- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 04-12-2017.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1865 -0,21%

GBP/USD $1,3479 +0,07%

USD/CHF Chf0,98501 +0,86%

USD/JPY Y112,39 +0,26%

EUR/JPY Y133,36 +0,04%

GBP/JPY Y151,503 +0,33%

AUD/USD $0,7598 -0,14%

NZD/USD $0,6857 -0,41%

USD/CAD C$1,26728 -0,17%

00:30 Australia Current Account, bln Quarter III -9.6 -9.2

00:30 Australia Retail Sales, M/M October 0.0% 0.3%

01:45 China Markit/Caixin Services PMI November 51.2 51.5

03:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.50%

03:30 Australia RBA Rate Statement

08:50 France Services PMI (Finally) November 57.3 60.2

08:55 Germany Services PMI (Finally) November 54.7 54.9

09:00 Eurozone Services PMI (Finally) November 55 56.2

09:30 United Kingdom Purchasing Manager Index Services November 55.6 55.0

10:00 Eurozone Retail Sales (MoM) October 0.7% -0.7%

10:00 Eurozone Retail Sales (YoY) October 3.7% 1.7%

13:30 Canada Trade balance, billions October -3.18

13:30 U.S. International Trade, bln October -43.50 -47.5

14:45 U.S. Services PMI (Finally) November 55.3 54.7

15:00 U.S. ISM Non-Manufacturing November 60.1 59.3

CAD/CHF has broken the downside trend line recently.

We might see a retracement which may be a price correction because price hasn't tested the trend line yet and therefore, we may expect an opportunity to enter long on CAD/CHF.

New orders for manufactured goods in October, down following two consecutive monthly increases, decreased $0.3 billion or 0.1 percent to $479.6 billion, the U.S. Census Bureau reported today. This followed a 1.7 percent September increase. Shipments, up ten of the last eleven months, increased $2.7 billion or 0.6 percent to $484.2 billion. This followed a 1.1 percent September increase. Unfilled orders, down three of the last four months, decreased $0.2 billion or virtually unchanged to $1,135.1 billion. This followed a 0.3 percent September increase. The unfilled orders-to-shipments ratio was 6.68, unchanged from September. Inventories, up eleven of the last twelve months, increased $1.2 billion or 0.2 percent to $661.6 billion. This followed a 0.6 percent September increase. The inventories-to-shipments ratio was 1.37, unchanged from September.

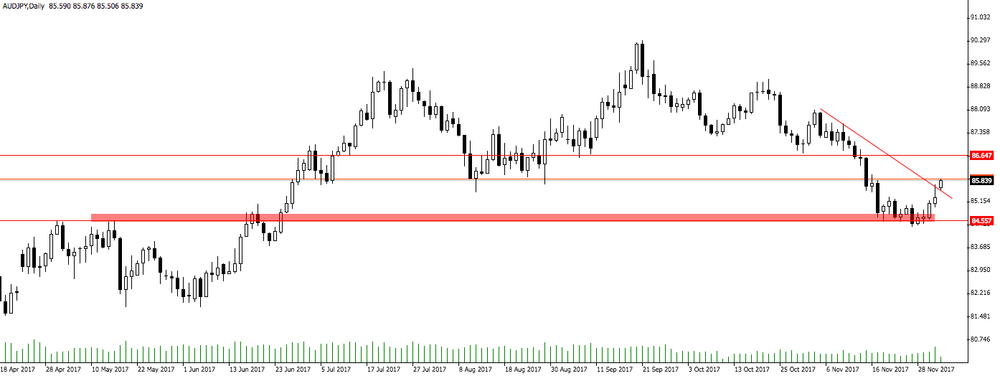

As we can see, if the daily candle closes above the downside trend line, we might expect a further appreciation on AUD/JPY.

Otherwise, if the price doesn't hold above the downside trend line, then we can consider go short when the price breaks the support level (red rectangle).

EUR/USD: 1.1800(426 млн), 1.1900(460 млн), 1.2000(1.01 млрд)

USD/JPY: 111.90-00(999 млн), 112.50-55(914 млн), 113.25(710 млн), 114.00-10(893 млн)

AUD/USD: 0.7500(291 млн), 0.7750(335 млн)

NZD/USD: 0.6920(371 млн)

USD/CAD: 1.2810(290 млн)

EUR/GBP: 0.8789(724 млн)

AUD/JPY: 84.06(260 млн), 85.75(257 млн)

AUD/NZD: 1.1100(847 млн)

In October 2017, compared with September 2017, industrial producer prices rose by 0.4% in both the euro area (EA19) and the EU28, according to estimates from Eurostat, the statistical office of the European Union. In September 2017, prices increased by 0.5% in both zones. In October 2017, compared with October 2016, industrial producer prices rose by 2.5% in the euro area and by 2.6% in the EU28.

The 0.4% increase in industrial producer prices in total industry in the euro area in October 2017, compared with September 2017, is due to rises of 1.3% in the energy sector and of 0.3% for intermediate goods, while prices remained stable for both capital and durable consumer goods and fell by 0.2% for non-durable consumer goods. Prices in total industry excluding energy rose by 0.2%.

The Sentix Economy Index for the Eurozone concludes its series of rising highs and returns 2.9 points in December. Expectations are responsible for this, with a more pronounced drop of 6.0 points. The assessment of the situation, on the other hand, can even increase slightly (+0.7 points). The values for Germany are also falling. The overall index dropped by 3.3 points to 39.1 points. Economic expectations have fallen by 5.3 points. There is also a calming effect on the global economy. Falling expectations dominate, with the emerging markets losing the least in relative terms.

November data pointed to a moderate rebound in UK construction output, with business activity rising at the strongest rate since June. New orders and employment numbers also increased to the greatest extent in five months. However, the improvement in construction growth was largely confined to residential work. The latest survey revealed sustained reductions in commercial building and civil engineering, with the latter now experiencing its longest period of decline since the first half of 2013.

Adjusted for seasonal influences, the IHS Markit/CIPS UK Construction PMI picked up from 50.8 in October to 53.1 in November, to remain above the 50.0 no-change value for the second month running. The latest reading was the highest for five months and signalled a solid rate of business activity growth across the construction sector.

EUR/USD: 1.1800(426 m), 1.1900(460 m), 1.2000(1.01 b)

USD/JPY: 111.90-00(999 m), 112.50-55(914 m), 113.25(710 m), 114.00-10(893 m)

AUD/USD: 0.7500(291 m), 0.7750(335 m)

NZD/USD: 0.6920(371 m)

USD/CAD: 1.2810(290 m)

EUR/GBP: 0.8789(724 m)

AUD/JPY: 84.06(260 m), 85.75(257 m)

AUD/NZD: 1.1100(847 m)

-

Border is not just a customs issue, it is also a political issue because it was part of the troubles of the past

The number of unemployed registered in the offices of the Public Employment Services has increased in November, +7,255 people in relation to the previous month. Last year, in November 2016, unemployment increased by 24,841 people. In the last 8 years in this same month registered unemployment had increased on average in more than 25,000 people (24,919). In this way, the total number of registered unemployed stands at 3,474,281, thus remaining at its lowest level in the last 8 years. In seasonally adjusted terms, unemployment has dropped by 22,744 people.

-

BoJ will continue to carefully monitor the global economic situation as well as potential risks

-

Among risks to global outlook, I am particularly concerned about protectionist tendency in some countries as well as geopolitical risks

-

We will continue current policy framework in order to achieve 2 pct target around fiscal 2019

-

Our monetary policy strategy changed in september last year to accommodate not just economy but financial stability

-

China resolutely opposes N.Korea actions that violate U.N. resolutions

-

In response to question on unilateral sanctions, says China opposes any actions that run counter to international law, U.N. security council

-

China has open attitude on solutions on Korean peninsula, but parties should be consultative

EUR/USD

Resistance levels (open interest**, contracts)

$1.2021 (5528)

$1.1983 (4088)

$1.1953 (5954)

Price at time of writing this review: $1.1869

Support levels (open interest**, contracts):

$1.1850 (3101)

$1.1822 (2693)

$1.1786 (3091)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 8 is 165326 contracts (according to data from December, 1) with the maximum number of contracts with strike price $1,1500 (8869);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3585 (2658)

$1.3552 (2651)

$1.3527 (1907)

Price at time of writing this review: $1.3462

Support levels (open interest**, contracts):

$1.3421 (1064)

$1.3365 (1374)

$1.3328 (1178)

Comments:

- Overall open interest on the CALL options with the expiration date December, 8 is 51838 contracts, with the maximum number of contracts with strike price $1,3400 (3590);

- Overall open interest on the PUT options with the expiration date December, 8 is 44178 contracts, with the maximum number of contracts with strike price $1,3000 (3978);

- The ratio of PUT/CALL was 0.85 versus 0.85 from the previous trading day according to data from December, 1.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.