- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 08-11-2017.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1594 +0,08%

GBP/USD $1,3114 -0,37%

USD/CHF Chf0,99999 +0,06%

USD/JPY Y113,86 -0,12%

EUR/JPY Y132,01 -0,04%

GBP/JPY Y149,327 -0,48%

AUD/USD $0,7677 +0,44%

NZD/USD $0,6960 +0,99%

USD/CAD C$1,27269 -0,38%

00:00 New Zealand RBNZ Press Conference

02:50 Japan Current Account, bln September 2380.4 2375.4

02:50 Japan Core Machinery Orders, y/y September 4.4% 1.9%

02:50 Japan Core Machinery Orders September 3.4% -1.8%

03:30 Australia Home Loans September 1.0% 3.0%

04:30 China PPI y/y October 6.9% 6.6%

04:30 China CPI y/y October 1.6% 1.8%

08:00 Japan Eco Watchers Survey: Current October 51.3 50.6

08:00 Japan Eco Watchers Survey: Outlook October 51

09:45 Switzerland Unemployment Rate (non s.a.) October 3.0% 3.0%

10:00 Germany Current Account September 17.8

10:00 Germany Trade Balance (non s.a.), bln September 20.0

12:00 Eurozone ECB Economic Bulletin

13:00 Eurozone EU Economic Forecasts

16:30 Canada New Housing Price Index, MoM September 0.1% 0.2%

16:30 Canada New Housing Price Index, YoY September 3.8%

16:30 U.S. Continuing Jobless Claims 1884 1890

16:30 U.S. Initial Jobless Claims 229 231

18:00 U.S. Wholesale Inventories September 0.8% 0.9%

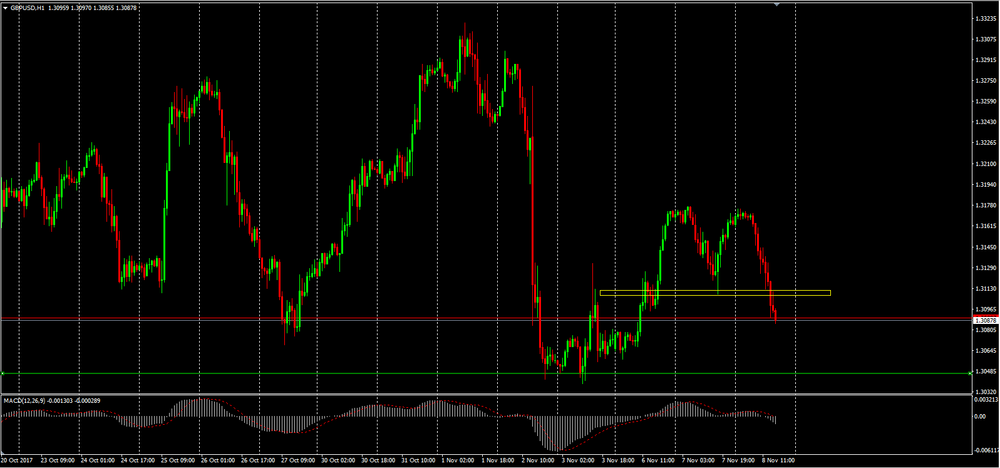

As we can see on 1h time frame chart, it is possible to see a chart pattern "Double Top" which the neckline has already been broken.

Therefore, it might be possible to see a depreciation of the British pound agaisnt the U.S dollar to values close to 1.305

EURUSD: 1.1545-60 (EUR 1.33bln) 1.1600 (980m) 1.1640 (845m) 1.1700 (505 m)

USDJPY: 112.25-30 (USD 1.68bln) 113.50 (695m) 113.70-75 (1.05bln) 113.95-114.00(980m) 114.50 (1.34bln) 114.75 (605m) 115.00 (600m)

GBPUSD: 1.3050-55 (GBP 545m) 1.3090 (500m) 1.3248 (320m)

AUDUSD: 0.7640-50 (AUD 520m) 0.7675-80(460m) 0.7750-55 (340m) 0.7800-05(365m)

NZD/USD: 0.6920-25 (NZD 645m), 0.6950 (655m)

AUDNZD: 1.1200 (AUD 1.58bln)

The trend in housing starts was 216,770 units in October 2017, compared to 215,153 units in September 2017, according to Canada Mortgage and Housing Corporation (CMHC). This trend measure is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

"The trend in housing starts essentially held steady in October following a decrease in September," said Bob Dugan, CMHC's chief economist. "Nevertheless, new home construction remains very strong in 2017, as the seasonally adjusted number of starts has been above 200,000 units in nine of ten months so far this year."

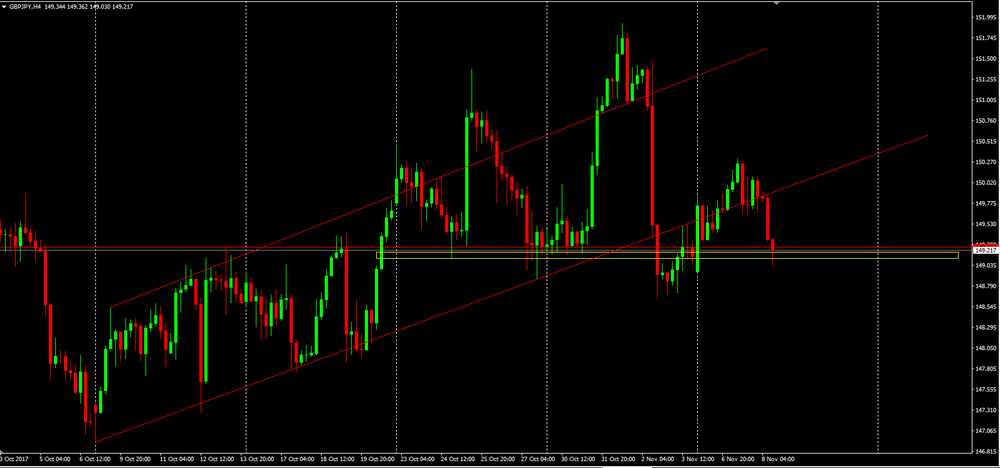

GBP/JPY on 4 hours time frame chart we can see that the price is in a critical zone.

The price at moment is close to a support line that might be relevent as soon as it is broken.

Besides the support level, we also have the possibilit to confirm a chart pattern (Head and Shoulders) which it reinforces the idea of a possible bearish movement against yen.

-

To grow by 2.2 pct in 2018 (previous forecast +1.6 pct)

-

Call for one-off extension of brexit negotiating timeframe to avoid worst case scenario of hard exit

-

German economy is gradually heading toward a boom phase

-

Expectations about UK's future trading relationships were dragging on spending by companies

-

Recruitment difficulties had intensified and were above normal in a range of activities

-

Employment intentions pointed to modest growth in staffing over the next six months

EUR/USD: 1.1545-55(1.1 b), 1.1600(911 m), 1.1640(753 m), 1.1700(503 m).

USD/JPY: 112.25-30(988 m), 113.50(691 m), 113.72-75(1.05 b),113.95-114.00(980 m), Y114.50(1.34 b), 114.75(605 m), 115.00(598 m).

GBP/USD: 1.3050-55(542 m), 1.3090(497 m), 1.3248(319 m).

AUD/USD: 0.7640-50(517 m), 0.7675-80(457 m), 0.7750-55(336 m),0.7800-05(365 m).

NZD/USD: 0.6920-25(642 m), 0.6950(652 m).

EUR/USD

Resistance levels (open interest**, contracts)

$1.1710 (3801)

$1.1662 (958)

$1.1635 (758)

Price at time of writing this review: $1.1599

Support levels (open interest**, contracts):

$1.1552 (5757)

$1.1529 (8287)

$1.1500 (6035)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 8 is 150553 contracts (according to data from November, 7) with the maximum number of contracts with strike price $1,1600 (8287);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3271 (1890)

$1.3235 (634)

$1.3204 (1281)

Price at time of writing this review: $1.3155

Support levels (open interest**, contracts):

$1.3108 (1115)

$1.3060 (1306)

$1.3030 (2506)

Comments:

- Overall open interest on the CALL options with the expiration date December, 8 is 39262 contracts, with the maximum number of contracts with strike price $1,3200 (3183);

- Overall open interest on the PUT options with the expiration date December, 8 is 38105 contracts, with the maximum number of contracts with strike price $1,3000 (4620);

- The ratio of PUT/CALL was 0.97 versus 0.98 from the previous trading day according to data from November, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

To decide on whether to declare North Korea a state sponsor of terrorism at end of Asia trip

-

Believes any talks with North Korea would require reducing threats, ending provocations and movement toward denuclearization

China's exports grew at a slower-than-expected pace in October, while imports surged on domestic demand, official data cited by rttnews.

In dollar terms, exports climbed 6.9 percent year-over-year in October, data from the General Administration of Customs revealed.

Shipments were forecast to climb 7.1 percent after rising 8.1 percent in September.

Meanwhile, imports surged 17.2 percent in October from a year ago, faster than the expected growth of 17.0 percent.

Consequently, the trade surplus totaled $38.2 billion in October versus the expected level of $39.1 billion. At the same time, the trade surplus with the U.S. decreased to $26.6 billion.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.