- Analytics

- Market analysis

- Market Opinions

- Between Possibility and Opportunity: GOLD

Between Possibility and Opportunity: GOLD

Analysts are trained to see charts and markets in terms of possibilities: there are thousands of ways the market could move, and they try to know and study them all.

Traders, being closer to the action, must look at things differently. For them, the markets and the charts are full of opportunities - out of those thousands of ways the market can go, they are interested in those areas and moments offering a window of opportunity.

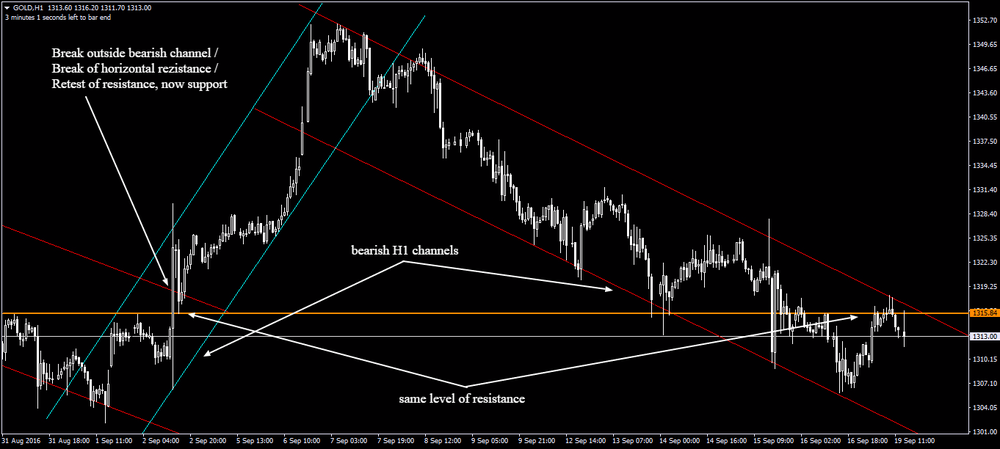

Today, Gold is giving us a rather interesting picture, which I would like to discuss with you today. Possibility or opportunity? I let you be the judge of that.

Gold is currently displaying a price action pattern very similar to that before the Sep.2 breakout. We are in a downward channel of about the same amplitude and duration, we are at the exact same horizontal key level and price has already pushed up into a first wave test at the key level. Could a similar scenario output happen, or could we expect that this time bears have learned their lesson?

Scenario/possibility 1 (Bullish): Gold could rise rapidly into a steady, powerful breakout to the upside. Opportunity: longs could be taken above the resistance line which (if history is any guide) could again turn into support after the breakout.

Scenario/possibility 2 (Bearish): Gold could remain bound within the same downward channel, or could spike up for a false breakout. Opportunity: in this case shorts would continue to be favored, and especially in the case of a false breakout bears will look for new lows withing the next 1-2 days.

What about you? Ideas? Comments? What is your outlook for Gold for the next few trading sessions?

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.