- Analytics

- News and Tools

- Market News

- Oil futures settled lower

Oil futures settled lower

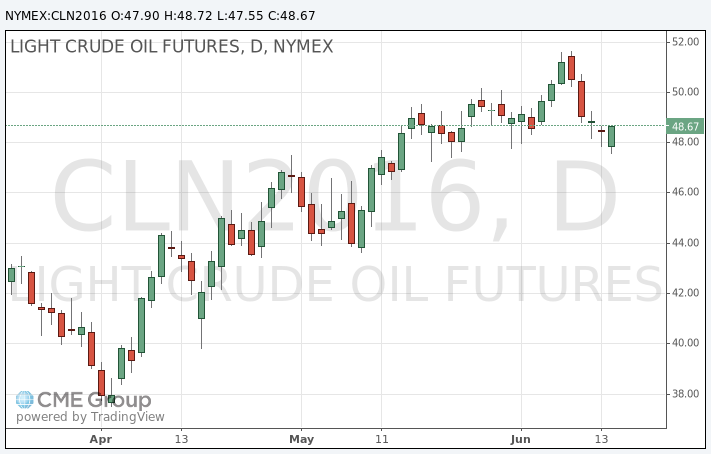

Oil futures settled lower Wednesday, pressured by concerns over global energy demand following disappointing U.S. economic data and ahead of the U.K. referendum scheduled for next week.

A modest weekly decline in U.S. crude supplies and the Federal Reserve's decision to stand pat on interest rates failed to offer much support for prices.

July West Texas Intermediate crude fell 48 cents, or 1%, to settle at $48.01 a barrel on the New York Mercantile Exchange, marking a fifth session decline in a row. The August contract for Brent lost 86 cents, or 1.7%, at $48.97 a barrel.

WTI oil futures had fallen below $48, but pared losses and saw a brief tick higher after the U.S. Energy Information Administration reported that U.S. crude supplies fell by 900,000 barrels for the week ended June 10. That contradicted the 1.2 million-barrel increase reported by the American Petroleum Institute late Tuesday, but still came in short of the 1.4 million-barrel decline expected by analysts polled by S&P Global Platts.

"The headline crude-oil number was less bullish than expected, but not as bearish as the API number-so basically a wash," Tyler Richey.

About a half-hour before WTI prices settled, the Fed announced that it would leave interest rates unchanged and it adopted a dovish stance on the outlook for monetary policy.

"The revisions to the 'dot plot' within the FOMC release that showed 6 members now only expect one rate hike in 2016," up from just one member at the last meeting, said Richey. That "was a dovish development and we are seeing the dollar correct lower as a result."

'Uncertainties about the health of the U.S. economy is the reason for the dollar weakness. That isn't necessarily a bullish thing for oil from a demand standpoint.'

"Traditionally, a weaker dollar would be supportive of oil prices, but…uncertainties about the health of the U.S. economy is the reason for the dollar weakness. That isn't necessarily a bullish thing for oil from a demand standpoint," he said.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.