- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 04-01-2018.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,2067 +0,44%

GBP/USD $1,3551 +0,25%

USD/CHF Chf0,97463 -0,22%

USD/JPY Y112,74 +0,21%

EUR/JPY Y136,06 +0,66%

GBP/JPY Y152,775 +0,46%

AUD/USD $0,7863 +0,37%

NZD/USD $0,7154 +0,89%

USD/CAD C$1,24875 -0,38%

00:30 Australia Trade Balance November 0.105 0.55

07:00 Germany Retail sales, real unadjusted, y/y November -1.4% 2.5%

07:00 Germany Retail sales, real adjusted November -1.2% 1.1%

07:45 France Consumer confidence December 102 103

07:45 France CPI, m/m (Preliminary) December 0.1% 0.3%

07:45 France CPI, y/y (Preliminary) December 1.2% 1.2%

08:00 Switzerland Foreign Currency Reserves December 738

10:00 Eurozone Producer Price Index, MoM November 0.4% 0.3%

10:00 Eurozone Producer Price Index (YoY) November 2.5% 2.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) December 1.5% 1.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) December 0.9%

13:30 Canada Trade balance, billions November -1.47 -1.2

13:30 Canada Employment December 79.5 1

13:30 Canada Unemployment rate December 5.9% 6%

13:30 U.S. Manufacturing Payrolls December 31.0 15

13:30 U.S. Government Payrolls December 7.0 5

13:30 U.S. Average workweek December 34.5 34.5

13:30 U.S. Private Nonfarm Payrolls December 221 185

13:30 U.S. Average hourly earnings December 0.2% 0.3%

13:30 U.S. Labor Force Participation Rate December 62.7%

13:30 U.S. International Trade, bln November -48.70 -49.5

13:30 U.S. Nonfarm Payrolls December 228 190

13:30 U.S. Unemployment Rate December 4.1% 4.1%

15:00 Canada Ivey Purchasing Managers Index December 63 62.2

15:00 U.S. Factory Orders November -0.1% 1.1%

15:00 U.S. ISM Non-Manufacturing December 57.4 57.6

15:15 U.S. FOMC Member Harker Speaks

17:30 U.S. FOMC Member Mester Speaks

18:00 U.S. Baker Hughes Oil Rig Count January 747

-

Trump says he will send high-level delegation including his family to winter olympics

-

Hopes good results will come from inter-Korean talks

Moreover, the latest upturn eased to a seven-month low. In line with the trend in output, the rate of growth in new business volumes softened slightly. Meanwhile, backlogs continued to rise and the latest expansion was the fastest for four months. Another solid rise in employment levels was linked to greater capacity pressures. On the price front, both input cost and charge inflation eased slightly. In line with softer business activity growth, the degree of optimism in the sector dipped to a 15-month low.

The seasonally adjusted final IHS Markit U.S. Services Business Activity Index registered 53.7 in December, down from 54.5 in November.

Prices for products sold by Canadian manufacturers, as measured by the Industrial Product Price Index (IPPI), increased 1.4% in November, mainly attributable to higher prices for energy and petroleum products. Prices for raw materials purchased by Canadian manufacturers, as measured by the Raw Materials Price Index (RMPI), rose 5.5%, primarily due to higher prices for crude energy products.

The IPPI rose 1.4% in November, following a 1.1% increase in October. Of the 21 major commodity groups, 16 were up, 4 were down and 1 was unchanged.

In the week ending December 30, the advance figure for seasonally adjusted initial claims was 250,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 245,000 to 247,000. The 4-week moving average was 241,750, an increase of 3,500 from the previous week's revised average. The previous week's average was revised up by 500 from 237,750 to 238,250.

Private sector employment increased by 190,000 jobs from October to November according to the November ADP National Employment Report

"The labor market continues to grow at a solid pace," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. "Notably, manufacturing added the most jobs the industry has seen all year. As the labor market continues to tighten and wages increase it will become increasingly difficult for employers to attract and retain skilled talent."

Mark Zandi, chief economist of Moody's Analytics, said, "The job market is red hot, with broad-based job gains across industries and company sizes. The only soft spots are in industries being disrupted by technology, brick-and-mortar retailing being the best example. There is a mounting threat that the job market will overheat next year."

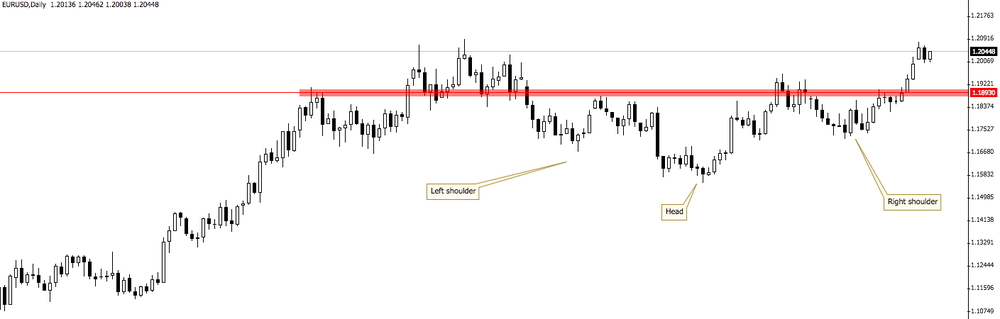

As we can see on daily time frame chart, the price has broken the neckline of the chart pattern (head and shoulders).

We can conclude that that pattern is now active, however, we might expect a slightly correction by the price close to the neckline in order to confirms the bullish movement on EUR/USD.

December data indicated that business activity growth picked up across the UK service sector, but the latest survey also found softer rises in new work and employment numbers at the end of 2017. At the same time, service providers indicated another marked increase in their average prices charged, which was overwhelmingly linked to strong cost pressures. Survey respondents signalled the fastest rise in operating expenses for three months, reflecting higher transportation costs, staff salaries and utility bills in December. The seasonally adjusted IHS Markit/CIPS UK Services PMI® Business Activity Index registered 54.2 in December, up from 53.8 in the previous month, to signal the second-fastest upturn in service sector output since April 2017.

The euro area economy gathered further growth momentum at the end of 2017, spurred on by a near-record expansion of manufacturing production and the steepest increase in service sector activity for over-six-and-a-half years. The final IHS Markit Eurozone PMI Composite Output Index posted 58.1 in December, up from 57.5 in November, to register its highest reading since February 2011. The headline index has signalled growth for 54 successive months, with the average level during quarter four the best since the opening quarter of 2011.

The rise in business activity was matched by similar robust increases in new work and employment, with rates of growth accelerating slightly in both cases. Furthermore, firms' confidence towards future prospects rebounded after easing in November and was among the highest seen in the past seven years.

The seasonally adjusted final IHS Markit Germany Services PMI Business Activity Index climbed to 55.8 in December from 54.3 in November, recording its highest reading since the final month of 2015. This latest increase in business activity extended a sequence of growth seen since mid2013, with the average pace of expansion for the year as a whole the best since 2011.

After having eased in recent months, rates of growth in services business activity and new orders improved in December. Meanwhile, confidence regarding the 12-month outlook for activity also strengthened. Rising workloads led companies to increase their staffing levels markedly again. On the price front, input costs continued to rise sharply while firms raised charges in line with improving customer demand.

The headline seasonally adjusted Business Activity Index ticked up to 54.6 in December from 54.4 in November, signalling a slightly sharper increase in activity over the month. This followed two successive months in which the rate of growth had slowed. Activity rose markedly at the end of 2017, extending the current sequence of expansion to 50 months.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2114 (4291)

$1.2087 (3118)

$1.2069 (4164)

Price at time of writing this review: $1.2030

Support levels (open interest**, contracts):

$1.1995 (2183)

$1.1949 (4092)

$1.1899 (4868)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 104498 contracts (according to data from January, 3) with the maximum number of contracts with strike price $1,2200 (6705);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3610 (2784)

$1.3577 (2969)

$1.3551 (2634)

Price at time of writing this review: $1.3519

Support levels (open interest**, contracts):

$1.3446 (2010)

$1.3399 (2321)

$1.3350 (2094)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 33997 contracts, with the maximum number of contracts with strike price $1,3500 (4419);

- Overall open interest on the PUT options with the expiration date January, 5 is 36541 contracts, with the maximum number of contracts with strike price $1,3250 (2808);

- The ratio of PUT/CALL was 1.07 versus 1.03 from the previous trading day according to data from January, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The Caixin China Composite PMI data (which covers both manufacturing and services) signalled a solid upturn in Chinese business activity at the end of 2017. At 53.0, the Composite Output Index picked up from 51.6 in November to indicate the fastest rate of activity growth for a year. Steeper increases in activity were registered across both the manufacturing and service sectors during December. Notably, services companies recorded the quickest expansion in activity since August 2014. This was shown by the seasonally adjusted Caixin China General Services Business Activity Index rising from 51.9 in November to 53.9 at the end of the year. Meanwhile, manufacturing output increased at a pace that, though modest, was the strongest seen for three months.

-

A few policymakers said the median Fed projection published in december would bring too many rate hikes in 2018; a few others said more hikes could be needed in 2018 than implied in median projection

-

Fed policymakers discussed how fiscal stimulus or easy financial market conditions could boost output too much and require a steeper path of rate hikes

-

A few policymakers suggested further study of price level targeting or nominal GDP targeting frameworks

-

Fed policymakers generally agreed flatness of yield curve not unusual by historical standards; some expressed concern a possible future inversion could portend economic slowdown

-

UK annual house price growth ended 2017 at 2.6%, compared with 4.5% in 2016

-

London weakest performing region, with house prices down 0.5% year-on-year

-

Significant differences in regional affordability, but saving for a deposit remains challenging for most.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: "Annual house price growth ended the year at 2.6%, within the 2-4% range that prevailed throughout 2017. This was in line with our expectations and broadly consistent with the 3- 4% annual rate of increase we expect to prevail over the long term (which is also our estimate for earnings growth in the long run)".

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.