- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 02-10-2017.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1733 -0,68%

GBP/USD $1,3276 -0,89%

USD/CHF Chf0,97441 +0,70%

USD/JPY Y112,72 +0,22%

EUR/JPY Y132,25 -0,48%

GBP/JPY Y149,626 -0,68%

AUD/USD $0,7831 +0,01%

NZD/USD $0,7193 -0,11%

USD/CAD C$1,25097 +0,36%

00:00 Australia HIA New Home Sales, m/m August -3.7%

00:00 China Bank holiday

00:00 Germany Bank Holiday

00:30 Australia Building Permits, m/m August -1.7%

03:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.50%

03:30 Australia RBA Rate Statement

05:00 Japan Consumer Confidence September 43.3 43.5

08:30 United Kingdom PMI Construction September 51.1 50.8

09:00 Eurozone Producer Price Index, MoM August 0.0% 0.1%

09:00 Eurozone Producer Price Index (YoY) August 2.0% 2.3%

12:30 U.S. FOMC Member Jerome Powell Speaks

19:00 U.S. Total Vehicle Sales, mln September 16.14 16.60

22:30 Australia AIG Services Index September 53

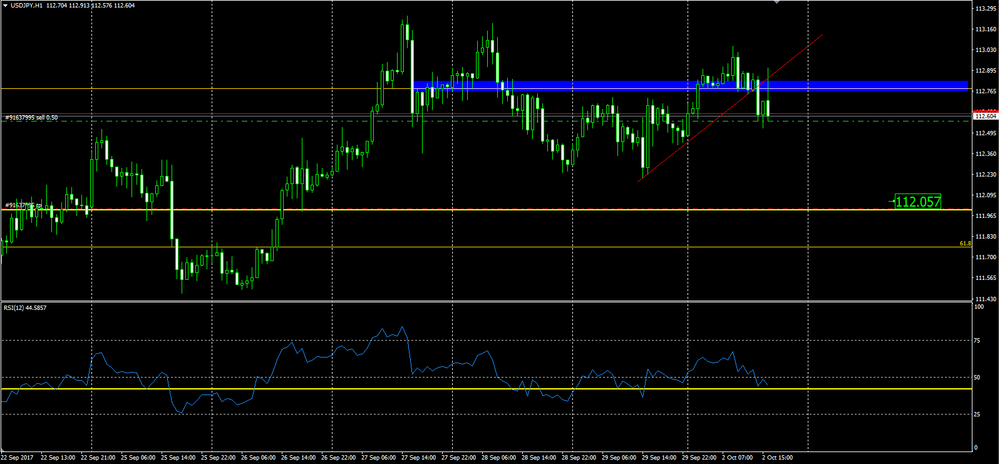

On 30 mins time frame chart we can see that price has broken our major trend line and already retested that trend line.

There is a possible potential bearish movement to 112.00 which is our previous major resistance.

Stops above the trend line would be fine to protect a possible entry on market and take profit close to our previous resistance.

"The September PMI registered 60.8 percent, an increase of 2 percentage points from the August reading of 58.8 percent. The New Orders Index registered 64.6 percent, an increase of 4.3 percentage points from the August reading of 60.3 percent. The Production Index registered 62.2 percent, a 1.2 percentage point increase compared to the August reading of 61 percent. The Employment Index registered 60.3 percent, an increase of 0.4 percentage point from the August reading of 59.9 percent.

The Supplier Deliveries Index registered 64.4 percent, a 7.3 percentage point increase from the August reading of 57.1 percent. The Inventories Index registered 52.5 percent, a decrease of 3 percentage points from the August reading of 55.5 percent. The Prices Index registered 71.5 percent in September, a 9.5 percentage point increase from the August level of 62, indicating higher raw materials prices for the 19th consecutive month.

Comments from the panel reflect expanding business conditions, with new orders, production, employment, order backlogs and export orders all growing in September; as well as, supplier deliveries slowing (improving) and inventories growing at a slower rate during the period. The Customers' Inventories Index remains at low levels" says Timothy R. Fiore, Chair of the Institute for Supply Management (ISM)

-

Says do not think any increase in taxable income from higher growth will compensate for proposed cuts in tax rates

-

Lower corporate tax rate, full deductibility of capital expenditures in period spent would benefit corporate credit quality

EURUSD: 1.1700 (EUR 690m) 1.1730 (400m) 1.1870 (390m) 1.200 (355m)

USDJPY: 111.00 (USD 460m) 111.50 (400m) 112.00 (340m) 112.25-30 (560m) 112.50 (850m) 112.76-80 (550m) 113.00-05 (700m)

GBPUSD: None of note

AUDUSD: None of note

USDCAD: 1.2700 (USD 520m)

-

Catalan issue is internal matter for Spain

-

Calls on all players to move to dialogue

-

Beyond purely legal aspects of matter, these are times for unity

-

Trusts spanish PM Rajoy to manage situation

-

Juncker, Rajoy will talk on monday

The euro area (EA19) seasonally-adjusted unemployment rate was 9.1% in August 2017, stable compared to July 2017 and down from 9.9% in August 2016. This remains the lowest rate recorded in the euro area since February 2009. The EU28 unemployment rate was 7.6% in August 2017, down from 7.7% in July 2017 and from 8.5% in August 2016. This is the lowest rate recorded in the EU28 since November 2008. These figures are published by Eurostat, the statistical office of the European Union. Eurostat estimates that 18.747 million men and women in the EU28, of whom 14.751 million in the euro area, were unemployed in August 2017. Compared with July 2017, the number of persons unemployed decreased by 104 000 in the EU28 and by 42 000 in the euro area. Compared with August 2016, unemployment fell by 1.923 million in the EU28 and by 1.319 million in the euro area.

The UK manufacturing sector continued to expand at a solid clip during September, with production and new orders both rising at above long-run average rates. However, the latest survey signalled that cost inflationary pressures surged higher. This reflected a combination of rising commodity prices, the exchange rate and increased supply-chain pressures.

The seasonally adjusted IHS Markit/CIPS Purchasing Managers' Index registered 55.9 in September, down from August's fourmonth high of 56.7, but above its long-run average of 51.7. Data included in the latest PMI report were collected between 12-26 September.

At a 79-month high of 58.1, little-changed from the flash estimate of 58.2, the final IHS Markit Eurozone Manufacturing PMI signalled expansion for the fifty-first month in a row. The average reading over the third quarter (57.4) was the highest since the opening quarter of 2011.

The upturn remained broad-based by nation, with all eight of the surveys comprising the euro area average reporting growth. Germany moved back to the top of the rankings - its PMI hit a 77-month high - while the Netherlands PMI scored a 79-month record, in second position overall. Austria was again one of the strongest-performing nations, despite seeing growth ease to a four-month low.

German manufacturing saw its strongest growth performance for over six years in September, recording marked and accelerated increases in both production levels and employment, according to the latest PMI survey data from IHS Markit and BME. However, there was also evidence of increasing supply-side pressures, as firms faced near-record delivery delays and sharply rising input costs.

At 60.6 in September, up from August's 59.3, the final IHS Markit/BME Germany Manufacturing PMI recorded its highest reading since April 2011 and signalled a strong improvement in the overall health of the goods-producing economy.

Growth continued to be driven by sharp rises in both domestic and foreign demand. As a result, firms enhanced their operating capacity by taking on more staff and raising their input buying, which in turn led to a marked rise in output. Meanwhile, input price inflation intensified amid reports of higher raw material prices. Concurrently, business confidence remained robust and rose from August's sevenmonth low.

The IHS Markit France Manufacturing Purchasing Managers' Index posted 56.1 in September to signal a further improvement in the overall health of the French manufacturing sector. The index was up from August's reading of 55.8 and the highest since April 2011.

Turnover in the retail sector fell by 0.6% in nominal terms in August 2017 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.3% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.2% in August 2017 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered a decline of 0.2%.

-

Any uncertainty is bad for business confidence

-

Transition of around two years will take immediate pressure off businesses

-

Businesses will plan on worst case scenario for Brexit if we do not give them clarity

The Australian Industry Group Index (Australian PMI) fell 5.6 points in September to 54.2 points (seasonally adjusted), indicating a deceleration in growth after August's spike to a recent high of 59.8 points. Results above 50 points indicate expansion with higher results indicating a stronger expansion.

September marked a twelfth consecutive month of expansion for the Australian PMI and the longest run of expansion since 2007 in the seasonally adjusted series. In trend terms, growth is continuing but looks to have decelerated through the September quarter

Output, order book volumes and foreign demand all increased solidly following modest expansions in August. Employment expanded for the thirteenth month in a row, albeit at the weakest pace since last November. Input price pressures continued to rise, although the rate of inflation facing producers was not met with equal hikes in charges to customers. Output prices picked up only marginally in September.

The headline Japan Manufacturing Purchasing Managers' Index - a composite singlefigure indicator of manufacturing performance - was at a four-month high of 52.9 in September, rising from 52.2 in August and signalling a robust improvement in the health of the manufacturing sector.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1929 (3695)

$1.1902 (1346)

$1.1873 (1696)

Price at time of writing this review: $1.1773

Support levels (open interest**, contracts):

$1.1741 (4273)

$1.1696 (3746)

$1.1648 (3507)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 6 is 104825 contracts (according to data from September, 29) with the maximum number of contracts with strike price $1,1800 (6795);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3610 (1497)

$1.3531 (957)

$1.3478 (1520)

Price at time of writing this review: $1.3369

Support levels (open interest**, contracts):

$1.3327 (884)

$1.3287 (1374)

$1.3243 (750)

Comments:

- Overall open interest on the CALL options with the expiration date October, 6 is 35277 contracts, with the maximum number of contracts with strike price $1,3700 (3027);

- Overall open interest on the PUT options with the expiration date September, 8 is 40432 contracts, with the maximum number of contracts with strike price $1,3150 (3167);

- The ratio of PUT/CALL was 1.15 versus 1.12 from the previous trading day according to data from September, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.