- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 03-06-2019.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Retail Sales, M/M | April | 0.3% | 0.2% |

| 01:30 | Australia | Current Account, bln | Quarter I | -7.2 | -2.5 |

| 01:45 | U.S. | FOMC Member Daly Speaks | |||

| 04:30 | Australia | Announcement of the RBA decision on the discount rate | 1.5% | 1.25% | |

| 04:30 | Australia | RBA Rate Statement | |||

| 08:30 | United Kingdom | PMI Construction | May | 50.5 | 50.5 |

| 09:00 | Eurozone | Harmonized CPI, Y/Y | May | 1.7% | 1.3% |

| 09:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | May | 1.3% | 0.9% |

| 09:00 | Eurozone | Unemployment Rate | April | 7.7% | 7.7% |

| 09:30 | Australia | RBA's Governor Philip Lowe Speaks | |||

| 12:30 | U.S. | FOMC Member Williams Speaks | |||

| 13:55 | U.S. | Fed Chair Powell Speaks | |||

| 14:00 | U.S. | Factory Orders | April | 1.9% | -1% |

| 22:30 | Australia | AIG Services Index | May | 46.5 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Retail Sales, M/M | April | 0.3% | 0.2% |

| 01:30 | Australia | Current Account, bln | Quarter I | -7.2 | -2.5 |

| 01:45 | U.S. | FOMC Member Daly Speaks | |||

| 04:30 | Australia | Announcement of the RBA decision on the discount rate | 1.5% | 1.25% | |

| 04:30 | Australia | RBA Rate Statement | |||

| 08:30 | United Kingdom | PMI Construction | May | 50.5 | 50.5 |

| 09:00 | Eurozone | Harmonized CPI, Y/Y | May | 1.7% | 1.3% |

| 09:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | May | 1.3% | 0.9% |

| 09:00 | Eurozone | Unemployment Rate | April | 7.7% | 7.7% |

| 09:30 | Australia | RBA's Governor Philip Lowe Speaks | |||

| 12:30 | U.S. | FOMC Member Williams Speaks | |||

| 13:55 | U.S. | Fed Chair Powell Speaks | |||

| 14:00 | U.S. | Factory Orders | April | 1.9% | -1% |

| 22:30 | Australia | AIG Services Index | May | 46.5 |

Analysts at TD Securities note that Canada's Q1 GDP extended the recent streak of sub-trend growth with another 0.4% print, although the details were more upbeat and confirmed a rebound in domestic demand.

- “Stronger consumption and a rebound in business investment were encouraging signs that reduce the odds of 2019 rate cuts, but hikes are still a ways off given uncertainty from elevated trade tensions and substantial slack in the economy and we continue to view 1.75% as the top of this cycle.

- We have seen some stabilization in the Toronto housing market although existing home sales continue to hold near a 7-year low at the national level while household leverage sits at a record high. Meanwhile, core inflation softened to 1.90% in April and will be hard pressed to recover given the muted growth backdrop and significant slack.

- The labour market remains the one bright spot in the domestic economy, perplexingly, with the April LFS reporting monthly job creation of 106.5k which pushed the six-month average to 51k. Furthermore, wages have finally started to pick up off the lows with average hourly earning for permanent workers running at 2.6% y/y. While this should provide the BoC some comfort to remain on the sidelines as the market prices in cuts, it is not enough to return the Bank to a tightening path.”

- 97% chance of December rate cut versus 77% prior

- 80% chance of rates being cut twice or more by year-end versus 70% prior

The Commerce

Department said on Monday that construction spending was flat m-o-m in April after

a revised 0.1 percent m-o-m gain in March (originally a 0.9 percent m-o-m decline).

Economists had

forecast construction spending increasing 0.4 percent m-o-m in April.

On a y-o-y

basis, construction spending dropped 1.2 percent in April.

According to

the report, investment in public construction surged 4.8 percent m-o-m, while

spending on private construction fell 1.7 percent m-o-m

A report from

the Institute for Supply Management (ISM) showed on Monday the U.S.

manufacturing sector expanded in May at a slower pace than in April.

The ISM's index

of manufacturing activity came in at 52.1 percent last month, down 0.7

percentage point from the April reading of 52.8 percent, missing economists'

forecast for a 53.0 percent reading.

That was the lowest reading since October 2016.

A reading above

50 percent indicates expansion, while a reading below 50 percent indicates

contraction.

The monthly drop

by the headline index was primarily attributable to slower increases in

production (-1.0 percentage point to 51.3 percent in May), supplier deliveries

index (-2.6 percentage point to 52.0 percent) and the inventories index (-2.0

percentage points to 50.9 percent). Meanwhile, new orders (+1.0 percentage

points m-o-m to 52.7 percent), employment (+1.3 percentage point to 53.7 percent)

and prices (+3.2 percentage points to 53.2 percent) indicators recorded gains.

Timothy R.

Fiore, Chair of the ISM Manufacturing Business Survey Committee said, “The past

relationship between the PMI and the overall economy indicates that the PMI for

May (52.1 percent) corresponds to a 2.7-percent increase in real gross domestic

product (GDP) on an annualized basis,” says Fiore.”

The latest

report by IHS Markit revealed on Monday the seasonally adjusted IHS Markit

final U.S. Manufacturing Purchasing Managers’ Index (PMI) fell to 50.5 in

April, down from 52.6 in April and the “flash” figure of 50.6.

The latest

headline figure signaled only a slight improvement in operating conditions,

with the latest reading the lowest since September 2009.

Economists had

forecast the index to stay unrevised at 50.6.

According to

the report, output growth weakened and new orders declined for the first time

since August 2009. At the same time, employment increased at the slowest rate

since March 2017 and backlogs of work were unchanged. On a price front, inflationary

pressures eased further, with both input costs and output prices increasing at

softer rates.

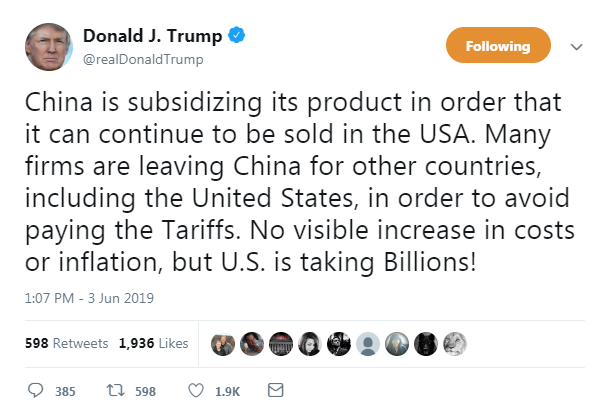

Deutsche Bank's analysts note that in today’s U.S. session, the Fed's Daly, Barkin and Bullard are due to speak, while the U.S. President Trump travels to the UK where he is expected to meet with UK PM May (continuing through to Wednesday).

- “Tuesday: In terms of data, in Europe, the May CPI report for the Euro Area is due along with the April unemployment rate, while in the US we'll get final April durable goods, capital goods and factory orders data. Meanwhile the Fed's Powell, Williams and Brainard are due to speak, the former making opening remarks at a Fed research conference.

- Wednesday: The remaining final May PMIs will be due in Japan, China, Europe and the US along with April PPI and retail sales for the Euro Area, and the May ISM nonmanufacturing and ADP employment print in the US. Away from that, the BoE's Ramsden is due to speak in the morning, followed by the Fed's Clarida, Bowman and Bostic. The Fed's Beige Book is also due to be released. Elsewhere, China's Xi Jinping makes a two-day state visit to Russia while President Trump meets Ireland PM Varadkar.

- Thursday: The ECB policy meeting will likely be the main focus of the day, while data releases in Europe include April factory orders in Germany and final Q1 GDP revisions for the Euro Area. In the US, we're due to get final Q1 readings for nonfarm productivity and unit labour costs, jobless claims and the April trade balance. The Fed's Kaplan and Williams are also due to speak, while the BoJ's Kuroda and BoE's Carney are also scheduled to make comments. President Trump is expected to meet France President Macron.

- Friday: The May employment report in the US will be the main data focus. Also due are April industrial production prints in Germany and France, April trade balance in Germany and April wholesale inventories and consumer credit in the US. The May foreign reserves reading for China is also expected at some stage. Meanwhile, UK PM May is due to step down as leader of the Conservative Party.”

Jane Foley, a senior FX strategist at Rabobank, says the Reserve Bank of Australia (RBA) is widely expected to be the second G10 central bank to have cut policy rates, following the footsteps of RBNZ.

- “We expect AUD/USD to edge lower in the months ahead towards 0.67 on a 6 mth view.

- The surprise election result did initially reel back confidence that the Bank was set to act again in June. However, the candid speech by RBA Governor Lowe on May 21 very quickly underscored the likelihood of a June rate cut.

- The RBA’s main policy rate at 1.5% currently stands well above the rate of several other G10 central banks. That said, the likelihood that the RBA will embark on a rate cutting cycle tomorrow has opened up the debate of whether the central bank may have to add quantitative easing to its tool-box in the not too distant future.

- In view of Australia’s current account deficit, the AUD has a capacity to be more sensitive than many other G10 currencies to be sensitive to a loss in broad-based risk appetite. The potential for losses in the Aussie in the coming months is accentuated by Australian’s strong trading links with China amid signs of slowing growth in the world’s second-largest economy.

- Given the market growing acceptable that the trade war between the US and China could last in some form for a prolonged period and that the RBA is set to react with rate cuts, we see scope for the AUD to remain vulnerable in the coming months.”

- Says his departure is not because of tariffs

- "It's very normal for the CEA chair to move on after two years"

Carsten Brzeski, ING's Chief Economist in Germany, notes that when the ECB meets in Vilnius this week, it will not only be the first meeting with Philip Lane on the Executive Board and Peter Praet in ECB retirement but also a meeting in which the ECB is facing new easing speculation by financial markets.

- "The latest drop in (market-based) inflation expectations, combined with somewhat higher uncertainties surrounding the growth outlook after the latest round of trade conflict, has triggered speculation about another rate cut. In our view, this speculation is premature. However, we expect the ECB to convey a slightly more dovish tone, probably with an announcement of favourable TLTRO-3 terms.

- During the meeting and the press conference, the following topics and discussions should garner the most attention:

- Macro assessment and new projections. It’s time again for a fresh round of ECB staff projections. It will be interesting to see how the ECB balances the better-than-expected first quarter with still fairly weak confidence indicators. The projections are the first of any official institution after the release of first quarter GDP data. Up to now, all downbeat projections for the eurozone were mainly driven by a weak first quarter and a gradual rebound throughout the year. The former, at least, is outdated. At the same time, confidence indicators are struggling to rebound significantly and the latest escalation of the trade conflict, as well as more negative macro news from China, suggest that it could take until the third quarter for any rebound to take place. As a consequence, we do not expect major changes to the ECB projections. Rather, we will carefully listen to what ECB President Mario Draghi has to say about the growth profile. Overall, for the time being, it seems as if the ECB’s base case scenario remains one of a soft patch, with the manufacturing sector suffering while services and domestic demand stabilise the economy.

- Inflation outlook. As regards inflation, the ECB will probably restate its “delayed, rather than derailed” take on headline inflation converging to the ECB’s target. This story, however, will get increasingly difficult to tell if the economy slows. In fact, if not for oil prices and some temporary factors, inflation would have hardly moved to the upside. Here, the underlying profile will say more about the ECB’s take on inflation than marginal changes to the annual projections. Another interesting aspect is the sharp deterioration of market-based inflation expectations, with 5Y5Y and 2Y2Y inflation swaps currently trading close to all-time lows. In the past, the announcements of new ECB stimulus often coincided with sharp drops in market-based inflation expectations. However, history might not always give the best guidance for the future.

- Details of TLTRO-3. In March, the ECB announced a new round of Targeted Longer-Term Refinancing Operations (TLTROs), starting in September this year. Since then, no details about the pricing have been released. Draghi’s comments during the April press conference, as well as the minutes, were not entirely clear on whether the ECB would announce any details at this week’s meeting or wait until the summer. In any case, the modalities will depend on bank transmission and the economic outlook.

- The tiering debate. The hot topic some months ago, the discussion on a possible tiering of the deposit rate seems to have moved to the backseat. Now, even Governing Council members who initially advocated some measures to compensate banks for the adverse effect from negative deposit rates have changed their (public) views. Also, the April Bank Lending Survey showed a positive impact on lending volumes from the negative interest rate policy. Therefore, we expect Draghi to repeat the earlier phrase introduced by Peter Praet that there has to be a “strong monetary policy case” for the ECB to introduce a tiering system. In our view, the ECB will only go there if it really considers further rate cuts.

- Under pressure. The ECB has turned off cruise control and is back to good old data-dependence. Knowing that actually there is not a lot it can do to really kick-start growth if needed, the ECB will stick to its current easing bias, adding a dovish comment here and an easing element there. New pressure from financial markets has increased the probability that the ECB will reveal (some) details of the new TLTROs this week. Under pressure or not, the ECB will do everything it can to keep the “whatever it takes” spirit alive."

- Sees a chance for good cooperation with the U.S.

Analysts at TD Securities are expecting a modest decline in the US ISM manufacturing index to 52.5 (market: 53.0) in May as they expect trade-related headwinds to remain a major obstacle for recovery in the short-term.

- “ISM-adjusted regional surveys failed to improve in May, with declines in three out of the six published surveys we track, which points to decline in inventories as the main source of weakness. Moreover, a recent spate of weak growth in core durable goods orders, a downside surprise in the Markit PMI survey, and another below-50 China manufacturing PMI print also boost the odds for a downside surprise in May.

- Construction spending (market: 0.4%) will be released alongside ISM to provide an update on building investment for April, while new vehicle sales for May (market: 16.83m units) will round out the data calendar.”

- Iran's oil output fell 230,000 barrels per day to 2.32 million barrels per day in May due to the negative impact of the U.S. sanctions

- Saudi Arabia's output rose 170,000 barrels per day to 9.96 million barrels per day in May

Analysts at the Royal Bank of Scotland (RBS) note that the U.S.-China trade tensions continue to escalate, compounding a domestically generated slowdown in China.

- “Witness a return to contraction in the country’s official manufacturing PMI in May (49.4) following two months of modest growth. Export orders also saw a marked decline. Perhaps of most concern for the Chinese leadership was the plunge in the employment index to a decade low.

- Beijing is sensitive to the link between unemployment and social unrest. The policy response so far has been sizeable. But there may just be some more in store for the second half of the year.”

- UK PM May and U.S. president Trump to hold business roundtable on Tuesday

James Smith, a Developed Market economist at ING, notes that the stockpiling frenzy of the first quarter is translating into a lull in activity for UK manufacturers in the second. But while this is partly a temporary correction, the sector faces a challenging summer as firms grapple with how best to prepare for a possible October 'no deal' Brexit

- "There was a stockpiling frenzy during the first quarter, as firms looked to insulate themselves against the supply-chain disruption of a possible ‘no deal’ Brexit back in March. By definition, much of this involved EU imports. But given the global nature of modern supply chains, the production data indicates that this process also gave UK-based manufacturers a boost during the first quarter.

- So what next? Well in the short-run, the last manufacturing PMI suggests that the sector faces a lull in activity as firms unwind at least some of their excess stockpiles. The PMI slipped from 53.1 to 49.4 in May, indicating contraction. But with ‘no deal’ fears rising now that the Conservative leadership contest is getting underway, businesses face a tricky decision over coming months. Some may opt to maintain elevated levels of stock ahead of the October deadline, which comes with an opportunity cost. Many others may be forced to unwind stock and rebuild it as we approach the Autumn, although warehousing ability will be again be a major challenge – much of it is reportedly already booked up ahead of Christmas.

- Throw in the impact of global trade tensions, and the sector faces a challenging few months. The immediate slowdown in production will contribute to a lower GDP figure for the second quarter (we’re pencilling in 0.2% QoQ), while the weaker investment climate generally will offset some of the better news on consumer spending over the next few quarters.

- For this reason, we don’t currently expect a rate hike from the Bank of England this year. That said, recently hawkish commentary from Governor Mark Carney suggests that a November move shouldn’t be totally ruled out, should the Article 50 period be extended further."

Spot remains under pressure and could extend the decline to the 107.70/50 band, suggested FX Strategists at UOB Group.

Next 1-3 weeks: “We indicated last Friday (31 May, spot at 109.40) that “looking ahead, the current consolidation is expected to be resolved by a downside break but 109.00 is a solid support and this level may hold for a while more. We added, “if USD were to register a daily closing below this level, it would indicate the start of a sustained decline to 108.45 (and possibly lower)”. However, the subsequent price action came as a surprise as it played out in a ‘fast-forward’ manner as USD sliced through 109.00 and plunged to 108.26 (before closing right at the low for a loss of -1.22%, the largest 1-day decline in 2 years). In other words, USD has moved into a ‘negative phase’ even though the decline appears to be running ahead of itself. That said, there is scope for the weakness to extend to 107.70 (there is another strong support at 107.50). On the upside, only a move above 109.30 would indicate that the current weakness has stabilized. Shorter-term, 109.00 is already a formidable level”.

Crude oil prices are likely to remain steady around current levels, as growing macro uncertainties, rising U.S. output and large availability of core OPEC nations' spare capacity will offset supply constraints from Iran and Venezuela, Goldman Sachs said.

"Escalating trade wars and weaker activity indicators have finally caught up with oil market sentiment. The magnitude and velocity of the move lower were further exacerbated by growing concerns over strong U.S. production growth and rising inventories," the U.S. bank said in a note.

"We expect oil prices to likely remain volatile in coming months around their current levels and our Q3 forecast levels," the investment bank said in the note.

Increasing output from low-cost U.S. producers, debottlenecking in Permian region and the International Maritime Organization's shift in bunker sulfur regulation in 2020 will lead to persistent backwardation, lower oil prices and tighter U.S. crude differentials, the note added

Cable’s downside pressure is expected to subside somewhat if the 1.2780 area is cleared, according to Karen Jones, Head of FICC Technical Analysis at Commerzbank.

“GBP/USD last week saw a slight erosion of the 2016-2019 uptrend line at 1.2615. We will not chase this lower, we note the 13 count and TD support at 1.2521 and also that the daily RSI has not confirmed the new low. It will need to regain the 20 day ma at 1.2780 as an absolute minimum in order to alleviate immediate downside pressure and avert further losses to the 1.2444 December 2018 low. Minor resistance lies at the 1.2772 February low ahead of the 1.2865 April low”.

Investors are overlooking the threat posed by the U.S.-China trade war, which could send the global economy into recession in less than a year, according to a research note published by Morgan Stanley.

Chetan Ahya, the investment bank’s chief economist, noted that the outcome of the trade war at the moment “is highly uncertain” but warned that if the U.S. follows through with 25% tariffs on the additional Chinese imports, “We could end up in a recession in three quarters.”

“Is such a prognosis alarmist? We think otherwise,” Ahya wrote.

In particular, investors are not fully appreciating the effect of reduced capital expenditures, which could drive down global demand, according to the bank.

An economic slowdown in early 2020 could hamstring Trump’s electoral chances. While policymakers are likely to act to stem the effects of a trade war, “given the customary lag before policy measures impact real economic activity, a downdraft in global growth appears inevitable,” according to Ahya.

According to the report from IHS Markit/CIPS, the UK manufacturing sector showed increased signs of renewed contraction in May.

At 49.4, down sharply from 53.1 in April, the headline seasonally adjusted PMI fell below the neutral 50.0 benchmark for the first time since July 2016.

Manufacturers reported increased difficulties in convincing clients to commit to new contracts during May. This mainly reflected the already high level of inventories following recent stockpiling activity in advance of the original Brexit date. The total volume of new business placed fell for the first time in seven months. The rate of contraction was the greatest since July 2016 and one of the fastest seen over the past six-and-a-half years.

New order inflows deteriorated from both domestic and overseas sources. New export business fell for the second month running and at the quickest pace in over four-and-a half years.

The renewed downturn in new orders weighed on both output and employment during May. The trend in production was the weakest during the past 34 months, as an increase at large companies was mostly offset by contractions at small and medium sized firms.

Output charges inflation rose to a three-month high in May, largely reflecting a marked acceleration for consumer goods. Purchase price inflation edged lower.

According to the report from IHS Markit, the eurozone’s manufacturing economy remained entrenched inside contraction territory during May.

After accounting for seasonal factors, Eurozone Manufacturing PMI® posted below the crucial 50.0 no-change mark for a fourth successive month, recording a level of 47.7 (unchanged from the earlier flash reading). That was slightly down on the previous month’s 47.9 and close to March’s near sixyear low.

According to market group data, weakness remained centred on the intermediate and investment goods sectors.

The latest downturn in new work inevitably continued to weigh on production, which was reported to be down in May for a fourth successive month. However, with the rate of contraction remaining modest, and slower than that of new work, firms were again able to make notable inroads into their backlogs.

There was further evidence of emerging slack in supply chains during May, as average lead times for the delivery of inputs shortened to the greatest degree since mid-2009.

On the price front, input cost inflation softened in May, falling to its lowest level since August 2016. Firms chose to pass on these higher operating expenses to clients as highlighted by a similarly modest increase in output charges.

Goldman Sachs economists said there was a 60% chance that the United States would slap tariffs on the final $300 billion of Chinese imports, up from their previous estimate of 40%.

"Rhetoric in China has intensified... additional escalation looks likely from both sides, including tariff and non-tariff measures," Goldman Sachs economists wrote.

After U.S. President Trump announced a levy on imports from Mexico last week, GS saw a 70% chance of the tariffs on Mexican imports coming into effect at 5% on June 10 and a more than 50% chance they will rise to 10% on July 1.

GS economists also cut their chances the USMCA trade agreement will be ratified this year to 35% from 60% previously.

They saw a 40% chance of tariffs on cars coming into effect later this year, from 25% previously.

According to the report from Federal Statistical Office (FSO), the consumer price index (CPI) increased by 0.3% in May 2019 compared with the previous month, reaching 102.7 points (December 2015 = 100). Inflation was 0.6% compared with the same month of the previous year.

The 0.3% increase compared with the previous month can be explained by several factors including rising prices for fuel and for international package holidays. In contrast, prices for hotel accommodation and books decreased.

In May 2019, the Swiss harmonised index of consumer prices (HICP) stood at 101.63 points (Base 2015 = 100). This corresponds to a rate of change of -0.2% compared with the previous month and +0.5% compared with the same month of the previous year. The HICP is an additional inflation indicator, the EU member countries according to a common method. On the basis of this index, inflation in Switzerland can be compared with that in the European countries.

British manufacturing growth has weakened over the past couple of months as European companies decided to divert supply chains away from the world's fifth-biggest economy while the Brexit crisis rumbled on, an industry survey showed.

The Make UK manufacturing organisation and accountants BDO said output and orders continued to grow but at a slower rate than in the early months of 2019. Britain's economy picked up early this year, helped by the biggest rise in factory output in 20 years as companies raced to stockpile goods to avoid disruption to supply chains in the run-up to the original March 29 Brexit deadline. But the latest quarterly Make UK survey showed a weakening of hiring and investment intentions.

Make UK expects British factory output to grow just 0.2% this year and 0.8% in 2020, weaker than the rest of the economy.

The Make UK/BDO survey covered 344 companies between May 1 and May 22.

In opinion of FX Strategists at UOB Group, Cable is expected to keep the offered bias in the near term.

Next 1-3 weeks: “While we expect GBP to trade with a “downside bias”, we were of the view that “GBP has to register a daily closing below 1.2600 in order to indicate the start of a ‘negative phase’ towards 1.2530”. GBP subsequently dipped briefly to 1.2560 before rebounding strongly to end the day higher by +0.15% (NY close of 1.2629). Despite the sharp bounce, only a move above 1.2685 would indicate that the current downward pressure has eased. Until then, another ‘stab’ on the downside is not ruled out but after last Friday’s price action, GBP is unlikely to move into a fresh ‘negative phase’ (more likely to consolidate and trade sideways at these lower levels)”.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1263 (2931)

$1.1228 (1967)

$1.1206 (1086)

Price at time of writing this review: $1.1176

Support levels (open interest**, contracts):

$1.1131 (3702)

$1.1092 (3874)

$1.1047 (3815)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 7 is 123905 contracts (according to data from May, 31) with the maximum number of contracts with strike price $1,1500 (9032);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2760 (626)

$1.2720 (883)

$1.2689 (443)

Price at time of writing this review: $1.2641

Support levels (open interest**, contracts):

$1.2576 (2237)

$1.2538 (858)

$1.2494 (1236)

Comments:

- Overall open interest on the CALL options with the expiration date June, 7 is 41375 contracts, with the maximum number of contracts with strike price $1,3450 (3277);

- Overall open interest on the PUT options with the expiration date June, 7 is 41496 contracts, with the maximum number of contracts with strike price $1,2700 (4008);

- The ratio of PUT/CALL was 1.00 versus 1.01 from the previous trading day according to data from May, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.