JPY: 113.00(555 m), 112.50(330 m)

AUD/USD: 0.7700(330 m)

-

Ecb finds interest rate risk is well managed in most european banks

-

Capital demand forindividual banks might be adapted

-

Supervisors will follow up on the results insupervisory dialogues with the individual banks

-

Says good business morale, positive trend in industrial orders point to continued upswing in sector

-

It's likely inflation pressures are building

-

The benefit of having a little time to decide on rate hike before december meeting 'and I plan to take it'

-

September job losses from hurricanes likely to be temporary

In August 2017, production in industry was up by 2.6% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In July 2017, the corrected figure shows a decrease of 0.1% (primary 0.0%) from June 2017.

In August 2017, production in industry excluding energy and construction was up by 3.2%. Within industry, the production of capital goods increased by 4.8% and the production of consumer goods by 2.1%. The production of intermediate goods showed an increase of 1.8%. Energy production was up by 1.7% in August 2017 and the production in construction decreased by 1.2%.

The Caixin China Composite PMI data (which covers both manufacturing and services) signalled a weaker expansion in total Chinese business activity at the end of the third quarter. Notably, the Composite Output Index fell from 52.4 in August to a three-month low of 51.4 in September.

The slowdown was driven by weaker increases in output at both manufacturing and services companies. A drop in the seasonally adjusted Caixin China General Services Business Activity Index from 52.7 to 50.6 in September pointed to only a marginal increase in services activity that was the slowest for 21 months. At the same time, growth in manufacturing production edged down to a three-month low.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1912 (3313)

$1.1856 (1354)

$1.1805 (209)

Price at time of writing this review: $1.1738

Support levels (open interest**, contracts):

$1.1671 (2759)

$1.1642 (3137)

$1.1609 (2950)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 87029 contracts (according to data from October, 6) with the maximum number of contracts with strike price $1,2000 (5216);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3280 (2216)

$1.3225 (2246)

$1.3153 (1050)

Price at time of writing this review: $1.3096

Support levels (open interest**, contracts):

$1.2969 (1146)

$1.2912 (1670)

$1.2878 (1878)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 30842 contracts, with the maximum number of contracts with strike price $1,3300 (3071);

- Overall open interest on the PUT options with the expiration date November, 3 is 28173 contracts, with the maximum number of contracts with strike price $1,3400 (2160);

- The ratio of PUT/CALL was 0.91 versus 1.15 from the previous trading day according to data from October, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.